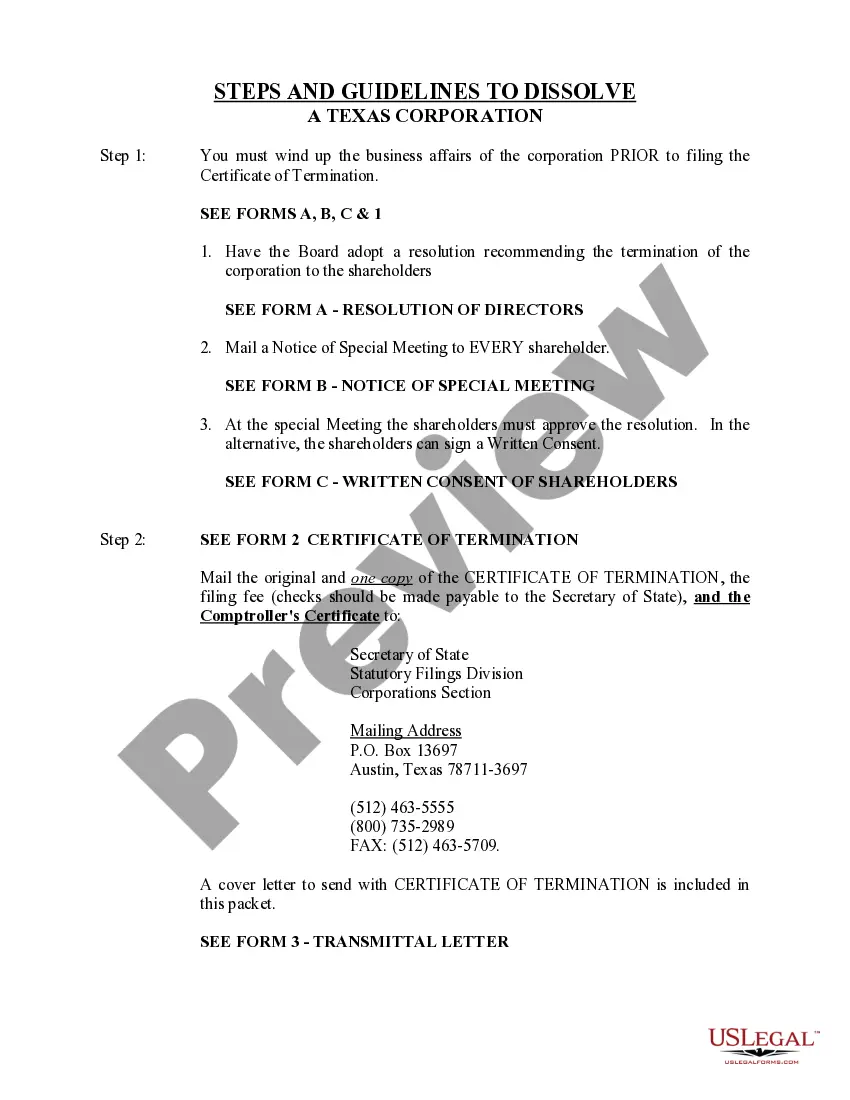

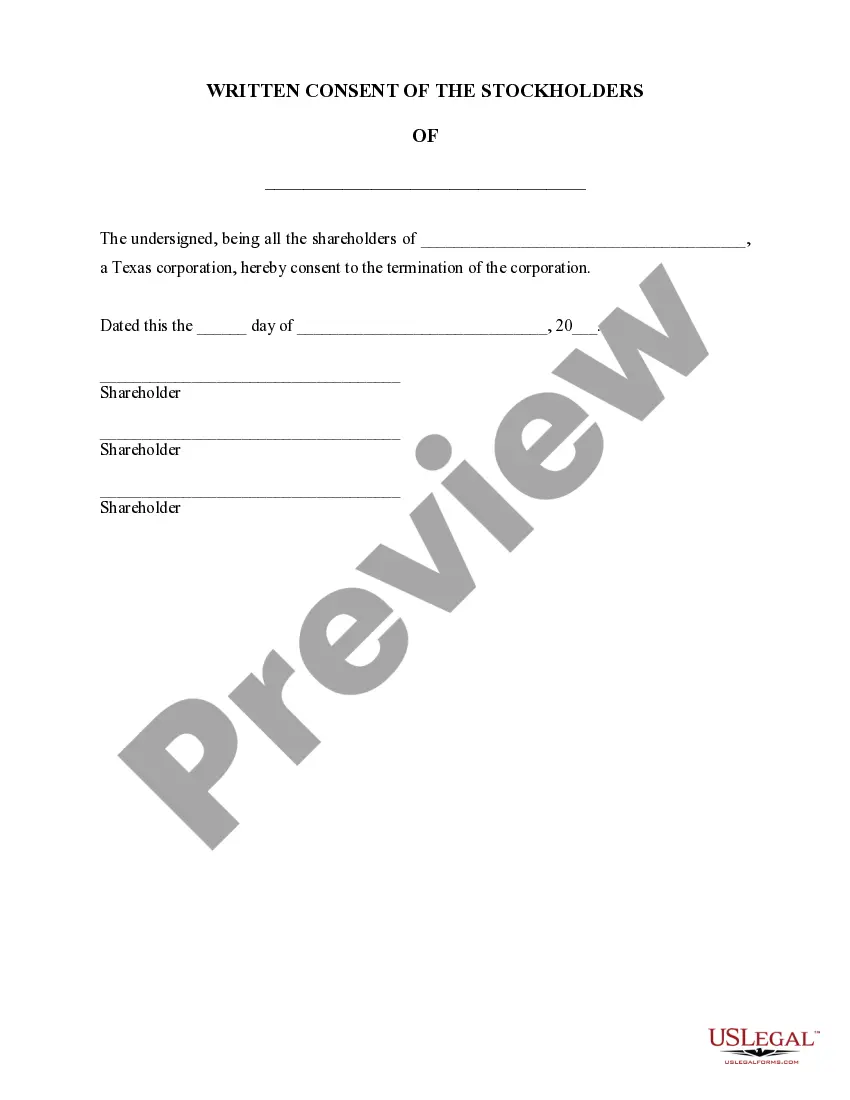

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Corpus Christi Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you are searching for a legitimate form, it’s impossible to select a superior service than the US Legal Forms website – likely the most comprehensive libraries on the internet.

With this collection, you can locate a vast number of templates for business and personal use by categories and regions, or key phrases.

Utilizing our enhanced search feature, obtaining the latest Corpus Christi Texas Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Confirm your selection. Click the Buy now button. Then, select the desired pricing plan and provide information to create an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Furthermore, the accuracy of every single document is confirmed by a team of professional attorneys who regularly review the templates on our platform and update them based on the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Corpus Christi Texas Dissolution Package to Dissolve Corporation is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the guidelines provided below.

- Ensure you have located the template you require. Review its description and use the Preview feature (if available) to examine its content.

- If it doesn’t fulfill your needs, use the Search box at the top of the page to find the suitable document.

Form popularity

FAQ

Dissolving an LLC involves the formal decision to end the business, while terminating refers to the completion of legal processes to conclude the LLC's existence. Essentially, dissolution is the decision stage, and termination is the implementation stage, which involves filing necessary documents like those in the Corpus Christi Texas Dissolution Package to Dissolve Corporation. Understanding this difference helps you navigate the legal requirements for your business effectively. By using our platform, you can ensure all necessary steps are followed correctly.

