Houston Texas Notice to Purchasers

Description

How to fill out Texas Notice To Purchasers?

If you're searching for an authentic form, it’s hard to find a superior location than the US Legal Forms website – one of the largest online collections.

Here you can access a vast array of form samples for business and personal uses categorized by types and states, or keywords.

With the excellent search functionality, locating the latest Houston Texas Notice to Purchasers is as simple as 1-2-3.

Receive the template. Choose the file format and download it to your device.

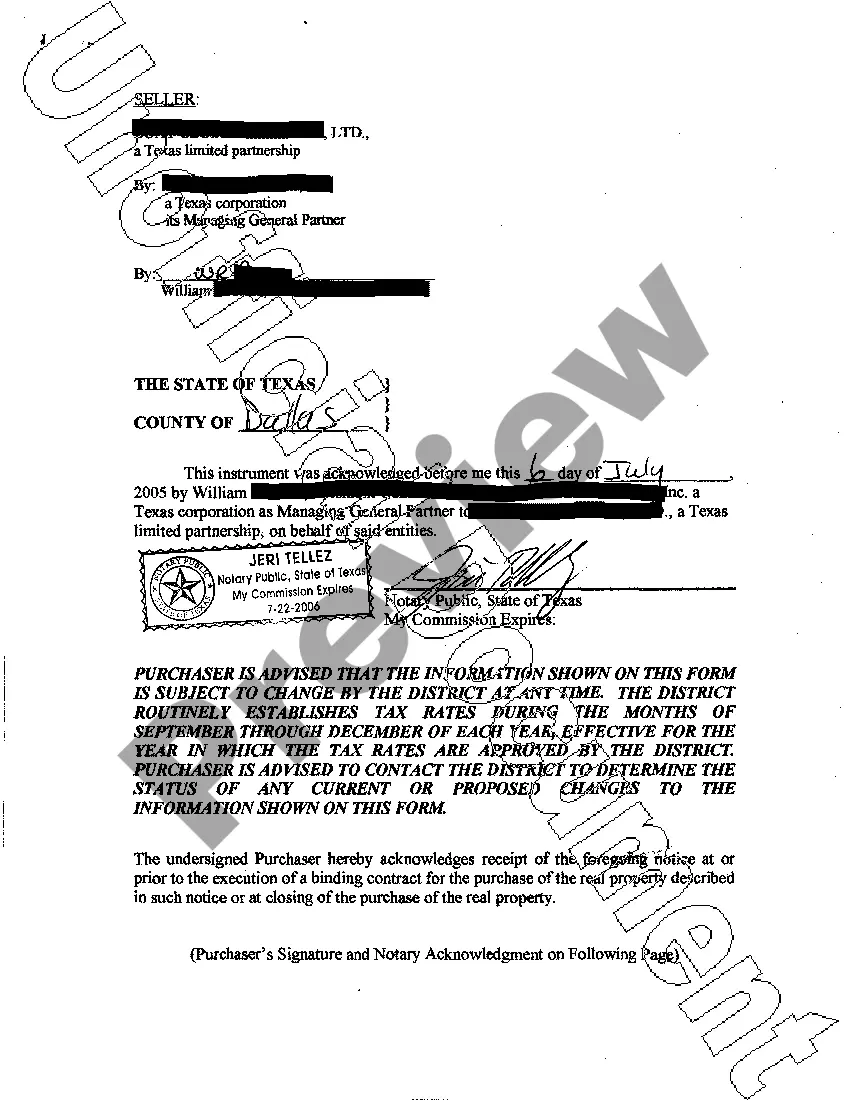

Make adjustments. Fill out, alter, print, and sign the acquired Houston Texas Notice to Purchasers.

- If you're already aware of our platform and possess a registered account, all you need to do to obtain the Houston Texas Notice to Purchasers is to Log In to your profile and select the Download option.

- If this is your first time using US Legal Forms, just adhere to the instructions outlined below.

- Ensure you have found the form you need. Review its description and utilize the Preview option to examine its content. If it doesn't meet your requirements, employ the Search field at the top of the page to find the appropriate document.

- Confirm your selection. Click on the Buy now option. Subsequently, choose the desired subscription plan and provide your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the account registration.

Form popularity

FAQ

MUDs (Municipal Utility Districts) finance the construction of public infrastructure that does not yet exist, typically utility facilities and roadways. Over time, developers within a MUD can be reimbursed for water, sewer, drainage and sometimes road infrastructure through property taxes.

Over the years, as the development is completed, MUD tax rates typically go down. But Gaddes said it often takes 20 to 30 years until the rate drops below city levels.

