The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

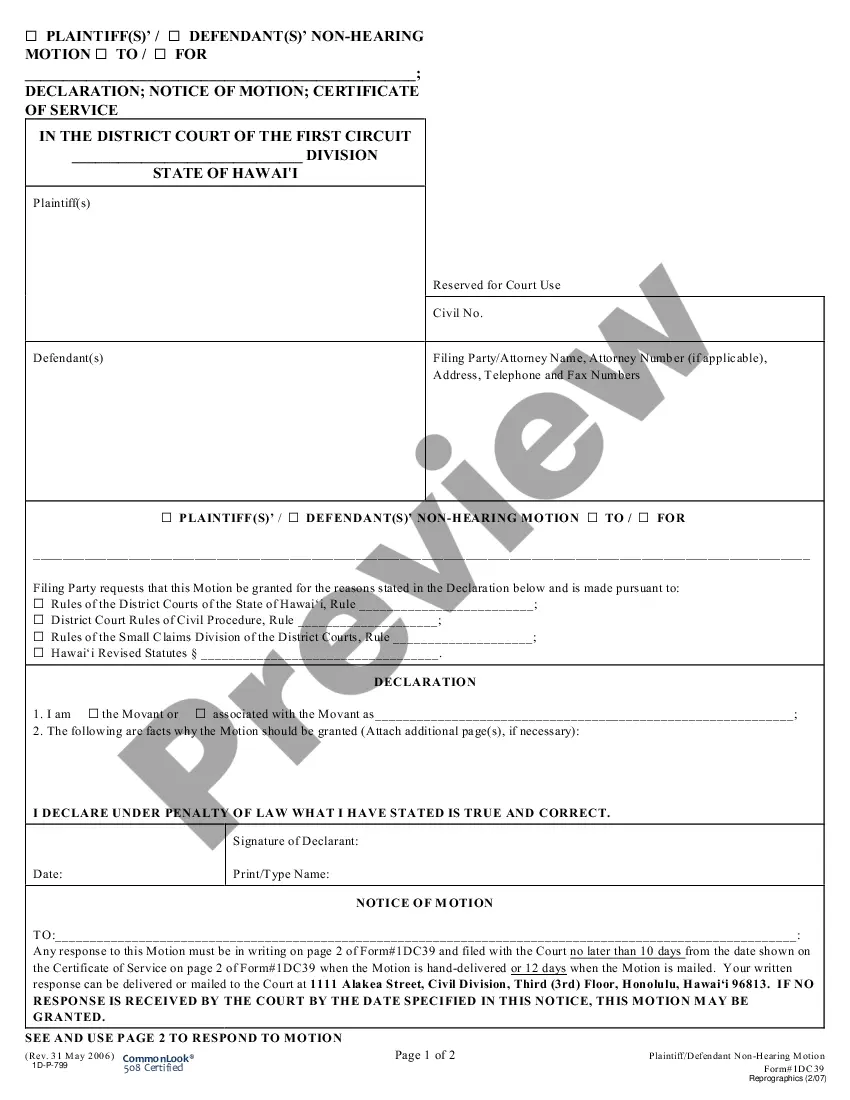

Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

Form popularity

FAQ

An example of a violation of the Fair Credit Billing Act includes a creditor's failure to respond to a billing dispute within the required timeframe. If a consumer disputes a charge and the creditor does not acknowledge the challenge or conduct a proper investigation, it constitutes a violation. If you have faced a situation tied to your Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, consider utilizing the US Legal Forms platform for guidance. It is essential to address such billing issues promptly.

To respond to a possible violation of the Fair Credit Reporting Act, begin by gathering all relevant documents and evidence supporting your claim. Contact the consumer reporting agency involved, and clearly state the issue and your expectation for rectification. Submitting a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency can help formally initiate your inquiry. Consulting with a knowledgeable professional can also enhance your ability to effectively navigate this process.

Failing to provide a clear notice to a consumer regarding an adverse action taken based on credit report information is a clear violation of the Fair Credit Reporting Act. When a lender denies credit or raises charges without properly informing the consumer of the decision's basis, it contravenes the law. If you suspect a violation related to your Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, you should consult an expert for assistance with your situation. Your financial wellbeing and rights matter.

An example of a violation of the Fair Credit Reporting Act is when a consumer reporting agency fails to investigate a dispute that a consumer has filed in good faith. If a lender uses information that should not be part of a credit report when making a lending decision, this also counts as a violation. Consumers filing a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency are explicitly safeguarding their rights. Seek legal remedies if you believe you have faced such a violation.

A negligent violation of the Fair Credit Reporting Act occurs when a consumer reporting agency fails to maintain reasonable procedures to ensure maximum accuracy of information. For instance, if they ignore evidence supporting a consumer's claim of inaccuracy, this may constitute a violation. Understanding the significance of the Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency can help consumers address such inaccuracies. Consumers have rights that can be enforced through legal avenues.

Consumer reporting agencies must correct or delete information that is found to be inaccurate, incomplete, or unverifiable within 30 days. This is essential to ensure that your credit report is accurate and trustworthy. If you have submitted a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, you can effectively challenge erroneous entries. Your rights under the Fair Credit Reporting Act protect you in these scenarios.

Disclosure of the use of information from an outside source means explaining how third-party data has influenced credit decisions. Creditors often gather additional information from various sources, which can affect your credit application outcomes. Understanding this concept can greatly enhance your experiences when making a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

A notice of incompleteness signals that there are missing elements in the information provided, which could impact credit decisions. For example, if a creditor receives an incomplete credit report, they may inform you of the deficiency, allowing you to rectify the situation. Being proactive in responding to such notices is important when dealing with the Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Disclosure of information generally means making certain facts available to others. In a credit context, this often involves sharing your credit history with lenders and credit agencies. This understanding is integral when you undertake a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

This disclosure refers to the communication of how outside entities have utilized your personal information in assessing credit. Creditors often rely on data from other sources in addition to credit reports when deciding approval for credit applications. By understanding these processes, you gain clarity that can aid in filing a Gilbert Arizona Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.