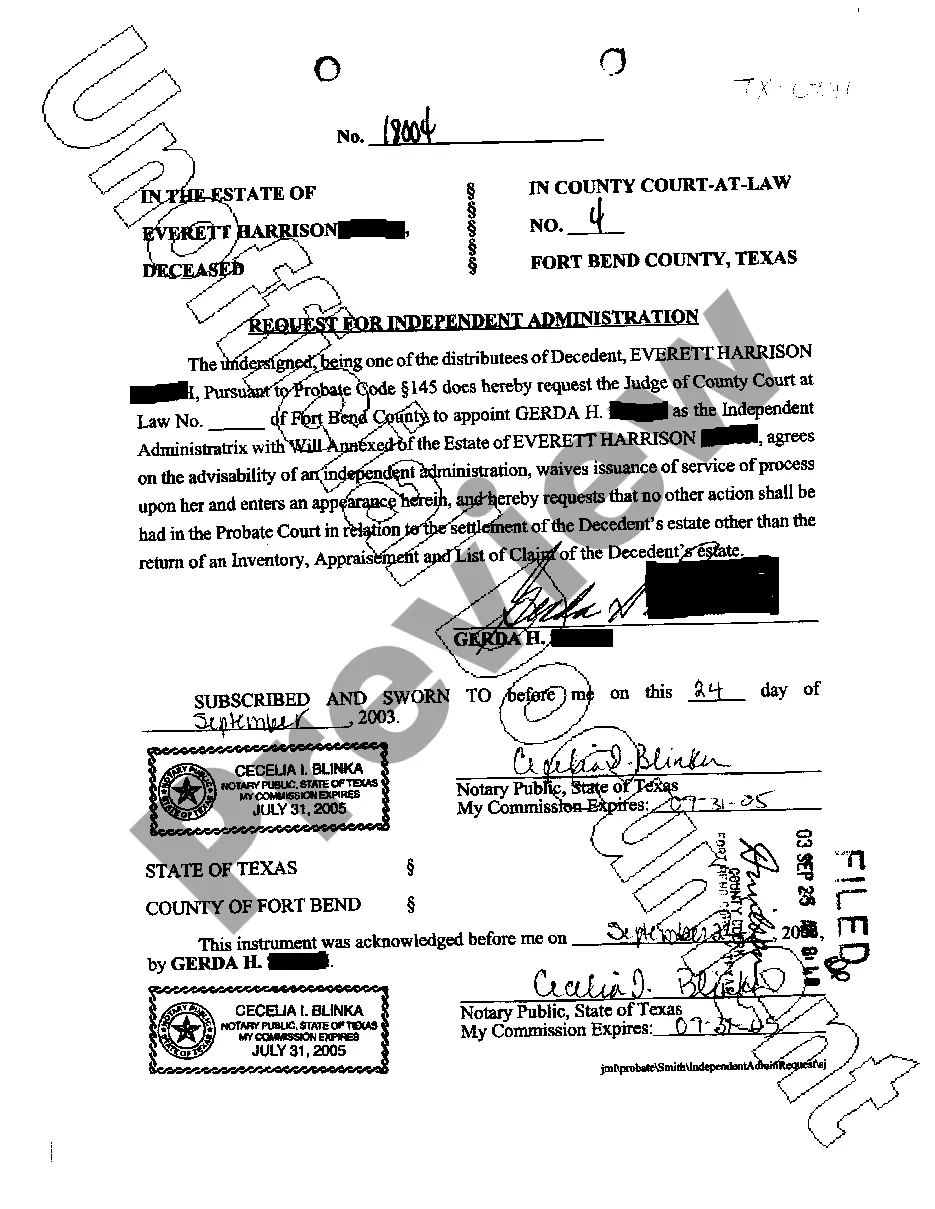

Collin Texas Request for Independent Administration

