Title: Knoxville Tennessee Complaints by Insurance Company to Recover Cost of Property Damage to Vehicle Introduction: In Knoxville, Tennessee, insurance companies often handle complaints related to property damage to vehicles. These complaints result when policyholders file claims seeking reimbursement or compensation for damages incurred due to various incidents. This article will provide a detailed description of Knoxville Tennessee complaints by insurance companies aimed at recovering the cost of property damage to vehicles, while incorporating relevant keywords. 1. Types of Complaints: a) Knoxville Tennessee Accident Damage Insurance Claim: Insurance companies frequently receive complaints from vehicle owners involved in accidents seeking compensation for property damage. These claims cover repairs, replacement, or fair market value of the damaged vehicle. b) Knoxville Tennessee Vandalism Insurance Claim: In incidents of deliberate harm caused to vehicles, such as vandalism, insurance companies receive complaints from policyholders. Vandalism claims aim to recover the cost of property damage resulting from intentional acts of destruction. c) Knoxville Tennessee Theft Insurance Claim: When a vehicle is stolen or experiences theft-related damages, policyholders file complaints to their insurance company to recoup the value of the stolen vehicle or repair expenses. Theft claims are common in urban areas and can involve comprehensive insurance coverage. d) Knoxville Tennessee Weather-related Insurance Claim: Severe weather conditions like hailstorms, floods, or falling trees can cause significant property damage to vehicles. Policyholders submit complaints to insurance companies for reimbursement or repairs related to weather-related incidents. e) Knoxville Tennessee Hit-and-Run Insurance Claim: Hit-and-run accidents often leave the victims without knowledge of the responsible party. Insurance companies address complaints filed by policyholders seeking coverage for property damage caused by unidentified drivers. f) Knoxville Tennessee Fire Insurance Claim: Instances of vehicle fires, whether due to accidents or other causes, result in complaints by policyholders. Insurance companies investigate these claims to determine the cause and recover the cost of property damage. Keywords: — KnoxvillTennesseese— - Complaint - Insurance company — Propertdamageag— - Vehicle - Costs - Recover — Reimbursemen— - Compensation - Claims - Accidents — Vandalis— - Theft - Weather-related incidents — Hit-and-ru— - Fire Note: The above content provides a general overview of the various types of Knoxville Tennessee complaints by insurance companies to recover the cost of property damage to vehicles. It is advised to consult legal professionals or insurance experts for case-specific advice or information.

What Insurance Related Issues Are Currently Being Prioritized In Tennessee

State:

Tennessee

Control #:

TN-CC23-01

Format:

