Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Pennsylvania Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you’ve previously made use of our service, sign in to your account and retrieve the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your payment plan.

If this is your inaugural encounter with our service, follow these straightforward steps to acquire your document.

You have perpetual access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to access it again. Make the most of the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and utilize the Preview function, if available, to verify if it satisfies your requirements. If it’s not suitable, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Set up an account and process the payment. Enter your credit card information or opt for the PayPal option to finalize the purchase.

- Acquire your Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

While the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors can simplify the transfer process, there are some disadvantages to consider. For instance, the existing mortgage terms might not be as favorable, which could mean higher interest rates than what is currently available on the market. Additionally, the existing borrower's credit profile impacts the mortgage, so if their credit score is low, it may affect your future payments. Understanding these challenges is crucial, and platforms like uslegalforms can help clarify the details for you.

To obtain a mortgage assumption, you first need to check if the current mortgage is assumable according to the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors. Once confirmed, you should apply through the lender to gain their approval. Prepare necessary financial documentation, and ensure both parties are clear on terms. Platforms like uslegalforms can assist you in navigating the paperwork and steps needed for a successful assumption.

Assuming a mortgage after a divorce, especially under the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, can present challenges. Both parties must agree on the terms of the assumption, and the assumption process can depend on the lender’s policies. Moreover, financial eligibility plays a key role, so if you have concerns, consulting with legal resources can simplify the process and provide clarity.

To qualify for the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, you generally need to meet the lender's financial criteria. This typically includes proving your income, creditworthiness, and financial stability. Each lender will have specific requirements, so reviewing them carefully is essential to facilitate a smooth process. If you are unsure, platforms like uslegalforms can provide resources to guide you through the qualification process.

To take over your mortgage, a buyer must first be approved by your lender. This process involves executing the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, which licenses the buyer to assume your mortgage under the original terms. It's essential for both you and the buyer to understand this agreement, as it impacts financial obligations and property ownership.

