Harris Texas Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

Statutes and guidelines in every domain differ across the nation.

If you aren't a lawyer, it can be challenging to navigate the different standards when it comes to composing legal documents.

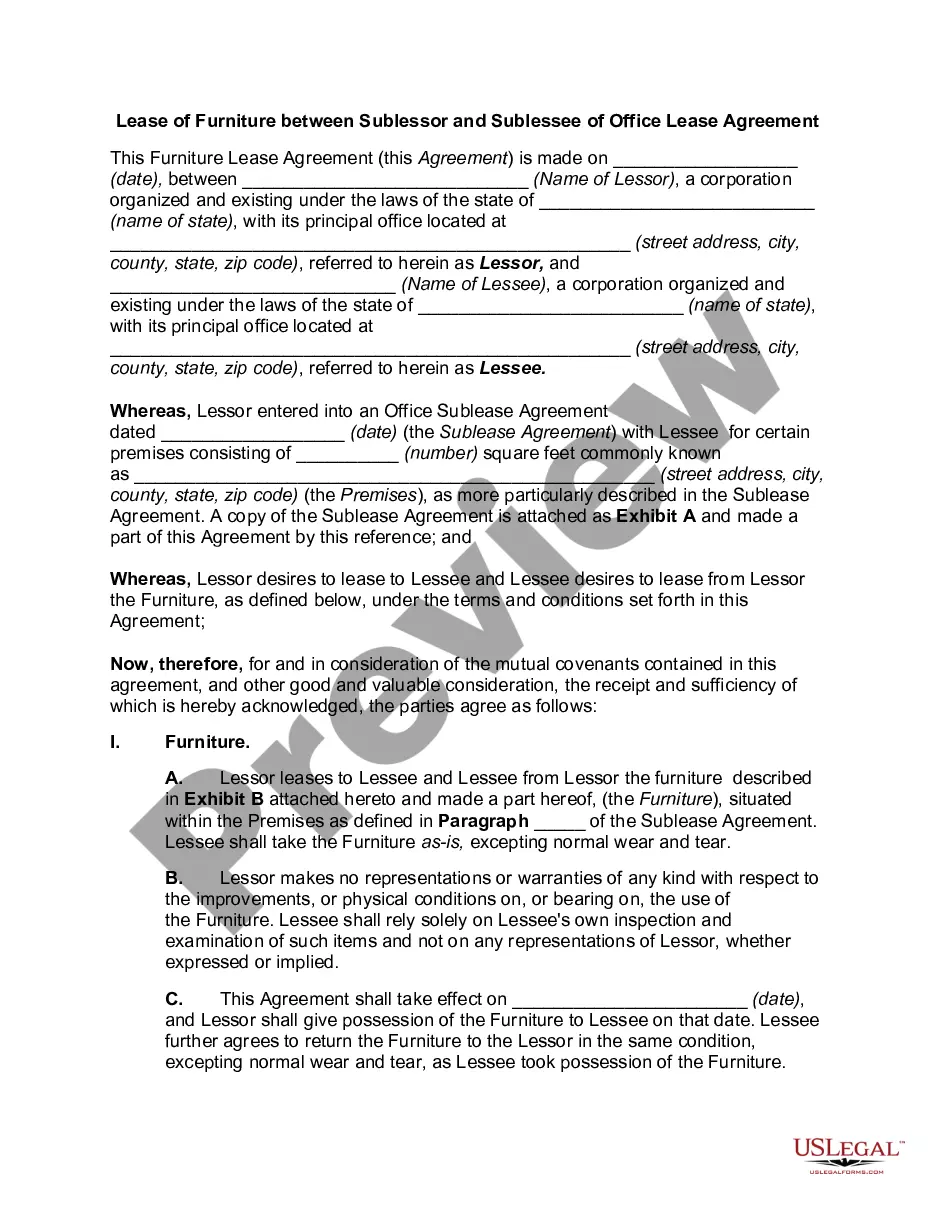

To prevent pricey legal fees while creating the Harris Exchange Addendum to Contract - Tax Free Exchange Section 1031, you must obtain a verified template applicable to your county.