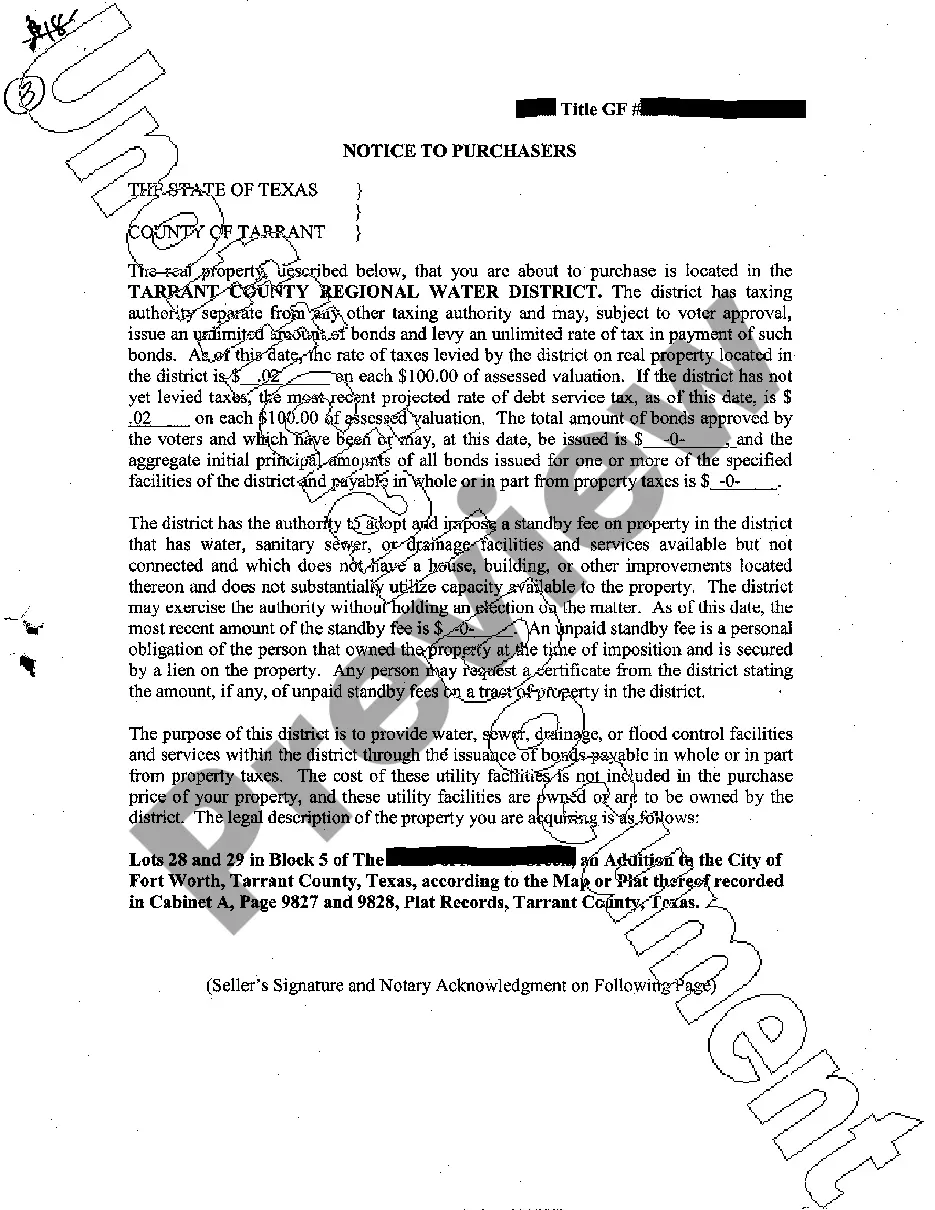

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

A Municipal Utility District (MUD) is one of several types of special districts that function as independent, limited governments. The purpose of a MUD is to provide a developer an alternate way to finance infrastructure, such as water, sewer, drainage, and road facilities.

MUDS are funded through bonds, or investments, made by the State of Texas and paid to the MUD to create the necessary infrastructure to provide water and sewer services to residents. Those bonds are paid off as the MUD collects taxes from residents of the community.

Section 49.452 of the Texas Water Code states that a buyer purchasing property within a MUD should receive a MUD Notice before entering into a binding contract. This notice must include information about the tax rate, current debts owed for bonds, and, if there is one, a standby fee.

How to fill out the Notice to Purchaser of Real Property in a Water DistrictYouTube Start of suggested clip End of suggested clip It's just simple it's easy you just put in the address on the very top and then you scroll down toMoreIt's just simple it's easy you just put in the address on the very top and then you scroll down to the bottom and you'll see mud information right here.

MUDs derive their authority from the Texas Constitution. They are regulated by the Texas Commission on Environmental quality, the Texas Attorney General (Public Finance Division), cities, counties, and the United States Environmental Protection Agency.

MUD notice information The notice provides information regarding the tax rate, bonded indebtedness, and standby fee, if any, of the MUD. A seller will typically know if a MUD is providing service to a property because the MUD assessment will be listed on the tax bill that the county sends to the property owner.