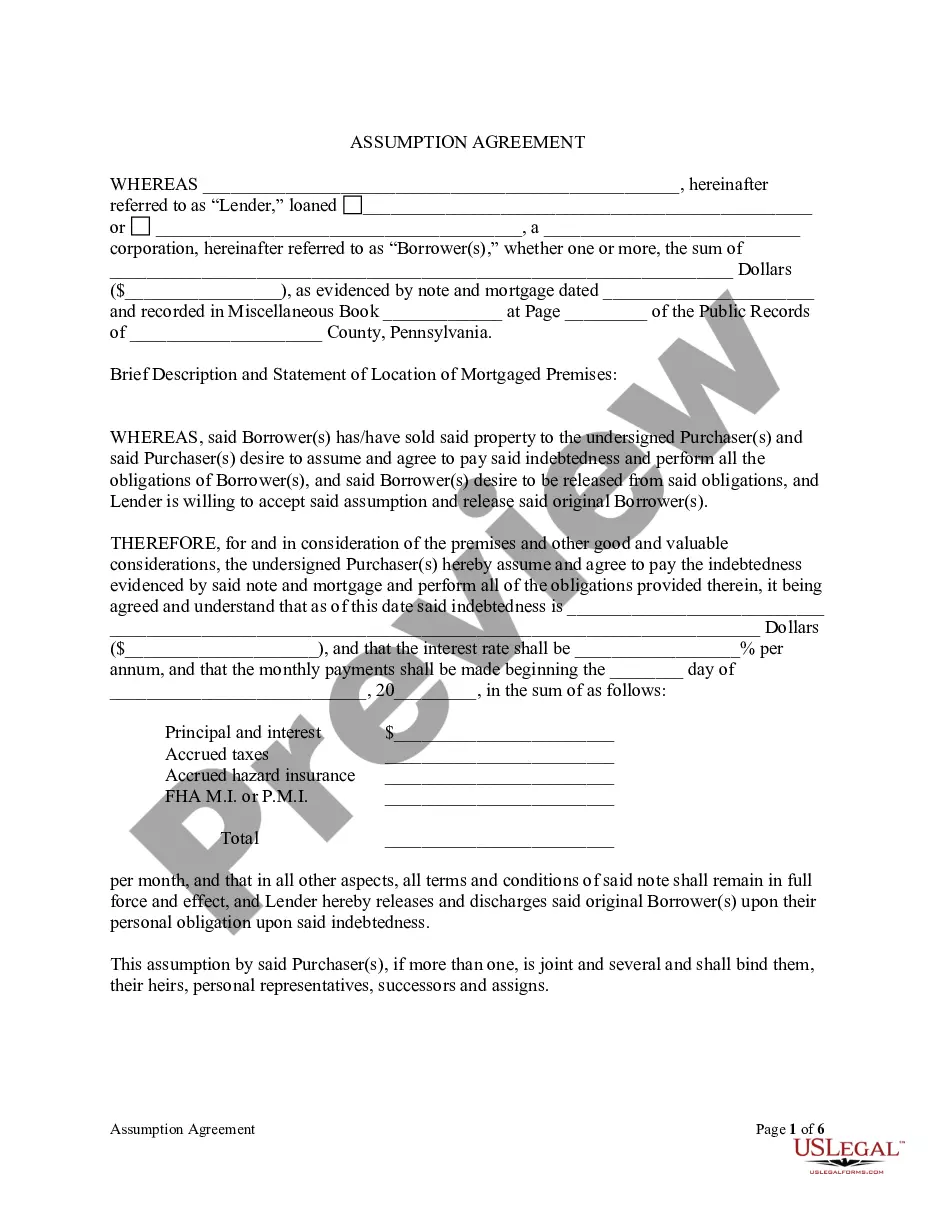

A mortgage assumption agreement is a formal document that allows a buyer to take over a seller's existing mortgage. The Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors outlines the terms under which this transfer occurs, ensuring both parties understand their responsibilities. This agreement protects all parties involved and helps streamline the process of transferring ownership.

To assume a mortgage, you typically need to apply for approval from the lender. The Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors requires financial qualification, which includes demonstrating your income and creditworthiness. Additionally, the original mortgagors must agree to the assumption, which transfers the mortgage responsibility to you while releasing them from liability.

