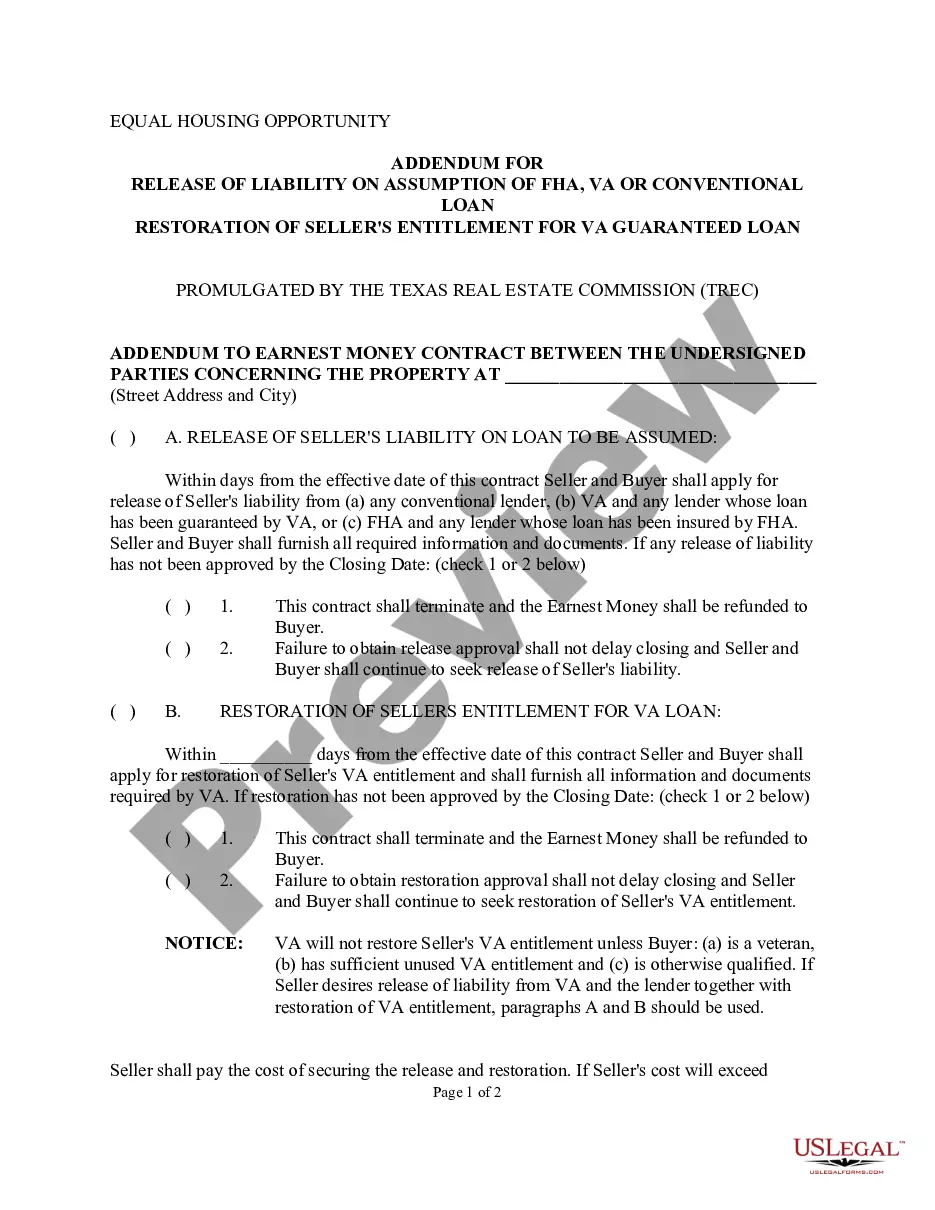

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Texas Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

Regardless of social or professional standing, filling out legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly impossible for an individual without legal training to create such documents from the beginning, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

However, if you are not acquainted with our platform, be sure to follow these steps before downloading the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

Verify that the form you have located is suitable for your area as the laws of one state or county do not apply universally to another. Preview the form and review a brief overview (if provided) of the situations for which the document can be utilized. If the one you selected does not meet your requirements, you can restart and look for the necessary document. Click Buy now and choose your preferred subscription plan. Log In using your account credentials or create a new one from the ground up. Select the payment method and proceed to download the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan once the payment is completed. You’re all prepared! Now you can either print the form or fill it out online. Should you encounter any difficulties accessing your purchased forms, you can simply find them in the My documents section. Whatever challenge you are trying to address, US Legal Forms has got you covered. Give it a shot today and witness the results firsthand.

- Our service provides a vast collection with over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to enhance their efficiency by utilizing our DYI templates.

- Whether you need the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan, or any other document that will be valid in your jurisdiction, US Legal Forms puts everything at your disposal.

- Here’s how you can obtain the Dallas Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan in just minutes using our dependable service.

- If you are already a member, feel free to Log In to your account to retrieve the required document.

Form popularity

FAQ

How to fill out the Addendum for Sale of Other Property by Buyer - YouTube YouTube Start of suggested clip End of suggested clip And then you'll add the addendum. The address of property is the property that they are looking toMoreAnd then you'll add the addendum. The address of property is the property that they are looking to purchase. And then in paragraph a that's the address of the property that they need to sell. Usually.

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

Name the parties to the contract. Indicate the addendum's effective date, using the same date format used in the original contract. Indicate the elements of the original contract that the addendum intends to change. Concisely but clearly describe the desired changes.

The addendum must be signed by both buyer and seller to become in effect. After signing, the addendum should be attached to the original purchase agreement....Be sure to include the following: Purchase Agreement Effective Date (for reference); Buyer's Name; Seller's Name; Property Address; and. Changes to the Agreement.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

What is specified in TREC's Loan Assumption Addendum? The Loan Assumption Addendum is used when the buyer is assuming the seller's existing loan, and should specify whether the seller will remain personally responsible for repayment of the note.

Description: This Addendum is attached to a contract when another contract has already been executed by the Seller and another Buyer (First Contract). It makes the contract that it is attached to contingent upon the termination of the First Contract.

Paragraph 2 (Property) is a very important section to understand in TREC's One to Four Family Residential Contract. Paragraph 2 pertains to the legal description of the property being conveyed and the improvements, accessories, and exclusions.

Buyer contingencies addenda. Buyer contingencies are the most common addenda, according to Justin Ostow, a top real estate agent in Tampa, Florida, who completes 10% more sales than the average agent. Contingencies dictate certain conditions which must be met for the contract to go through.

A VA restoration of entitlement allows borrowers who have previously utilized their VA loan entitlement to purchase another home with the VA's guaranty again.