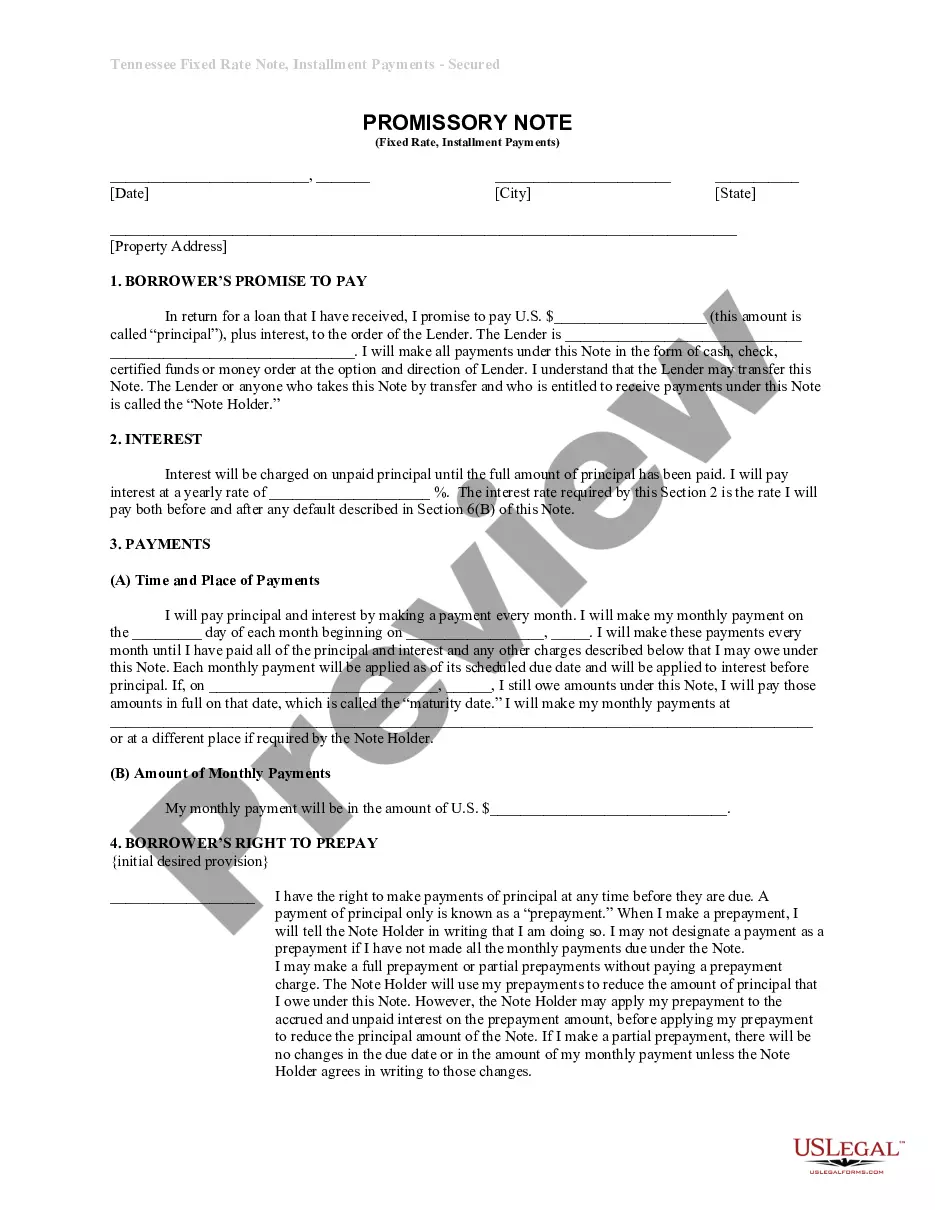

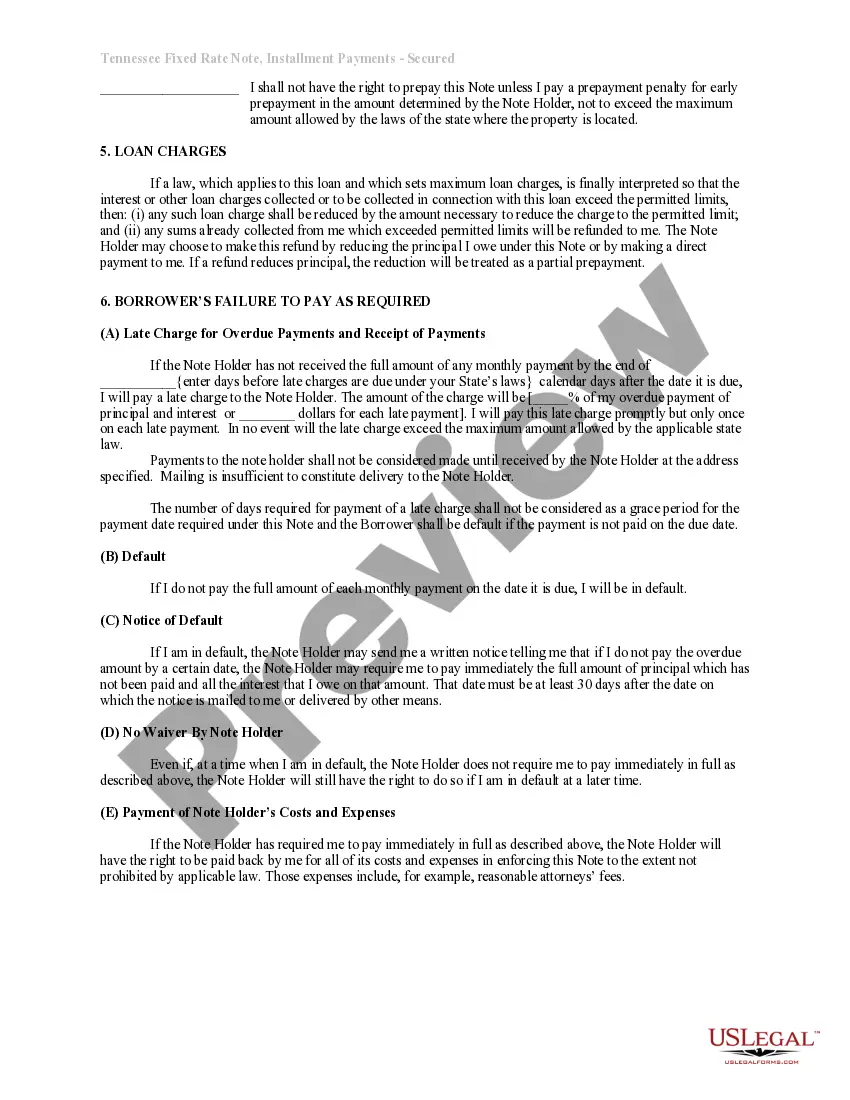

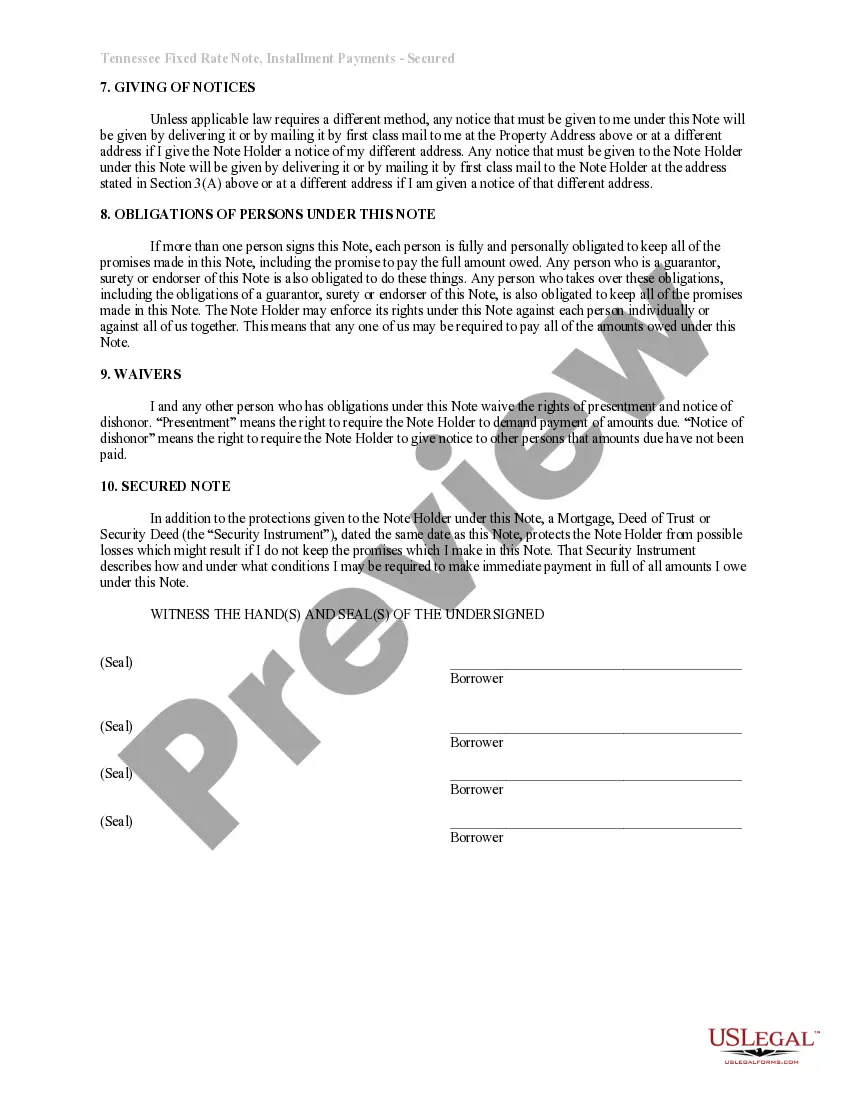

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Knoxville Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Knoxville, Tennessee. This promissory note serves as evidence of debt, specifying the amount borrowed, interest rate, repayment schedule, and the residential property used as collateral. In Knoxville, Tennessee, there are several types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available to borrowers, including: 1. Knoxville Tennessee Fixed Rate Promissory Note: The interest rate on this type of promissory note remains constant throughout the loan term, ensuring a predictable repayment plan for both parties involved. 2. Knoxville Tennessee Installments Promissory Note: This note allows the borrower to repay the loan amount in installments over a specified period. It offers flexibility to borrowers who may prefer smaller, regular payments rather than a lump sum. 3. Knoxville Tennessee Promissory Note Secured by Residential Real Estate: This type of note requires the borrower to pledge a residential property as collateral to secure the loan. By doing so, they provide assurance to the lender that, in case of default, the property can be sold to