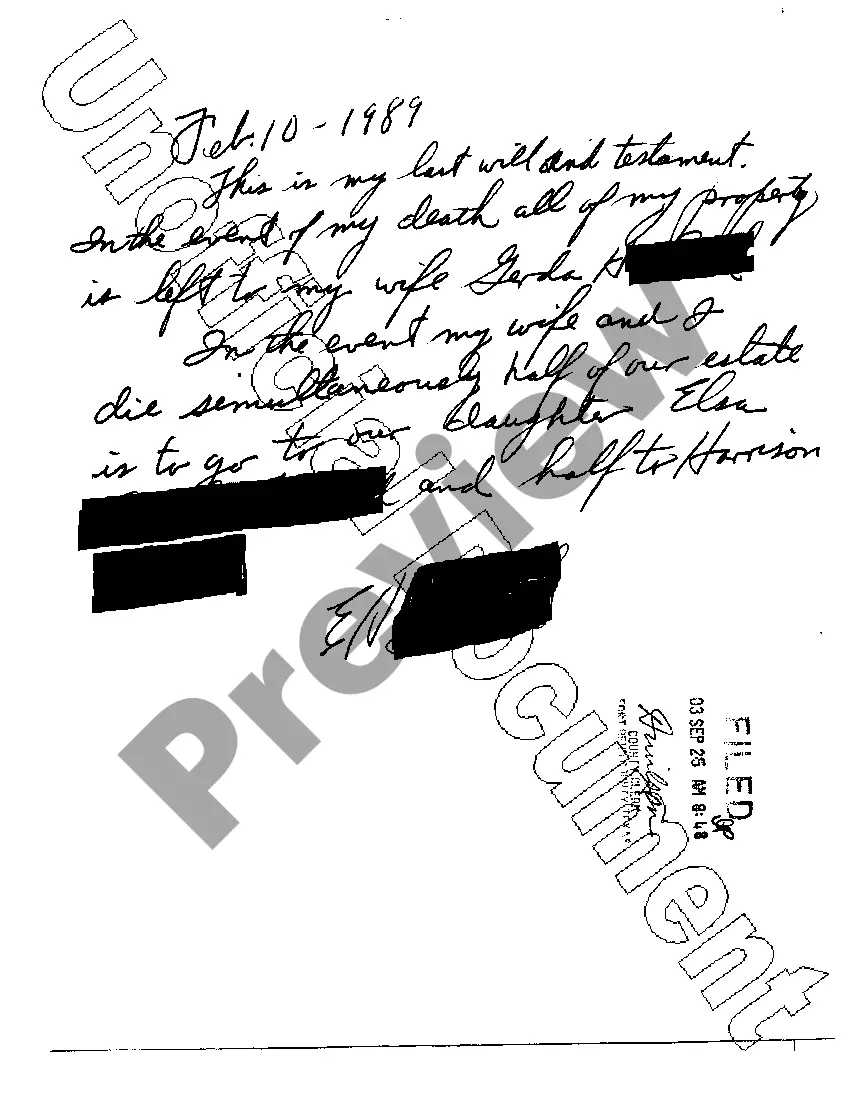

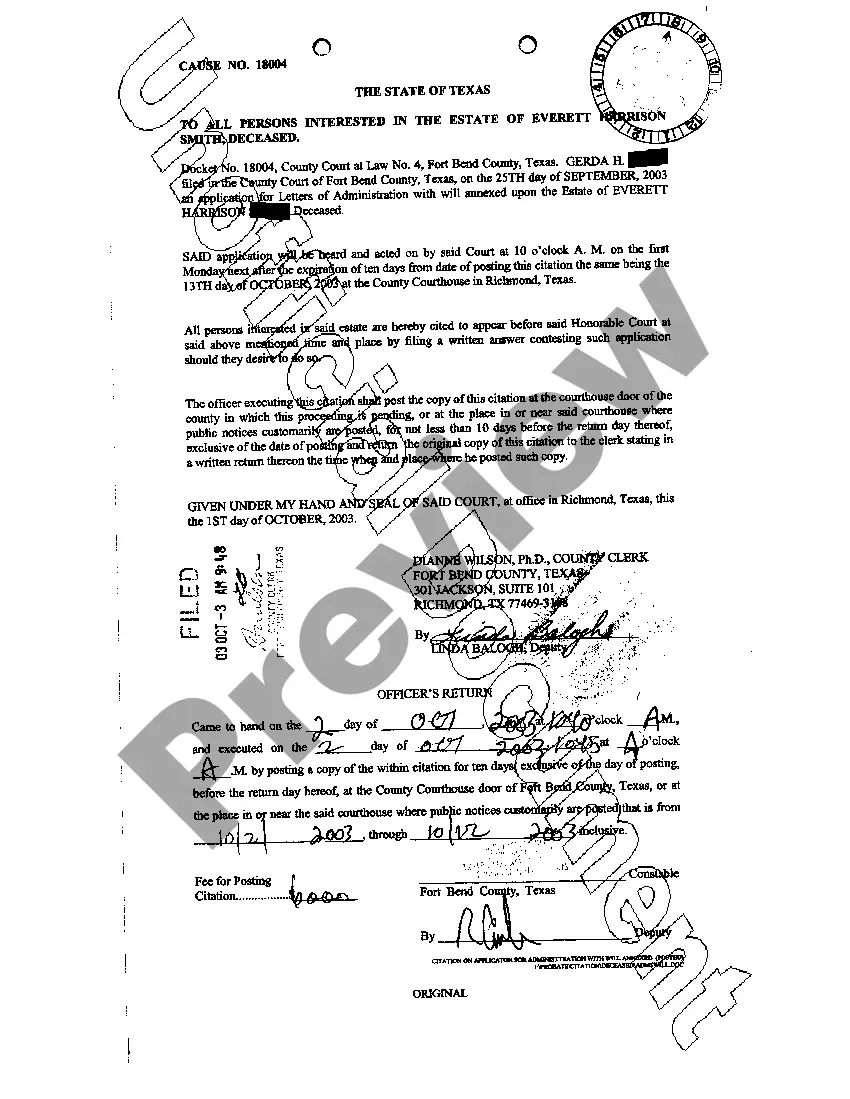

