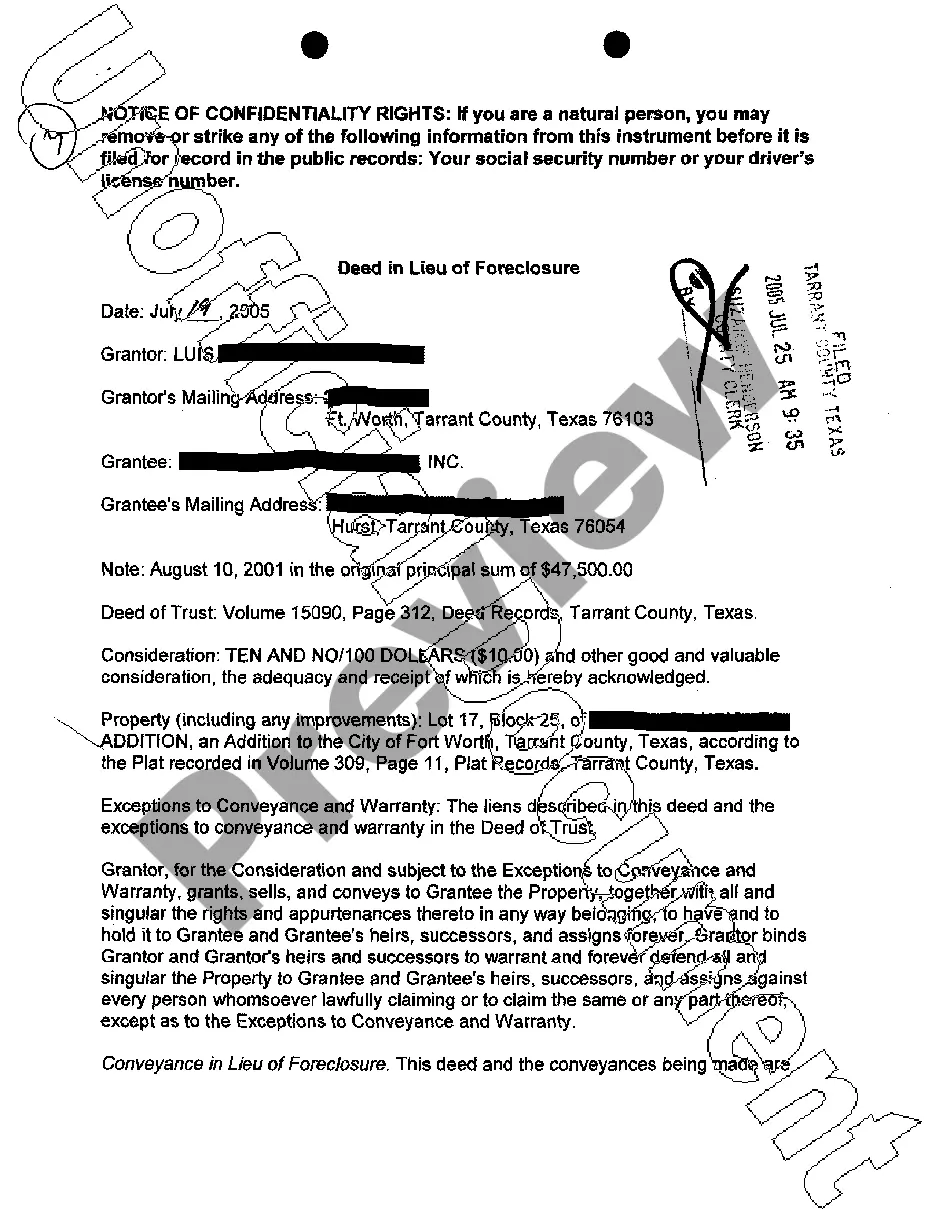

This detailed sample Deed in Lieu of Foreclosure complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Collin Texas Deed in Lieu of Foreclosure

Description

How to fill out Texas Deed In Lieu Of Foreclosure?

We consistently seek to minimize or sidestep legal complications when handling intricate legal or financial issues.

