The Harris County, Texas Non-Homestead Affidavit and Designation of Homestead are legal documents that relate to property ownership and taxation in the county. These documents are essential for property owners in order to assert their rights and claim exemptions on their homes or other qualified properties. Here is a detailed explanation of each document: 1. Harris County Non-Homestead Affidavit: The Harris County Non-Homestead Affidavit is a legal document used to declare that a property does not qualify for a homestead exemption. This affidavit is necessary for properties that are not utilized as the owner's primary residence or do not meet the criteria set for a homestead. By filing this affidavit, property owners ensure that their property is taxed accordingly based on its non-homestead status. Related keywords: Harris County, non-homestead property, property taxation, affidavit, primary residence, property owners. 2. Harris County Designation of Homestead: The Harris County Designation of Homestead is a legal document used to claim a homestead exemption on a property. This document is essential for property owners who use their property as their primary residence and want to enjoy the associated tax benefits. By designating a property as a homestead, owners can lower their property taxes and protect their property from certain types of creditors. Related keywords: Harris County, homestead exemption, primary residence, property taxes, tax benefits, designated homestead, property protection. It is important to note that these documents are specific to Harris County in Texas. Other counties or states may have similar documents, but the details and requirements may vary. In Harris County, there may be additional types of non-homestead affidavits and homestead designations based on certain criteria or circumstances. Some possible variations include: 1. Disabled Person's Homestead Exemption: A designation specifically for individuals with disabilities, providing additional tax benefits and protections. 2. Over-65 Homestead Exemption: A designation available for individuals aged 65 or older, offering additional tax exemptions and benefits. 3. Surviving Spouse Homestead Exemption: A designation for surviving spouses of qualified property owners, allowing them to continue benefiting from the homestead exemption. 4. Additional Non-Homestead Affidavits: Variations of non-homestead affidavits may exist to address specific situations, such as properties used for rental purposes or properties subject to certain restrictions. It is important for property owners to consult with legal professionals or tax authorities in Harris County, Texas, to ensure they complete the correct documents and receive the appropriate exemptions and benefits based on their specific circumstances.

