Montgomery Maryland Direct Deposit Form for Payroll

Description

How to fill out Direct Deposit Form For Payroll?

Organizing documentation for business or personal requirements is consistently a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is essential to consider all federal and state laws and regulations applicable in the specific region.

Nevertheless, smaller counties and even towns have legislative rules that must also be taken into account.

The benefit of the US Legal Forms library is that all forms you have ever purchased remain accessible; you can retrieve them in your profile under the My documents tab at any time. Join the service and swiftly acquire verified legal forms for any circumstance with just a few clicks!

- All these factors contribute to the anxiety and lengthy process of creating a Montgomery Direct Deposit Form for Payroll without professional guidance.

- It's simple to sidestep costs associated with attorneys drafting your documents and produce a legally acceptable Montgomery Direct Deposit Form for Payroll independently, utilizing the US Legal Forms online library.

- This resource is the largest online repository of state-specific legal templates that are professionally validated, ensuring their legitimacy when selecting a sample for your county.

- Current subscribers can simply sign in to their accounts to download the form they require.

- If you haven't yet subscribed, follow the step-by-step instructions below to acquire the Montgomery Direct Deposit Form for Payroll.

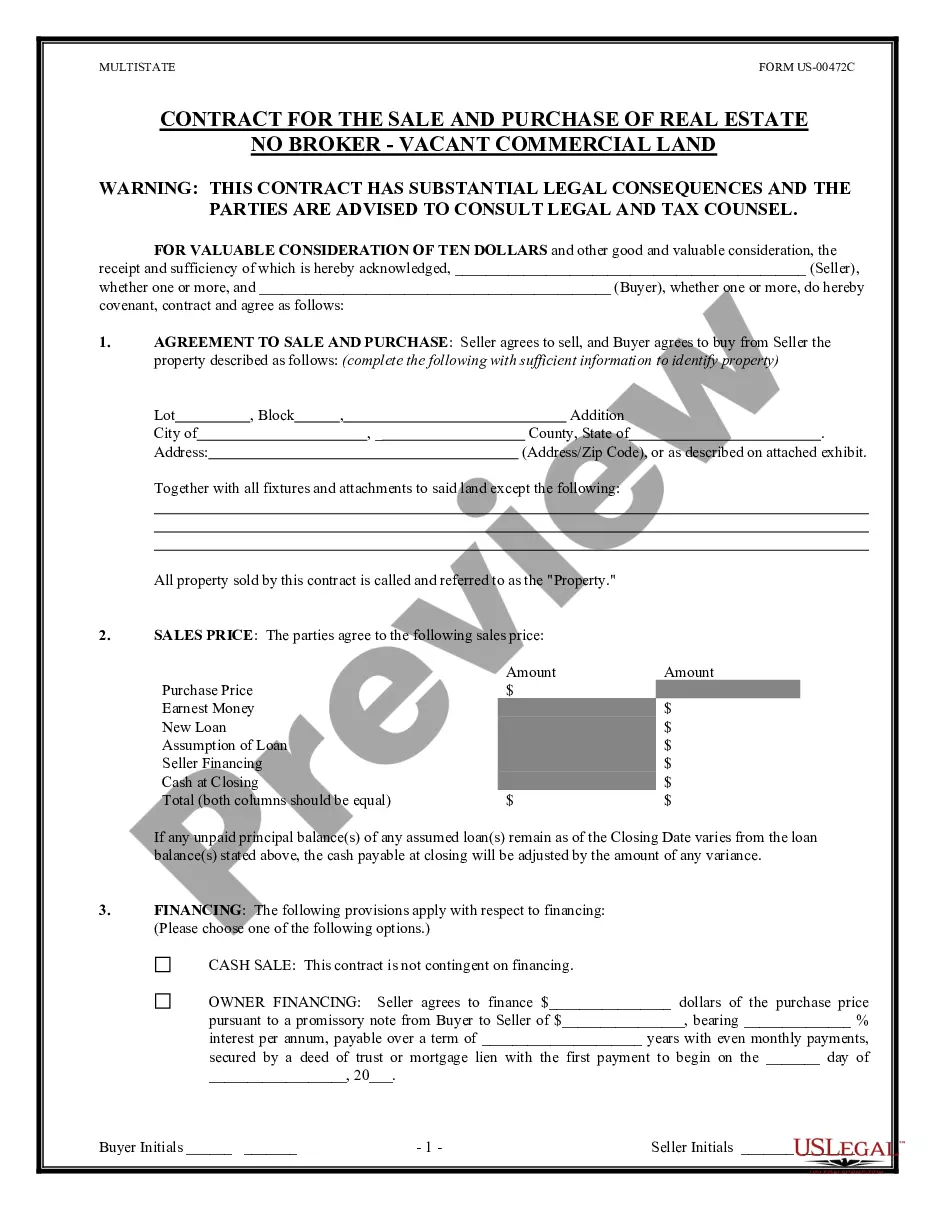

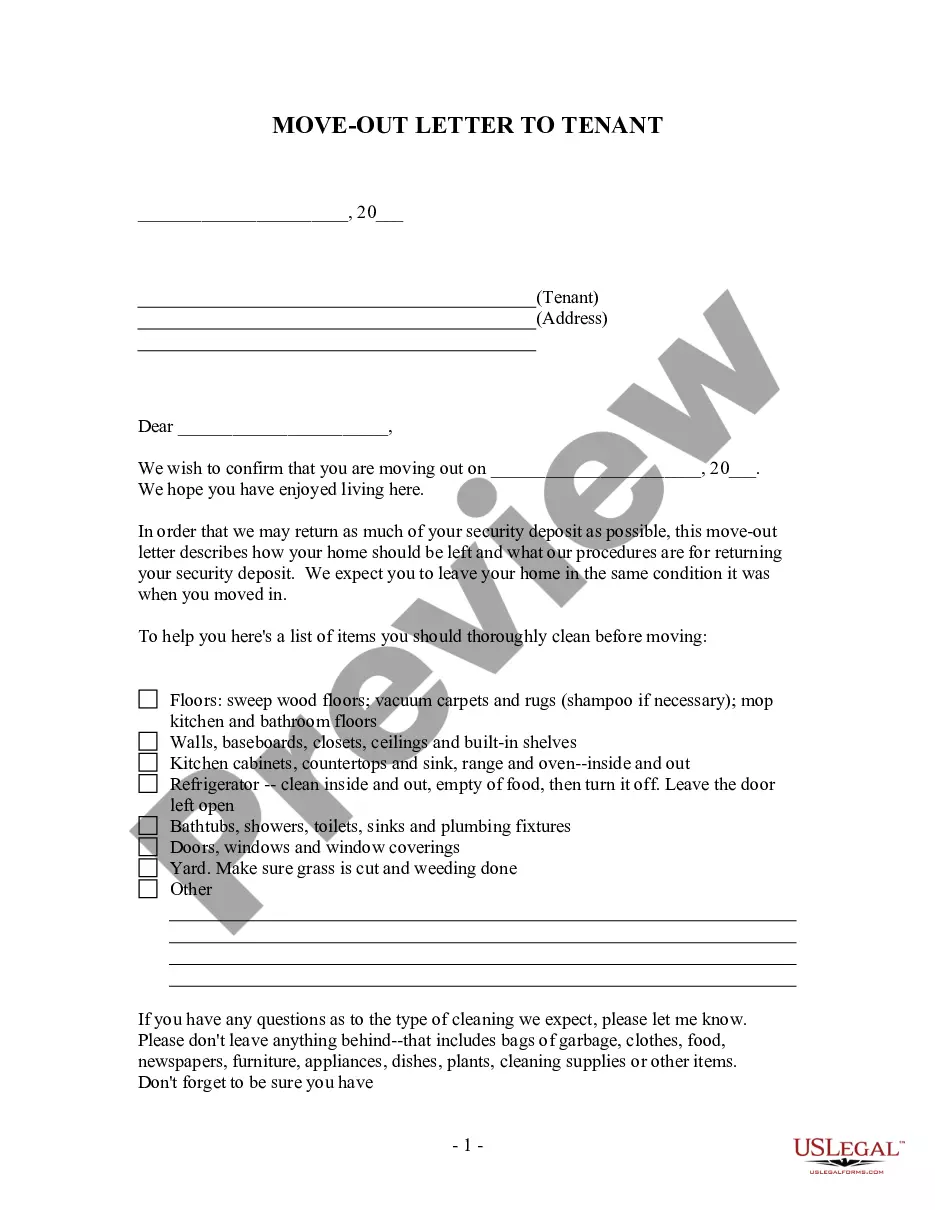

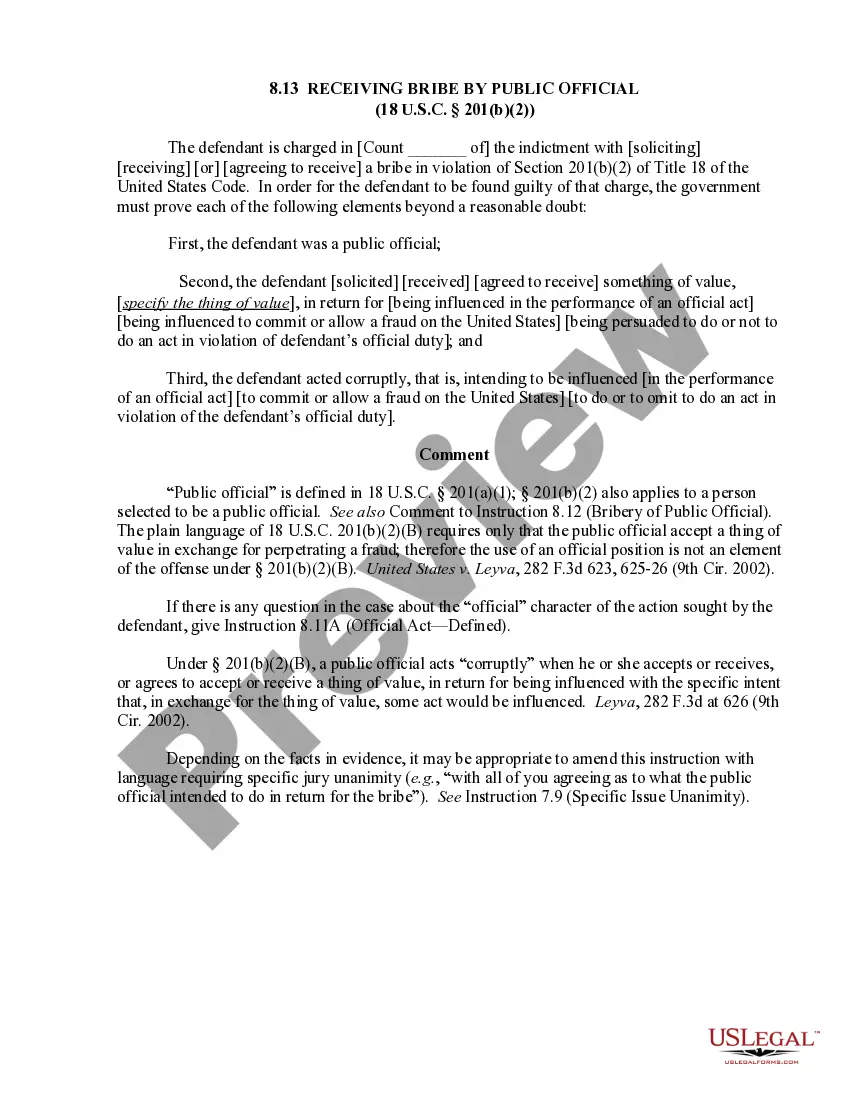

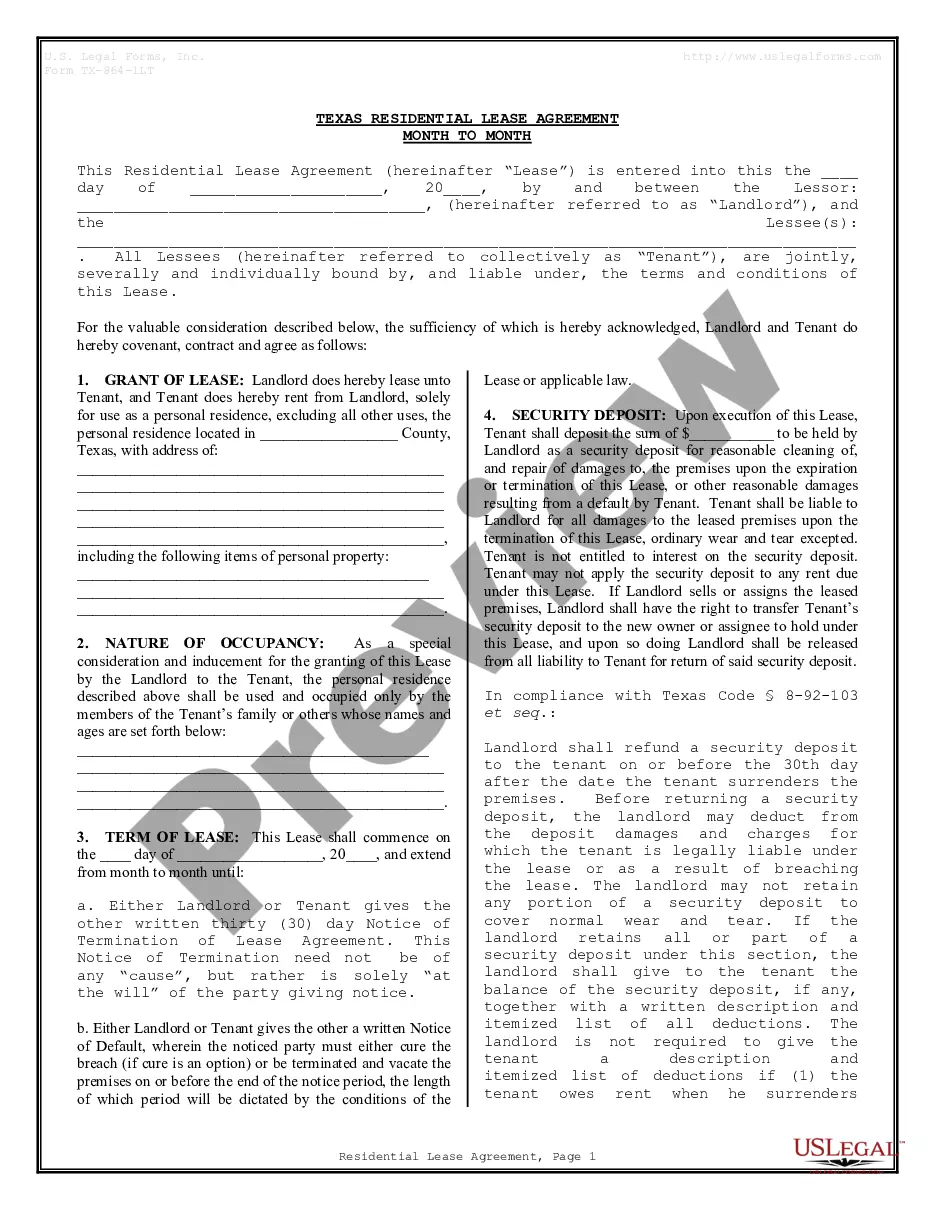

- Browse through the opened page and confirm if it contains the document you are looking for.

- To achieve this, utilize the form description and preview if available.

Form popularity

FAQ

