Allentown Pennsylvania Quitclaim Deed from Corporation to LLC

Description

How to fill out Pennsylvania Quitclaim Deed From Corporation To LLC?

If you have previously utilized our service, Log In to your account and store the Allentown Pennsylvania Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You maintain continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to swiftly locate and store any template for your personal or business requirements!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview feature, if it exists, to verify that it satisfies your needs. If it doesn’t meet your criteria, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete a payment. Input your credit card information or utilize the PayPal option to finish the transaction.

- Obtain your Allentown Pennsylvania Quitclaim Deed from Corporation to LLC. Choose the file format for your document and download it to your device.

- Finalize your document. Print it or take advantage of professional online editors to complete and sign it electronically.

Form popularity

FAQ

People often place property into an LLC to protect their personal assets from liabilities related to the property. An LLC provides a legal separation between personal and business assets, which can offer significant financial protection. Moreover, transferring property using an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC can simplify management and enhance privacy. Using USLegalForms can help you understand and execute this process smoothly.

To change the ownership of an LLC in Pennsylvania, you typically need to execute an operating agreement that outlines the new ownership structure. Then, file the necessary forms with the Pennsylvania Department of State. It’s wise to notify the IRS of any changes as they may affect your tax filings. For assistance, USLegalForms can guide you through this process, especially for scenarios like an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC.

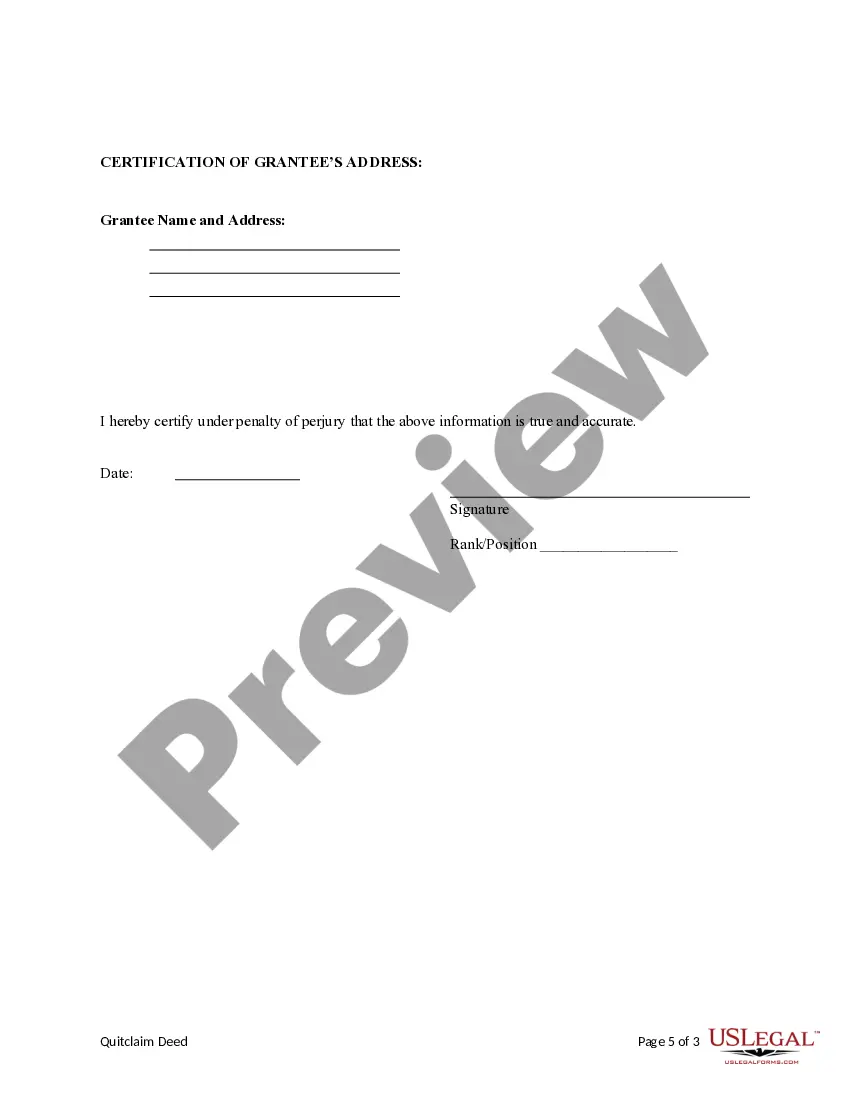

Filling out a quitclaim deed form involves providing the necessary details, such as the names of the parties involved and the description of the property. It is crucial to have accurate information to avoid future disputes. Online services like USLegalForms can guide you through creating an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC effortlessly.

Yes, you can transfer personal funds to your LLC as capital contributions. This process strengthens your business’s financial foundation, making it clear that these funds are for business use. Make sure to document the transfer appropriately to maintain a clear separation between personal and business finances.

To transfer personal assets to an LLC, draft a quitclaim deed that specifies the asset details. Ensure that the deed includes all parties involved and follows state requirements. For assistance, consider consulting tools like USLegalForms to navigate an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC.

Yes, you can file a quitclaim deed on your own. Many people successfully complete this task with proper knowledge of the requirements and forms. Utilizing resources from platforms like USLegalForms can provide step-by-step guidance, especially for an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC.

Transferring deeds to an LLC can be completed through a quitclaim deed. It is essential to fill out the deed accurately, reflecting the LLC as the new owner. Using an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC ensures you follow local regulations and formalize the transfer effectively.

To transfer assets from personal ownership to your business, you must create proper documentation. This often involves drafting an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC, which signifies the transfer. Make sure to consult with a legal expert to understand the implications of these transfers.

You can absolutely transfer personal assets to your LLC. This process clarifies ownership and allows your business to benefit from those assets. For formalized transfers, using an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC can simplify the legalities involved.

Yes, transferring personal assets into an LLC can protect your assets from personal liabilities. By doing so, you limit personal risk and create a clear distinction between your assets and your business. In this case, consider using an Allentown Pennsylvania Quitclaim Deed from Corporation to LLC to ensure the transfer is legally sound.