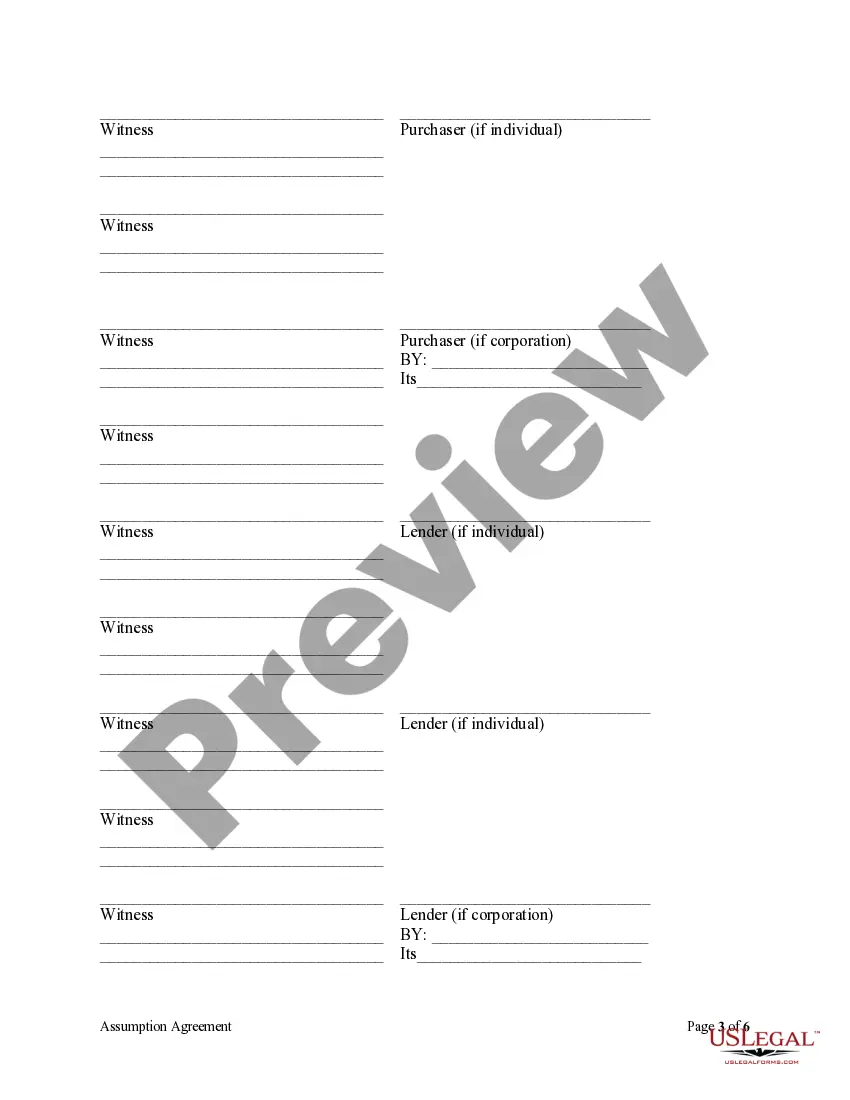

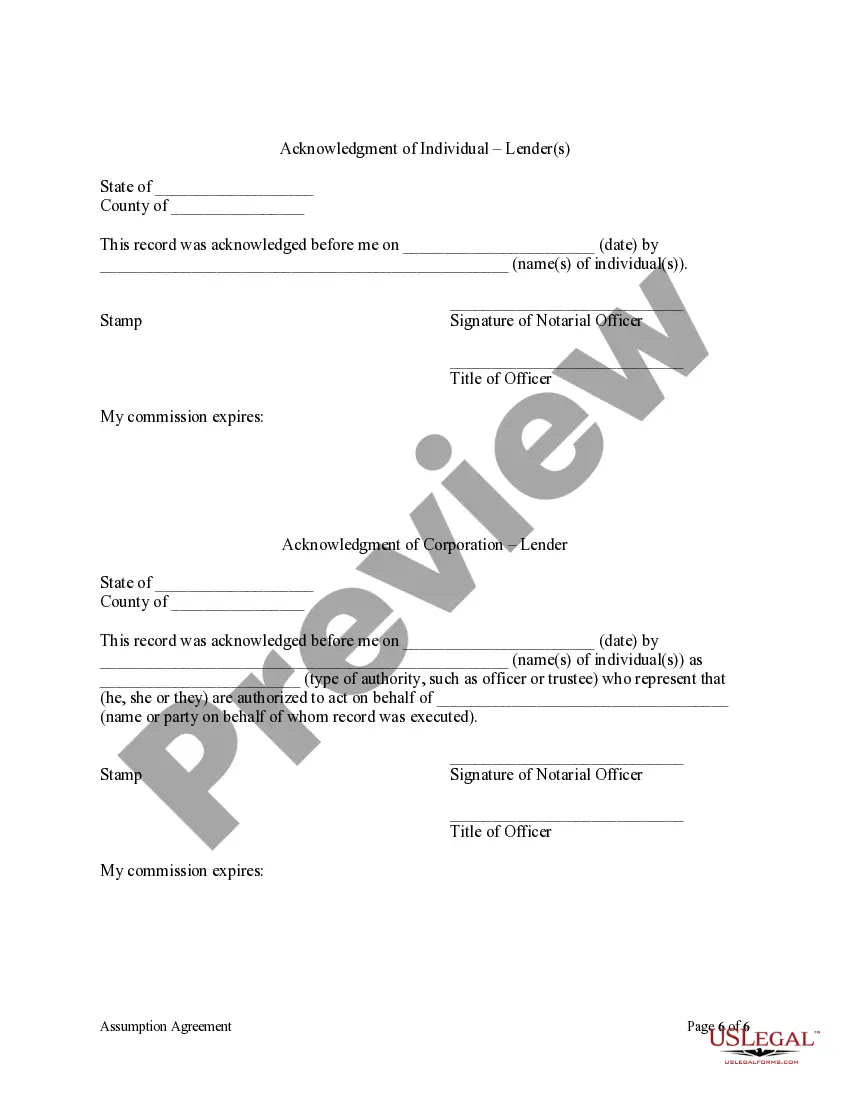

The primary parties in an assumption agreement are the new borrower, the lender, and the original mortgagor. The new borrower is the individual or entity assuming the mortgage, while the lender provides consent for the transfer. Understanding who these parties are is crucial for completing an Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors effectively and legally.

