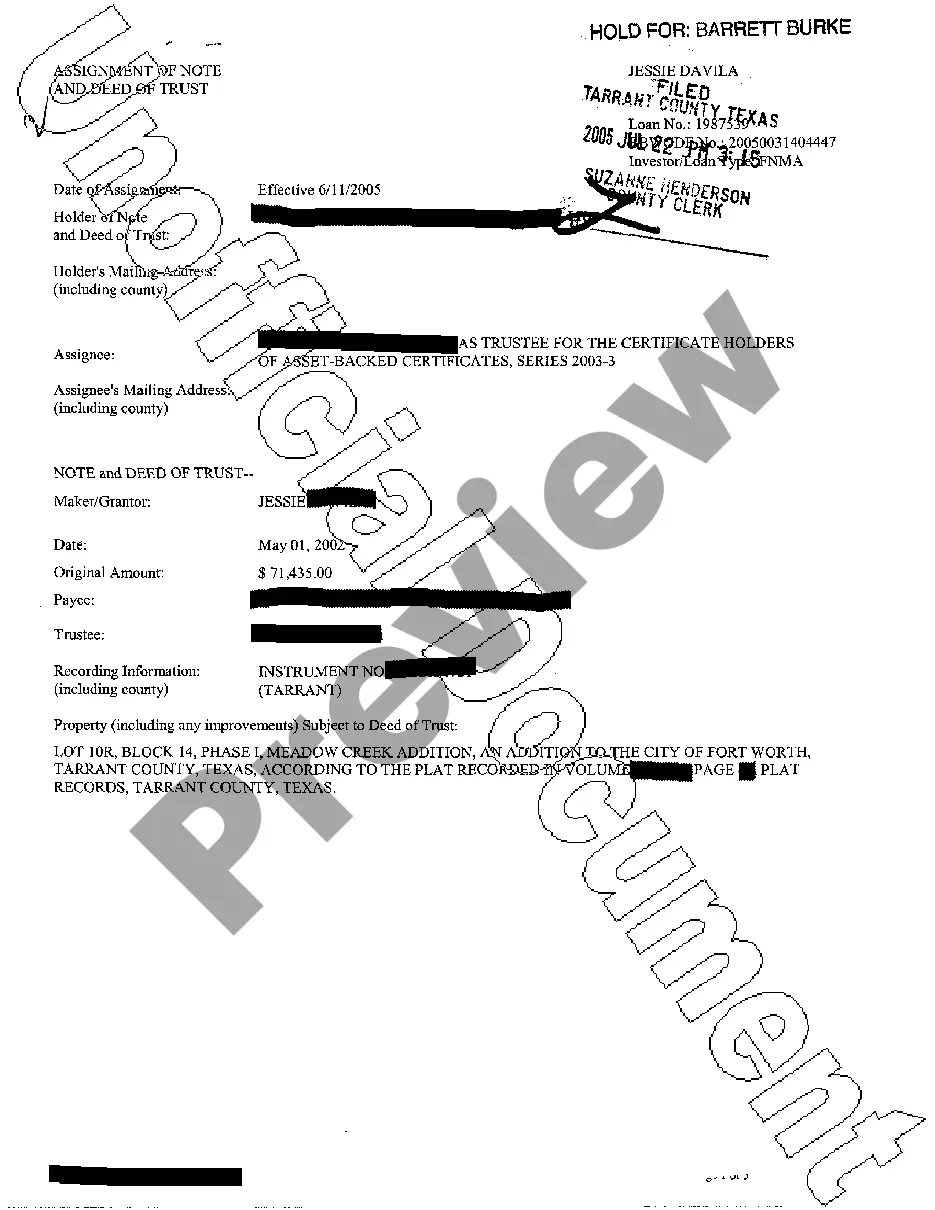

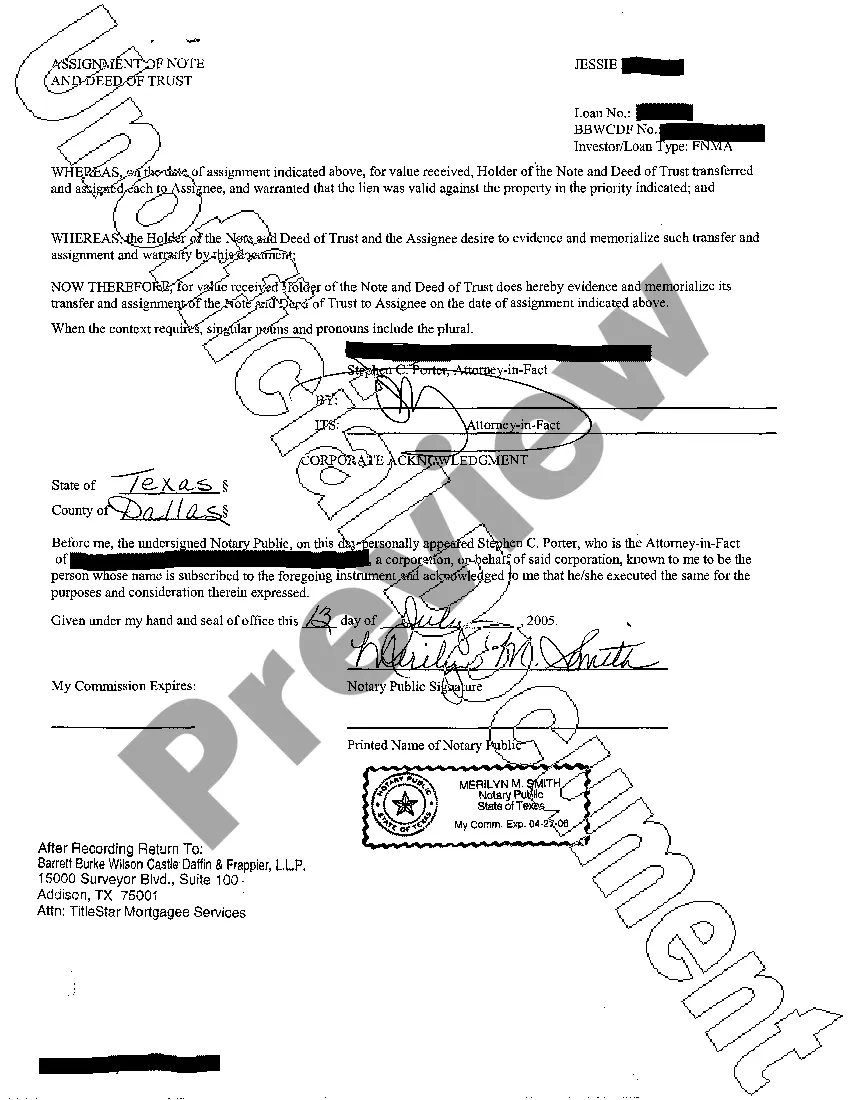

Harris Texas Assignment of Note and Deed of Trust is a legal document that transfers the ownership of a promissory note and associated deed of trust from one party to another. It is a crucial component of real estate transactions in Harris County, Texas, and plays a significant role in ensuring the rights and obligations of all parties involved. The Assignment of Note refers to the transfer of the borrower's obligation to repay a loan to a new lender or holder of the note. This document outlines the terms and conditions of the loan, such as the principal amount, interest rate, repayment schedule, and any other relevant provisions. By assigning the note, the original lender effectively transfers their rights to receive payments to a new party. The Deed of Trust, on the other hand, is a legal instrument that secures the repayment of the loan by granting the lender a lien or security interest in the real property being financed. It outlines the rights and responsibilities of the borrower (also known as the trust or), the lender (also called the beneficiary), and the trustee, who holds legal title to the property until the loan is fully repaid. There are various types of Harris Texas Assignment of Note and Deed of Trust, each designed to cater to specific circumstances or financing arrangements. Some common types include: 1. Straight Assignments: This type of assignment involves the direct transfer of the promissory note and deed of trust from one party to another without any modifications to the terms or conditions of the original loan. 2. Assignment with an Assumption: In certain cases, borrowers may want to transfer their debt obligation to a new buyer or investor. In these situations, an assignment with an assumption allows for the transfer of both the note and the deed of trust, along with the buyer assuming all the loan terms and conditions. 3. Assignment of Partial Interest: When multiple lenders are involved in a loan, an assignment of partial interest may occur. In this scenario, one lender assigns a portion of their interest in the note and deed of trust to another lender, usually to diversify risk or accommodate changes in investment strategies. It is crucial to consult with a qualified real estate attorney or a title company experienced in Harris County, Texas, to ensure that the Assignment of Note and Deed of Trust complies with all local laws and requirements. Proper execution of these documents secures the rights and protects the interests of all parties involved in a real estate transaction.

Harris Texas Assignment of Note and Deed of Trust

Description

