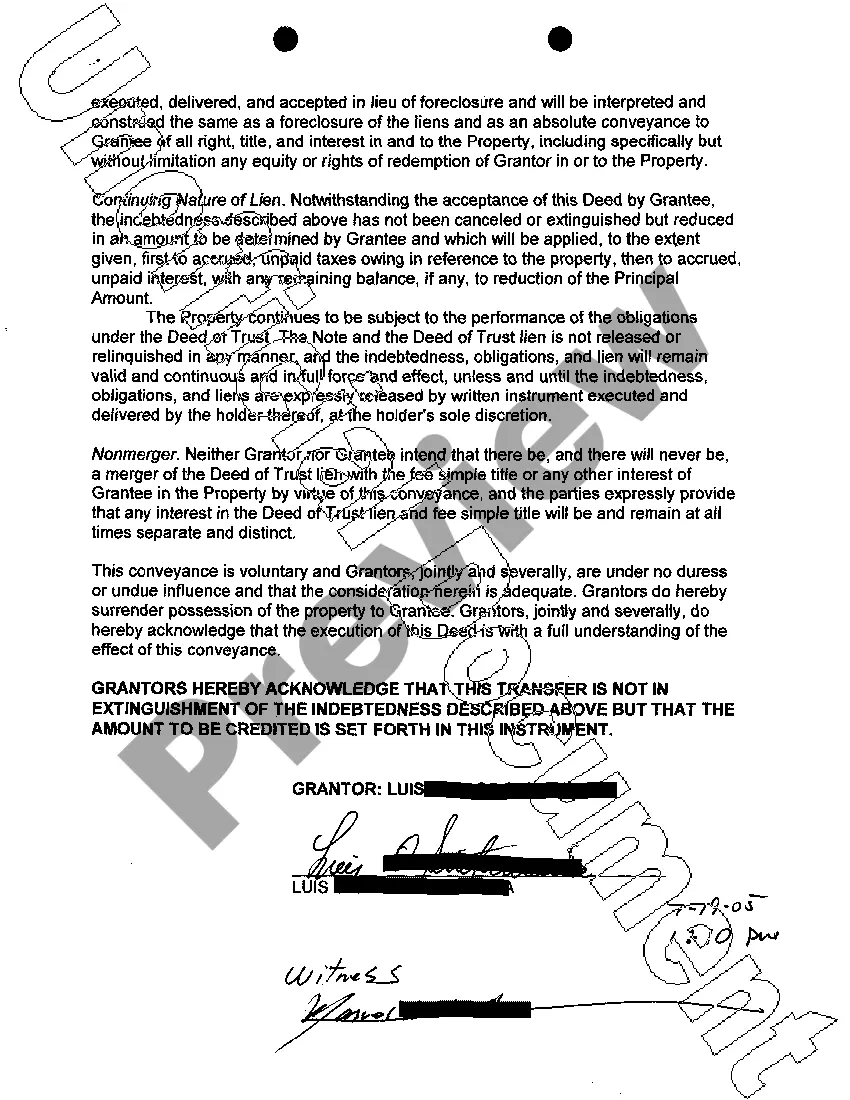

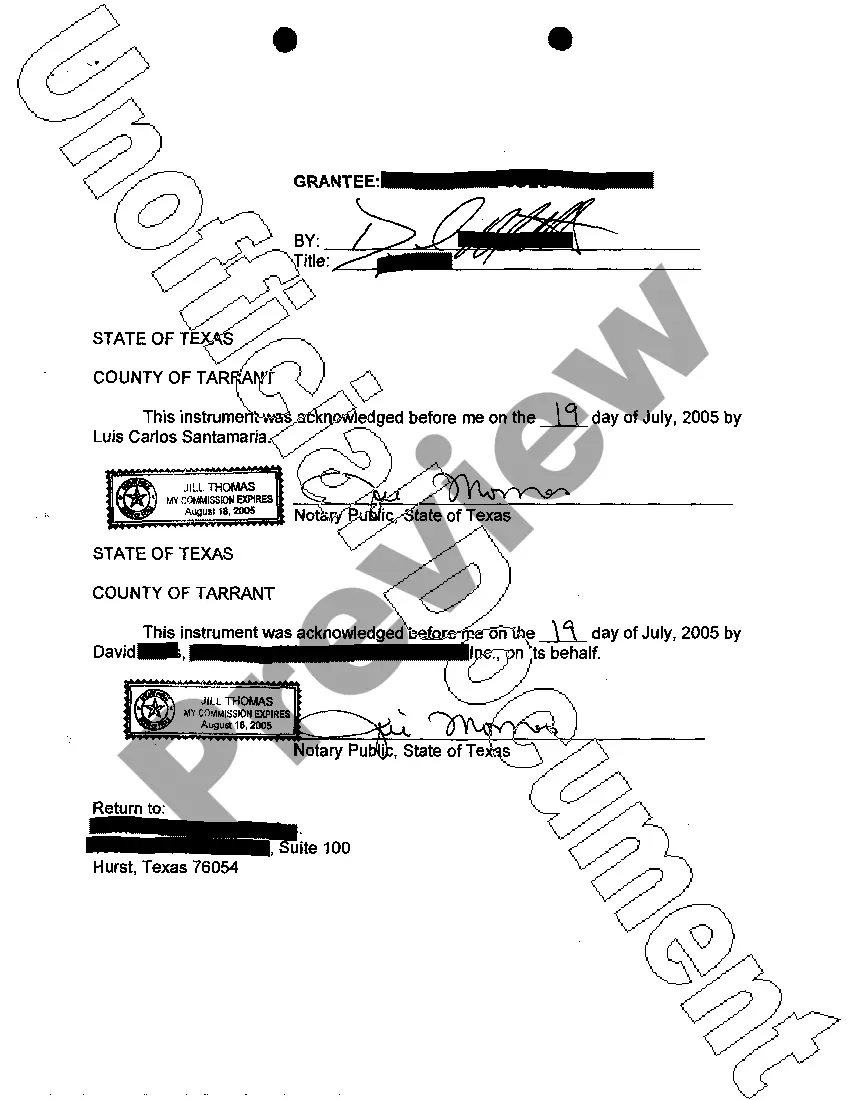

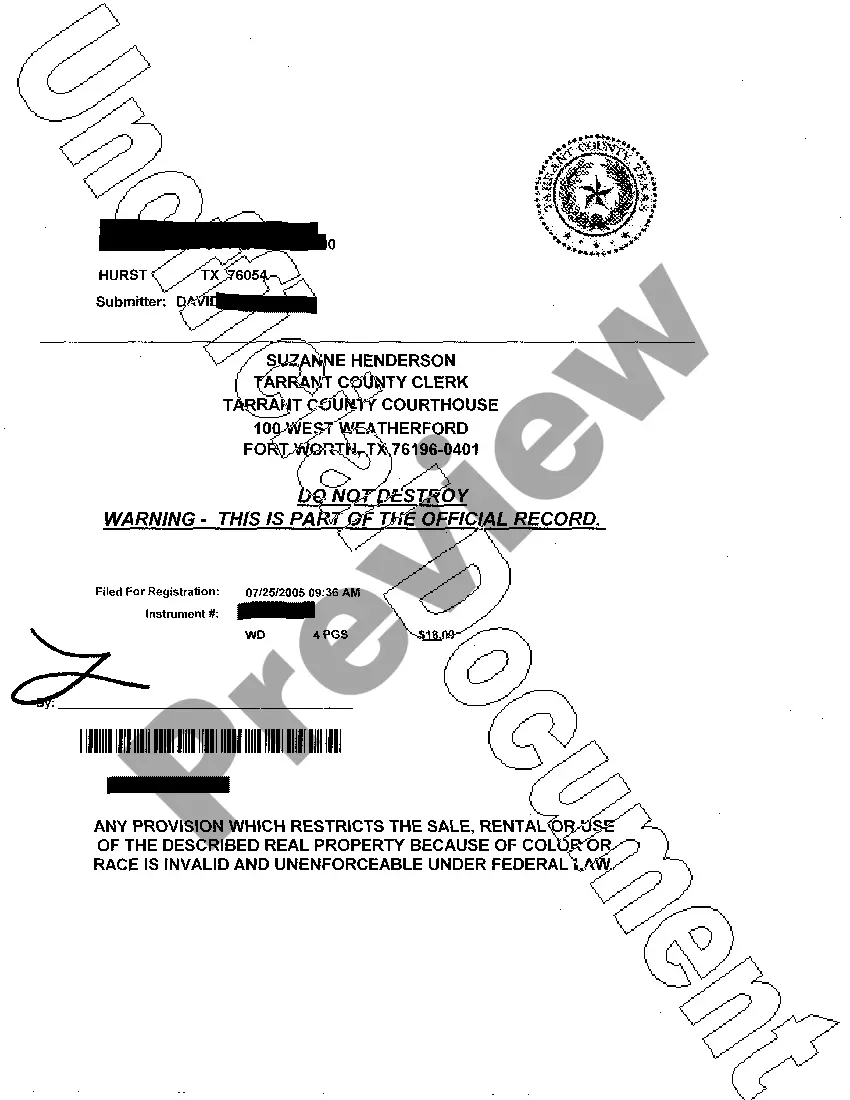

Fort Worth Texas Deed in Lieu of Foreclosure refers to a legal agreement between a homeowner and the mortgage lender or service that allows the homeowner to transfer the property title back to the lender in exchange for the cancellation of the mortgage debt. This option is usually pursued by homeowners who are facing financial hardships and are unable to continue making mortgage payments. Keywords: Fort Worth Texas, Deed in Lieu of Foreclosure, foreclosure, mortgage lender, mortgage service, homeowner, property title, mortgage debt, financial hardships, mortgage payments. There are no notably different types of Fort Worth Texas Deed in Lieu of Foreclosure as it generally refers to the process and agreement followed in this specific geographical area. However, it is important to note that the specifics of the agreement and the terms and conditions involved may vary depending on the lender or service. When homeowners decide to pursue a Deed in Lieu of Foreclosure, they begin by contacting their mortgage lender or service to express their intent and explore the possibility of this alternative to avoid foreclosure. The lender or service will then assess the homeowner's financial situation and generally require them to provide documentation such as hardship letters, financial statements, and a list of assets and liabilities. Once the lender or service has reviewed the homeowner's financial information and determined that they qualify for a Deed in Lieu of Foreclosure, they will negotiate the terms of the agreement. This includes determining if there are any outstanding liens or junior mortgages on the property, which may require additional negotiations with other creditors. After the agreement is reached, the homeowner voluntarily transfers