This is the simplest and most cost-effective way to obtain current templates for any legal purpose. Access them effortlessly and keep your documentation organized with US Legal Forms!

- That's where utilizing the US Legal Forms platform becomes invaluable.

- US Legal Forms is widely recognized by millions as a reliable online repository of over 85,000 state-specific legal documents.

- It serves as an excellent option for professionals and individuals looking for do-it-yourself templates for various personal and business situations.

- All documents can be reused: once you select a template, it stays accessible in your profile for subsequent use.

- Thus, if you possess an account with an active subscription, you can simply Log In and re-download the Harris Exchange Addendum to Contract - Tax Free Exchange Section 1031 from the My documents section.

- For newcomers, a few additional steps are required to obtain the Harris Exchange Addendum to Contract - Tax Free Exchange Section 1031.

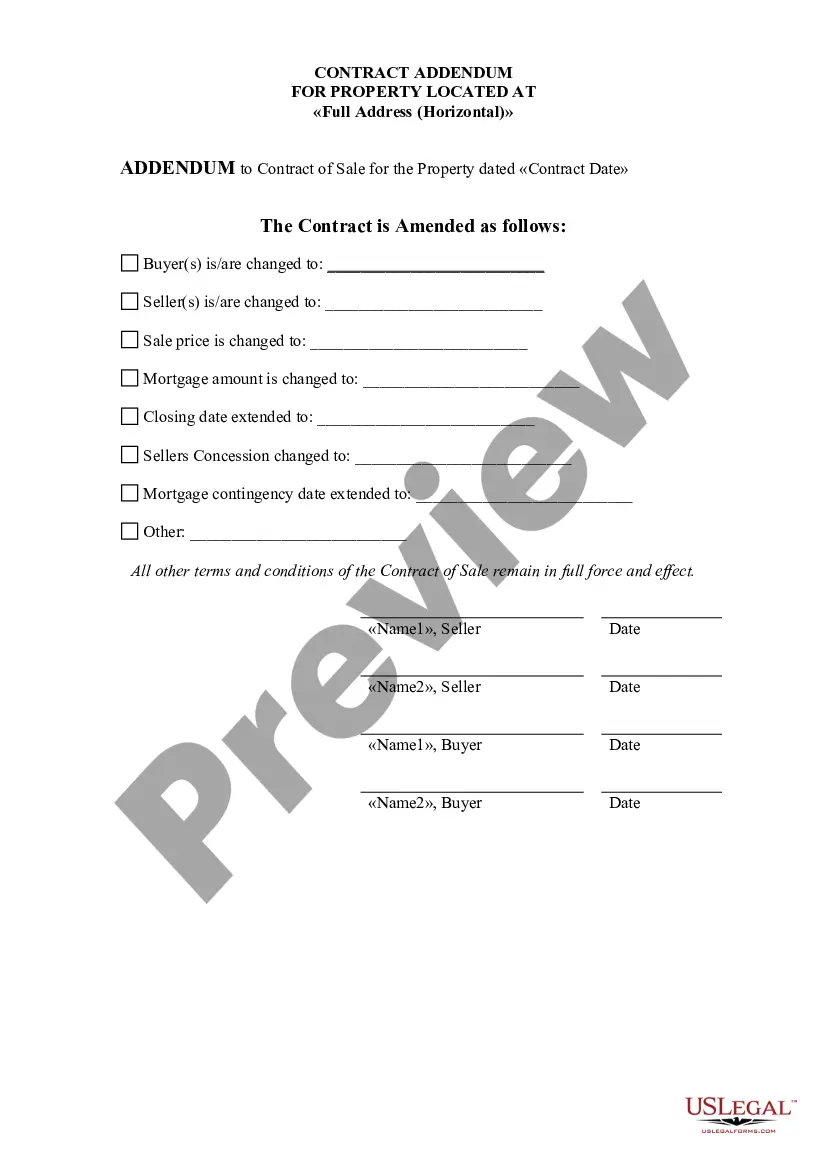

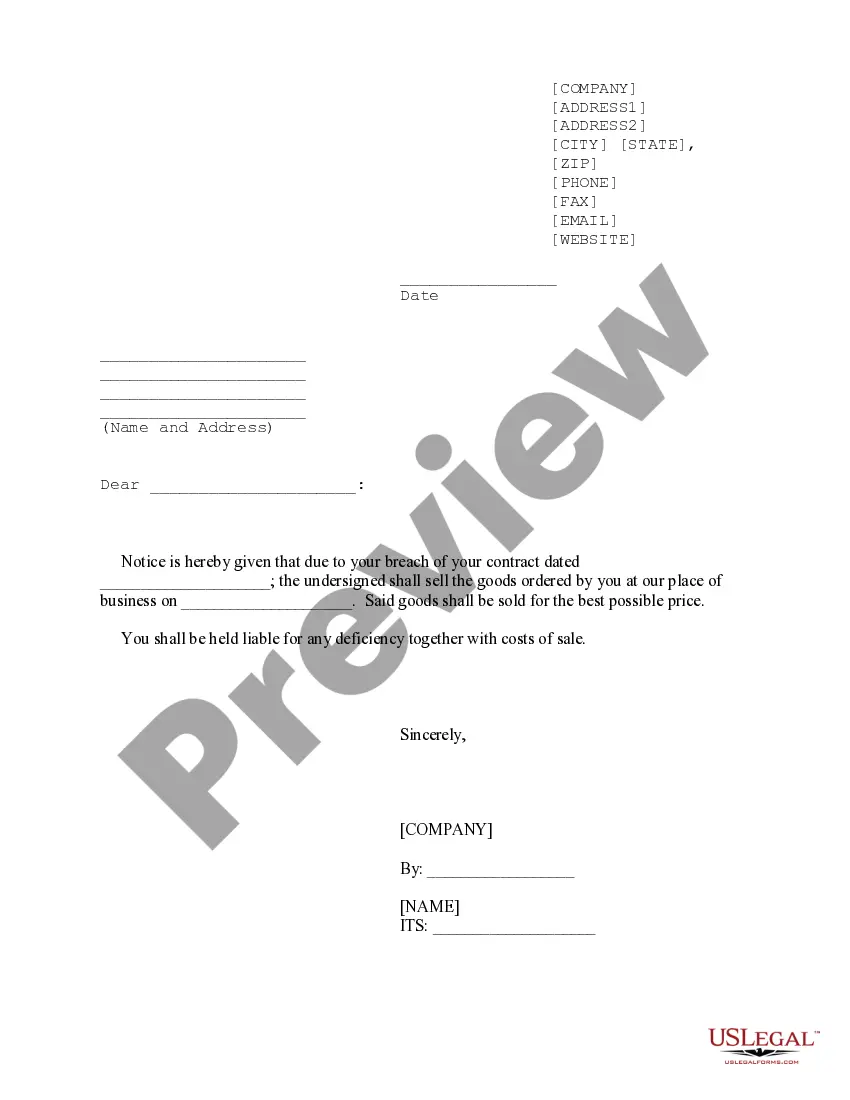

- Review the page content to ensure you've located the suitable template.

- Take advantage of the Preview feature or read the form description if it is provided.

- Search for another document if there are discrepancies with any of your requirements.

- Click the Buy Now button to acquire the document upon finding the right one.

- Select one of the subscription plans and either log in or create an account.

- Determine your preferred method to pay for your subscription (via credit card or PayPal).

- Choose the file format you want to save the document in and hit Download.

- Complete and sign the document by hand after printing it or accomplish everything digitally.

