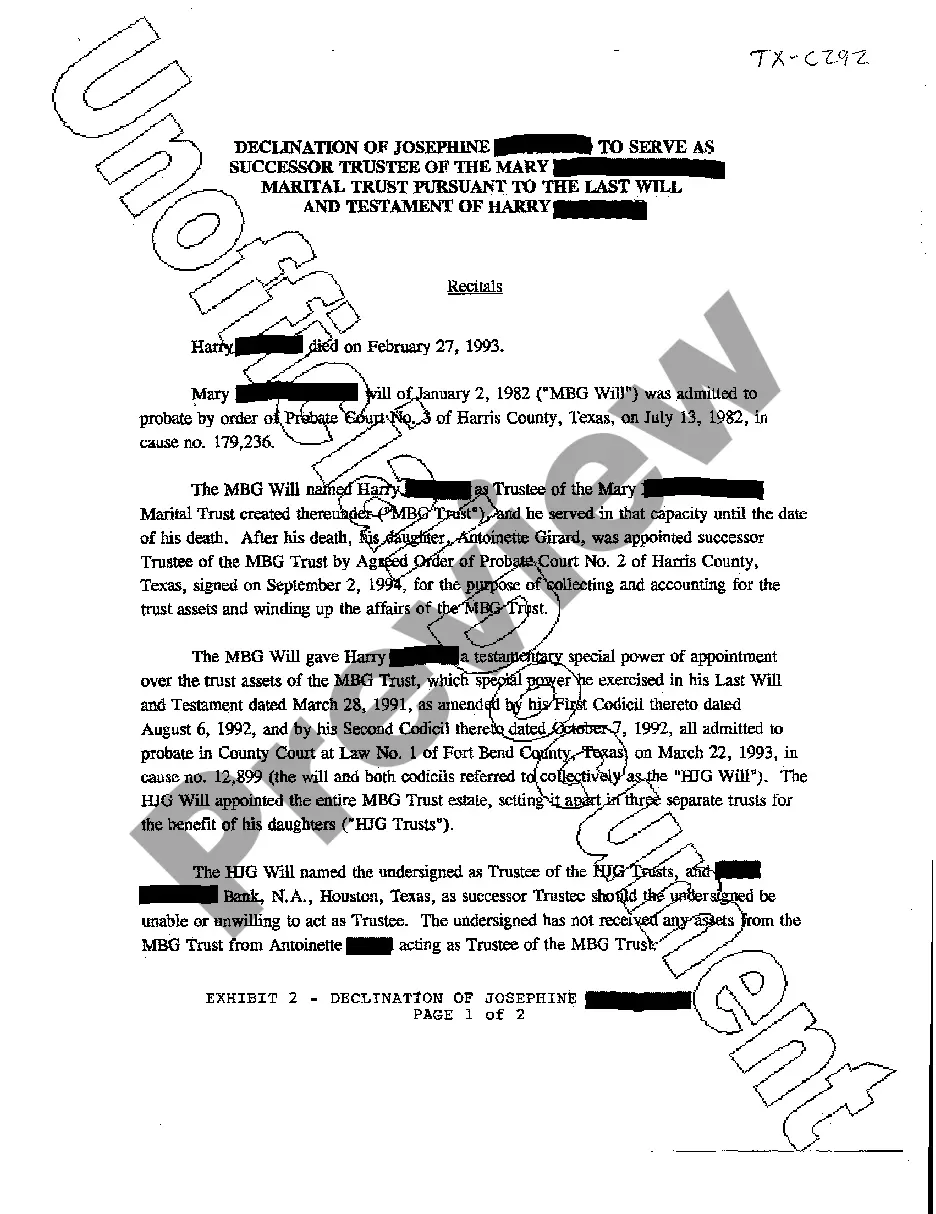

Laredo Texas Recitals regarding Declination to Serve as Successor Trustee

Description

How to fill out Laredo Texas Recitals Regarding Declination To Serve As Successor Trustee?