the ownership of the property back to the lender or service by signing a deed. This deed clearly states that the transfer is in lieu of the foreclosure process. The lender or service agrees to release the homeowner from their obligations under the mortgage and cancels the debt. It is worth noting that Fort Worth Texas Deed in Lieu of Foreclosure can have implications for the homeowner's credit score. While it may not have as severe an impact as a foreclosure, it can still negatively affect their creditworthiness and future ability to obtain credit or loans. Furthermore, it is essential for homeowners seeking a Deed in Lieu of Foreclosure to consult legal and financial professionals experienced in foreclosure and real estate to understand the potential tax consequences and other legal aspects associated with this option. In summary, Fort Worth Texas Deed in Lieu of Foreclosure is a legal process that allows financially distressed homeowners to transfer ownership of their property back to the mortgage lender or service in exchange for the cancellation of the mortgage debt. It serves as an alternative to foreclosure and allows homeowners to avoid the lengthy and costly legal proceedings associated with foreclosure.

Fort Worth Texas Deed in Lieu of Foreclosure

Description

How to fill out Fort Worth Texas Deed In Lieu Of Foreclosure?

Are you in search of a trustworthy and economical supplier of legal documents to obtain the Fort Worth Texas Deed in Lieu of Foreclosure? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have everything you need. Our platform offers over 85,000 current legal document templates for individual and business needs. All templates provided are not generic and are tailored based on the stipulations of specific states and regions.