PDF

Instant download

This form is available by subscription

Description

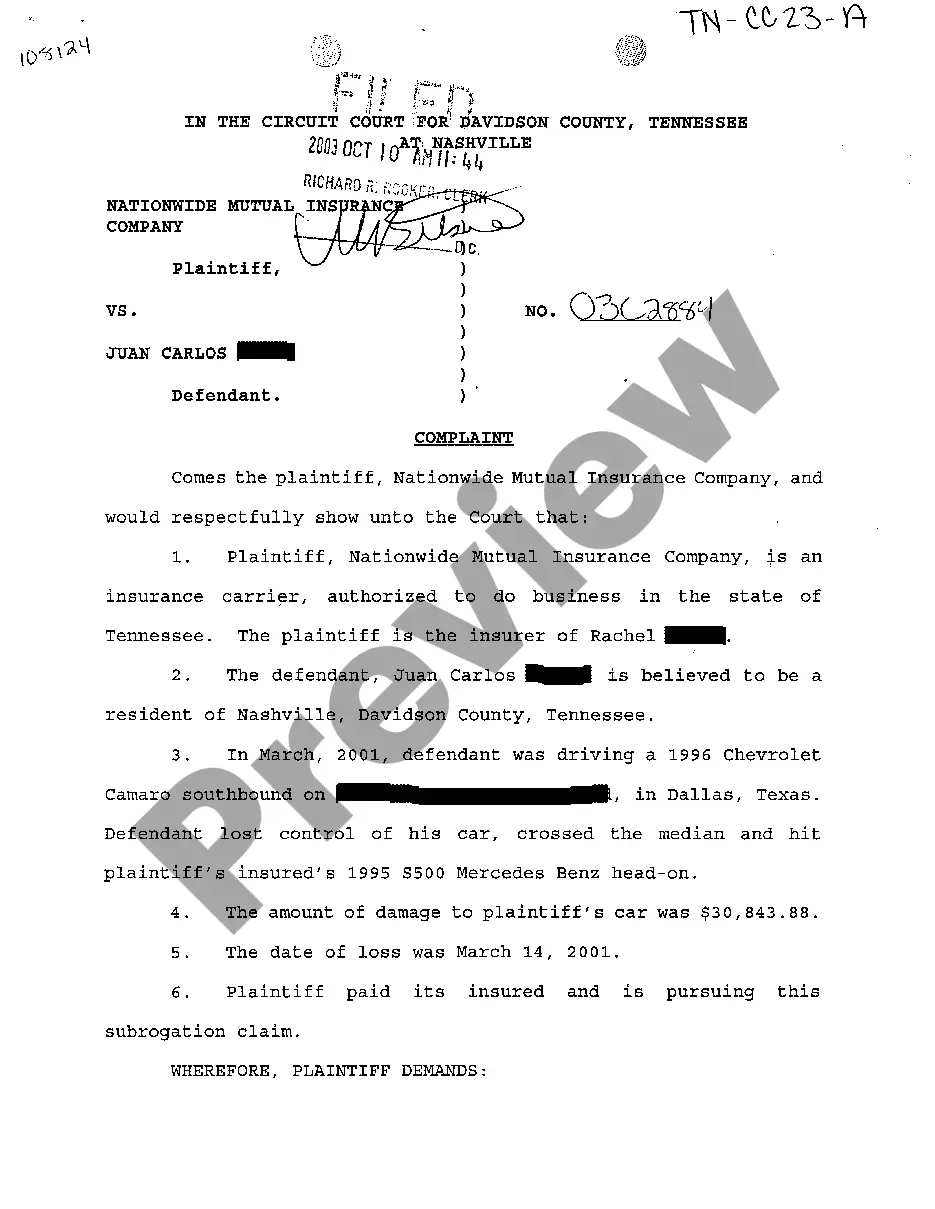

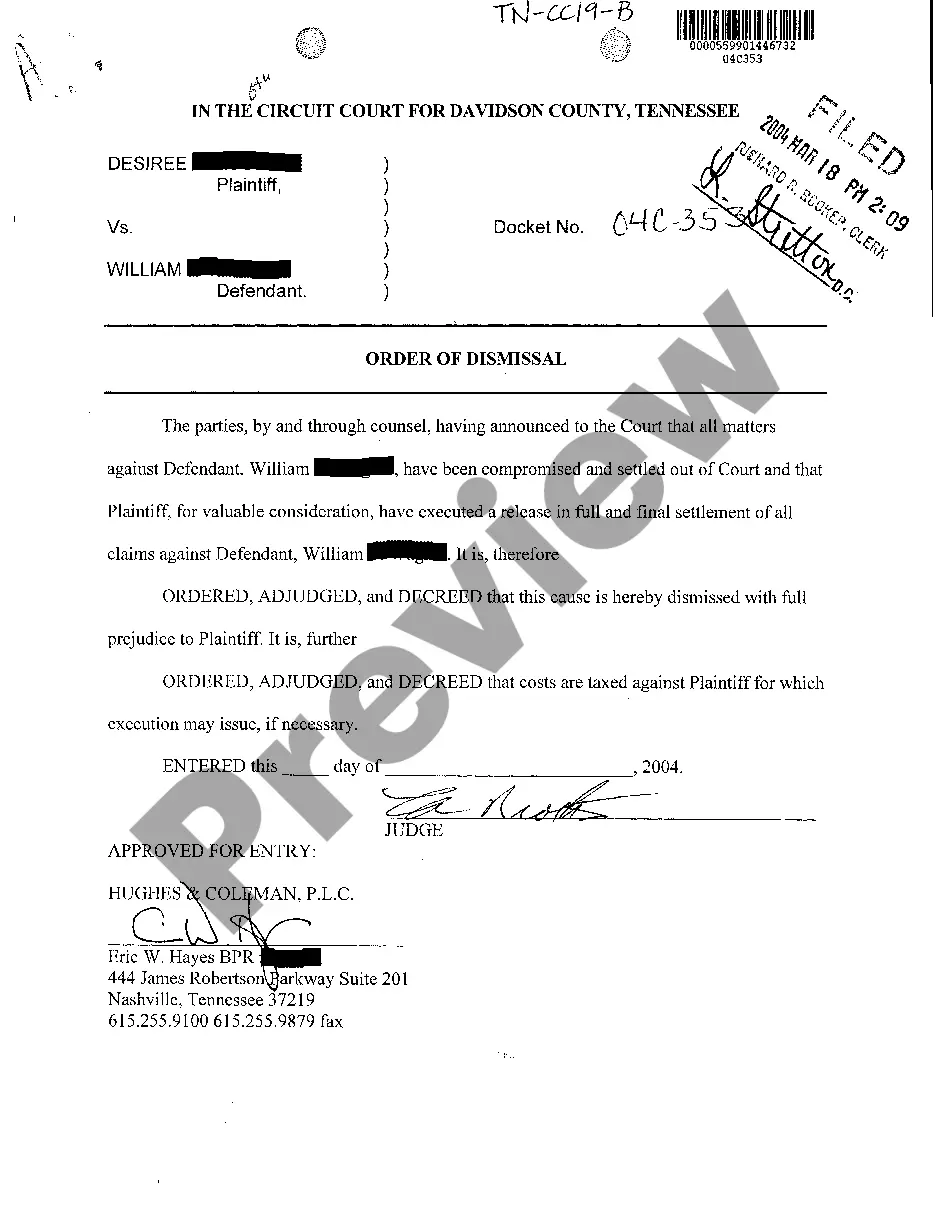

A01 Complaint by Insurance Company to recover cost of property damage to vehicle

Title: Knoxville Tennessee Complaints by Insurance Company to Recover Cost of Property Damage to Vehicle Introduction: In Knoxville, Tennessee, insurance companies often handle complaints related to property damage to vehicles. These complaints result when policyholders file claims seeking reimbursement or compensation for damages incurred due to various incidents. This article will provide a detailed description of Knoxville Tennessee complaints by insurance companies aimed at recovering the cost of property damage to vehicles, while incorporating relevant keywords. 1. Types of Complaints: a) Knoxville Tennessee Accident Damage Insurance Claim: Insurance companies frequently receive complaints from vehicle owners involved in accidents seeking compensation for property damage. These claims cover repairs, replacement, or fair market value of the damaged vehicle. b) Knoxville Tennessee Vandalism Insurance Claim: In incidents of deliberate harm caused to vehicles, such as vandalism, insurance companies receive complaints from policyholders. Vandalism claims aim to recover the cost of property damage resulting from intentional acts of destruction. c) Knoxville Tennessee Theft Insurance Claim: When a vehicle is stolen or experiences theft-related damages, policyholders file complaints