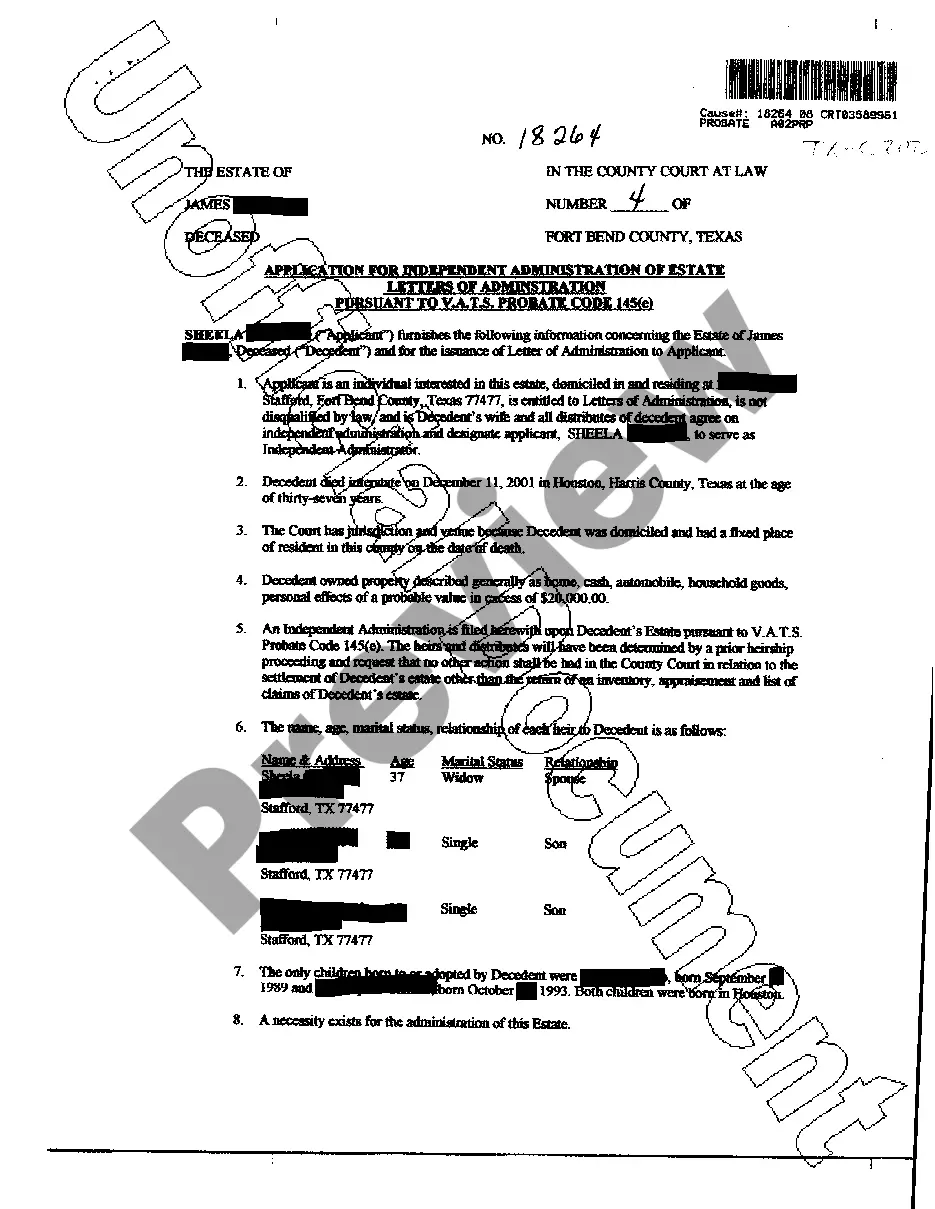

Description

How to fill out Texas Request For Independent Administration?

