Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

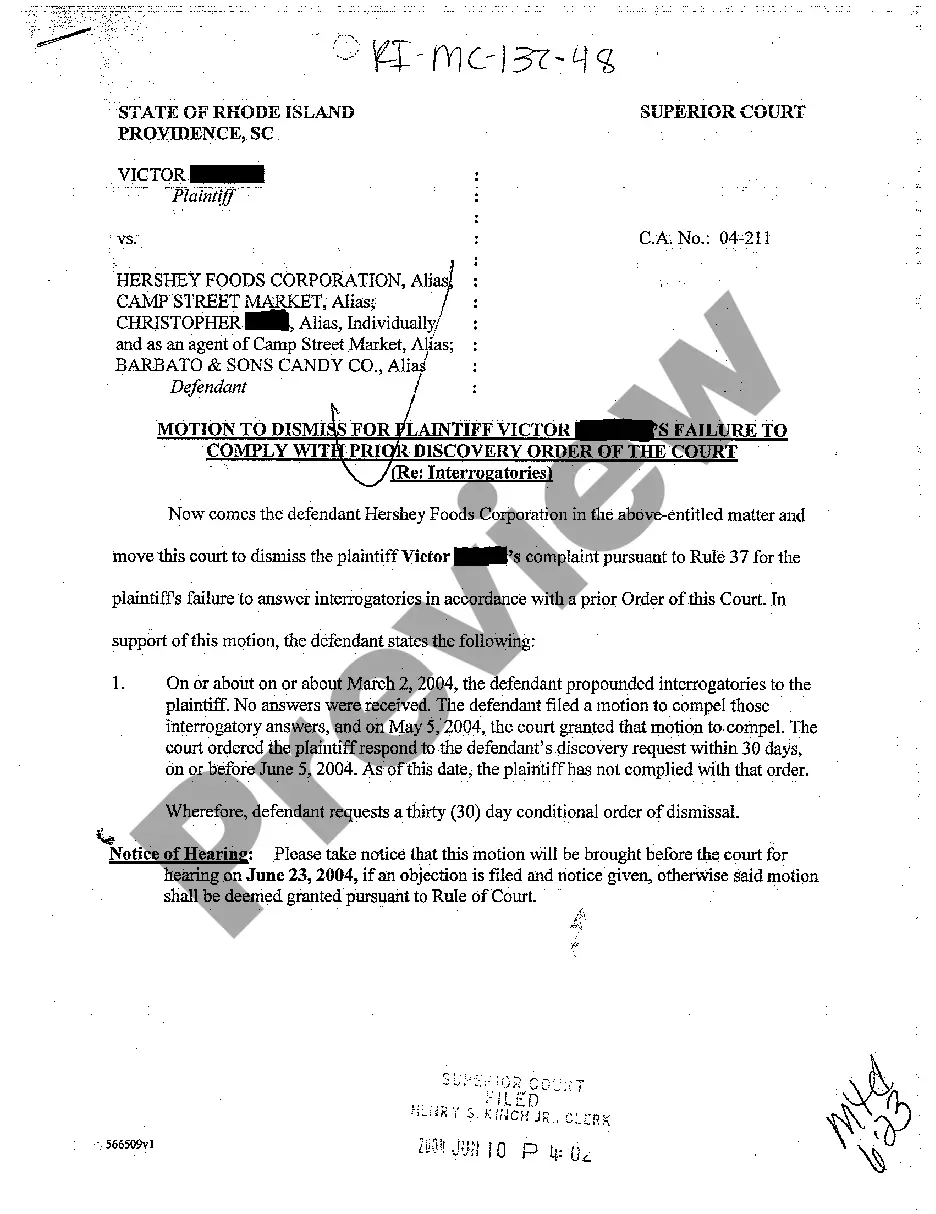

Wayne Michigan Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

Preparing documents for business or personal purposes is always a significant obligation.

When formulating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws relevant to the particular jurisdiction.

Nevertheless, minor counties and even municipalities have legislative processes that should also be taken into account.

To locate the document that meets your expectations, employ the search tab in the page header.

- All these factors make it burdensome and time-consuming to draft Wayne Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency without professional help.

- It's simple to avoid incurring costs by hiring attorneys to prepare your documents and create a legally sound Wayne Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency on your own, utilizing the US Legal Forms online repository.

- It is the finest online collection of state-specific legal documents that are thoroughly vetted, ensuring their legitimacy when selecting a template for your county.

- Previously registered users only need to Log In to their accounts to access the required form.

- If you do not have a subscription yet, follow the step-by-step instructions below to obtain the Wayne Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

- Review the page you've navigated to and confirm if it contains the document needed.

- To do this, utilize the form description and preview if these choices are available.

Form popularity

FAQ

Under the Equal Credit Opportunity Act Regulation B, a written adverse action notice must include the action taken, the specific reasons for that action, and the contact details of the institution. Additionally, it should inform the consumer of their right to obtain a copy of their credit report. This ensures that consumers receive transparent communication regarding any adverse actions impacting them.

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

If you find information in your credit report that you believe is inaccurate, you can dispute what is in the report with the credit reporting company and the company that provided the information. The credit reporting company is required to conduct an investigation and correct any errors it finds.

Within 30 days lenders must notify consumers of action taken in writing. -If Adverse Action must provide statement of reasons and include statement that ECOA prohibits discrimination. -Must include info on credit agency, name address, and name of agency that enforces lenders compliance.

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

Credit Score Disclosure Section 609(g) referenced above has another requirement where a creditor must send a "credit score disclosure" to an applicant of a consumer loan secured by 1 to 4 units of residential real property.

Adverse action is defined in the Equal Credit Opportunity Act and the FCRA to include: a denial or revocation of credit. a refusal to grant credit in the amount or terms requested. a negative change in account terms in connection with an unfavorable review of a consumer's account 5 U.S.C.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

A statement indicating that the account "meets FCRA requirements" may be added if a consumer disputes information on their credit report, but the credit bureau determines that the information is accurate. Additionally, it can be concluded that all information is accurate and under federal regulations.

Credit Score Disclosure Exception to Risk-Based Pricing Notice. The January 2010 Final Rules included a compliance option in which a creditor may choose to send a credit score exception notice to all credit applicants instead of providing a risk-based pricing notice to certain consumers.