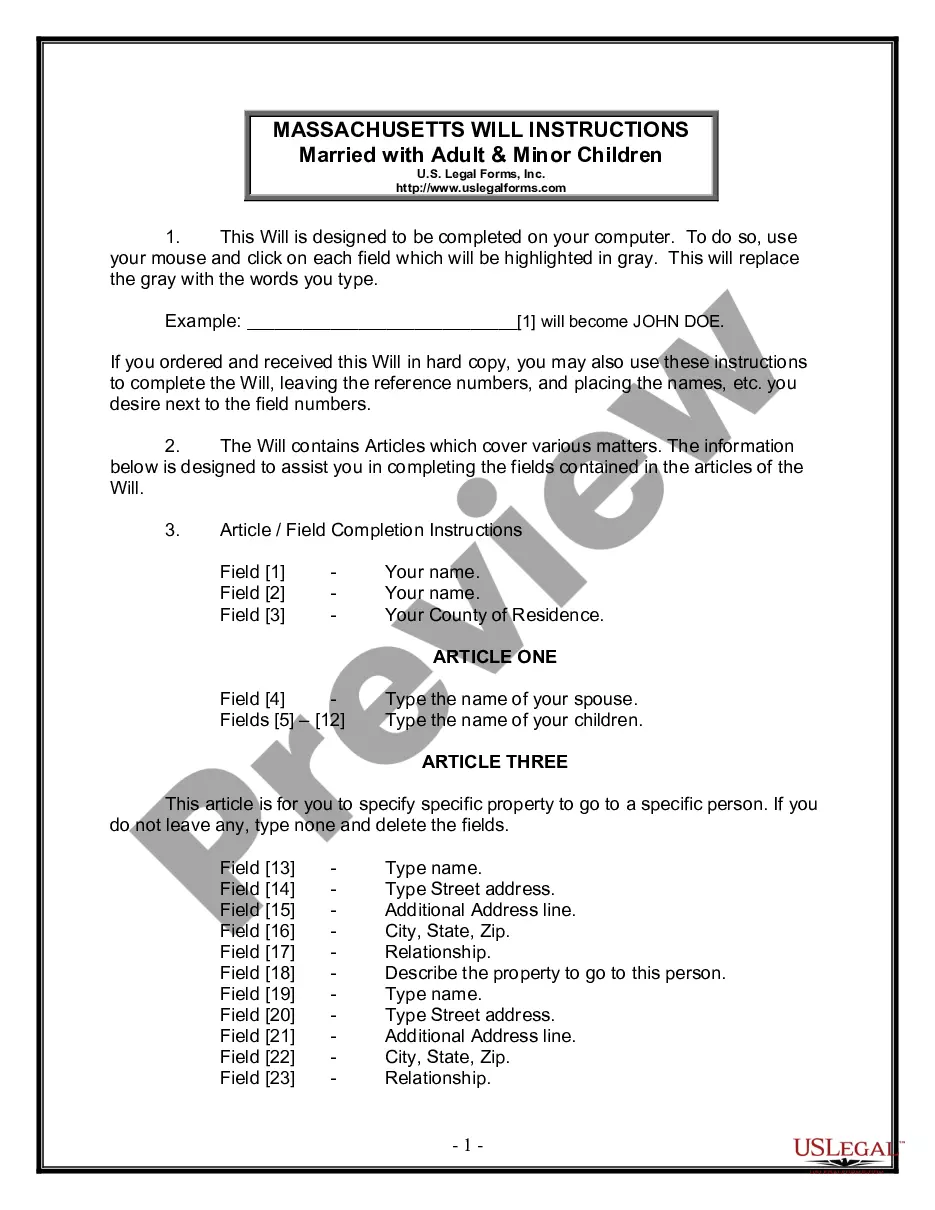

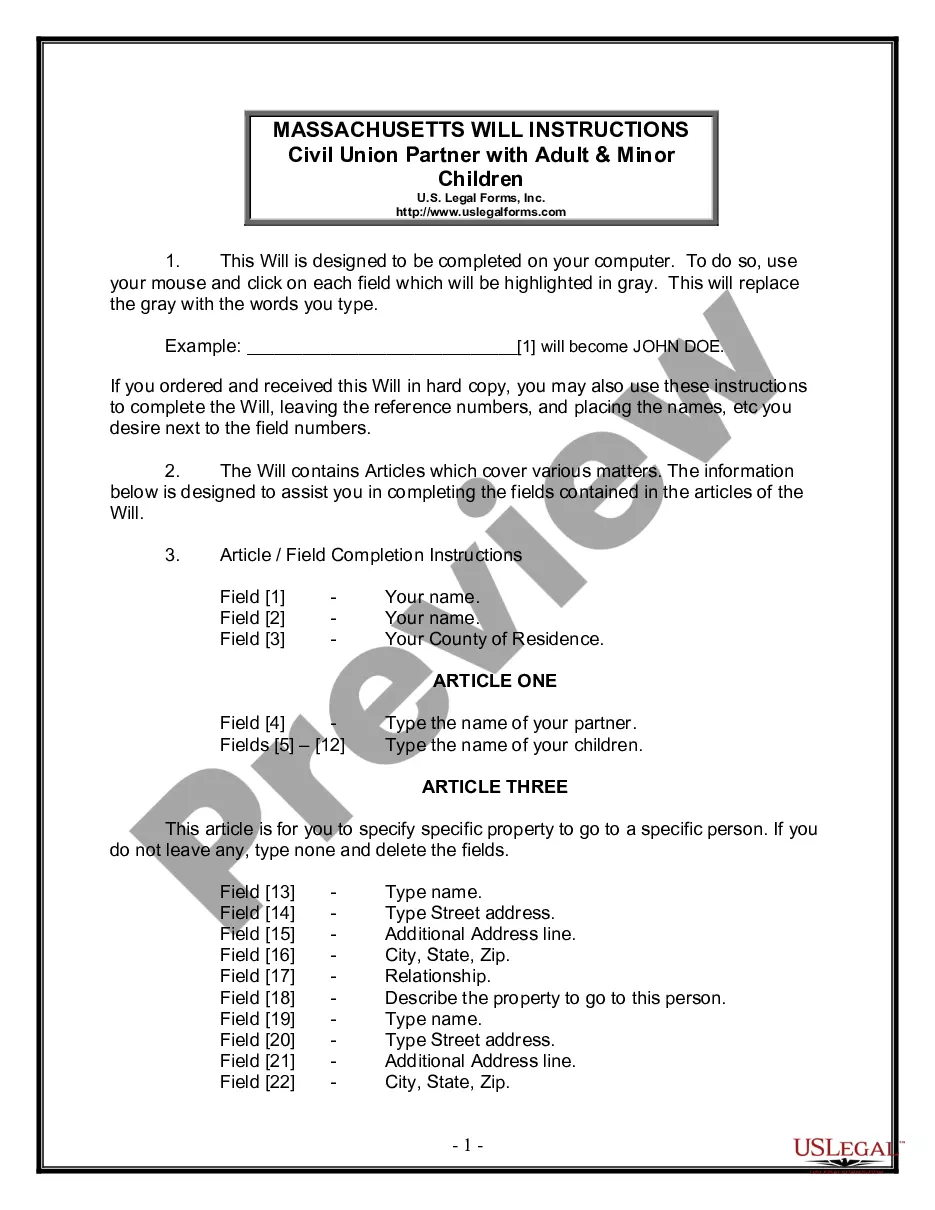

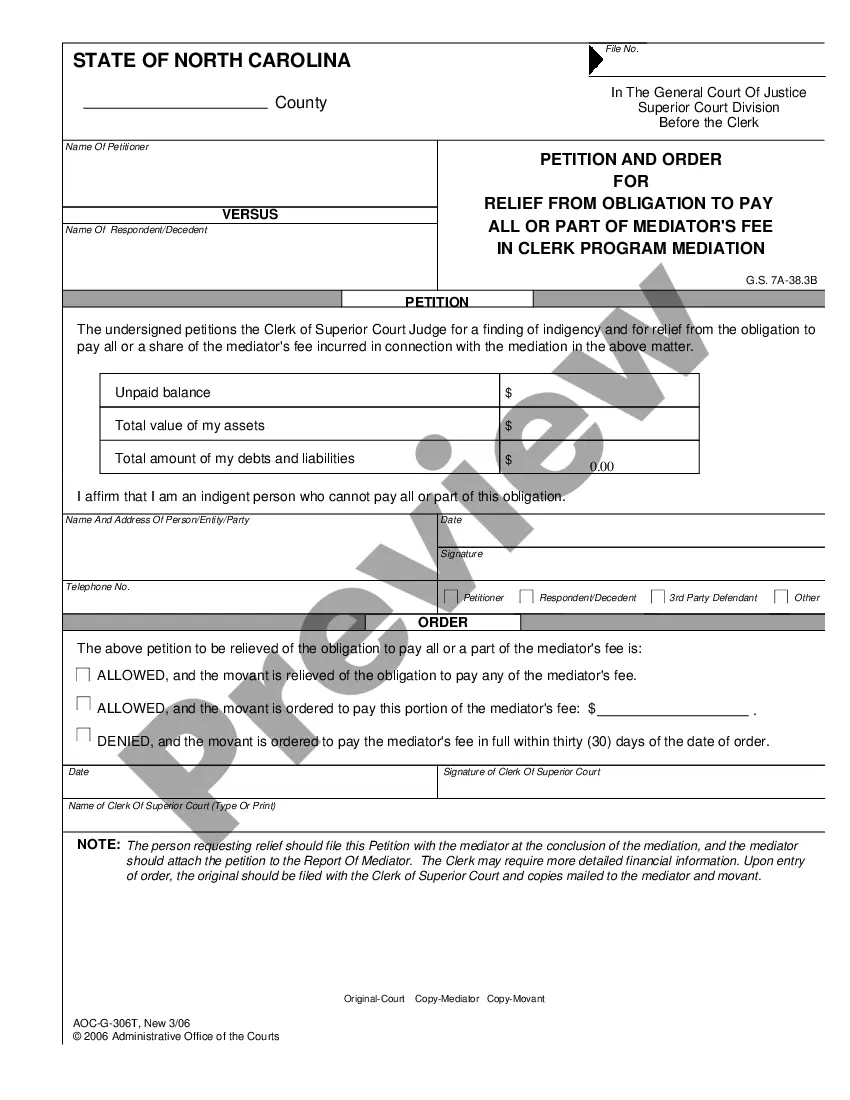

