Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

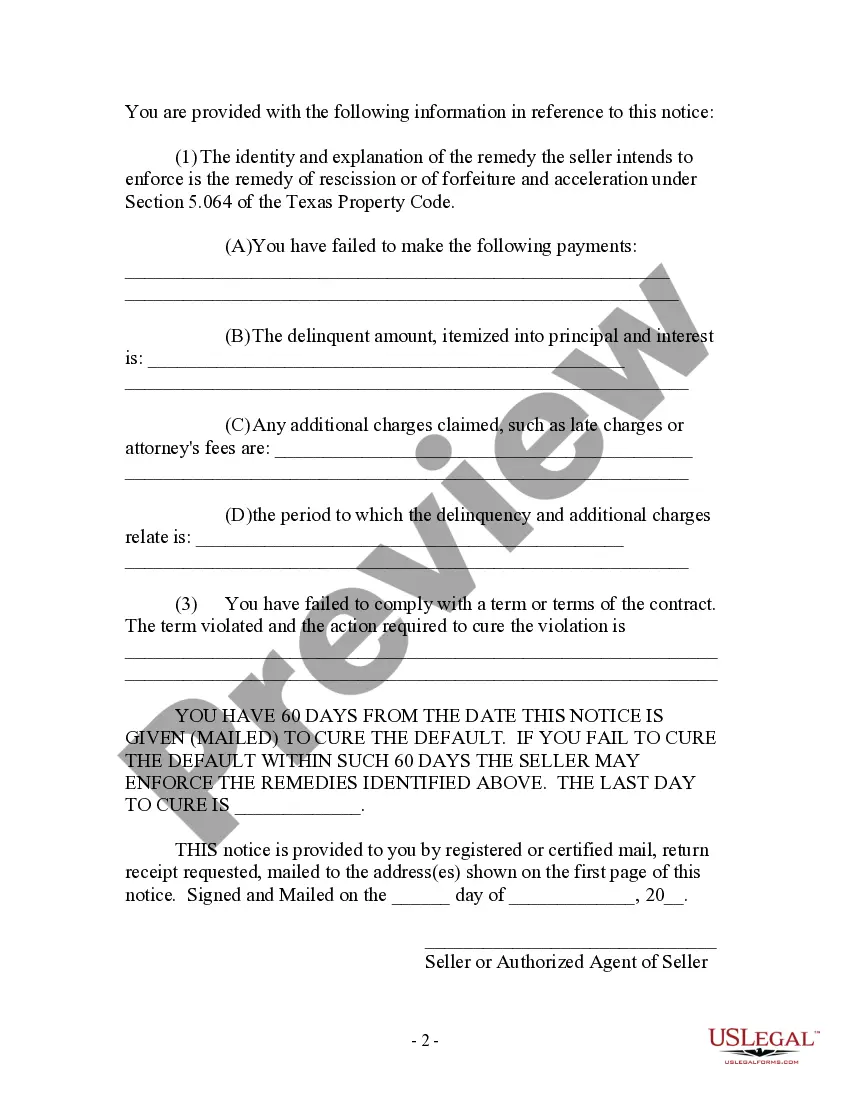

In Laredo, Texas, a Contract for Deed Notice of Default by Seller to Purchaser is an important legal document that outlines the default terms when a purchaser has either paid 40 percent of the agreed purchase price or made 48 consecutive payments towards the property. This notice acts as a warning and notifies the purchaser of their failure to meet the contractual obligations, giving them an opportunity to rectify the situation or face potential consequences. The Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a safeguard for both parties involved in the real estate transaction. By explicitly defining the conditions under which default may occur, it provides clarity and helps protect the interests of both the seller and purchaser. Here are some key factors to consider regarding this notice: 1. Payment Percentages: The notice applies when the purchaser has paid 40 percent of the total purchase price. This could include down payments, installments, or other agreed-upon payment arrangements. 2. Payment Duration: Alternatively, the notice is applicable if the purchaser has made a total of 48 consecutive payments towards the property. This provision ensures that the purchaser has made a substantial financial commitment towards the purchase. 3. Default Conditions: The notice outlines the specific actions or failures on the part of the purchaser that constitute a default under the contract. These conditions may include non-payment, late payment, violation of property use restrictions, failure to maintain insurance, or any other breach of the agreement. 4. Cure Period: The notice typically grants the purchaser a specific period to cure the default, usually 30 days or as stipulated in the contract. During this timeframe, the purchaser has the opportunity to bring their payments up to date or address any other default conditions. 5. Consequences of Default: If the purchaser fails to cure the default within the specified time, the notice may indicate various consequences. These can include forfeiture of all payments made, loss of any equity in the property, termination of the contract, and potential legal proceedings, such as eviction or foreclosure. Different types of Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser can include specific variations based on the agreed-upon terms between the seller and purchaser. Some different types may include: 1. Laredo Texas Contract for Deed Notice of Default with Specific Remedies: This type of notice may outline specific remedies or actions the purchaser needs to take to cure the default, such as making an immediate lump sum payment for the outstanding balance. 2. Laredo Texas Contract for Deed Notice of Default with Repossession Clause: In this case, the notice may state that the seller has the right to repossess the property upon default, potentially voiding the contract and forfeiting any payments made by the purchaser. 