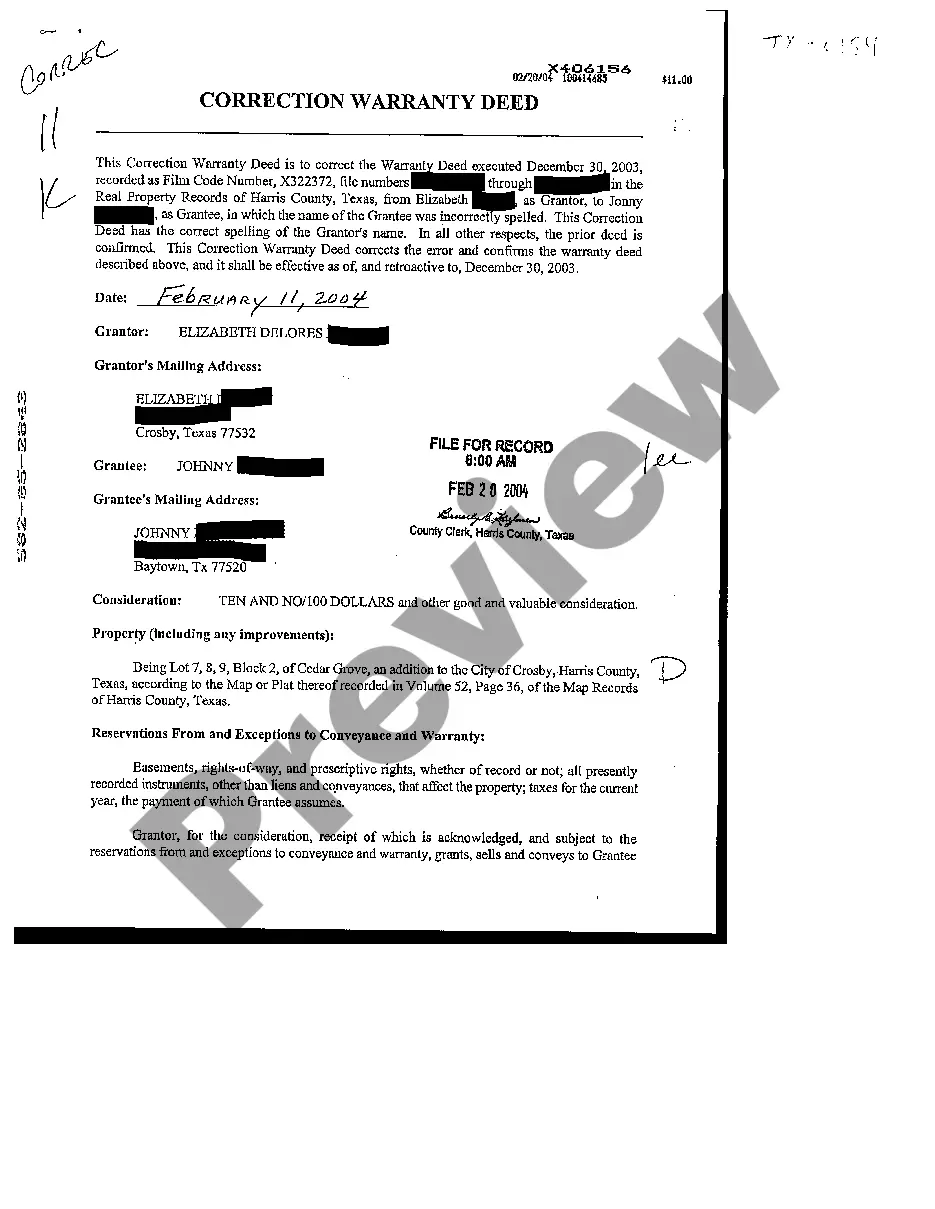

This form is a Correction Warranty Deed where the Grantor is an individual and the Grantee is an individual. This deed is used to correct a mutual mistake: misspelled name of a party. This deed complies with all state statutory laws.

Houston Texas Correction Warranty Deed

Description

How to fill out Texas Correction Warranty Deed?

We consistently seek to lessen or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal assistance services that are typically quite costly.

Nevertheless, not all legal issues are of the same level of complexity; many can be handled independently.

US Legal Forms is an online resource of current self-help legal documents covering everything from wills and power of attorneys to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to lose the form, you can always download it again from the My documents section. The procedure is just as straightforward for those who are not familiar with the website! You can create your account in just a few minutes. Ensure that the Houston Texas Correction Warranty Deed adheres to the laws and regulations specific to your state and locality. Additionally, it’s essential that you review the description of the form (if provided), and should you notice any differences from what you initially sought, look for an alternative form. Once you confirm that the Houston Texas Correction Warranty Deed fits your needs, you can select a subscription plan and proceed with payment. After that, you’re able to download the document in any format available. With over 24 years in the industry, we’ve assisted millions by delivering customizable and current legal documents. Take advantage of US Legal Forms now to conserve your time and resources!

- Our repository empowers you to manage your own legal affairs without the need for professional legal representation.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Utilize US Legal Forms whenever you need to locate and retrieve the Houston Texas Correction Warranty Deed or any other document swiftly and securely.

Form popularity

FAQ

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

The spouse whose name is to be removed from the title will need to sign the deed in front of any notary. This can be done anywhere in the world. The signed and notarized deed will then need to be filed with the county clerk's office in the county where the property is located.

The lender will need to be satisfied that you will be able to afford the mortgage as the sole mortgagor. The mortgage lender will then need to give you written consent in order to remove the other party from the deeds to your house. The lender will require the change in ownership to be carried out by a solicitor.

How to Transfer Texas Real Estate Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).Create a new deed.Sign and notarize the deed.File the documents in the county land records.

General Warranty Deed prepared for $195.

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

No, a warranty deed does not prove ownership. A title search is the best way to prove that a grantor rightfully owns a property. The warranty deed is a legal document that offers the buyer protection. In other words, the property title and warranty deed work in tandem together.

A person cannot be passively removed from a deed. If the person is still living, you may ask them to remove themselves by signing a quitclaim, which is common after a divorce. The individual who signs and files a quitclaim is asking to have their name removed from the property deed.

What is a Correction Deed? A correction deed, or correction instrument, is used to clarify ambiguities or cure errors in an existing instrument conveying real property without having to resort to judicial reformation.

Your deed will be prepared by a Texas licensed attorney in about an hour. This fee does not include the county recording fee. The county recording fee is approximately $15 to $40, depending on the county the property is located in.