Round Rock Texas Non- Homestead Affidavit and Designation of Homestead

Description

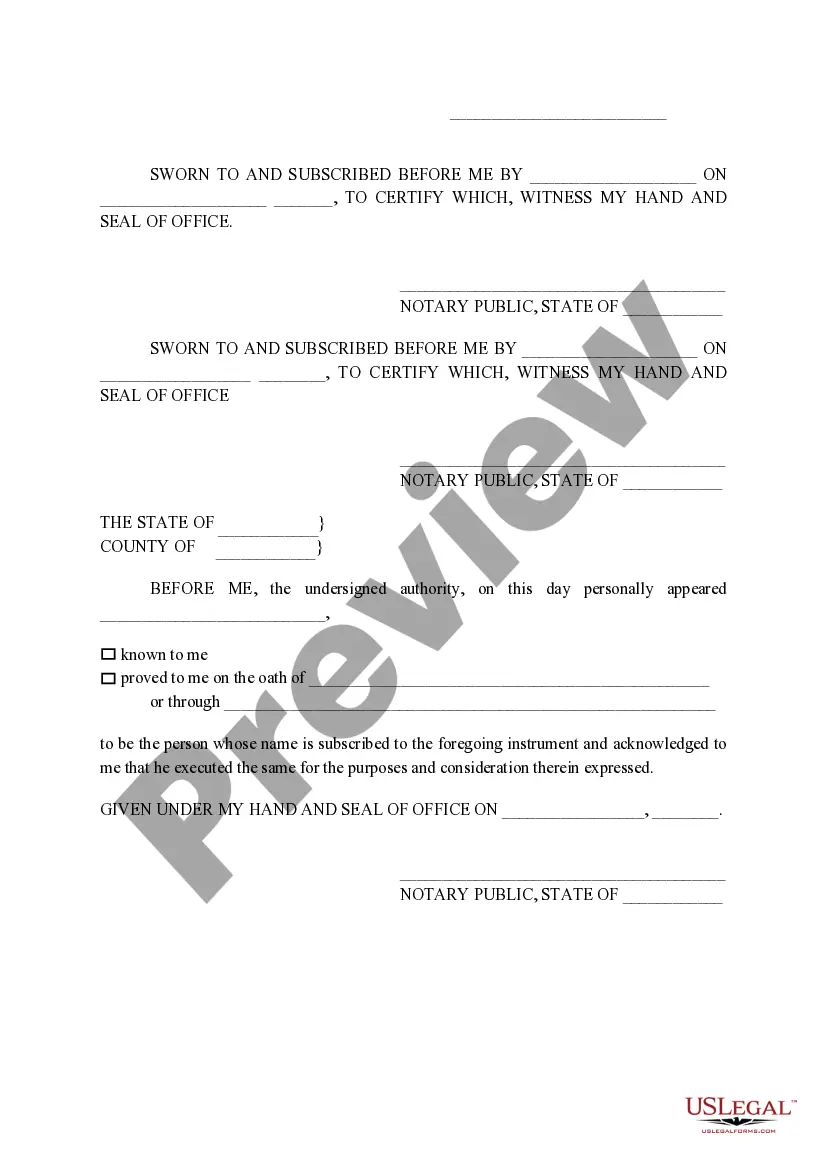

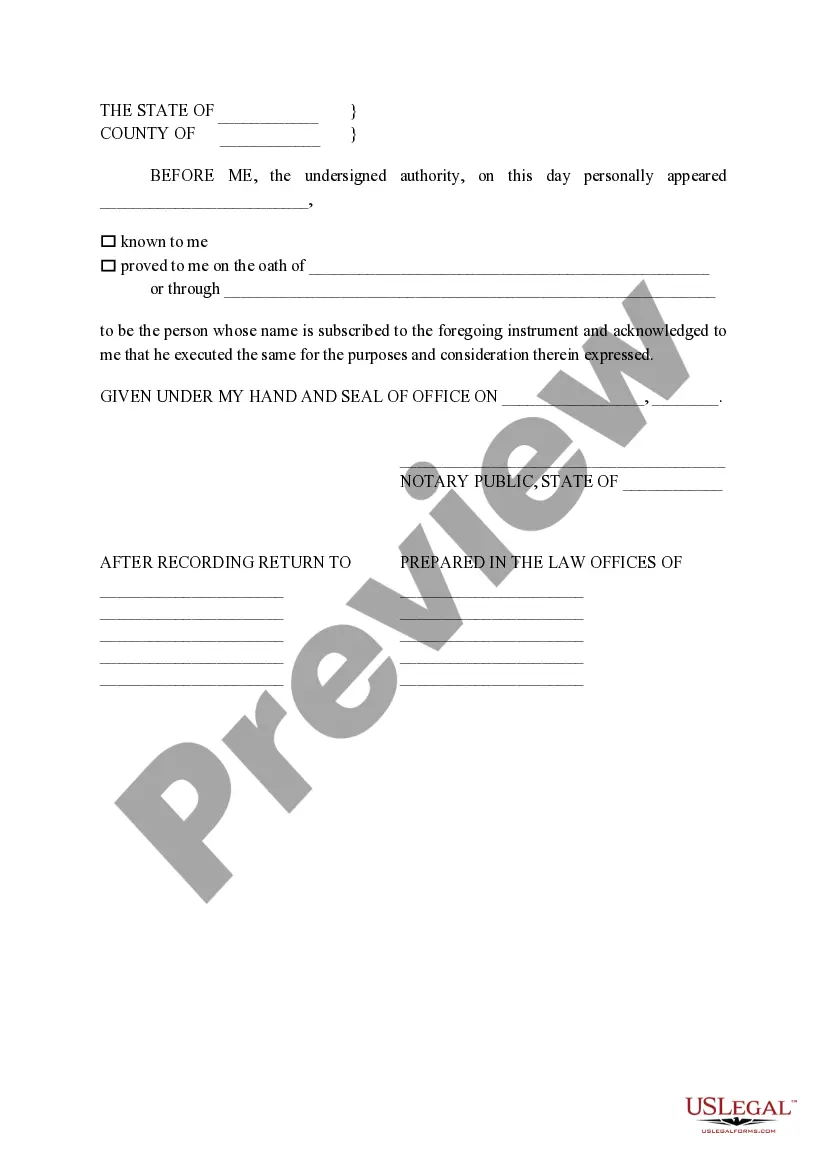

How to fill out Texas Non- Homestead Affidavit And Designation Of Homestead?

If you are looking for an appropriate form, it’s unfeasible to select a more suitable service than the US Legal Forms website – one of the most comprehensive online repositories.

With this repository, you can locate thousands of form examples for commercial and personal use by categories and locations, or keywords.

Utilizing our sophisticated search tool, acquiring the most updated Round Rock Texas Non-Homestead Affidavit and Designation of Homestead is as simple as 1-2-3.

Obtain the document. Choose the format and save it to your device.

Make changes. Complete, alter, print, and sign the acquired Round Rock Texas Non-Homestead Affidavit and Designation of Homestead.

- If you are already familiar with our system and possess an account, all you need to obtain the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview option to assess its content. If it doesn’t fulfill your needs, use the Search bar at the top of the screen to find the appropriate document.

- Confirm your choice. Choose the Buy now option. Then, select the desired pricing plan and provide details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

An example of a non-homestead property would be a rental house that an individual owns but does not live in. It could also include vacation homes or commercial properties that do not serve as the owner's primary residence. Identifying the status of your properties is essential, and the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead can assist you in determining which properties fall under this classification.

Homestead taxes refer to those taxes applied to a primary residence that qualifies for various exemptions, potentially lowering the tax burden. Conversely, non-homestead taxes apply to properties that do not meet these criteria, such as rental properties or second homes, which are taxed at full value. Understanding the distinctions is crucial, and employing tools like the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead can provide clarity in these matters.

To file a homestead exemption in Texas, you typically need to present a completed application form along with proof of your identity and ownership of the property. Documents like a Texas driver's license, a recent utility bill, or a property deed can serve as verification. By utilizing the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead, you can ensure that you have all necessary paperwork in order to maximize your benefits.

In Texas, a homestead exemption can reduce your property's taxable value, resulting in lower property taxes. Generally, the exemption reduces the value by $25,000 for school district taxes, and additional exemptions may apply for seniors or disabled individuals. Utilizing the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead can help you navigate these tax benefits more effectively.