3. Laredo Texas Contract for Deed Notice of Default with Revised Payment Plan: This type of notice may provide the option for the purchaser to propose a revised payment plan to rectify the default, allowing them to catch up on missed payments over a specified period. It is crucial for both parties to thoroughly review and understand the terms and conditions outlined in the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser. Seeking legal advice or consultation can help ensure compliance and protect their respective interests in this real estate transaction.In Laredo, Texas, a Contract for Deed Notice of Default by Seller to Purchaser is an important legal document that outlines the default terms when a purchaser has either paid 40 percent of the agreed purchase price or made 48 consecutive payments towards the property. This notice acts as a warning and notifies the purchaser of their failure to meet the contractual obligations, giving them an opportunity to rectify the situation or face potential consequences. The Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a safeguard for both parties involved in the real estate transaction. By explicitly defining the conditions under which default may occur, it provides clarity and helps protect the interests of both the seller and purchaser. Here are some key factors to consider regarding this notice: 1. Payment Percentages: The notice applies when the purchaser has paid 40 percent of the total purchase price. This could include down payments, installments, or other agreed-upon payment arrangements. 2. Payment Duration: Alternatively, the notice is applicable if the purchaser has made a total of 48 consecutive payments towards the property. This provision ensures that the purchaser has made a substantial financial commitment towards the purchase. 3. Default Conditions: The notice outlines the specific actions or failures on the part of the purchaser that constitute a default under the contract. These conditions may include non-payment, late payment, violation of property use restrictions, failure to maintain insurance, or any other breach of the agreement. 4. Cure Period: The notice typically grants the purchaser a specific period to cure the default, usually 30 days or as stipulated in the contract. During this timeframe, the purchaser has the opportunity to bring their payments up to date or address any other default conditions. 5. Consequences of Default: If the purchaser fails to cure the default within the specified time, the notice may indicate various consequences. These can include forfeiture of all payments made, loss of any equity in the property, termination of the contract, and potential legal proceedings, such as eviction or foreclosure. Different types of Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser can include specific variations based on the agreed-upon terms between the seller and purchaser. Some different types may include: 1. Laredo Texas Contract for Deed Notice of Default with Specific Remedies: This type of notice may outline specific remedies or actions the purchaser needs to take to cure the default, such as making an immediate lump sum payment for the outstanding balance. 2. Laredo Texas Contract for Deed Notice of Default with Repossession Clause: In this case, the notice may state that the seller has the right to repossess the property upon default, potentially voiding the contract and forfeiting any payments made by the purchaser. 3. Laredo Texas Contract for Deed Notice of Default with Revised Payment Plan: This type of notice may provide the option for the purchaser to propose a revised payment plan to rectify the default, allowing them to catch up on missed payments over a specified period. It is crucial for both parties to thoroughly review and understand the terms and conditions outlined in the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser. Seeking legal advice or consultation can help ensure compliance and protect their respective interests in this real estate transaction.