College Station Texas Deed in Lieu of Foreclosure is a legal option available to homeowners who are facing the risk of foreclosure. It is a process where the homeowner transfers the title of their property back to the lender in exchange for being released from their mortgage debt. This option can provide a solution for borrowers who are unable to keep up with their mortgage payments and want to avoid the negative consequences of foreclosure. In College Station, Texas, there are different types of Deed in Lieu of Foreclosure available, depending on the specific circumstances of the homeowner: 1. Traditional Deed in Lieu of Foreclosure: This is the standard option where the homeowner voluntarily transfers the property title to the lender. In return, the lender agrees to release the borrower from any further mortgage obligations. 2. Deed in Lieu of Foreclosure with Cash for Keys: In some cases, lenders may offer a cash incentive to homeowners to help them transition out of the property smoothly. This option provides financial assistance to the borrower in exchange for their cooperation in moving out of the property and executing the Deed in Lieu of Foreclosure. 3. Deed in Lieu of Foreclosure with Deficiency Judgment Waiver: In this scenario, the lender agrees to waive their right to pursue a deficiency judgment against the homeowner. A deficiency judgment is the difference between the outstanding loan amount and the fair market value of the property. By waiving this right, the lender cannot seek further compensation from the borrower if the property's value does not cover the mortgage debt. It is important for homeowners considering a College Station Texas Deed in Lieu of Foreclosure to understand that this option may have implications on their credit score, as it is reported as a negative event. However, it is typically less damaging than a foreclosure. Additionally, it is crucial for borrowers to consult with a real estate attorney or a housing counselor to fully understand their rights, responsibilities, and potential tax implications of this process. In summary, College Station Texas Deed in Lieu of Foreclosure is an alternative to foreclosure that provides homeowners with an option to transfer their property title back to the lender and be released from their mortgage debt. This process may include additional options such as cash incentives or deficiency judgment waivers. Nonetheless, it is advised for borrowers to seek professional assistance to navigate through this complex process successfully.

College Station Texas Deed in Lieu of Foreclosure

Description

How to fill out College Station Texas Deed In Lieu Of Foreclosure?

If you’ve already utilized our service before, log in to your account and save the College Station Texas Deed in Lieu of Foreclosure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your College Station Texas Deed in Lieu of Foreclosure. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

One key disadvantage of a College Station Texas Deed in Lieu of Foreclosure is the potential for tax implications. If your lender forgives any part of your mortgage debt, it may be considered taxable income by the IRS. This financial obligation could surprise you during tax season if you are not prepared. To navigate these complexities, consider seeking advice from a tax professional or exploring solutions offered by platforms like USLegalForms.

The College Station Texas Deed in Lieu of Foreclosure process typically spans several weeks. After you submit the necessary documents, the lender will review your request and may require a property evaluation. Once approved, the lender will guide you through signing the deed, which can streamline your transition away from ownership. To expedite this process, consider using platforms like US Legal Forms, which provide resources and templates to ensure everything goes smoothly.

No, a lender is not obligated to accept a deed in lieu of foreclosure, even if you offer one. Acceptance is at the discretion of the lender, who will evaluate various factors such as the property's value and your financial situation. Knowing this can influence your decisions when facing financial hardship and seeking alternatives like the College Station Texas Deed in Lieu of Foreclosure. For assistance, consider using US Legal Forms to explore your options.

In Texas, the property code related to a deed in lieu of foreclosure is often referenced under Title 11, Chapter 51, and Chapter 92. This code outlines the procedures and requirements lenders and borrowers must follow for this transaction. Understanding these regulations is vital for anyone considering a College Station Texas Deed in Lieu of Foreclosure. To ensure compliance, you may find US Legal Forms helpful for navigating these legalities.

In Texas, a deed in lieu of foreclosure allows homeowners to voluntarily transfer their property back to the lender to avoid foreclosure. This legal process can help you relieve yourself of mortgage debt and move on financially. It serves as an alternative to foreclosure and may be less damaging to your credit report. Understanding the details and requirements is crucial, and resources like US Legal Forms can guide you through it.

