Albuquerque New Mexico Fee Estimate Worksheet

Description

Form popularity

FAQ

Albuquerque's tax rate, which encompasses various taxes, generally totals about 7.875%. This rate can affect your transactions and budgeting. When preparing your financial forecasts or estimates, utilizing the Albuquerque New Mexico Fee Estimate Worksheet allows you to include these important figures, ensuring clarity and confidence in your financial decisions.

In Albuquerque, the total gross receipts tax rate is often around 7.875%. This percentage includes both state and local taxes, which you need to factor into any financial planning. Your Albuquerque New Mexico Fee Estimate Worksheet can play a crucial role in understanding how this tax impacts your overall costs.

To obtain a New Mexico CRS number, visit the New Mexico Taxation and Revenue Department's website. Filling out the online application is straightforward and will provide you with the number necessary for reporting your gross receipts and sales. Using this number in conjunction with your Albuquerque New Mexico Fee Estimate Worksheet can help ensure accurate tax estimates.

Yes, Albuquerque residents are subject to New Mexico's state income tax. Income tax rates can depend on your annual income, making it important to stay informed about your tax brackets. To cover your potential tax liabilities effectively, refer to the Albuquerque New Mexico Fee Estimate Worksheet for accurate budgeting.

The sales tax rate in New Mexico typically sits at 5.125%. However, municipalities, like Albuquerque, can add local taxes, resulting in varying rates across the state. This knowledge is essential when filling out your Albuquerque New Mexico Fee Estimate Worksheet, as estimating your total expenses accurately hinges on understanding the local tax landscape.

The PIT-B form, or the Personal Income Tax Return form B, is used by residents of New Mexico to report personal income. This form helps individuals calculate their state tax liability, ensuring compliance with New Mexico tax laws. For those engaging in various financial activities, reflecting correctly on your Albuquerque New Mexico Fee Estimate Worksheet can guide your understanding of your tax obligations.

Tuition at the University of New Mexico (UNM) varies based on the student's residency and course load. For in-state undergraduate students, tuition usually ranges from approximately $4,000 to $6,000 per semester. It's important to note that additional fees may apply, so using an Albuquerque New Mexico Fee Estimate Worksheet can aid in calculating your total expense. This tool will help you capture all potential costs, ensuring you are financially prepared for your education.

In Albuquerque, New Mexico, the hotel tax is typically a combination of state, city, and county taxes. Currently, the total hotel tax rate is around 7.75%, but this can vary based on the specific location within the city. Understanding these fees is essential for budget planning, especially when completing an Albuquerque New Mexico Fee Estimate Worksheet. Taking this into account can help you more accurately estimate your overall travel costs.

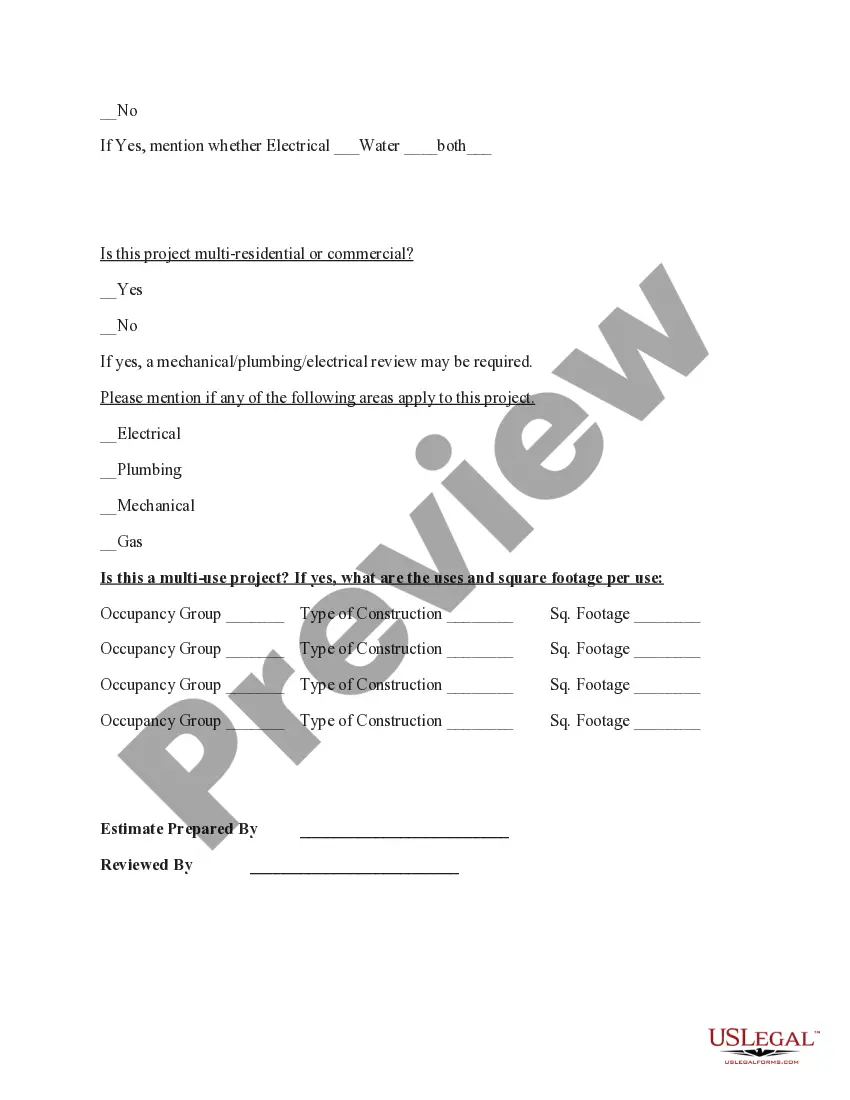

To get a building permit in New Mexico, you need to start by preparing your project plans. It's important to check with your local government office for specific requirements, as these can vary. Once you have your plans ready, submit them along with the completed Albuquerque New Mexico Fee Estimate Worksheet to estimate your costs. This worksheet will help you understand the fees involved in obtaining your permit.