This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds, where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, has decided to disclaim his/her interest in the proceeds. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

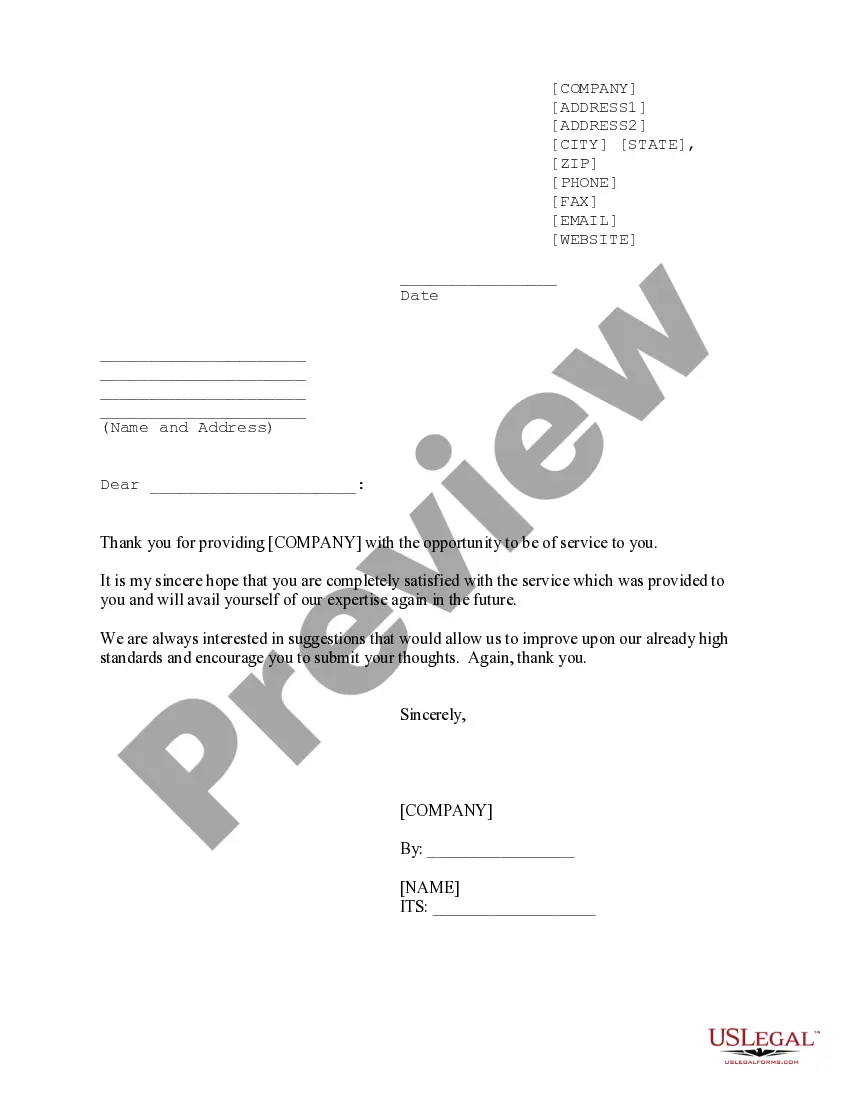

How to fill out Texas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Finding validated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms repository.

It’s a web-based collection of over 85,000 legal documents for both personal and professional requirements and various real-life scenarios.

All the forms are meticulously organized by usage area and jurisdictional categories, making it as straightforward as 1-2-3 to look for the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Maintaining your documentation organized and compliant with legal standards is of utmost significance. Leverage the US Legal Forms library to have crucial document templates for any requirements readily available!

- For anyone already familiar with our service and who has made use of it previously, acquiring the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract requires merely a few clicks.

- Simply Log In to your account, choose the document, and click Download to save it on your device.

- The procedure will involve just a couple of additional steps for new users.

- Follow the instructions below to commence using the most comprehensive online form catalogue.

- Review the Preview mode and form description. Ensure you have selected the appropriate one that fulfills your needs and completely aligns with your local jurisdiction criteria.

Form popularity

FAQ

To disclaim an inherited property in Texas, first, draft a written disclaimer that meets the state's legal criteria, as outlined in the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Make sure you state that you are renouncing your rights to the asset and submit this document within nine months. It is crucial to follow the correct procedural steps to avoid complications in the estate distribution, and uslegalforms can offer you the necessary guidance and resources.

Writing an inheritance disclaimer letter requires you to clearly express your decision to renounce the property. Start by stating your identity and relationship to the deceased, followed by your specific intentions regarding the property. Clearly reference the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, and ensure that you sign and date the letter. If needed, consider using uslegalforms to access templates that can guide you through this process.

To avoid capital gains tax on inherited property in Texas, you will typically benefit from a step-up in basis, which adjusts the value of the property to its market value at the time of the original owner's death. When you renounce an inheritance, as per the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, you could also sidestep taxes that may come from accepted property. It is always advisable to consult a tax professional to navigate this complex area effectively.

An estate disclaimer occurs when an individual chooses not to accept an inheritance, which may include assets from a life insurance policy or an annuity contract. For instance, if a beneficiary inherits property that they do not want due to tax implications or other reasons, they may issue a disclaimer stating they waive their right to that property. This action can influence how the estate is distributed to other beneficiaries. Such cases often relate closely to the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Renunciation of property refers to the legal act of refusing an inheritance or asset one is entitled to receive. In the context of Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, it specifically involves rejecting benefits from life insurance or annuity contracts. Understanding this process can help prevent unexpected tax implications or liabilities.

A disclaimer is deemed legal in Texas if it meets the state’s statutory requirements, which include being in writing, signed, and filed in a timely manner. Additionally, the disclaimant must not have accepted any benefits from the property they wish to disclaim. Complying with these requirements ensures the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is valid.

In Texas, the time limit for filing a disclaimer is generally nine months from the date of the decedent’s death. Acting within this time frame is crucial for the disclaimer to be effective. If you have questions about the timeline or process, uslegalforms can offer guidance tailored to your specific situation.

To disclaim an inheritance in Texas, start by drafting a written disclaimer that specifies your intention not to accept the property. Ensure that the disclaimer is signed, witnessed, and filed within the appropriate timeframe. Engaging with uslegalforms can facilitate this process and provide you with all necessary legal language required.

Filing a disclaimer in Texas can often be completed relatively quickly, assuming you have all necessary information and documentation. Generally, you should file the disclaimer within nine months of the decedent’s death to ensure its validity. Using the uslegalforms platform can help you streamline the paperwork and avoid delays.

A disclaimer effectively allows a person to refuse an inheritance from an estate, preventing any associated tax liability or other obligations. When you disclaim, the property is passed directly to the next beneficiary without going through the disclaimant. This process simplifies the transfer of assets from the estate, particularly in the context of the Killeen Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.