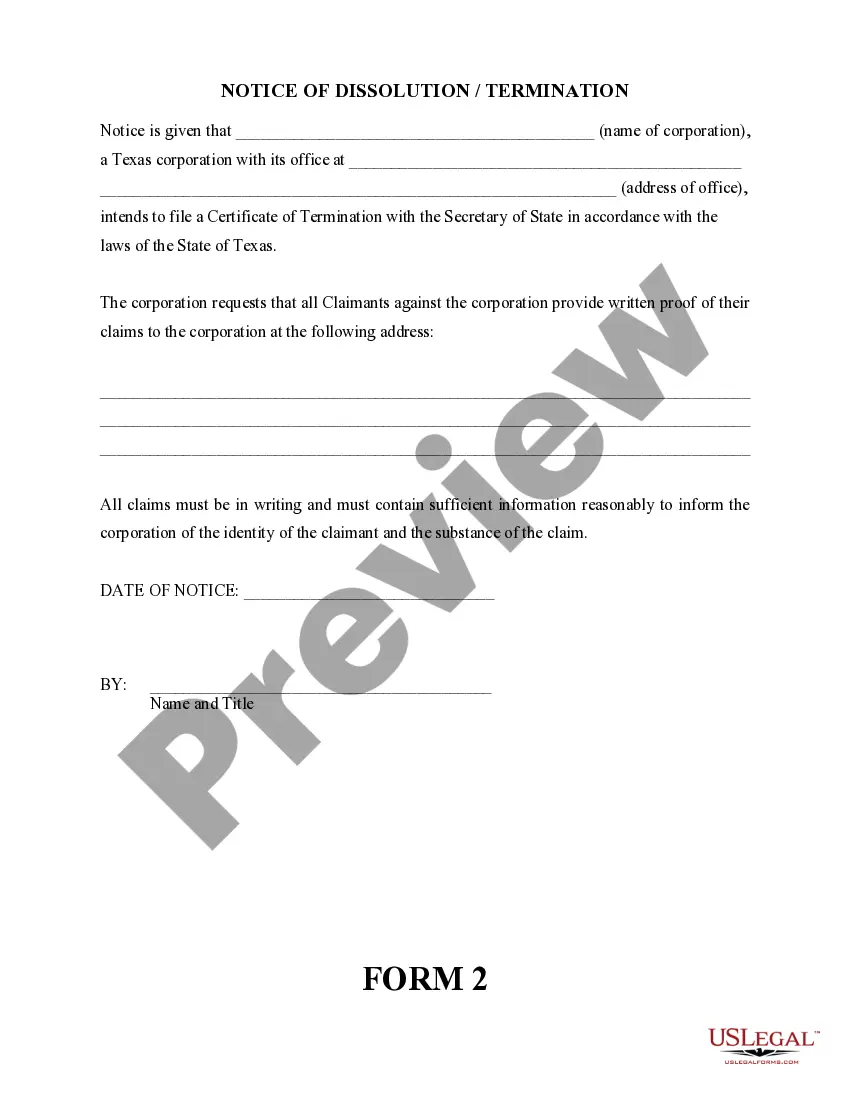

To dissolve an LLC in Texas, you will need to complete and file the Certificate of Termination, often included in the Corpus Christi Texas Dissolution Package to Dissolve Corporation. Additionally, ensure that all debts are settled and any final tax filings are made. It may also be beneficial to notify creditors of the dissolution. This process ensures a smooth termination of your LLC and compliance with state regulations.

To fill out form 651 as part of the Corpus Christi Texas Dissolution Package to Dissolve Corporation, ensure you provide accurate information about your corporation. This includes the name of the corporation, the reason for dissolution, and the effective date. You can easily access form 651 on the Texas Secretary of State's website. Don't forget to review your completed form for any errors before submission.

