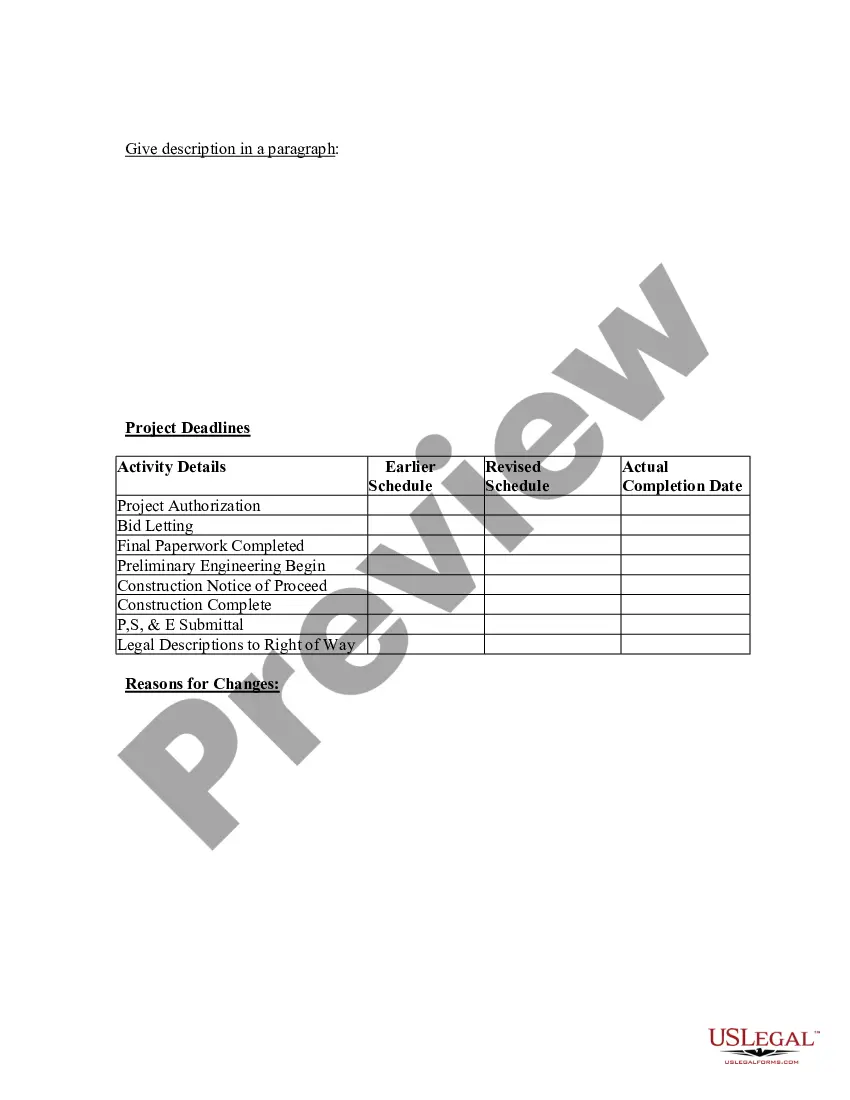

Louisville Kentucky Cost Estimate and Schedule Data Sheet

Description

Form popularity

FAQ

The occupational tax rate in Jefferson County, Kentucky, varies based on the type of business and its location. Generally, businesses can expect the rate to hover around 1.5%. It's important for business owners to factor this into their Louisville Kentucky Cost Estimate and Schedule Data Sheet. By understanding these rates, you can better prepare your financial projections and manage your resources effectively.

The PO box for the Louisville Metro Revenue Commission is an important address for anyone needing to send inquiries or payments. Specifically, you can find assistance related to various taxes and city services here. For inquiries about the Louisville Kentucky Cost Estimate and Schedule Data Sheet or any tax-related questions, this is the right place to start.

Yes, Louisville, KY, has a city tax that every resident should be aware of. This tax helps fund local projects and services that benefit the community. Therefore, when preparing your budget or analyzing the Louisville Kentucky Cost Estimate and Schedule Data Sheet, ensure this tax is accounted for.

The occupational tax rate in Louisville, KY, applies to individuals and businesses working within the city. This tax contributes to local infrastructure and community services. When you are looking at the Louisville Kentucky Cost Estimate and Schedule Data Sheet, be sure to include this rate in your calculations.

The Louisville Metro tax rate varies based on income and the type of property owned. For residents and businesses, this rate impacts your overall financial obligations to the city. It’s important to consider this when analyzing figures on the Louisville Kentucky Cost Estimate and Schedule Data Sheet.

The TARC tax is a local tax that funds public transportation services in the Louisville Metro area. This tax plays a vital role in maintaining the bus system that many residents rely on for their daily commute. Keep this tax in mind when reviewing the Louisville Kentucky Cost Estimate and Schedule Data Sheet.

Louisville is located within Jefferson County, Kentucky. This county offers a variety of resources and amenities for residents and businesses alike. When reviewing the Louisville Kentucky Cost Estimate and Schedule Data Sheet, understanding county specifics can help you make more informed decisions.

The Louisville Metro tax is a local tax applied to residents in the area. This tax helps fund essential city services and programs. If you are looking for detailed information about the Louisville Kentucky Cost Estimate and Schedule Data Sheet, it’s essential to factor in this tax when calculating your total expenses.

PO Box 856910 in Louisville, KY, is often used for various state tax-related correspondence. This address is managed by the Kentucky Department of Revenue for efficient receipt of tax documents and payments. If you have questions regarding this PO Box, the Louisville Kentucky Cost Estimate and Schedule Data Sheet can provide further insight into how it relates to your tax obligations and filings.

Kentucky taxes are calculated based on your total income, taking into account any deductions you qualify for. The tax rates are progressive, meaning they increase as your income rises. To simplify this process, you can refer to the Louisville Kentucky Cost Estimate and Schedule Data Sheet, which outlines the tax brackets and how they apply to different income levels.