Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

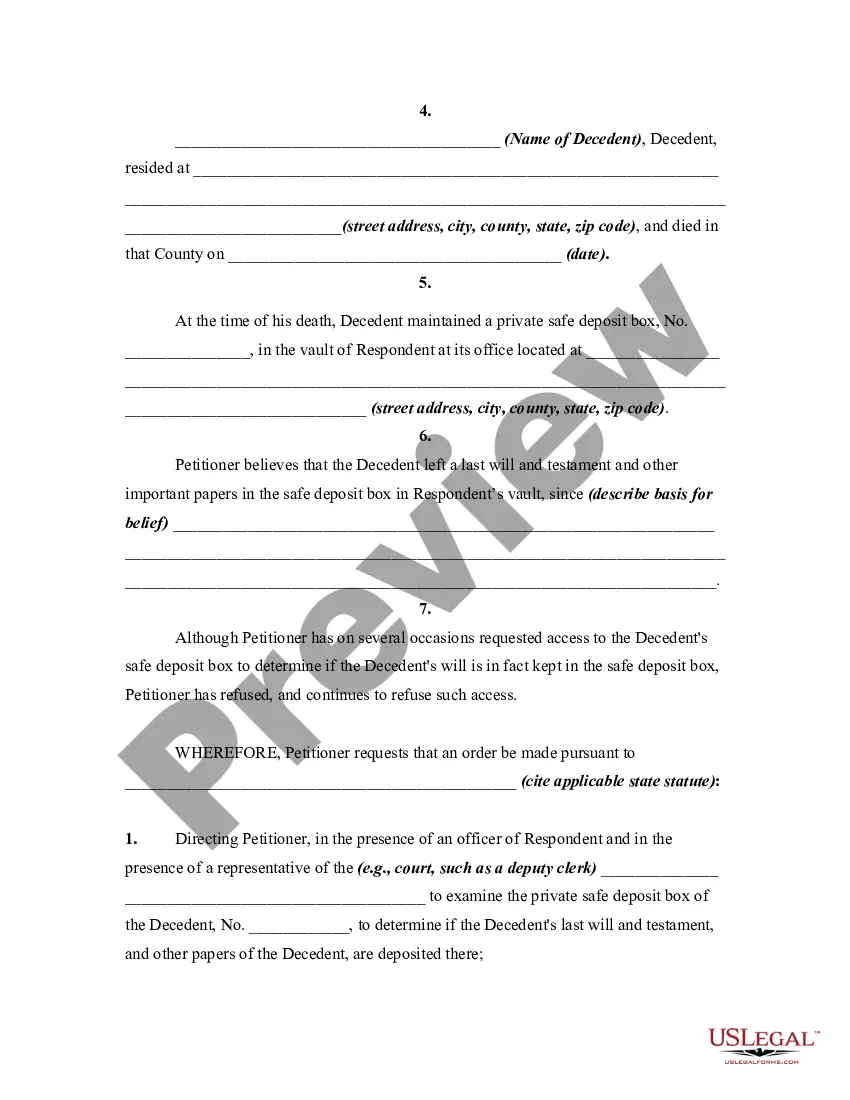

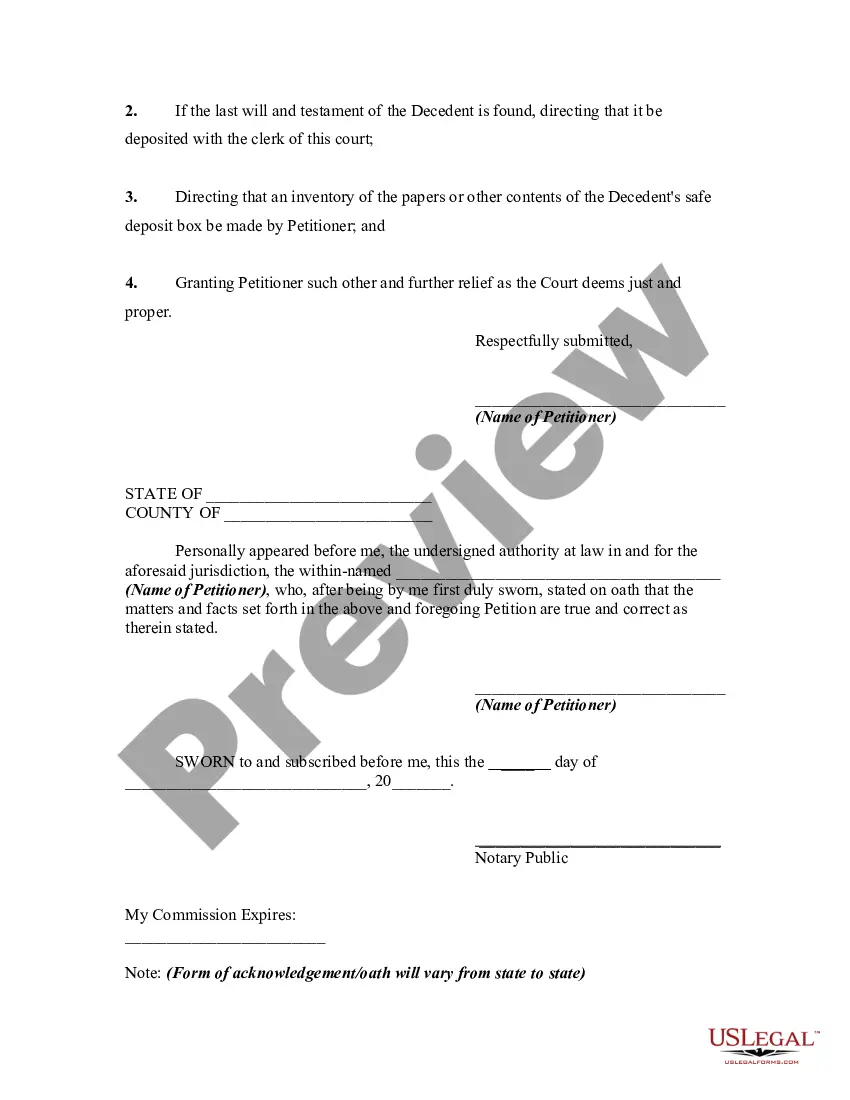

San Bernardino California Petition For Order to Open Safe Deposit Box of Decedent

Description

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

Statutes and guidelines in every area differ from one jurisdiction to another.

If you're not an attorney, it's simple to become confused by the different standards when it involves crafting legal documents.

To prevent expensive legal fees when preparing the San Bernardino Petition For Order to Open Safe Deposit Box of Decedent, you require a confirmed template applicable for your locale.

It's the simplest and most economical method to obtain current templates for any legal needs. Access them all with a few clicks and keep your paperwork organized with US Legal Forms!

- Utilize the US Legal Forms platform.

- US Legal Forms is relied upon by millions as an online directory of over 85,000 state-specific legal templates.

- It serves as an excellent resource for professionals and individuals seeking do-it-yourself templates for various personal and business situations.

- All documents can be reused: once you acquire a template, it remains accessible in your account for future use.

- Thus, when you hold an account with an active subscription, you can simply Log In and re-download the San Bernardino Petition For Order to Open Safe Deposit Box of Decedent from the My documents section.

- For new clients, additional steps are required to obtain the San Bernardino Petition For Order to Open Safe Deposit Box of Decedent.

- Evaluate the page content to confirm you have located the correct sample.

- Utilize the Preview feature or review the form description if it's available.

Form popularity

FAQ