to their insurance company to recoup the value of the stolen vehicle or repair expenses. Theft claims are common in urban areas and can involve comprehensive insurance coverage. d) Knoxville Tennessee Weather-related Insurance Claim: Severe weather conditions like hailstorms, floods, or falling trees can cause significant property damage to vehicles. Policyholders submit complaints to insurance companies for reimbursement or repairs related to weather-related incidents. e) Knoxville Tennessee Hit-and-Run Insurance Claim: Hit-and-run accidents often leave the victims without knowledge of the responsible party. Insurance companies address complaints filed by policyholders seeking coverage for property damage caused by unidentified drivers. f) Knoxville Tennessee Fire Insurance Claim: Instances of vehicle fires, whether due to accidents or other causes, result in complaints by policyholders. Insurance companies investigate these claims to determine the cause and recover the cost of property damage. Keywords: — KnoxvillTennesseese— - Complaint - Insurance company — Propertdamageag— - Vehicle - Costs - Recover — Reimbursemen— - Compensation - Claims - Accidents — Vandalis— - Theft - Weather-related incidents — Hit-and-ru— - Fire Note: The above content provides a general overview of the various types of Knoxville Tennessee complaints by insurance companies to recover the cost of property damage to vehicles. It is advised to consult legal professionals or insurance experts for case-specific advice or information.

