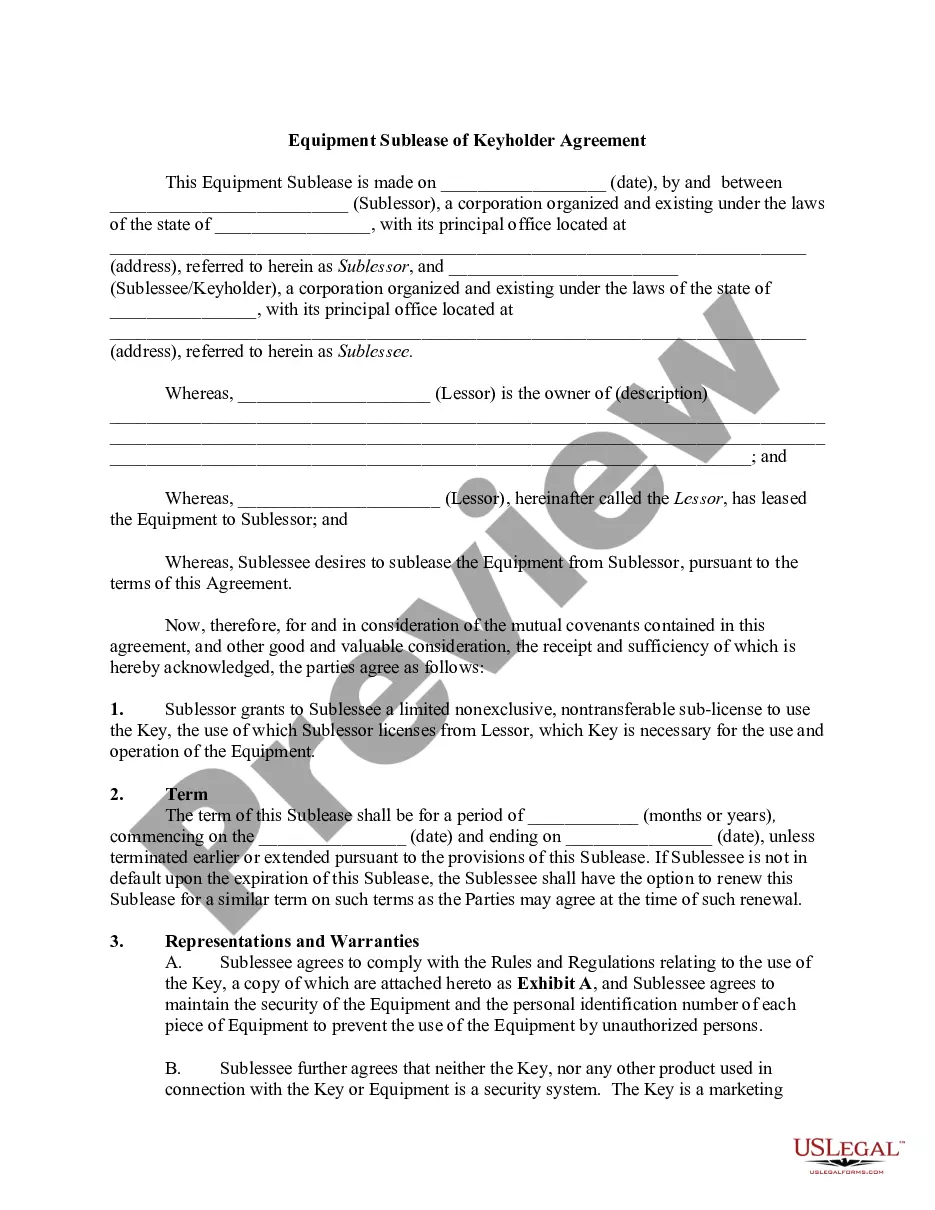

When a Lessee leases out the whole or part of the leased premises to a third person it is called a sublease. Even if a proper sublease exists, the primary lessee will be responsible for payment of all charges to the primary lessor and the primary lessee will be responsible for any damage caused by the sub lessee. This Equipment Sublease, which is a part of the Keyholder Agreement, is an agreement by which equipment is subleased. In the agreement, the equipment is subleased along with a sublicense to use the network and software necessary for the use of the equipment. Key Holder service is generally a password based database application. Such services often provide local authorities with emergency contact and keyholder information.

Oklahoma City Oklahoma Equipment Sublease of Key Holder Agreement

Description

Form popularity

FAQ

Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501.

With Oklahoma source gross income of $1,000 or more is required to file an Oklahoma income tax return.

Generally, your Oklahoma income tax return is due April 15th. However: If you e-file (through a preparer or the internet), your due date is extended to April 20th. Any taxes due on April 20th must be paid electronically (by direct debit, etc.)

Oklahoma Income Taxes. Prepare and e-file your current year Oklahoma state tax return - resident, nonresident, or part-year resident returns - with your IRS return via eFile.com.

Oklahoma Income Taxes. Prepare and e-file your current year Oklahoma state tax return - resident, nonresident, or part-year resident returns - with your IRS return via eFile.com.

With Oklahoma source gross income of $1,000 or more is required to file an Oklahoma income tax return.

Zip Code List County - Oklahoma County, Oklahoma Zip CodeCityCounty 73107 Oklahoma City Oklahoma County 73108 Oklahoma City Oklahoma County 73109 Oklahoma City Oklahoma County 73110 Midwest City Oklahoma County48 more rows Zip Code List County ciclt.net ? clt ? capitolimpact ? gw_ziplist ciclt.net ? clt ? capitolimpact ? gw_ziplist

Oklahoma City has many unique districts that define the city's culture and embody the Modern Frontier moniker. The National Stockyards is the world's largest feeder and stocker cattle market located in Stockyard City. OKC Facts & Numbers visitokc.com ? media ? okc-facts-numbers visitokc.com ? media ? okc-facts-numbers