Once you go into the safe deposit. Box you put in your key first they put in their key. Second. AndMoreOnce you go into the safe deposit. Box you put in your key first they put in their key. Second. And only on the combination. Of those keys being turned at the same time does the box.

California Probate Code 331 controls access to a safe deposit box after the death of decedent. If the decedent owned the safe deposit box with a spouse or another person, then that person will have access to it.

8.1 In the event of your death we are under no obligation to allow access to the safe deposit box to any person unless they can provide a valid grant of probate or letters of administration appointing them as the executor or administrator of your estate.

If the bank does not have specific rules, the Florida law provides that if a safe-deposit box is rented or leased in the names of two or more lessees, access to the safe-deposit box will be granted to either of them, regardless of whether or not the other lessee is living or competent.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

After a period of time, the FDIC or the bank must transfer unclaimed property to the state. Federal law requires unclaimed deposit accounts to be transferred to the state after 18 months, and state laws differ on the period of time after which contents of safe deposit boxes must be transferred.

The rules and procedures for safe deposit boxes can vary by state and by bank, so ask your bank about the options for granting someone access and what you would have to do if you later change your mind.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.

What Items Should Not Be Stored in a Safe Deposit Box? Cash money. Most banks are very clear: cash should not be kept in a safe deposit box.Passports.An original will.Letters of Intent.Power of Attorney.Valuables, Jewelry or Collectibles.Spare House Keys.Illegal, Dangerous, or Liquid Items.