Irrespective of social or occupational standing, accomplishing law-related documents is an unfortunate requirement in today's society.

Frequently, it's nearly impossible for an individual lacking any legal training to generate this type of documentation from scratch, primarily due to the complicated terminology and legal nuances they involve.

This is where US Legal Forms proves beneficial.

Ensure the template you have selected is appropriate for your locality, as the statutes of one region do not apply to another.

Review the document and check a brief overview (if available) of scenarios the document can be utilized for.

- Our service offers an extensive assortment of over 85,000 ready-to-use state-specific templates suitable for nearly any legal matter.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency by using our DIY papers.

- Whether you need the Collin Texas Request for Independent Administration or other documents that are appropriate in your locale, with US Legal Forms, everything is easily accessible.

- Here's how to obtain the Collin Texas Request for Independent Administration in mere minutes with our reliable platform.

- If you are currently an existing user, feel free to Log In to your account and download the necessary form.

- However, if you are new to our repository, be sure to follow these steps before acquiring the Collin Texas Request for Independent Administration.

Form popularity

FAQ

An independent administrator of an estate in Texas is a person or entity appointed by the court to manage the estate without court supervision. This means they have the authority to make decisions on behalf of the estate, handle assets, and distribute inheritance according to the will or state law. The Collin Texas Request for Independent Administration streamlines the process, allowing for quicker resolutions and reduced costs for families. Using platforms like USLegalForms can simplify this process by providing the necessary legal documents and guidance needed.

An independent administrator in Texas possesses broad powers to manage the estate without needing court approval for most actions. This role allows for the sale of assets, payment of debts, and distribution of property in a timely manner. A Collin Texas Request for Independent Administration empowers you to direct the estate efficiently while keeping costs and delays to a minimum. For help with completing this request, platforms like US Legal Forms can provide valuable tools and templates.

Independent executor fees in Texas typically range from 2% to 5% of the estate’s value, depending on various factors such as the complexity of the estate. These fees cover the executor’s services in managing the estate independently, which can significantly enhance efficiency. Understanding these fees is crucial for anyone considering a Collin Texas Request for Independent Administration. By utilizing resources like US Legal Forms, you can find detailed information and guidance on these fees.

A dependent administrator in Texas is a person who manages the estate under the supervision of the court. This role involves following specific guidelines set by the court, which can add complexity and length to the estate administration process. In contrast, a Collin Texas Request for Independent Administration allows for greater flexibility and control over estate management. Choosing independent administration can streamline the process and reduce court involvement.

In Texas, an administrator of an estate can be an individual who is either named in a will or appointed by the court. This individual must be at least 18 years old and of sound mind. Choosing the right administrator is crucial in handling the estate efficiently, and submitting a Collin Texas Request for Independent Administration can make this process more straightforward. Utilizing platforms like US Legal Forms can provide the necessary guidance and forms to help you along the way.

An independent executor is someone designated by a will to manage the estate without court supervision, while an independent administrator is appointed by the court when there is no valid will. Both roles involve similar duties, but the key difference lies in their appointment. For those navigating these roles, submitting a Collin Texas Request for Independent Administration can ensure smooth proceedings. Proper use of resources like US Legal Forms can further ease the process.

In Texas, bank accounts that have designated beneficiaries typically do not go through probate. These accounts pass directly to the named beneficiaries upon the account holder's death. This can save time and resources, emphasizing the importance of clearly stating beneficiary designations. However, if additional legal clarification is needed, a Collin Texas Request for Independent Administration may be beneficial.

In Texas, the administrator can be a person named in the will or an individual appointed by the court. This person must be at least 18 years old and must not have any legal disabilities. To facilitate this, making a Collin Texas Request for Independent Administration can help establish the autonomy needed for effective estate management. At times, online resources like US Legal Forms make navigating this process simpler.

To get a letter of administration in Texas, start by completing the appropriate application forms and filing them with the probate court. You will need to provide information about the deceased and the estate. A well-prepared Collin Texas Request for Independent Administration, possibly supported by resources from uslegalforms, can lead to a smoother process and quicker approval of your application.

The timeline to obtain letters of administration in Texas can vary, but it typically takes about 30 to 90 days. The process duration depends on factors such as court schedules and whether there are any disputes regarding the estate. By ensuring that your Collin Texas Request for Independent Administration is complete and accurate, you can help expedite this timeline and avoid unnecessary delays.