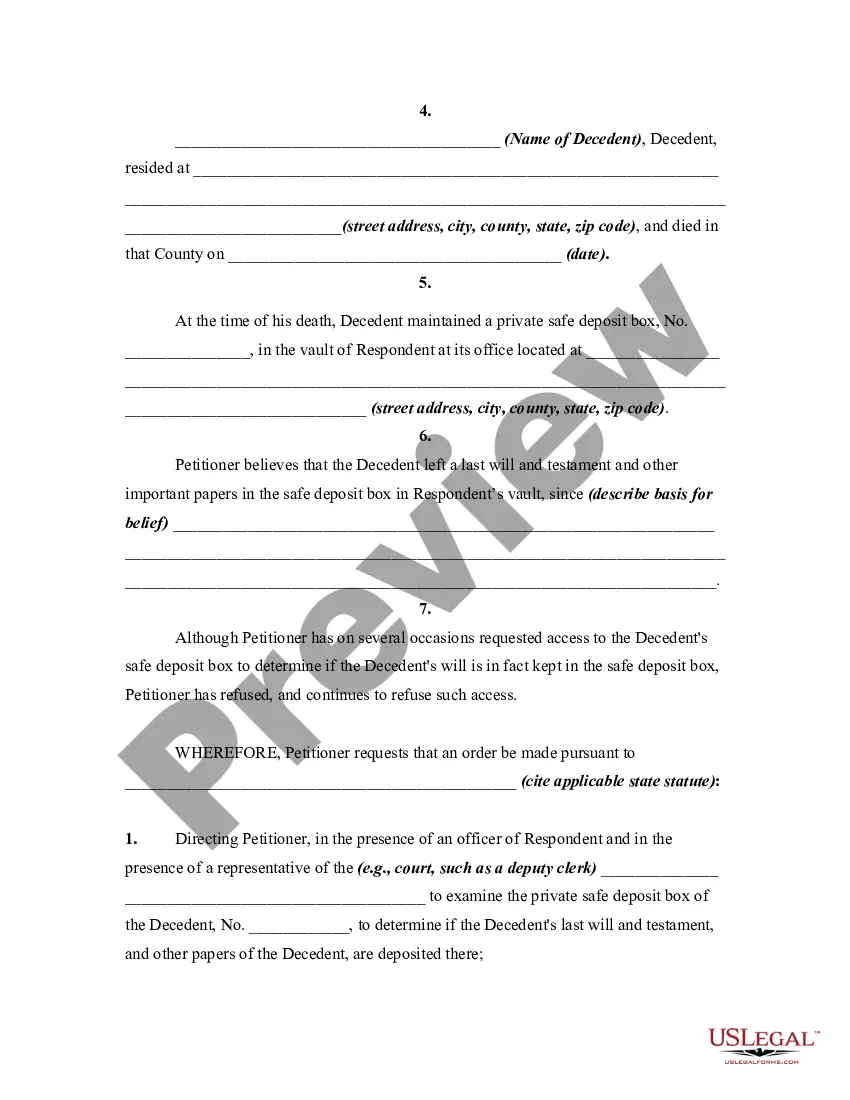

Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Fairfax Virginia Petition For Order to Open Safe Deposit Box of Decedent

Description

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

If you are searching for a trustworthy legal document provider to acquire the Fairfax Petition For Order to Open Safe Deposit Box of Decedent, consider US Legal Forms. Regardless of whether you want to start your LLC enterprise or manage your asset allocation, we can assist you.

US Legal Forms is a trustworthy service that has been supplying legal forms to millions of clients since 1997.

You can easily choose to search or browse the Fairfax Petition For Order to Open Safe Deposit Box of Decedent, either by a keyword or the respective state/county that the document is intended for.

After identifying the required form, you can Log In to download it or save it in the My documents section.

Don't have an account? It's simple to begin! Just locate the Fairfax Petition For Order to Open Safe Deposit Box of Decedent template and review the form's preview and description (if provided). If you are satisfied with the template's terms, proceed and click Buy now. Register for an account and choose a subscription plan. The template will be instantly accessible for download once the payment is completed. Now you can complete the form.

- You do not have to be well-versed in law to locate and retrieve the necessary form.

- You can explore from more than 85,000 forms classified by state/county and circumstance.

- The user-friendly interface, assortment of supplementary resources, and committed assistance team simplify the process of finding and completing various documents.

Form popularity

FAQ

If the property remains unclaimed and is classified as abandoned, the bank may be required to transfer the contents of the safe deposit box to the state treasurer or unclaimed-property office in a process called escheat.

Generally, estates cannot realistically close before six months after the decedent's death because the surviving spouse has the right to make her claim for an elective share within that six months.

8.1 In the event of your death we are under no obligation to allow access to the safe deposit box to any person unless they can provide a valid grant of probate or letters of administration appointing them as the executor or administrator of your estate.

Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card. The bank allows only those individuals to open the box. From then on, the bank records the signature of any individual allowed to open the box.

In addition to freezing accounts, levying accounts, garnishing wages, and seizing assets, the IRS can get a court order to freeze and seize or force a sale of the contents of a safe deposit box to satisfy a tax debt or penalty.

In New York, banks will seal a safe deposit box following the death of an owner or co-owner. The bank will then only allow the safe deposit box to be opened after a Court issues an order to that effect.

Virginia has no set time limit for settling an estate. You can take the time you need to grieve and get your affairs in order before you settle the estate. However, Virginia courts do generally recommend that you start the process within a week to 30 days after the funeral.

Step 1 Determine Whether a Will Exists. Under Virginia Code § 64.2-601, a will must be admitted to probate, even if it pertains to a small estate.Step 2 Prepare Affidavit. Download the Virginia Small Estate Act Affidavit and fill it out.Step 3 Get Affidavit Notarized.Step 4 Collect the Assets.

The statute of limitations for challenging a Virginia will is usually one year. The statute of limitations on inheritance is also one year in Virginia. However, this could be reduced to as little as six months. Anyone who believes they have grounds to challenge a will should do so immediately.

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. f0a7 if no surviving spouse, all passes to the children and their descendants.