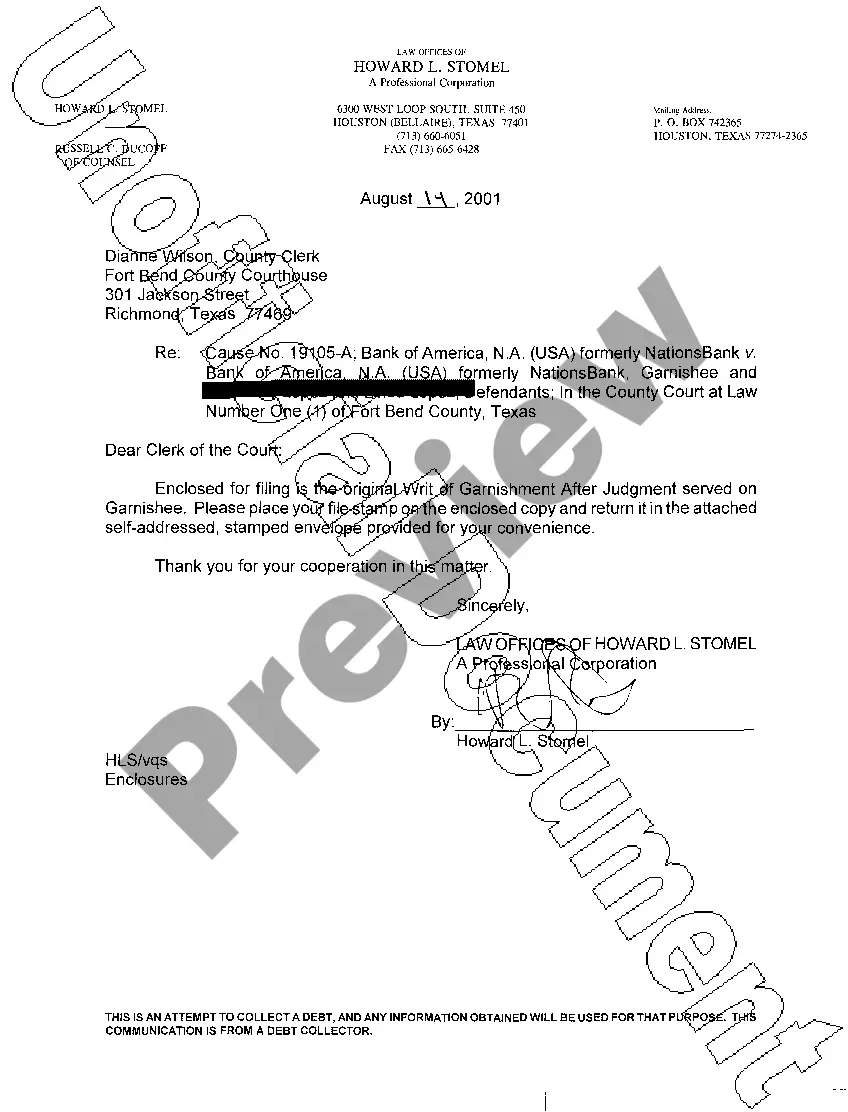

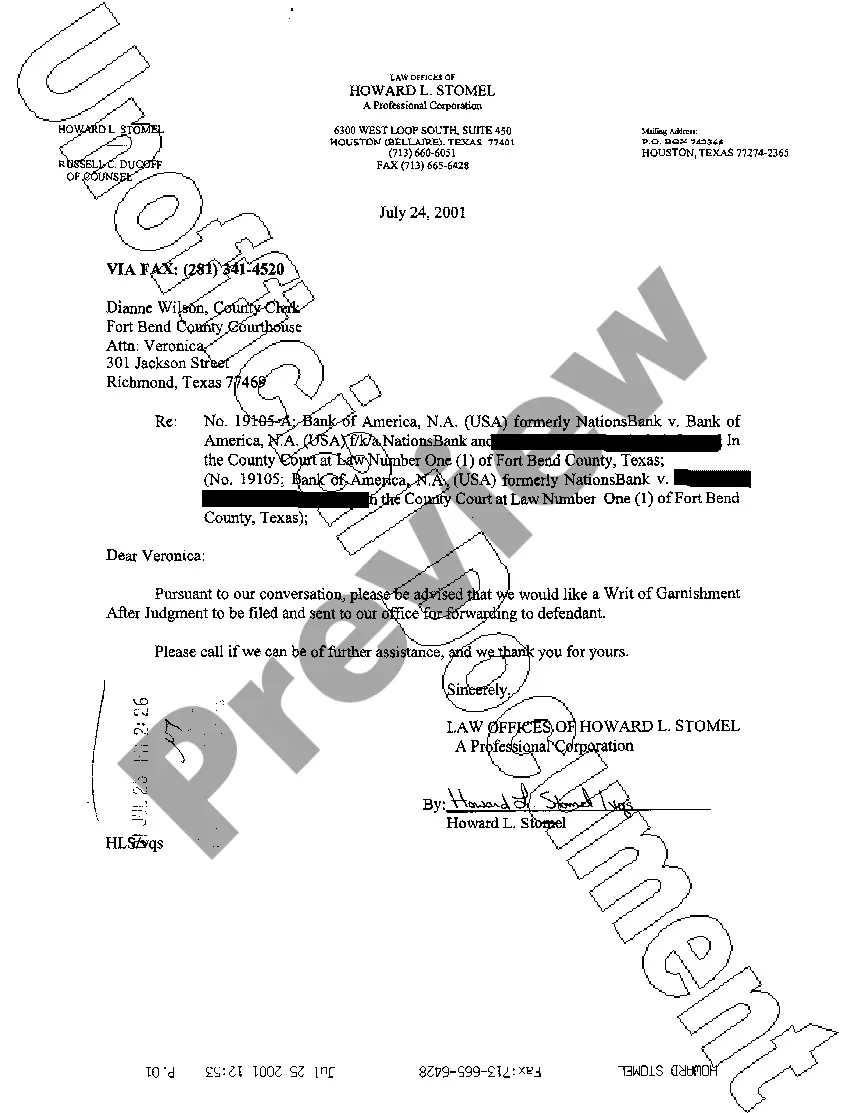

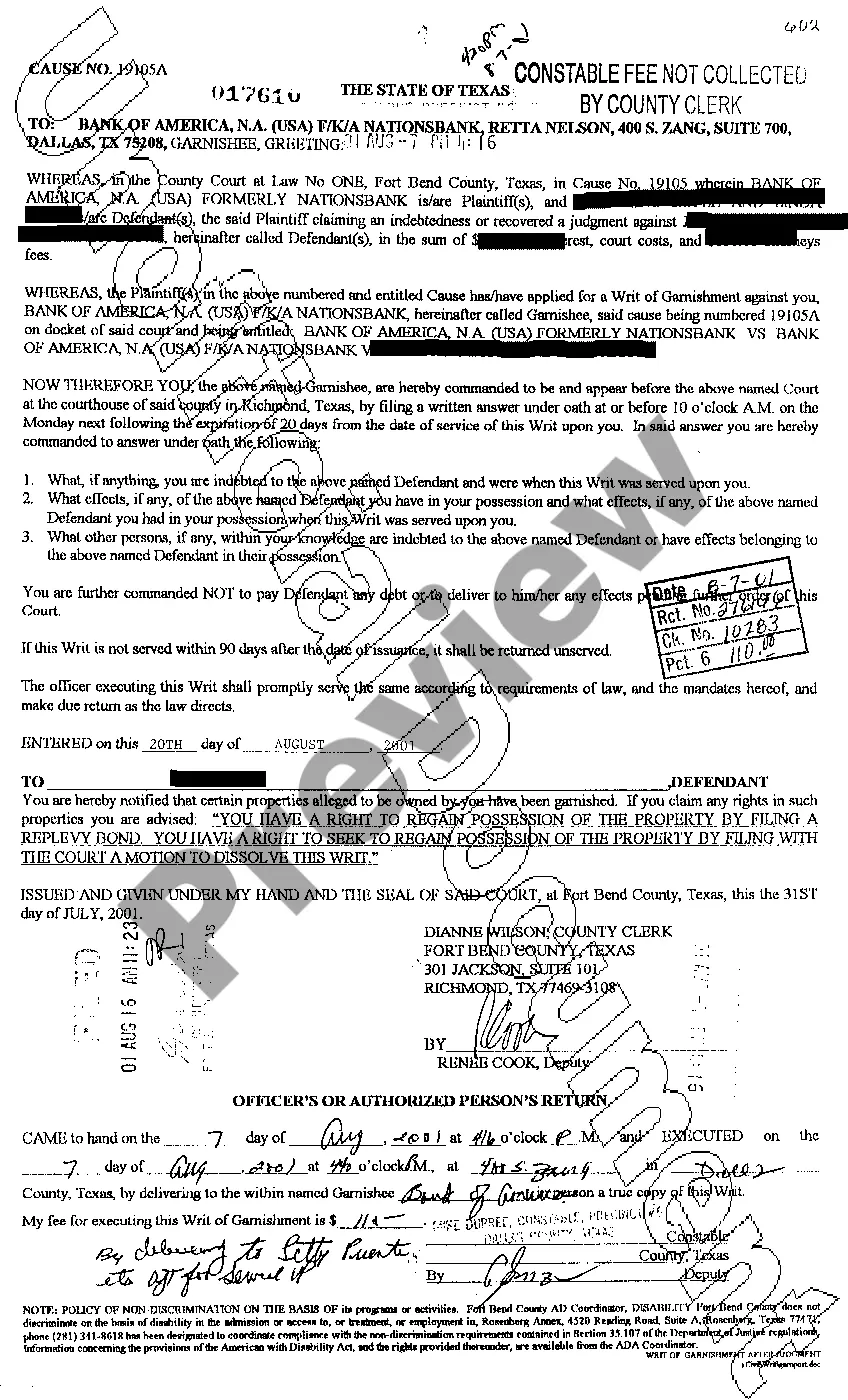

Dallas Texas Writ of Garnishment

Description

How to fill out Texas Writ Of Garnishment?

Irrespective of one's social or professional rank, completing legal documentation is a regrettable requirement in the current workplace. Frequently, it’s nearly impossible for an individual lacking legal training to create this type of paperwork from scratch, primarily due to the complex terminology and legal nuances they contain.

This is where US Legal Forms proves beneficial. Our platform provides an extensive collection with over 85,000 ready-to-use state-specific documents that cater to almost any legal circumstance. US Legal Forms also serves as a valuable resource for associates or legal advisors looking to conserve time by using our DIY paperwork.

Whether you require the Dallas Texas Writ of Garnishment or any other document valid in your state or region, with US Legal Forms, everything is easily accessible. Here’s how to obtain the Dallas Texas Writ of Garnishment swiftly using our reliable platform. If you are a current subscriber, you can go ahead and Log In to your account to retrieve the necessary document.

You’re all set! Now you can either print the document or fill it out online. If you encounter any issues retrieving your purchased forms, you can easily access them in the My documents section.

Regardless of the issue you’re attempting to resolve, US Legal Forms has you covered. Give it a try today and experience it for yourself.

- Ensure the form you have located is tailored to your region considering that the regulations of one state or area do not apply to another state or area.

- Examine the form and read a brief description (if available) of the scenarios for which the document can be utilized.

- If the one you selected does not meet your requirements, you can begin anew and search for the required document.

- Click Buy now and select the subscription package that best fits your needs.

- Enter your Log In details or create a new account from scratch.

- Choose the payment option and proceed to download the Dallas Texas Writ of Garnishment once the payment is complete.