To access the form, you must Log In to your account, find the required template, and click the Download button next to it. Please note that you can retrieve your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No need to worry. You can set up an account within minutes, but before doing so, ensure to.

Now you can establish your account. Then select the subscription plan and complete your payment. Once payment is confirmed, download the Fort Worth Texas Deed in Lieu of Foreclosure in any available format. You can return to the website anytime and redownload the document at no extra cost.

Acquiring current legal forms has never been simpler. Give US Legal Forms a shot today, and say goodbye to wasting hours researching legal documents online forever.

- Verify that the Fort Worth Texas Deed in Lieu of Foreclosure complies with your state and local laws.

- Review the form’s description (if available) to understand its intended purpose and audience.

- Restart the search if the template does not meet your particular needs.

Form popularity

FAQ

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

A deed is a legal document which transfers the ownership of a property from a seller to a buyer; whereas a deed of trust is a document or mortgage alternative in many states which does not transfer the property directly to the buyer but transfers it to a trustee or company which holds the title as security until the

A deed in lieu of foreclosure (often shortened to deed in lieu) is one of many forms of deeds in Texas used to convey title to real property (see Deeds in Texas). A borrower gives a deed in lieu to avoid the foreclosure of its defaulted mortgage loan.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Texas, there are three ways in which a lienholder can foreclose on a property: Judicial Foreclosure. A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner.Non-Judicial Foreclosure.Expedited Foreclosure.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.