settle the outstanding debt. 4. Knoxville Tennessee Promissory Note Interest Rate: The interest rate included in this type of note determines the cost of borrowing for the borrower. It is important for both parties to agree upon an interest rate that is fair and reflects the current market conditions in Knoxville, Tennessee. When drafting a Knoxville Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is essential to include specific details such as the names of the lender and borrower, the loan amount, interest rate, repayment schedule, and any applicable late fees or penalties. Additionally, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations regarding real estate transactions and lending practices in Knoxville, Tennessee.A Knoxville Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Knoxville, Tennessee. This promissory note serves as evidence of debt, specifying the amount borrowed, interest rate, repayment schedule, and the residential property used as collateral. In Knoxville, Tennessee, there are several types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available to borrowers, including: 1. Knoxville Tennessee Fixed Rate Promissory Note: The interest rate on this type of promissory note remains constant throughout the loan term, ensuring a predictable repayment plan for both parties involved. 2. Knoxville Tennessee Installments Promissory Note: This note allows the borrower to repay the loan amount in installments over a specified period. It offers flexibility to borrowers who may prefer smaller, regular payments rather than a lump sum. 3. Knoxville Tennessee Promissory Note Secured by Residential Real Estate: This type of note requires the borrower to pledge a residential property as collateral to secure the loan. By doing so, they provide assurance to the lender that, in case of default, the property can be sold to settle the outstanding debt. 4. Knoxville Tennessee Promissory Note Interest Rate: The interest rate included in this type of note determines the cost of borrowing for the borrower. It is important for both parties to agree upon an interest rate that is fair and reflects the current market conditions in Knoxville, Tennessee. When drafting a Knoxville Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is essential to include specific details such as the names of the lender and borrower, the loan amount, interest rate, repayment schedule, and any applicable late fees or penalties. Additionally, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations regarding real estate transactions and lending practices in Knoxville, Tennessee.