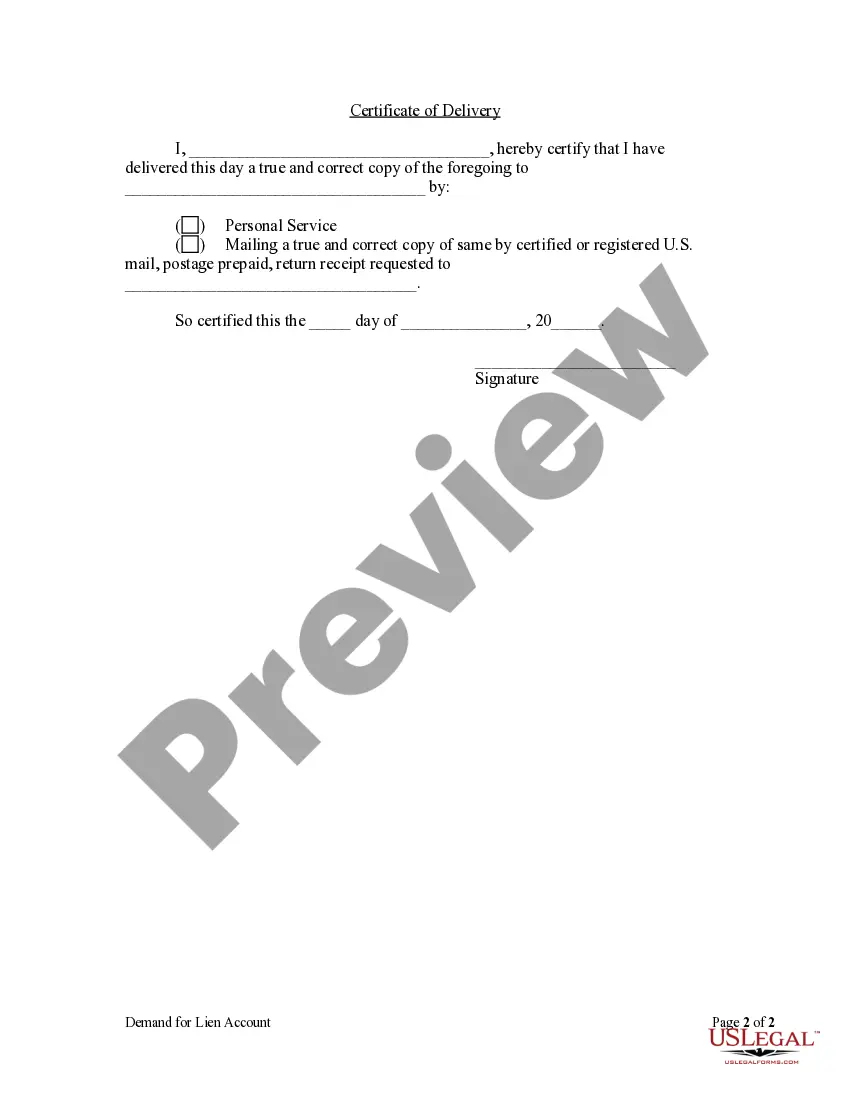

The owner, by serving written request within fifteen days after the completion of the contract, may require any person who may have a lien under the provisions of this chapter, to furnish him an itemized and verified account of his lien claim, the amount thereof, and his name and address. No action or other proceeding shall be commenced for the enforcement of such lien until ten days after such statement is so furnished pursuant to the request of the owner.

Sioux Falls South Dakota Demand for Lien Account by Corporation

Description

How to fill out South Dakota Demand For Lien Account By Corporation?

Do you require a trustworthy and budget-friendly legal document supplier to obtain the Sioux Falls South Dakota Demand for Lien Account by Corporation or LLC? US Legal Forms is your ideal choice.

Whether you need a straightforward arrangement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the courts, we have you covered. Our platform provides over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are customized according to the specifications of individual states and regions.

To download the document, you must Log In to your account, find the necessary form, and click the Download button beside it. Please keep in mind that you can download your previously acquired document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can set up an account in moments, but before doing that, ensure to.

Now you can create your account. Then select the subscription plan and complete the payment. Once the payment is finalized, download the Sioux Falls South Dakota Demand for Lien Account by Corporation or LLC in any format provided. You can return to the website anytime and redownload the document without incurring additional charges.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal documents online forever.

- Verify that the Sioux Falls South Dakota Demand for Lien Account by Corporation or LLC aligns with the regulations of your state and local jurisdiction.

- Review the form’s specifics (if available) to understand who it is intended for and its purpose.

- Restart your search if the form does not suit your legal needs.

Form popularity

FAQ

Yes, South Dakota has adopted the Uniform Commercial Code (UCC), which standardizes commercial transactions across the country. This adoption plays a crucial role for businesses in Sioux Falls and beyond, especially when dealing with matters like the Sioux Falls South Dakota Demand for Lien Account by Corporation. By aligning with the UCC, South Dakota provides clarity for corporations in terms of secured transactions and lien processes. This consistency supports businesses in understanding their rights and obligations under commercial law.

Filing a lien in South Dakota involves completing the appropriate mechanics lien forms, ensuring they are signed and notarized, and then submitting them to the county recorder's office. You must follow specific guidelines to enforce your rights effectively. USLegalForms can simplify this process, helping you file a Sioux Falls South Dakota Demand for Lien Account by Corporation accurately and promptly.

To obtain a seller's permit in South Dakota, you need to apply through the Department of Revenue. The process requires you to register your business and provide relevant identification. If you are a corporation aiming to file for a Sioux Falls South Dakota Demand for Lien Account, USLegalForms can assist you in navigating the paperwork smoothly.

The minimum amount for a mechanics lien in South Dakota depends on the type of work or materials provided, but it generally needs to reflect the unpaid balance. This amount must be sufficient to justify the lien's validity. By utilizing resources like USLegalForms, you can clarify the requirements specific to your Sioux Falls South Dakota Demand for Lien Account by Corporation.

You generally have 120 days from the last day of work or the last day materials were supplied to file a mechanics lien in South Dakota. This deadline is essential to secure your rights under state law. To ensure you meet this timeline, consider using USLegalForms for guidance on submitting your Sioux Falls South Dakota Demand for Lien Account by Corporation.

In South Dakota, filing a mechanics lien typically takes a few days once you have all the required documentation ready. The process is relatively straightforward, but it is critical to ensure you have the correct forms. Utilizing a service like USLegalForms can streamline this process, helping you file a Sioux Falls South Dakota Demand for Lien Account by Corporation efficiently.

The IRS treats co-owned LLCs as partnerships for tax purposes. Like one-member LLCs, co-owned LLCs do not pay taxes on business income; instead, the LLC owners each pay taxes on their share of the profits on their personal income tax returns (with Schedule E attached).

File your lien with the register of deeds File your completed form with the register of deed's office in the South Dakota county where the property is located, and pay the recording fee.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In South Dakota, a judgment lien can be attached to real estate only (not personal property).

South Dakota business owners benefit from: No corporate income tax. No personal income tax. No personal property tax.