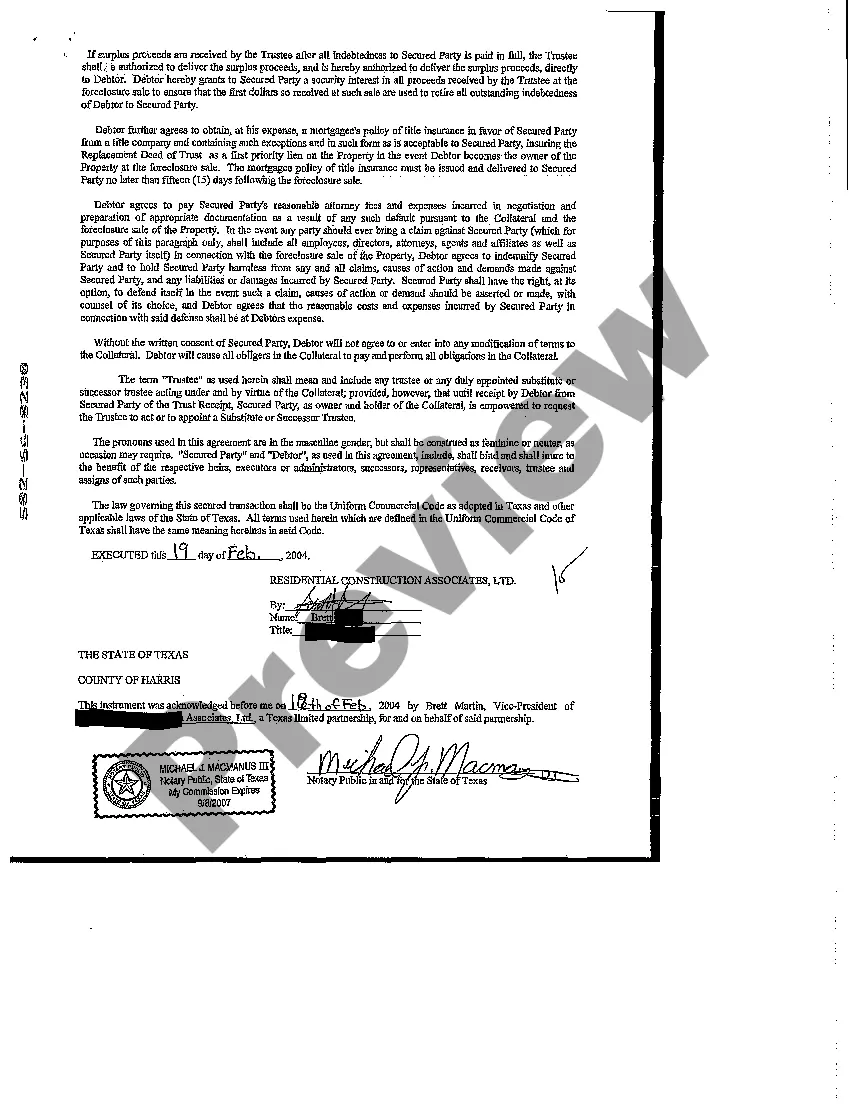

Corpus Christi Texas Collateral Assignment of Note and Liens is a legal process that involves transferring the rights to a promissory note and the associated liens to another party as collateral for a loan or security agreement. This assignment is typically used in real estate transactions and lending arrangements, wherein the borrower pledges the property as collateral. In Corpus Christi, Texas, there are various types of Collateral Assignment of Note and Liens, each serving different purposes and scenarios. These may include: 1. Real Estate Collateral Assignment: This type of assignment is commonly used when a borrower offers real property, such as a house or commercial building, as collateral to secure a loan. The lender may file a lien against the property, providing them with the right to foreclose in case of default. 2. Vehicle Collateral Assignment: This involves assigning the rights to a promissory note and associated liens related to a vehicle as collateral. If the borrower fails to repay the loan as agreed, the lender can repossess the vehicle to satisfy the debt. 3. Equipment Collateral Assignment: In certain business transactions, parties may assign the rights to a promissory note and related liens associated with equipment or machinery. This allows the lender to seize the equipment if the borrower defaults on the loan. 4. Accounts Receivable Collateral Assignment: This type of assignment involves pledging a company's accounts receivable as collateral for a loan. If the borrower fails to repay, the lender can claim the outstanding invoices or claim payment directly from the company's clients. 5. Stock Collateral Assignment: In some cases, individuals may pledge their stock holdings as collateral for a loan. By assigning the rights to the stock and any associated liens, the lender can seize or sell the shares if the borrower defaults. It is important to note that each Corpus Christi Texas Collateral Assignment of Note and Liens is subject to specific legal requirements and documentation. The agreement between the parties should be carefully drafted to include the terms and conditions of the assignment, rights and remedies in case of default, and any necessary filings with relevant authorities. In summary, Corpus Christi Texas Collateral Assignment of Note and Liens is a legal process that allows the transfer of rights to a promissory note and associated liens as collateral for a loan. Various types exist, including real estate, vehicle, equipment, accounts receivable, and stock assignments. Proper legal documentation and adherence to specific requirements are crucial when entering into such agreements.