Harris Texas Non- Homestead Affidavit and Designation of Homestead

Description

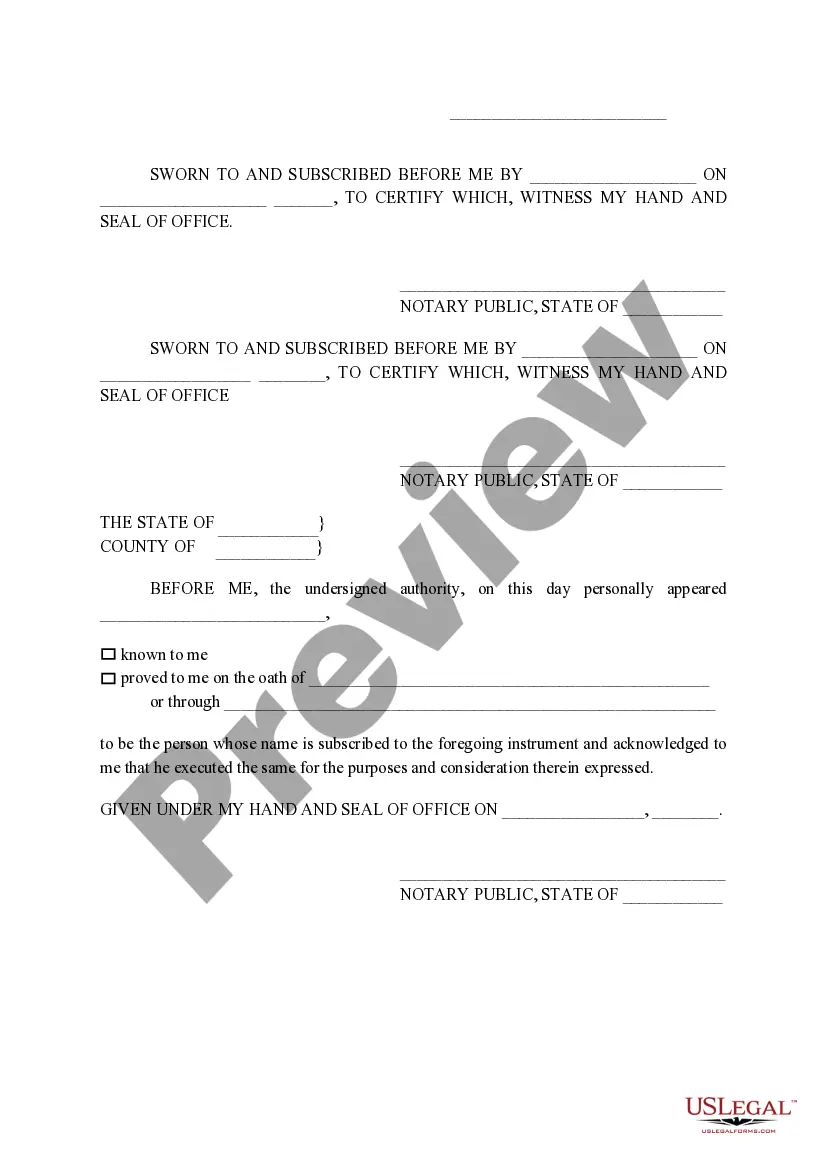

How to fill out Texas Non- Homestead Affidavit And Designation Of Homestead?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our effective platform with numerous documents enables you to locate and acquire nearly any document example you need.

You can download, complete, and sign the Harris Texas Non-Homestead Affidavit and Designation of Homestead in just a few minutes instead of spending hours online searching for the correct template.

Using our collection is an excellent way to enhance the security of your document filing.

Locate the form you need. Confirm that it is the template you were searching for: verify its title and description, and use the Preview feature if available. Otherwise, utilize the Search option to find the suitable one.

Initiate the download process. Click Buy Now and select the pricing option you prefer. Next, create an account and pay for your order using a credit card or PayPal.

- Our knowledgeable attorneys frequently review all the documents to ensure they are applicable to a specific area and adhere to current laws and regulations.

- How do you access the Harris Texas Non-Homestead Affidavit and Designation of Homestead.

- If you have an account, simply Log In to your account. The Download option will be active on all the samples you view.

- Moreover, you can locate all previously saved documents in the My documents section.

- If you do not yet have an account, follow the instructions below.

Form popularity

FAQ

A Texas homestead designation is an official acknowledgment that a property serves as a homeowner's primary residence. This designation brings various rights and protections, including property tax benefits. To secure these advantages, submitting the Harris Texas Non-Homestead Affidavit and Designation of Homestead is crucial, as it formalizes your claim to homestead benefits.

The voluntary designation of homestead in Texas allows property owners to assert their home as a homestead intentionally. This designation is not mandatory, but it provides essential benefits, such as property tax exemptions and legal protection. When you file the Harris Texas Non-Homestead Affidavit and Designation of Homestead, you actively choose to protect your home and financial interests.

A homestead affidavit in Texas is a detailed statement that confirms a property as a homestead. This affidavit confirms eligibility for certain benefits, including tax exemptions. By filing the Harris Texas Non-Homestead Affidavit and Designation of Homestead, you ensure your rights as a homeowner are protected and recognized under Texas law.

The designation of homestead affidavit in Texas is a legal document that establishes a home as a homestead. This affidavit allows homeowners to claim specific rights, including tax benefits and certain protections from creditors. By completing the Harris Texas Non-Homestead Affidavit and Designation of Homestead, you safeguard your property and potentially reduce your tax liability.