Form popularity

FAQ

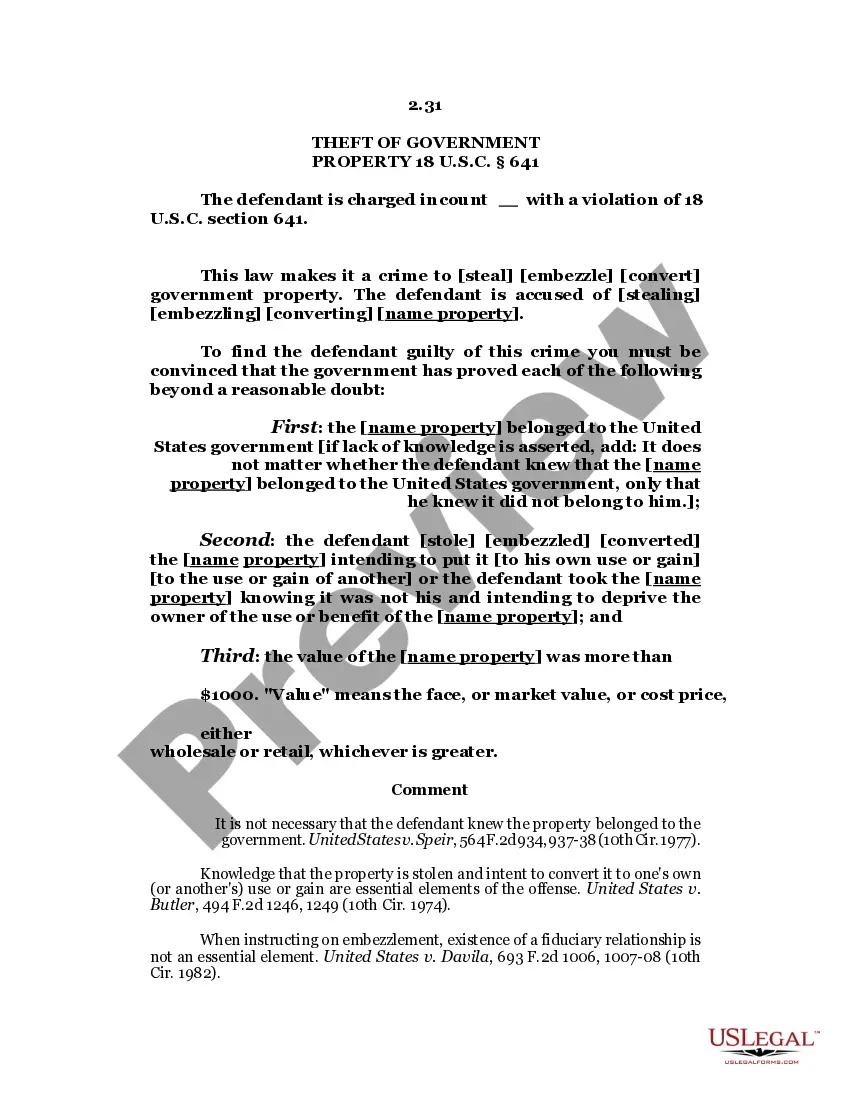

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

While many taxpayers include phrases within their purchase and sale contracts to establish their intent to exchange, the Internal Revenue Code does not require this in a Section 1031 tax-deferred exchange.

The three primary 1031 exchange rules to follow are: Replacement property should be of equal or greater value to the one being sold. Replacement property must be identified within 45 days. Replacement property must be purchased within 180 days.

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).

Another reason someone would not want to do a 1031 exchange is if they have a loss, since there will be no capital gains to pay taxes on. Or if someone is in the 10% or 12% ordinary income tax bracket, they would not need to do a 1031 exchange because, in that case, they will be taxed at 0% on capital gains.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

A 1031 exchange is a real estate investing tool that allows investors to swap out an investment property for another and defer capital gains or losses or capital gains tax that you otherwise would have to pay at the time of sale.

If the sale of your Relinquished Property closed on or between October 18, 2021 and December 31, 2021, the standard 180-day exchange period will be shortened. However, you can file for a tax extension by April 15, 2022 to obtain a full 180-day exchange period.

A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value.