Corpus Christi Texas Collateral Assignment of Note and Liens

Description

How to fill out Corpus Christi Texas Collateral Assignment Of Note And Liens?

Are you searching for a reliable and cost-effective provider of legal forms to obtain the Corpus Christi Texas Collateral Assignment of Note and Liens? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish regulations for living together with your partner or a set of documents to facilitate your divorce in court, we've got you taken care of. Our platform offers over 85,000 current legal document templates for personal and business usage. All templates we provide are not generic and are tailored to meet the specifications of particular states and counties.

To acquire the document, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can access your previously bought form templates anytime from the My documents section.

Are you unfamiliar with our platform? No problem. You can easily create an account, but before doing that, ensure to take the following steps.

Now you can proceed to register your account. Then choose the subscription option and advance to payment. Once the transaction is completed, download the Corpus Christi Texas Collateral Assignment of Note and Liens in any available file format. You can return to the website whenever needed and redownload the document at no additional cost.

Obtaining up-to-date legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time understanding legal documents online.

- Verify if the Corpus Christi Texas Collateral Assignment of Note and Liens aligns with your state's and local area's laws.

- Examine the form’s details (if available) to understand who and what the document is meant for.

- Reinitiate the search if the template isn’t suitable for your specific needs.

Form popularity

FAQ

A collateral transfer of note and lien occurs when a borrower transfers their rights to a note and any associated lien to a lender as guarantee for a financial obligation. This transfer is often seen in Corpus Christi Texas Collateral Assignment of Note and Liens, and it allows lenders to have a claim on both the note and the underlying collateral should the borrower default. Understanding this concept can help secure financing more effectively.

In Texas, attorneys are generally authorized to draft deeds of trust and notes, ensuring they comply with state laws. However, individuals can draft these documents as long as they follow the legal requirements outlined in Texas law. Utilizing resources like USLegalForms can simplify this process and ensure that your documents meet these legal standards.

Whether a lien is good or bad largely depends on the perspective of the parties involved. For lenders, liens provide assurance and can be seen as a safeguard against default. For borrowers, a lien can be helpful for obtaining financing but may complicate ownership rights if debts arise. Therefore, understanding the implications of Corpus Christi Texas Collateral Assignment of Note and Liens is essential for making informed financial decisions.

In Texas, the statute of limitations for enforcing a property lien typically spans between four to ten years, depending on the type of lien. For example, a mechanic's lien has a four-year limit, while other forms like a mortgage lien can extend to ten years. Knowing these time frames is vital when navigating the Corpus Christi Texas Collateral Assignment of Note and Liens to ensure your rights are protected and properly enforced.

The three primary types of liens include voluntary liens, statutory liens, and judgment liens. Voluntary liens occur when property owners willingly use their property as collateral for loans. Statutory liens arise through laws, like tax liens, whereas judgment liens result from court decisions. Understanding these types is essential when dealing with Corpus Christi Texas Collateral Assignment of Note and Liens, as each type affects property rights differently.

Assigning a contract in Texas involves drafting an assignment agreement and securely notifying all involved parties. Make sure to include specifics regarding the rights and obligations being transferred. If you are focusing on the Corpus Christi Texas Collateral Assignment of Note and Liens, this procedure can streamline your transactions and protect your investments.

To file a release of lien in Texas, you need to complete a release form and submit it to the county clerk’s office where the lien is recorded. Ensure that all required details, such as the property description and the lienholder’s information, are included. This process is crucial for anyone navigating the Corpus Christi Texas Collateral Assignment of Note and Liens, as it clears the title for future transactions.

To legally assign a contract, you should create a written agreement that outlines the terms of the assignment, notifying the other party involved. Both the original and new parties should sign this document for it to be enforceable. For those considering the Corpus Christi Texas Collateral Assignment of Note and Liens, following these steps ensures a clear transfer of rights.

Yes, contract assignment is permitted in Texas unless explicitly prohibited in the agreement. This flexibility allows you to transfer your rights and obligations to another party, which can be beneficial in many scenarios. Utilizing the Corpus Christi Texas Collateral Assignment of Note and Liens facilitates this process smoothly.

A lien assignment occurs when the holder of a lien transfers their rights to another party. This can happen for various reasons, such as funding needs or restructuring. Understanding lien assignments through the lens of the Corpus Christi Texas Collateral Assignment of Note and Liens can empower property owners to manage their financial obligations effectively.