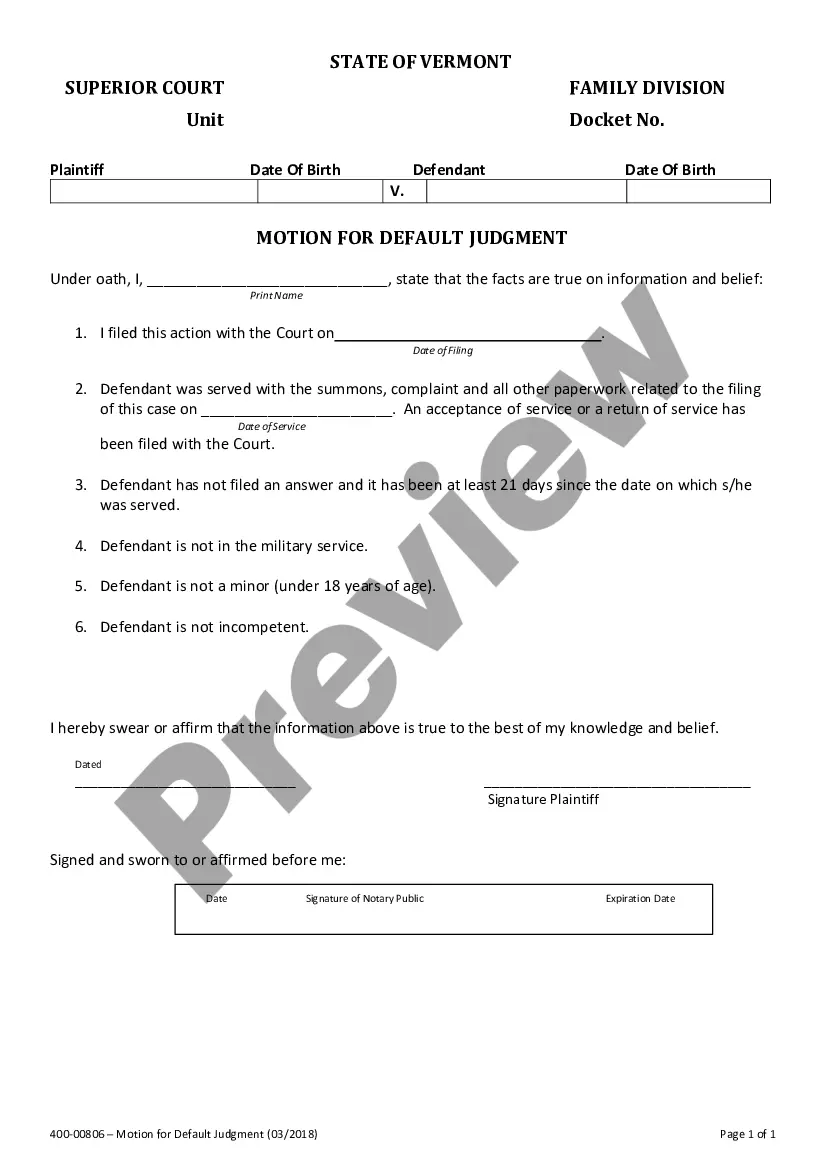

Locating authenticated templates pertinent to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital collection of over 85,000 legal documents catering to both personal and professional requirements and various real-life scenarios.

