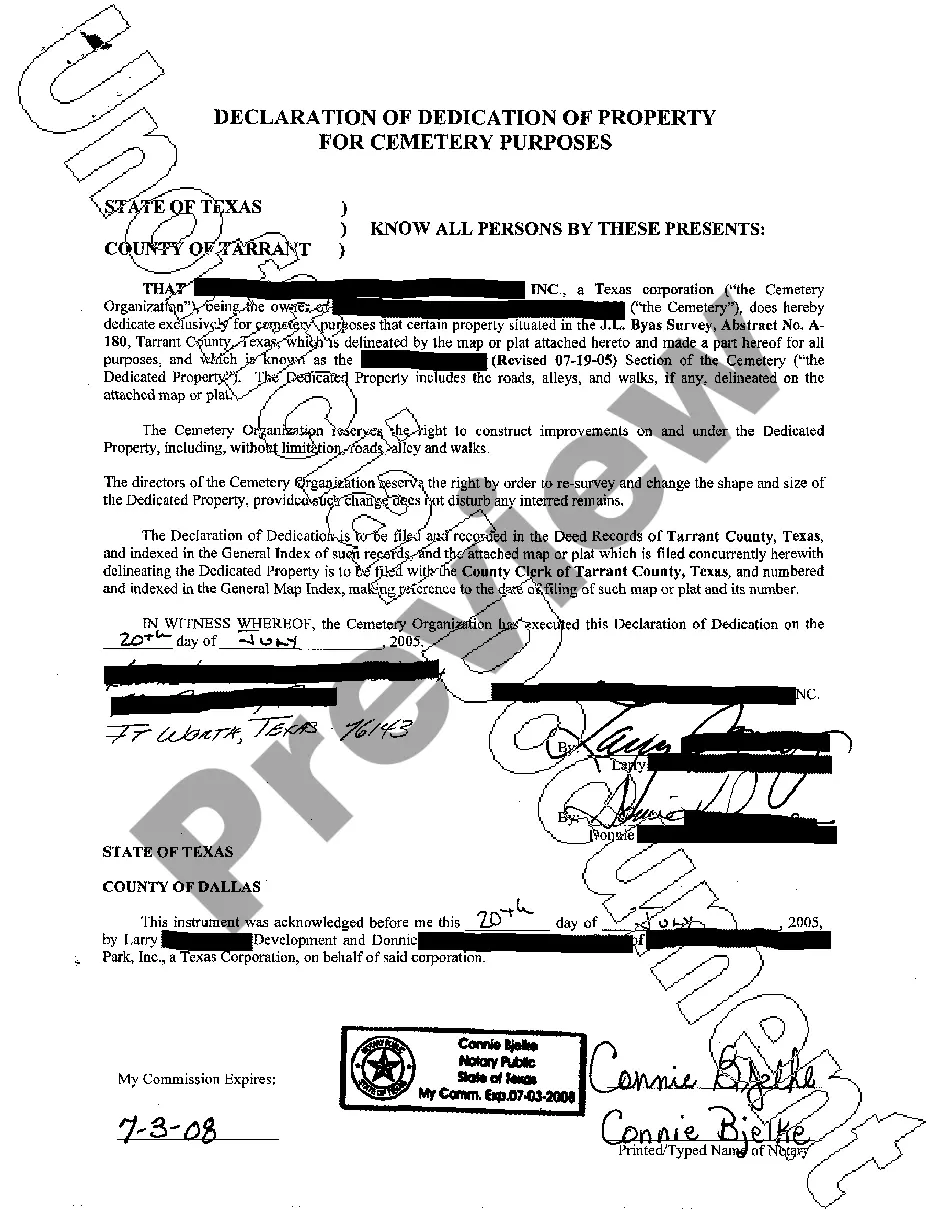

The Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes is a legal document that outlines the dedication and use of specific property for cemetery purposes in the city of Round Rock, Texas. This declaration is essential for ensuring the proper management and maintenance of burial grounds within the community. The Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes serves as a written agreement between the property owner and the city, establishing the intended use of the land exclusively for cemetery purposes. It sets forth the terms and conditions under which the property will be maintained as a final resting place for deceased individuals and guarantees perpetual care and preservation of the cemetery. This declaration includes various key elements such as the legal description of the property, which provides specific details about the location and boundaries of the dedicated land. It may also highlight any existing structures or improvements on the property, such as chapels, mausoleums, or crematories, and define their roles within the cemetery facility. Additionally, the document outlines the regulations and restrictions related to the use and development of the cemetery property. This may include stipulations regarding landscaping, grave markers, fencing, access roads, or any other relevant factors that contribute to the overall appearance and functionality of the cemetery. These guidelines help maintain a respectful and dignified environment for both visitors and the deceased. Different types of Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes may exist based on specific details or categories of cemetery properties. Examples can include: 1. Municipal Cemetery Declarations: These declarations are applicable to cemetery properties owned and operated by the city of Round Rock, Texas. They establish the city's commitment to providing burial plots and associated services to the local community. 2. Private Cemetery Declarations: These declarations apply to cemetery properties owned by private individuals, organizations, or religious groups. They outline the dedication of the land solely for cemetery use and establish guidelines for the private cemetery's operation and maintenance. 3. Memorial Garden Declarations: This type of declaration may be specific to cemetery properties that are developed as memorial gardens, where the emphasis is on creating a serene and contemplative environment. These declarations often include provisions for the landscaping, design, and perpetual care of the garden. In conclusion, the Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes is a legally binding document that ensures the proper use, maintenance, and perpetual care of cemetery properties in Round Rock, Texas. Different types of declarations may exist, focusing on municipal cemeteries, private cemeteries, or memorial gardens, each with their unique guidelines and requirements.

Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes

Description

How to fill out Round Rock Texas Declaration Of Dedication Of Property For Cemetery Purposes?

If you have previously utilized our service, Log In to your account and retrieve the Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it as per your payment agreement.

If this is your inaugural encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly find and store any template for your personal or business needs!

- Ensure you’ve located an appropriate document. Browse the description and use the Preview feature, if accessible, to verify if it satisfies your requirements. If it does not suit you, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Round Rock Texas Declaration of Dedication of Property for Cemetery Purposes. Select the file format for your document and save it onto your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

Nonprofit corporations can establish, manage, maintain, improve, or operate a private cemetery, according to Section 711.021 of the Health and Safety Code. Property dedicated to cemetery purposes and used as a burial ground may not be sold in such a manner as to interfere with its use as a cemetery (State v.

The Texas Historical Commission or other state agencies do not enforce cemetery laws. This responsibility belongs to county and municipal law enforcement agencies. If you are aware of cemetery vandalism or desecration, contact your county sheriff or local police department.

The family which owns the Deed of Grant is responsible for the grave maintenance, subject to the rules of the authority which owns the cemetery and looks after the grounds. Some cemeteries can have quite strict regulations about things people are permitted to do and what is expected of them.

To be deductible the contributions must be voluntary and must be made to or for the use of a nonprofit cemetery or crematorium, whose funds are irrevocably dedicated to the care of the cemetery as a whole. A donor may not deduct a contribution made for the perpetual care of a particular lot or crypt.

The Texas Historical Commission or other state agencies do not enforce cemetery laws. This responsibility belongs to county and municipal law enforcement agencies. If you are aware of cemetery vandalism or desecration, contact your county sheriff or local police department.

Section 711.001 of the Health and Safety Code defines a cemetery as a place that is used or intended to be used for interment, containing one or more graves.

Most bodies are buried in established cemeteries, but burial on private property may be possible in Texas. Before conducting a home burial or establishing a family cemetery, check with the county or town clerk for any local zoning laws you must follow.

Cemeteries in Texas are exempt from property taxation, requiring that the cemetery must be only used for burial purposes and does not turn a profit.