Setting up direct deposit is simpleyou just need your employees' bank account information, signed approval, and a service to help facilitate....Choose a Direct Deposit Provider.Set Up Direct Deposit Service.Get Employee Authorization and Bank Information.Determine Pay Cycle.

To write a bank authorization letter, call or visit your bank to obtain a power of attorney form or third party authorization form. If you want someone to have limited access to your account, get a limited financial power of attorney form so you can specify what the other person will have access to.

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

The most basic way to move money into someone else's account is to walk into the bank and tell the teller you'd like to make a cash deposit. You'll need some direct deposit information, like the recipient's full name and bank account number, to complete the deposit.

Get a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

Set up direct depositAsk for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF).Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.More items...

You need the recipient's name and address as it appears on the account to which you are sending money. You also need the name of the bank, the bank routing number and the bank account number. The routing number identifies the bank, while the account number is a unique identifier of your recipient's account.

Once you have obtained the form, you will need the following information to fill it out: your bank's mailing address, the bank's routing number, your account number and the type of account you will be depositing to. Some forms might ask for your Social Security number or mailing address.

How to set up direct deposit for employees: A step-by-step guideStep 1: Decide on a direct deposit provider.Step 2: Initiate the direct deposit setup process.Step 3: Collect information from your employees.Step 4: Enter the employee information into your system.Step 5: Create a direct deposit and payroll schedule.More items...