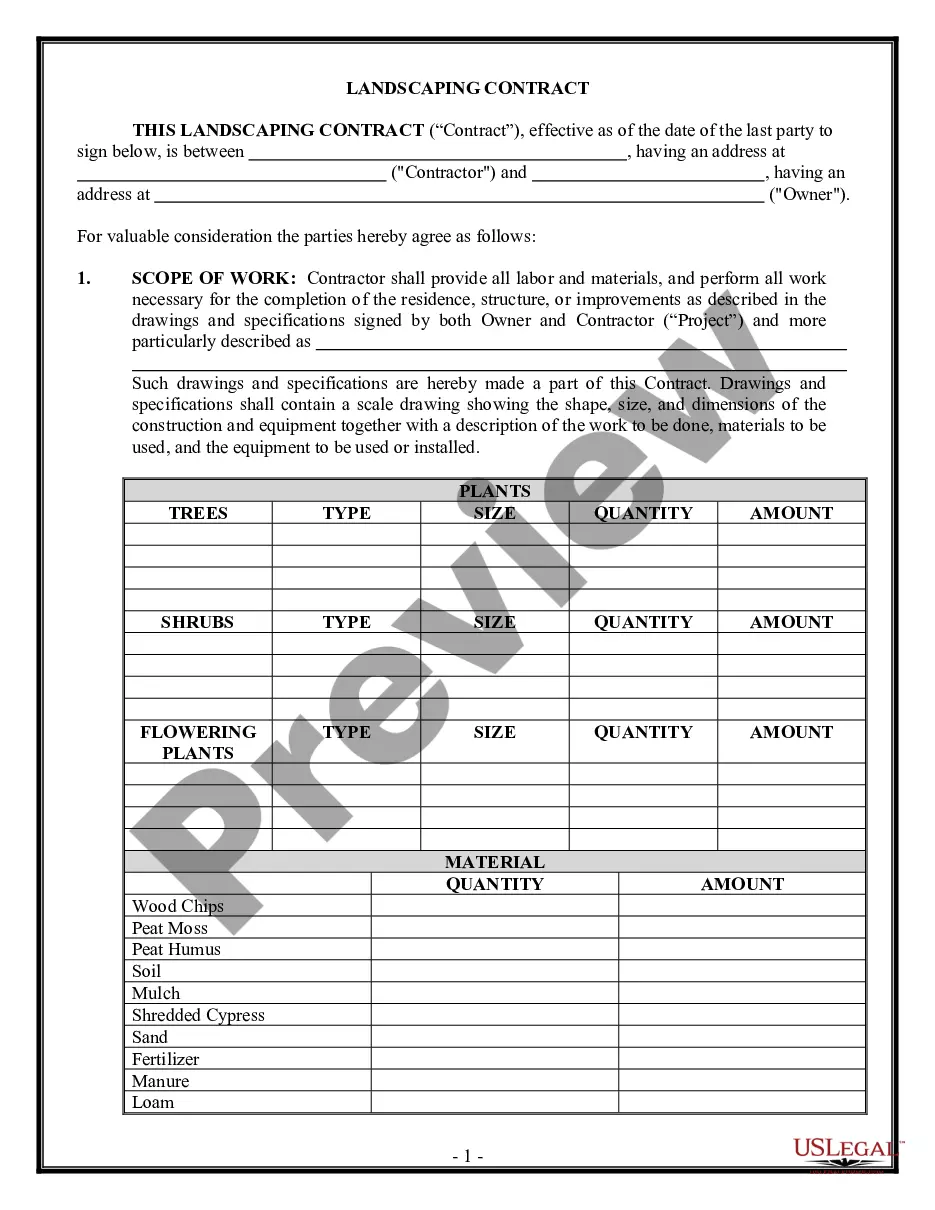

Free preview

How to fill out Knoxville Tennessee Complaint By Insurance Company To Recover Cost Of Property Damage To Vehicle?

If you’ve already utilized our service before, log in to your account and download the Knoxville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Knoxville Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!