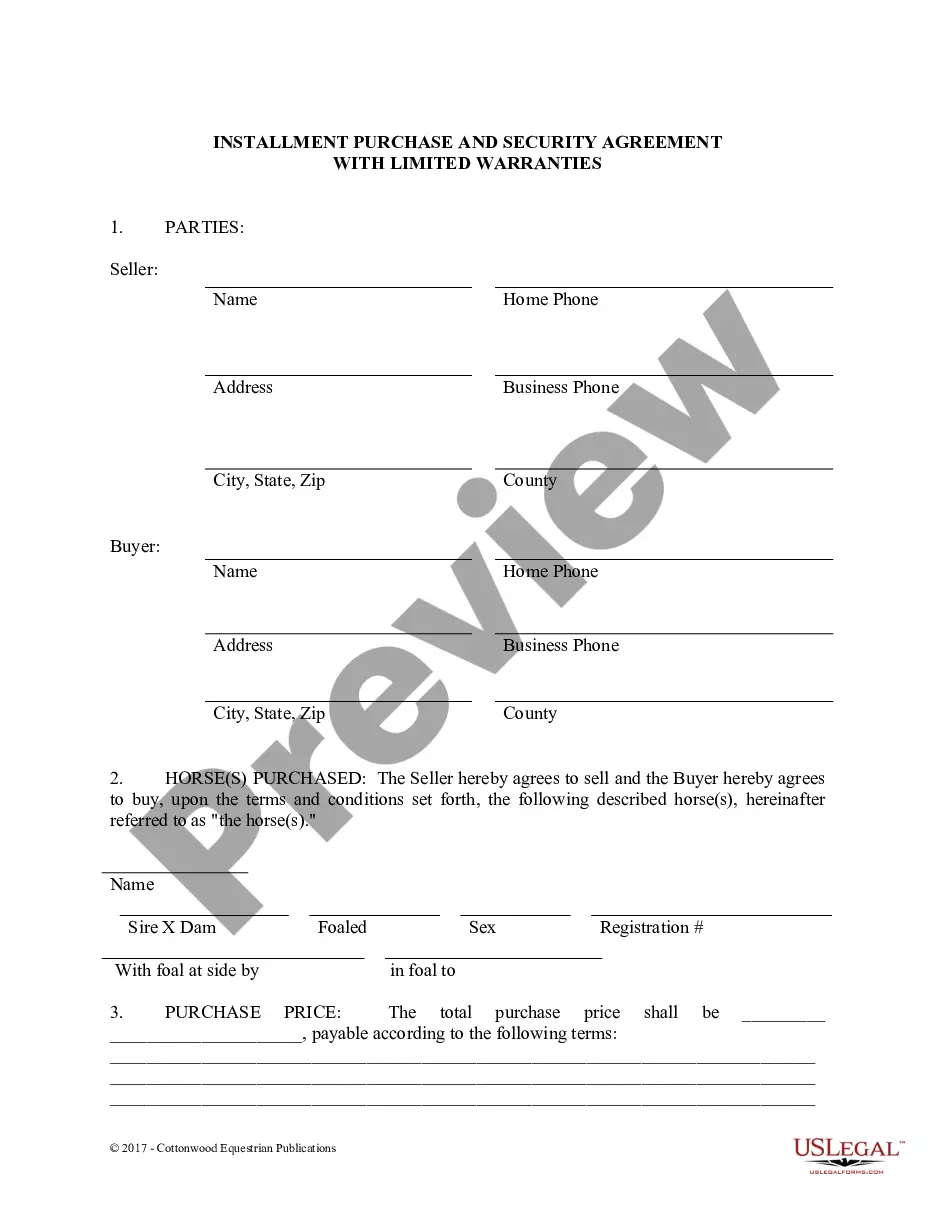

A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt. The agreement of the creditor and the debtor that the creditor shall have a security interest in the goods must be evidenced by a written security agreement unless the creditor retains what is known as a possessory security interest by taking possession of the collateral.

This form is a generic sample of an assignment of the security interest that is evidenced and formed by a security agreement. An assignment of a security interest in personal property is similar, in many ways, to an assignment of a deed of trust or mortgage covering real property.

Collin Texas Assignment of Interest of Seller in a Security Agreement is a legal document that transfers the rights and interests of a seller in a security agreement to another party. This agreement is commonly used in various financial transactions, such as loans and leases, to ensure the interests of all parties involved are legally protected. The assignment of interest of the seller in a security agreement is essential when parties wish to transfer ownership or responsibilities related to the security agreement. In Collin, Texas, there are different types of assignment of interest of the seller in a security agreement, including: 1. Absolute Assignment: This is a complete transfer of the seller's rights and interests to another party. In this type of assignment, the new party assumes all responsibilities and rights associated with the security agreement. 2. Partial Assignment: As the name suggests, this type of assignment involves the transfer of only a portion of the seller's interests in the security agreement. This could be a partial transfer of the rights, obligations, or both, depending on the terms agreed upon between the parties. 3. Assignment by Way of Security: This type of assignment is commonly used as collateral for loans. The seller assigns their interests in the security agreement to secure a debt owed to the new party. If the borrower fails to repay the loan, the new party can exercise their rights under the security agreement to recover their investment. 4. Assignment of Specific Assets: In some cases, parties may choose to assign specific assets outlined in the security agreement rather than the entirety of their interests. This type of assignment is useful when there is a need to transfer ownership of individual assets while preserving the overall security agreement. In Collin County, Texas, the Assignment of Interest of Seller in a Security Agreement must comply with the relevant state laws and regulations. It is crucial to ensure that the assignment is properly documented, outlining the specific terms, rights, and responsibilities of all parties involved. To execute the assignment, it is advisable to engage the services of legal professionals who specialize in contract law or have experience in drafting and reviewing security agreements. These professionals can provide the necessary guidance and expertise to ensure that the assignment is valid, enforceable, and protects the interests of all parties involved. In summary, the Collin Texas Assignment of Interest of Seller in a Security Agreement is a legal document allowing the transfer of a seller's rights and interests in a security agreement to another party. The different types of assignments include absolute, partial, assignment by way of security, and assignment of specific assets. It is essential to comply with state laws and engage legal professionals for proper execution of these agreements.