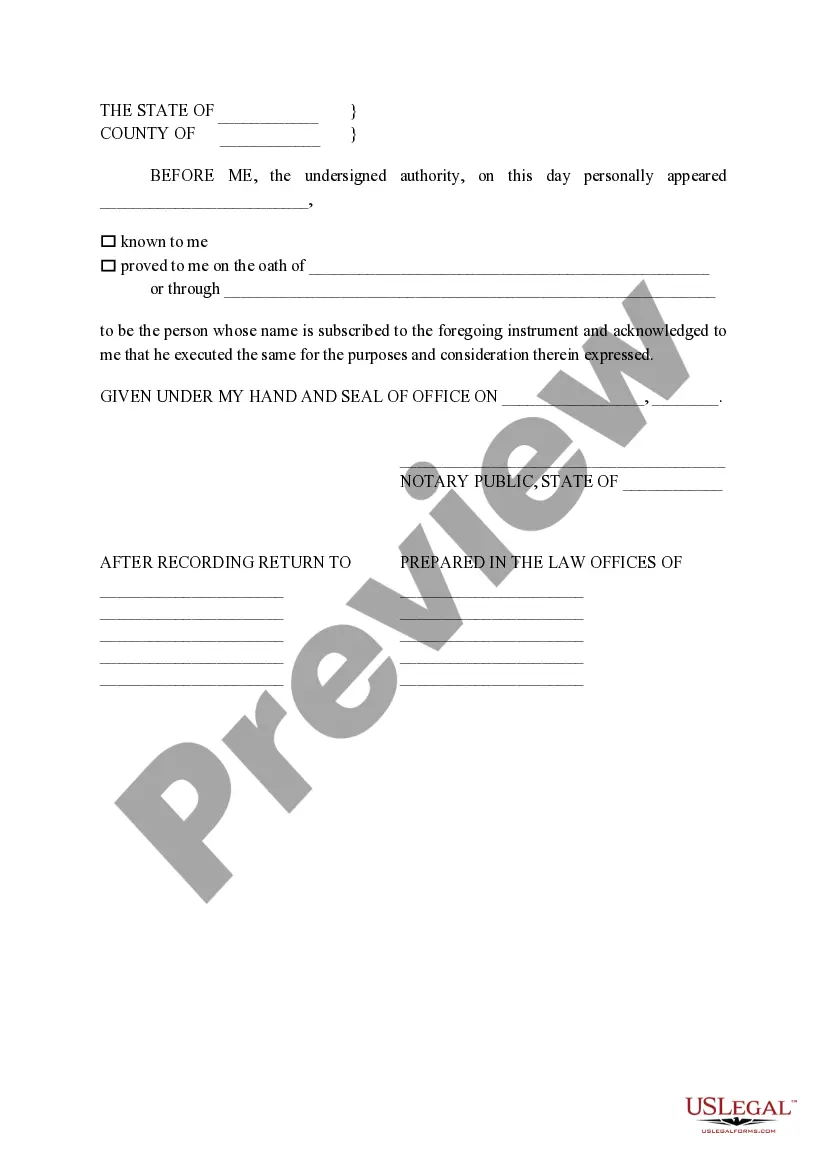

To designate a homestead in Texas, you need to file a Harris Texas Non-Homestead Affidavit and Designation of Homestead with your local county appraisal district. This process involves providing personal information and details about the property. Once you submit the affidavit, the designation officially goes into effect, providing you with property tax exemptions and protection against creditors.

When filing a homestead exemption, certain information is crucial for the process. You will need your property’s address, your Texas driver's license number, and details regarding your residency. Additionally, you should have the completed Harris Texas Non-Homestead Affidavit and Designation of Homestead on hand. Gathering all this information beforehand can help you file more efficiently.

If you forgot to file for a homestead exemption in Texas, don’t worry; you still have options. You can file a late application for the current tax year, but it’s important to act as soon as possible. Submitting a Harris Texas Non-Homestead Affidavit and Designation of Homestead can still grant you tax savings, but be mindful of deadlines for late submissions. Seeking guidance from USLegalForms can help navigate the filing process smoothly.

To file a homestead exemption in Texas, you must provide essential information about your property and residency status. You should complete a Harris Texas Non-Homestead Affidavit and Designation of Homestead form accurately and include documentation that proves your ownership and primary residence. This information helps the appraisal district to determine your eligibility and streamline the exemption process.

The approval process for a homestead exemption in Texas typically takes around one to three months. Once you submit your application, the appraisal district will review your documents, including your Harris Texas Non-Homestead Affidavit and Designation of Homestead. Keep in mind that response times may vary based on the volume of applications and the specific county. Patience is essential as you await your exemption confirmation.

To file a homestead exemption in Texas, you will need specific documents to support your application. Generally, you will require proof of residency, such as a Texas driver's license, and a completed Harris Texas Non-Homestead Affidavit and Designation of Homestead form. Additionally, you may need to provide evidence of property ownership, such as a deed. Ensuring you have all the required documents simplifies the filing process.

More info

The Texas Comptroller of Public Accounts website has an online form, here. Property tax forms and applications can be filed with the Texas Comptroller of Public Accounts by clicking here. Homeowners should check the address on the form to make sure it is correct. The application form is also on the Comptroller of Public Accounts website. I am not married, not a widow, and my spouse will not receive a tax break from property taxes when my name is on the deed. How can I get a tax break from property taxes? There are several ways in which you can qualify for a tax break on your spouse's property. If the property that we are referring to is real property, the family member that gets a tax break must be the owner at the time of death. Your spouse, child, grandchild, or any other person who has a legitimate interest in the money that you get from property taxes, should be considered a beneficiary.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.