The main disadvantage of a College Station Texas deed in lieu of foreclosure is its potential impact on your credit score. While it may be less damaging than a foreclosure, it still indicates financial distress. Additionally, you may face tax implications on any debt forgiven by the lender. Carefully consider these factors and consult a financial advisor before proceeding.

Writing a deed in lieu of foreclosure letter involves clearly stating your intention to transfer ownership of the property back to your lender. Include your property details and current financial situation, and express your willingness to resolve the debt. Make sure to use polite and formal language throughout the letter. If you need guidance, US Legal Forms offers templates that simplify this process.

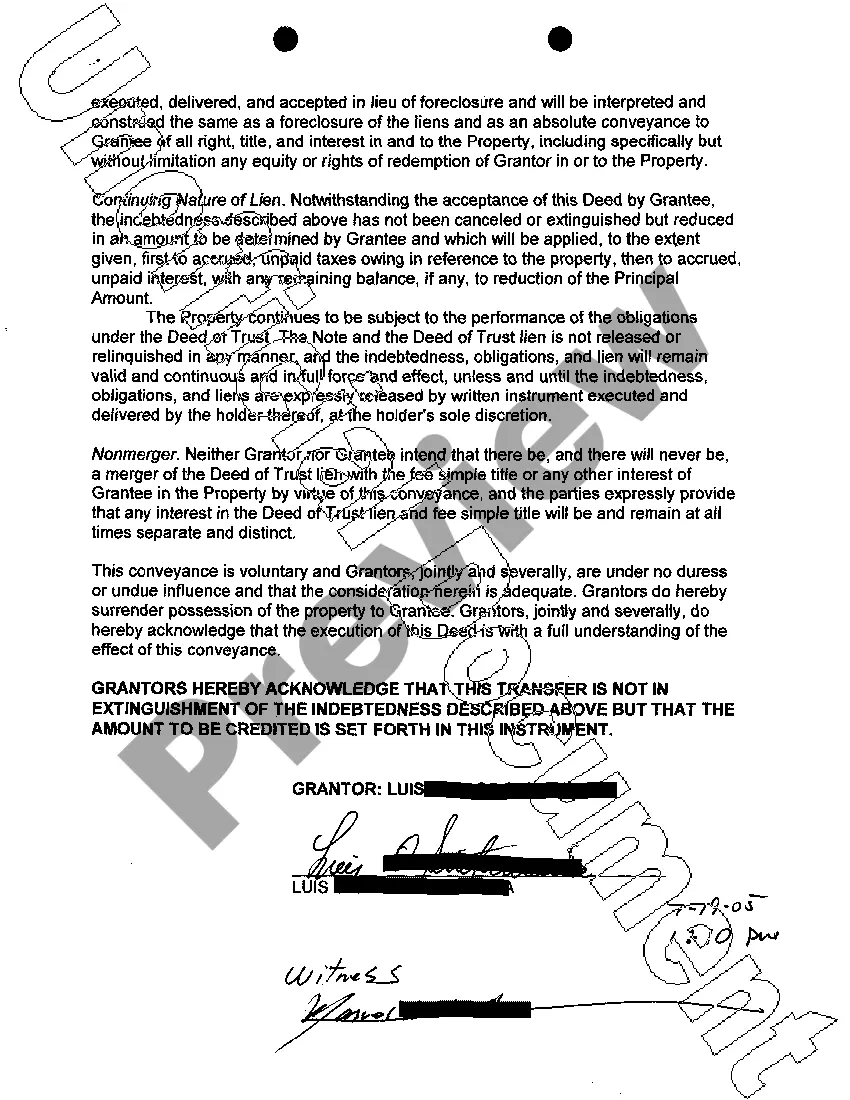

To file a College Station Texas deed in lieu of foreclosure, begin by contacting your lender to discuss your situation. You will need to provide documentation that proves your financial difficulties. After your lender agrees to your proposal, you’ll complete the necessary documents and sign them before a notary public. Finally, you file these documents with your local county recorder’s office.

The College Station Texas deed in lieu of foreclosure process typically takes several weeks to a few months to complete. This timeframe depends on factors such as lender response time and the completion of required documents. Generally, once you apply, your lender will evaluate your request and notify you of their decision. Throughout this period, staying in contact with your lender can help speed up the process.