All the paperwork is accurately sorted by usage area and jurisdiction, making it as straightforward as ABC to find the Laredo Texas Recitals concerning Declination to Serve as Successor Trustee.

Maintaining documents organized and in compliance with legal standards is of significant importance. Utilize the US Legal Forms library to have essential document templates readily available for any requirements!

- For those who are already acquainted with our platform and have utilized it previously, obtaining the Laredo Texas Recitals concerning Declination to Serve as Successor Trustee only requires a few clicks.

- Simply Log In to your account, choose the document, and hit Download to save it onto your device.

- This procedure will require just a few additional steps for newcomers.

- Adhere to the instructions below to begin with the most comprehensive online form library.

- Examine the Preview mode and form description. Ensure you’ve selected the correct one that satisfies your requirements and aligns completely with your local jurisdiction stipulations.

Form popularity

FAQ

Section 112.035 of the Texas Property Code pertains to the revocation of a trust and the formal process required for such action. This section is crucial for trustees and beneficiaries who wish to understand how to lawfully terminate a trust. Consulting this section can provide clarity within the context of Laredo Texas Recitals regarding Declination to Serve as Successor Trustee, and US Legal Forms offers helpful documents to assist you.

Section 11.35 of the Texas Property Tax Code deals with property tax exemptions related to certain public purposes. This includes various exemptions that can significantly reduce tax liability. If you want to explore implications and processes associated with property taxation, particularly in Laredo Texas Recitals regarding Declination to Serve as Successor Trustee, US Legal Forms can provide you with valuable resources.

Section 113.151 of the Texas Property Code focuses on the powers and responsibilities assigned to a trustee when dealing with trust assets. It delineates the fiduciary duties involved and ensures that trustees operate within a legal framework. Knowing this code can help you understand more about the implications in the context of Laredo Texas Recitals regarding Declination to Serve as Successor Trustee.

A declination to serve as trustee form is a legal document allowing an individual to formally decline the role of trustee when appointed. This process is essential for preventing unwanted responsibilities and liabilities associated with trust management. Using this form correctly is vital, especially in Laredo Texas Recitals regarding Declination to Serve as Successor Trustee; consider using US Legal Forms for an easy-to-fill template.

Property Code 113.053 in Texas addresses the appointment and duties of a trustee concerning trust property. This code section is crucial for understanding a trustee's capabilities and limitations while managing trust assets. If you face issues related to this code, refer to resources like US Legal Forms, which can assist in navigating Laredo Texas Recitals regarding Declination to Serve as Successor Trustee.

In Texas, a trustee generally needs the consent of all beneficiaries to sell trust property, unless the trust document provides otherwise. This ensures that all parties involved have a say in significant decisions, reinforcing the importance of trust terms in Laredo Texas Recitals regarding Declination to Serve as Successor Trustee. If you have questions about specific scenarios, consider consulting the US Legal Forms platform for guidance.

Section 112.057 of the Texas Property Code outlines the requirements for a successor trustee to serve. It includes provisions about the appointment process and the responsibilities of the trustee. Understanding this section can clarify your rights and obligations, especially in Laredo Texas Recitals regarding Declination to Serve as Successor Trustee.

If you find yourself in a position where you do not want to serve as an executor, it's important to express your feelings early. You can officially decline the role, which may involve some paperwork or court notification. Using resources such as US Legal Forms can guide you through this process, ensuring that you comply with the Laredo Texas Recitals regarding Declination to Serve as Successor Trustee and protect your interests.

Assigning a successor trustee typically involves specifying this choice within the trust documents. Ensure that the individual you choose is willing to accept this responsibility and is aware of the duties involved. By following the guidelines set out in the Laredo Texas Recitals regarding Declination to Serve as Successor Trustee, you can make a well-informed decision that suits your estate’s needs.

A disinterested trustee is someone who has no personal stake in the estate being managed. Their primary duty is to administer the trust impartially, ensuring that all beneficiaries are treated fairly. This role is often preferred as it aligns with the Laredo Texas Recitals regarding Declination to Serve as Successor Trustee, promoting transparency and reducing potential conflicts of interest.