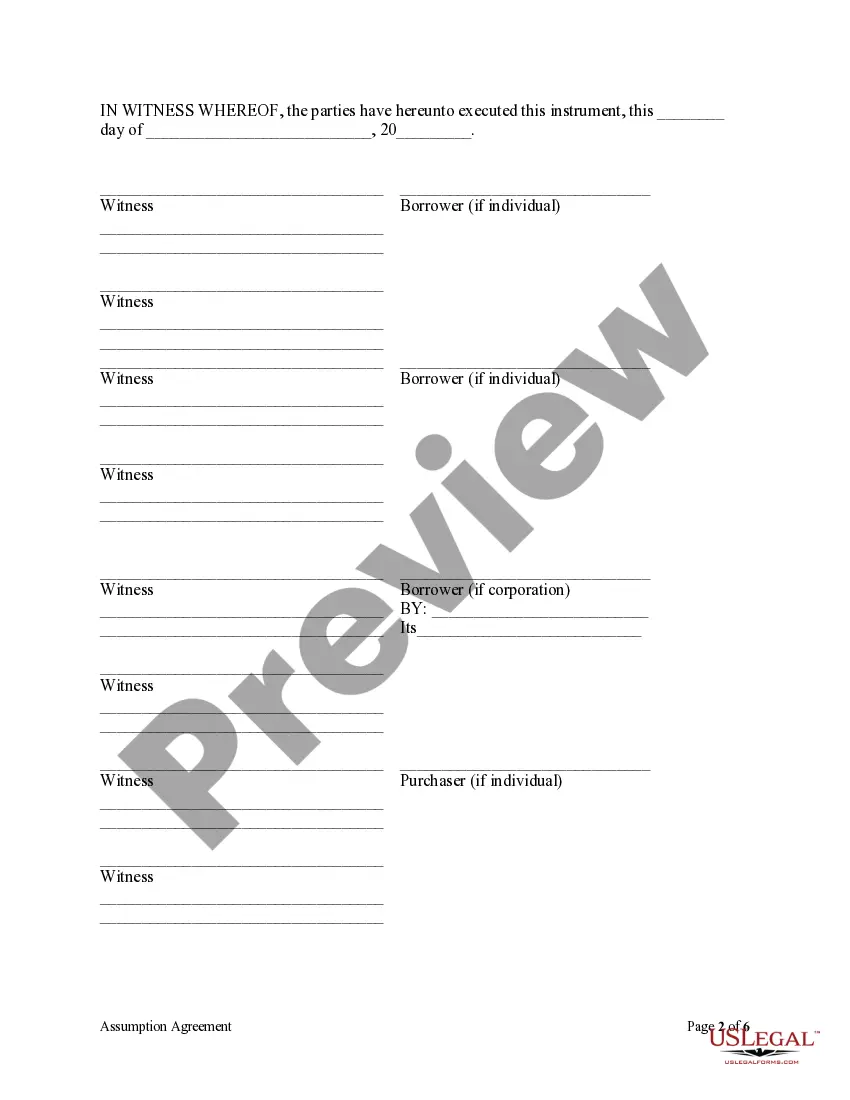

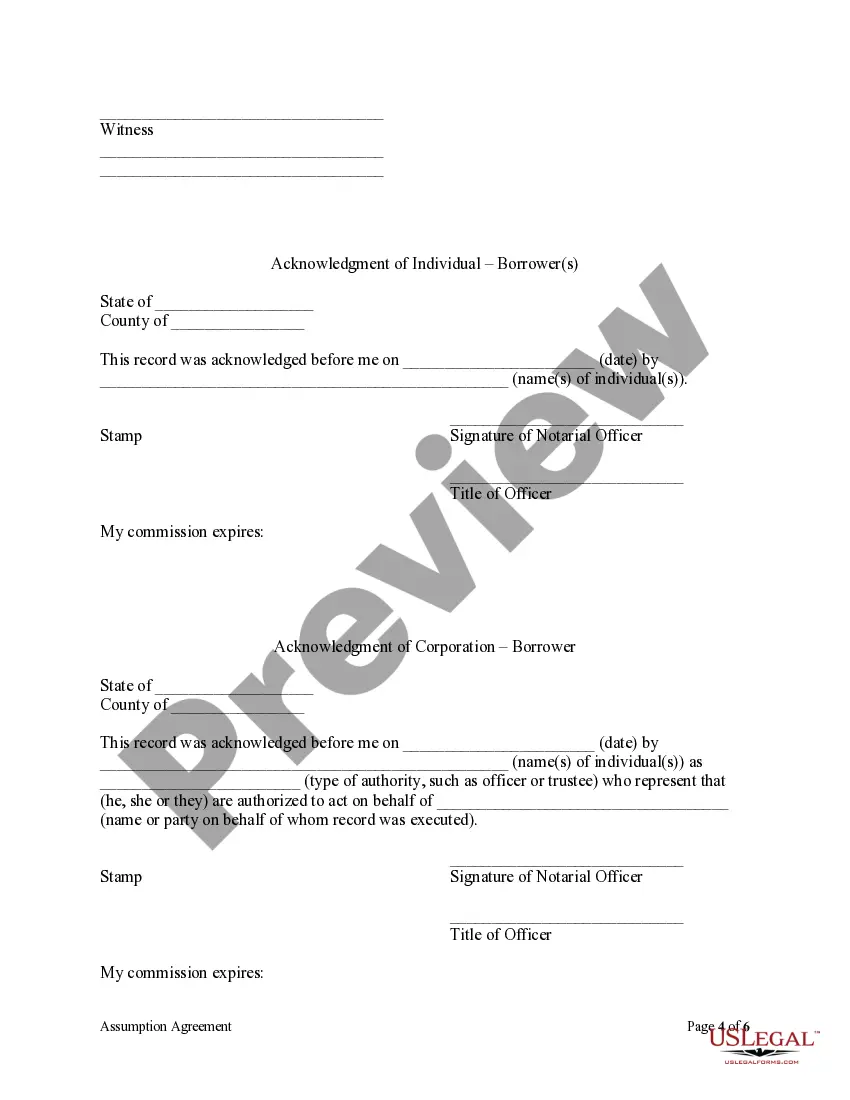

The assumption agreement is generally signed by the person assuming the mortgage and the lender. In some cases, the original mortgage holder may also need to sign off on the agreement. This is an important step in formalizing the Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors, as it transfers the obligations and rights of the mortgage.

To assume a mortgage, you typically need several key documents. First, you will require the original mortgage agreement along with any amendments. Additionally, you may need proof of income, credit reports, and personal identification. Ensuring you have these documents is vital for a smooth Allentown Pennsylvania Assumption Agreement of Mortgage and Release of Original Mortgagors process.