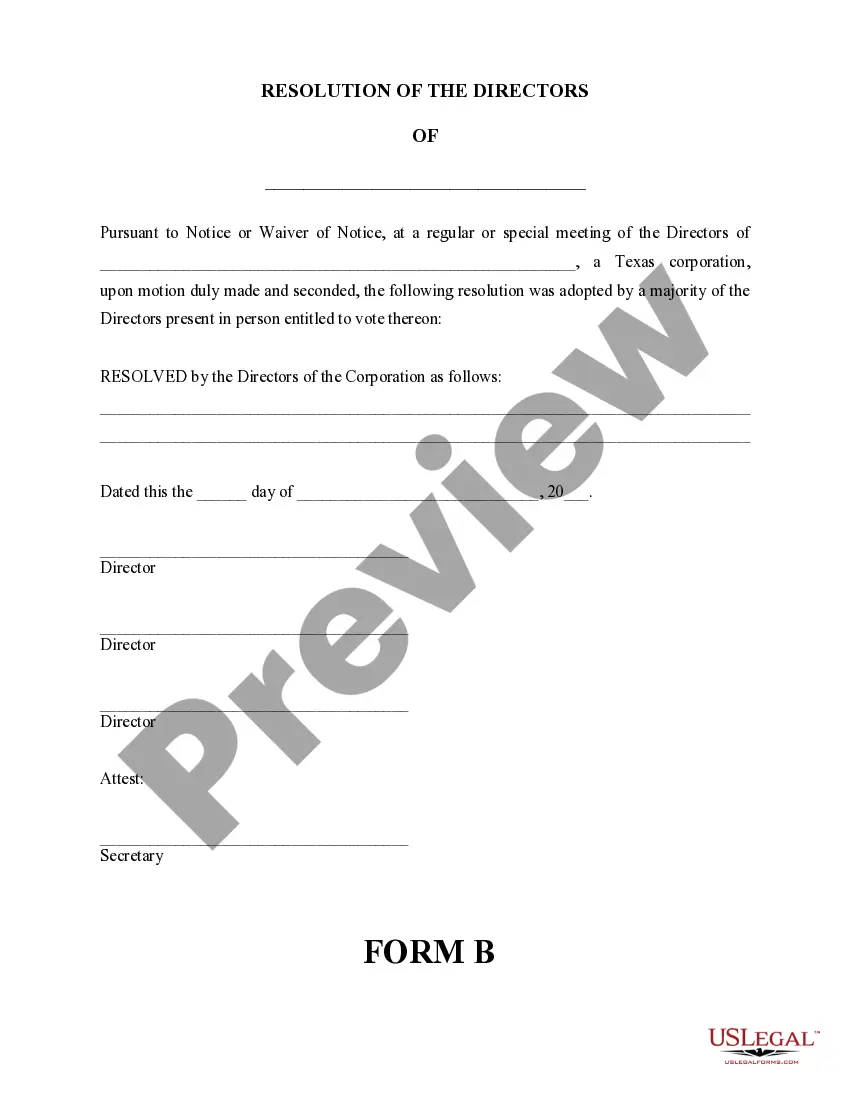

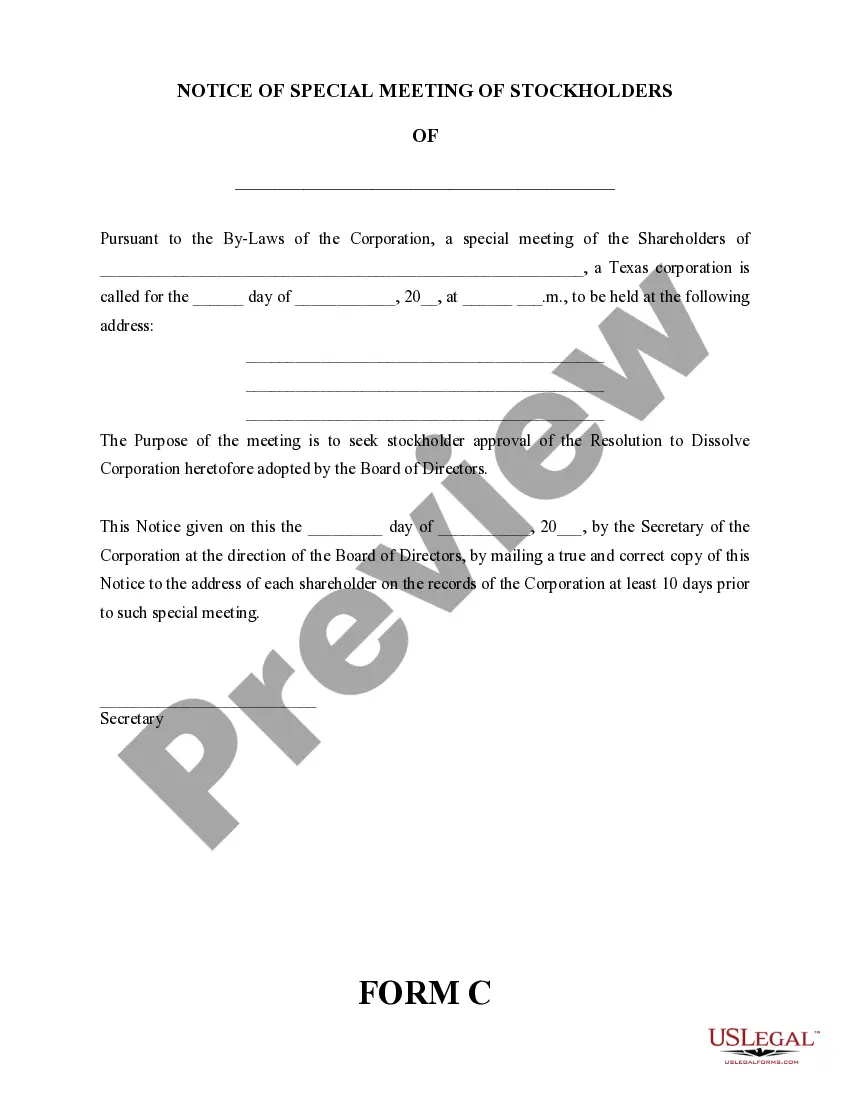

Dissolving a corporation involves several steps, starting with obtaining board approval and notifying all stakeholders. Next, you must settle all debts and obligations, file the certificate of termination, and acquire the certificate of account status. Using the Corpus Christi Texas Dissolution Package to Dissolve Corporation can provide you with a clear roadmap to navigate these steps effectively.

To close your Texas Comptroller account, you should complete the required forms and ensure all tax obligations are settled. It is advisable to contact the Comptroller’s office for specific instructions based on your corporation's status. By leveraging the Corpus Christi Texas Dissolution Package to Dissolve Corporation, you can receive guidance on closing your account smoothly.

To obtain a Texas certificate of account status, you can visit the Texas Comptroller's website or contact their office. You will need to provide your corporation's name and possibly other identifying information. By following the steps outlined in the Corpus Christi Texas Dissolution Package to Dissolve Corporation, you can ensure that you gather all necessary information efficiently.

To request a certificate of account status to terminate your corporation in Texas, you need to contact the Texas Comptroller's office directly. You may submit your request online or via mail, providing necessary details about your corporation. Using the right procedures is essential, and utilizing the Corpus Christi Texas Dissolution Package to Dissolve Corporation will guide you through this process efficiently.

Closing your business for tax purposes involves filing the final tax returns and settling any outstanding tax liabilities. You should also formally cancel any business accounts to avoid future taxes. The Corpus Christi Texas Dissolution Package to Dissolve Corporation can assist you in navigating these tax requirements effectively, providing the tools needed for a straightforward closure.

To legally close your business in Texas, you need to follow specific steps, including settling debts and filing the correct termination forms. Depending on your business structure, these forms may vary, so be cautious. Utilizing the Corpus Christi Texas Dissolution Package to Dissolve Corporation streamlines this process by offering comprehensive support and resources, ensuring you comply with all legal requirements.

Dissolving a C Corp in Texas requires filing a Certificate of Dissolution with the Secretary of State. Before you file, ensure that all corporate debts and obligations are settled to avoid complications. The Corpus Christi Texas Dissolution Package to Dissolve Corporation provides you with the necessary forms and outlines the steps to complete this process correctly, making it easier for you to handle.