How to fill out Harris Texas Assignment Of Note And Deed Of Trust?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney solutions that, as a rule, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Harris Texas Assignment of Note and Deed of Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Harris Texas Assignment of Note and Deed of Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Harris Texas Assignment of Note and Deed of Trust is suitable for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Section 13.001 - Validity of Unrecorded Instrument (a) A conveyance of real property or an interest in real property or a mortgage or deed of trust is void as to a creditor or to a subsequent purchaser for a valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

The grantor must sign the deed and have it notarized. Depending on the type of deed, the grantor's spouse may also need to sign it. The grantee does need to sign the deed but may need to sign related agreements in some circumstances. 4.

You may obtain Texas land records, including deeds, from the county clerk in the Texas county in which the property is located. You can search online for a deed in some counties, or else request the deed from the clerk in person, by mail, phone, fax or email.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

Purchase paper copies of documents without the unofficial watermark in person at any Annex Location. by fax: (713) 437-4868. by email to: ccinfo@cco.hctx.net. by mail to: Teneshia Hudspeth, Harris County Clerk. Attn: Information Department. P.O. Box 1525. Houston, TX. 77251. For Questions Call (713) 274-6390.

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.

Recording Deeds Texas does not require that a deed be recorded in the county clerk's real property records in order to be valid. The only requirement is that it is executed and delivered to the grantee, which then makes the transfer fully effective.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

Interesting Questions

More info

They can also assist you in obtaining the necessary paperwork to execute the transaction. Texas Title and Mortgage Brokers. Our company is known and trusted by more than 30,000 Texas homeowners and refinances! Our experience in the field of real estate and foreclosure services has earned us the respect of many customers. We have been in real estate business here in Texas since 1949 and have developed a reputation of providing high quality, reliable service. Our company operates out of Houston's Uptown area. Our company offers Texas mortgage services from the purchase to closing of Texas mortgage loans. Our company's services include, foreclosures, repossession of residential properties, home improvement loans and more. With more than ten years of experience in these areas, we are happy to get your Texas mortgage. Please use the contact information to call us for more information on Texas property insurance rates and costs.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.