To achieve this, we seek legal assistance that is typically very expensive.

However, not all legal issues are of equal complexity; many can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents, encompassing everything from wills and powers of attorney to incorporation articles and petitions for termination.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always download it again from the My documents section. The process is equally simple if you’re a newcomer to the website! You can establish your account in just a few minutes. Ensure to verify if the Collin Texas Deed in Lieu of Foreclosure complies with the laws and regulations of your specific state and region. Furthermore, it’s crucial to review the form’s layout (if accessible), and if you detect any inconsistencies with what you were initially searching for, look for another form. Once you’ve confirmed that the Collin Texas Deed in Lieu of Foreclosure is suitable for your needs, you can choose a subscription option and proceed with the payment. Afterward, you can download the document in any available file format. With over 24 years of service, we’ve assisted millions by providing customizable and up-to-date legal forms. Utilize US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs independently without needing a lawyer.

- We grant access to legal document templates that may not always be publicly accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Leverage US Legal Forms whenever you need to obtain and download the Collin Texas Deed in Lieu of Foreclosure or any other document quickly and securely.

Form popularity

FAQ

A Collin Texas Deed in Lieu of Foreclosure can significantly damage your credit score, often dropping it by 100 points or more. This negative mark can remain on your credit report for up to seven years. The extent of the damage depends on your overall credit history. Taking proactive steps, such as working with USLegalForms to manage aspects of your financial recovery, can aid in rebuilding your credit over time.

A primary disadvantage of a Collin Texas Deed in Lieu of Foreclosure is the potential for tax implications. When the lender forgives a portion of the mortgage debt, the homeowner may face a tax bill for the forgiven amount. Additionally, this option does not eliminate all responsibilities associated with the property, such as liens or other debts. Understanding these pitfalls can help homeowners make more informed decisions.

One significant disadvantage to lenders when accepting a Collin Texas Deed in Lieu of Foreclosure is the potential loss of value. The lender may end up taking ownership of a property that is worth less than the outstanding mortgage amount. Additionally, lenders typically incur legal fees and other costs associated with the transfer. As a result, it can be less appealing compared to pursuing a traditional foreclosure process.

A Collin Texas Deed in Lieu of Foreclosure is a legal process where homeowners voluntarily transfer their property back to the lender to avoid the foreclosure process. This option can help homeowners remove the burden of monthly mortgage payments and assist in protecting their credit scores from a more significant mark of foreclosure. It provides an alternative solution to both lenders and homeowners, promoting a smoother transition.

To write a foreclosure letter, begin with a clear, concise statement of your intention to address the foreclosure situation. Include details about your property, your financial circumstances, and any proposals for negotiation, such as considering a deed in lieu of foreclosure. Make sure to sign the letter and provide your contact information for further communication.

Filing a Collin Texas Deed in Lieu of Foreclosure involves several steps. Start by reviewing your financial standing and contacting your lender to express your intent. After receiving the lender’s approval, complete the necessary paperwork, including any required legal forms, and submit them back to the lender for processing.

To file a Collin Texas Deed in Lieu of Foreclosure, you should first contact your lender to discuss the necessary procedures. Once approved, you will need to complete specific forms, which may include providing a hardship letter and financial documentation. Finally, submit the completed forms to your lender to begin processing your request.

The Collin Texas Deed in Lieu of Foreclosure process typically takes several weeks to a few months to complete. The duration largely depends on the lender's response time and the complexity of the homeowner’s financial situation. Homeowners are encouraged to stay in communication with their lender throughout the process to ensure timely updates.

When writing a deed in lieu of foreclosure letter, begin by clearly stating your intention to transfer the property back to the lender. Include your property details, your contact information, and explain your financial situation concisely. It’s important to express a willingness to cooperate with the lender to make the process smooth and avoid foreclosure.

A common example of a Collin Texas Deed in Lieu of Foreclosure is when a homeowner submits a request to their lender, seeking to transfer ownership of their home to avoid foreclosure. For instance, if a homeowner can no longer afford their mortgage payments, they may negotiate with the lender to give back the property, thereby eliminating the need for foreclosure proceedings.