A property is classified as a homestead in Texas if it is used as a primary residence for the owner. The homeowner must occupy the property and establish it as their principal place of living. To protect your rights further, consider filing a Round Rock Texas Non-Homestead Affidavit and Designation of Homestead. This can ensure you receive the necessary benefits associated with homestead status.

The difference between rural and urban homesteads in Texas primarily lies in zoning regulations and the type of protections offered. Urban homesteads often deal with stricter city ordinances, while rural homesteads may enjoy broader property use. Additionally, the property tax exemptions and creditor protections can differ based on the location. If you are considering filing for a homestead designation, US Legal Forms can help clarify the distinctions and provide the appropriate forms for the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead.

A designation of homestead request form in Texas identifies your property as your homestead and initiates the legal process of protecting it. Completing this form is crucial for securing the benefits afforded to homestead properties, which can include reduced property taxes and protections against creditors. By filing the form correctly, you safeguard your home and its value. US Legal Forms can assist you with the necessary documents for the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead.

The property code for homestead designation in Texas falls under Section 41 of the Texas Property Code. This section outlines the qualifications and requirements for claiming a homestead. Understanding this code helps ensure that you adhere to the regulations when filing for your homestead. For specific forms related to the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead, consider consulting US Legal Forms.

The designation of homestead affidavit in Texas is a legal document that formalizes your intent to claim a property as your primary residence. This affidavit protects your home from certain types of creditors and may provide property tax exemptions. By filing the affidavit, you affirm your rights to homestead protections. To easily navigate this process, turn to US Legal Forms for guidance on completing the Round Rock Texas Non-Homestead Affidavit and Designation of Homestead.

To designate a homestead in Texas, you must file a designation of homestead affidavit with your local county clerk. This document officially marks your residence as your homestead, providing protections from creditors and tax benefits. Make sure to include all required information, such as your name and property details. For a smooth process, consider using US Legal Forms to obtain the right affidavit for your Round Rock Texas Non-Homestead Affidavit and Designation of Homestead.