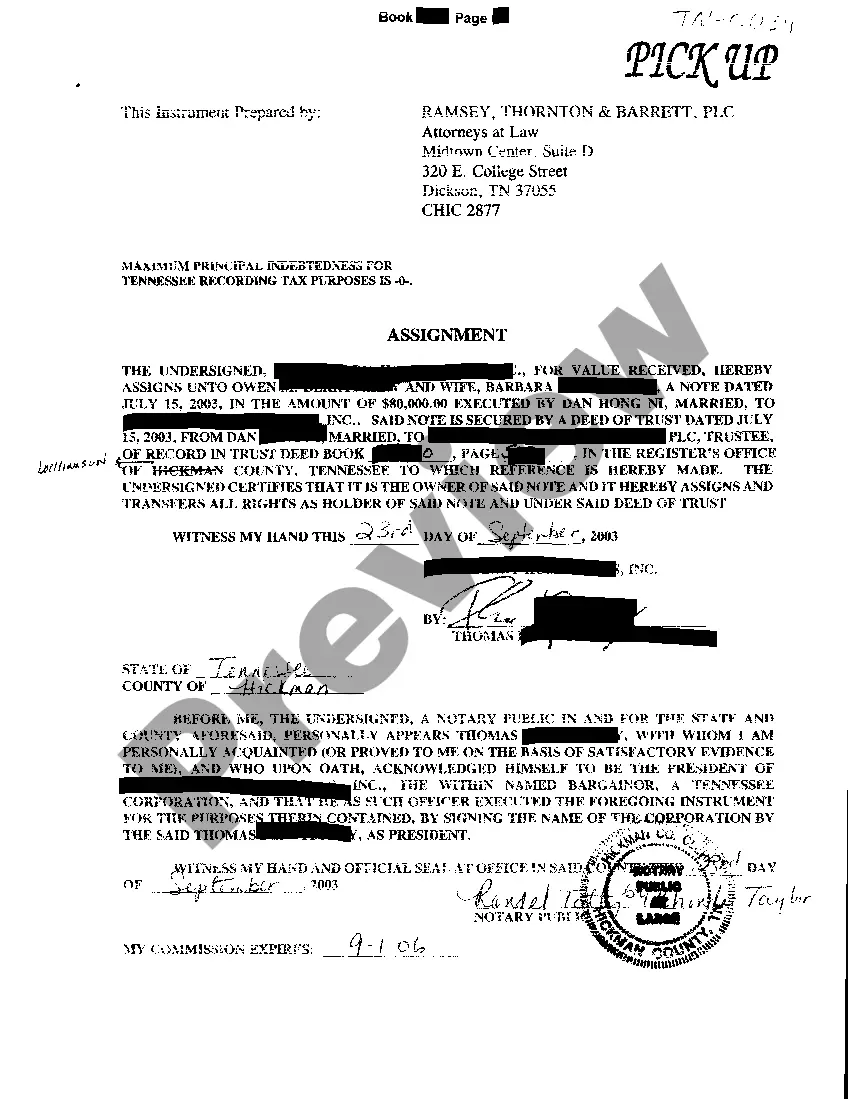

A Memphis Tennessee Assignment of Promissory Note is a legal document executed when the original holder of a promissory note transfers the rights and obligations of the note to another party. The assignment can be either partial or complete, depending on the terms negotiated between the parties involved. The purpose of the Assignment of Promissory Note is to document the agreement between the assignor (the original holder) and the assignee (the new holder) regarding the transfer of ownership and rights related to the promissory note. This document is crucial in legally formalizing the transfer and ensuring that the assignee has the legal rights to enforce the terms of the note. Memphis Tennessee, being a jurisdiction within the United States, adheres to certain legal requirements and provisions when it comes to the Assignment of Promissory Note. These requirements may vary from state to state, so it is essential to be aware of the specific regulations in Memphis, Tennessee. Different types of Memphis Tennessee Assignment of Promissory Note may include: 1. Partial Assignment: This type of assignment involves the transfer of only a portion of the interest in the promissory note. The assignor retains ownership and responsibilities for the remaining part of the note while still transferring a defined share to the assignee. This type of assignment is common when multiple parties share interest in the promissory note. 2. Complete Assignment: As the name suggests, this type of assignment involves the transfer of the entire promissory note, including all rights, interest, and obligations. The assignor relinquishes ownership entirely, and the assignee assumes complete control and responsibility for the promissory note. When executing a Memphis Tennessee Assignment of Promissory Note, it is advisable to include specific details such as the names and contact information of the parties involved (assignor and assignee), the description of the promissory note being assigned (including the original promissory note's details), the effective date of the assignment, and any conditions or limitations associated with the assignment. Additionally, it is crucial to ensure the document complies with Memphis Tennessee laws and regulations. Seeking legal advice or assistance from a qualified professional familiar with Memphis Tennessee's jurisdiction can help ensure that all necessary provisions are met, and the assignment is legally valid and enforceable.

Memphis Tennessee Assignment of Promissory Note

Description

How to fill out Memphis Tennessee Assignment Of Promissory Note?

If you have previously used our service, Log Into your account and download the Memphis Tennessee Assignment of Promissory Note onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your file.

You will have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or business needs!

- Confirm you have located the suitable document. Examine the information and utilize the Preview feature, if available, to determine if it meets your needs. If it does not fit, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription option.

- Establish an account and complete your payment. Use your credit card information or the PayPal method to finish the transaction.

- Obtain your Memphis Tennessee Assignment of Promissory Note. Choose your document's file format and save it in your device.

- Finalize your document. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

A promissory note is a written promise to pay within a specific time period. This type of document enforces a borrower's promise to pay back a lender by a specified period of time, and both parties must sign the document.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

In Tennessee, a six year statute of limitations will apply to most promissory note cases and guaranty cases. (A ten year statute of limitations applies to demand notes.) The six year period begins to run from the date the promissory note or personal guaranty was breached.

Depending on which state you live in, the statute of limitations with regard to promissory notes can vary from three to 15 years. Once the statute of limitations has ended, a creditor can no longer file a lawsuit related to the unpaid promissory note.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

When the loan is evidenced by one Promissory Note, the Lender may not at a later date cause any additional notes to be issued. (1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement.

In Tennessee, there is no legal requirement to have a promissory note notarized. To make the document into a legal document, a Tennessee promissory note must be signed and dated by the borrower.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.