Form popularity

FAQ

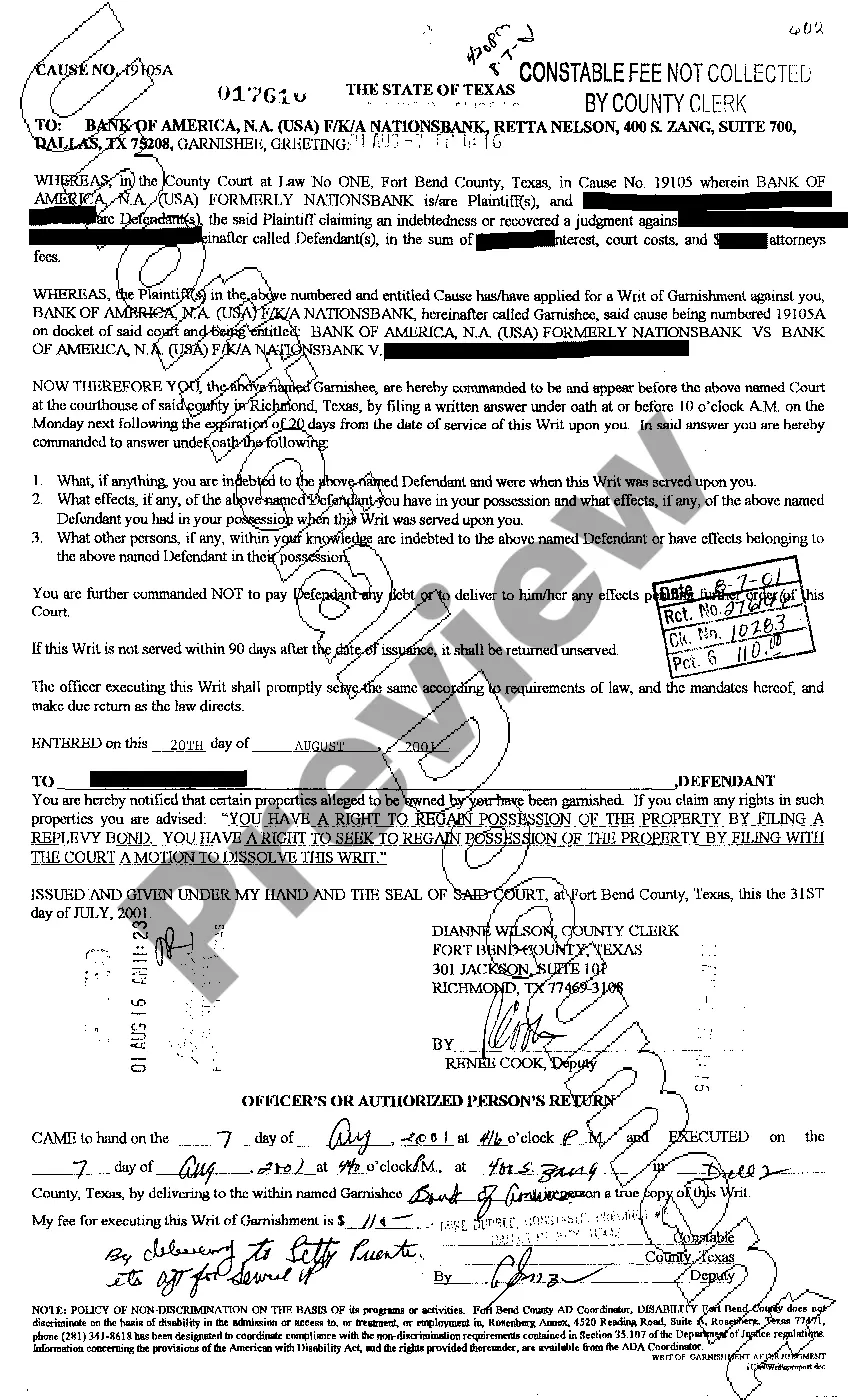

Once the Dallas Texas writ of garnishment is served, the garnishee, typically a bank or employer, is legally required to withhold funds or wages from the debtor. This process can lead to the garnishee turning over the specified amount to you, the creditor, to satisfy the judgment. It is essential to monitor the situation, as both the debtor and the garnishee may have specific rights and deadlines to address. Utilizing resources from platforms like US Legal Forms can help you understand and navigate these next steps effectively.

To obtain a Dallas Texas writ of garnishment, you must first file a lawsuit and secure a judgment against the debtor. After receiving the judgment, you can then complete the necessary paperwork to request the writ from the court. It’s advisable to use platforms like US Legal Forms, which streamline this process and provide the required templates to ensure that you meet all legal standards. Once you have the correctly filled forms, you can submit them to the court for approval.

To obtain a writ of garnishment in Texas, you must first have a judgment against the debtor. Then, you can complete the required legal forms and file them with the court. Utilizing USLegalForms can simplify this process by providing the necessary documents and detailed instructions, helping you efficiently pursue your Dallas Texas writ of garnishment.

Yes, you can file a writ of garnishment in Texas if you have a valid judgment against a debtor. This process allows you to seize funds from the debtor's bank account or wages to satisfy the debt. To navigate the complexities of filing a Dallas Texas writ of garnishment, consider utilizing USLegalForms, which offers forms and support tailored to your needs.

In Texas, a writ of garnishment can be served by an authorized process server or a sheriff. This service is crucial because it ensures that the garnishee receives the necessary legal notice. To enforce your Dallas Texas writ of garnishment effectively, consulting with legal professionals or using resources like USLegalForms can provide you with the right guidance and documentation.

In Texas, you file a writ of execution with the district or county court that issued the original judgment against the debtor. You typically need to provide certain documentation and forms to initiate this process. If you're considering a Dallas Texas Writ of Garnishment, uslegalforms can offer assistance in navigating the paperwork, ensuring that you follow the correct procedures for your case.

The process of obtaining a writ of garnishment begins when a creditor petitions the court for permission to garnish an individual's wages or bank account. After the court reviews the petition, it may issue a Dallas Texas Writ of Garnishment, which is then served on the employer or financial institution. This step is critical, as it legally binds the third party to withhold the specified amount until the debt is resolved.

Under federal law, the maximum amount that can be garnished from your paycheck is 25% of your disposable earnings or the amount by which your weekly earnings exceed 30 times the federal minimum wage, whichever is less. In Texas, the rules are similar, but you may find specific exemptions that could apply to your situation. When dealing with a Dallas Texas Writ of Garnishment, it's important to understand these limits to protect your earnings effectively.