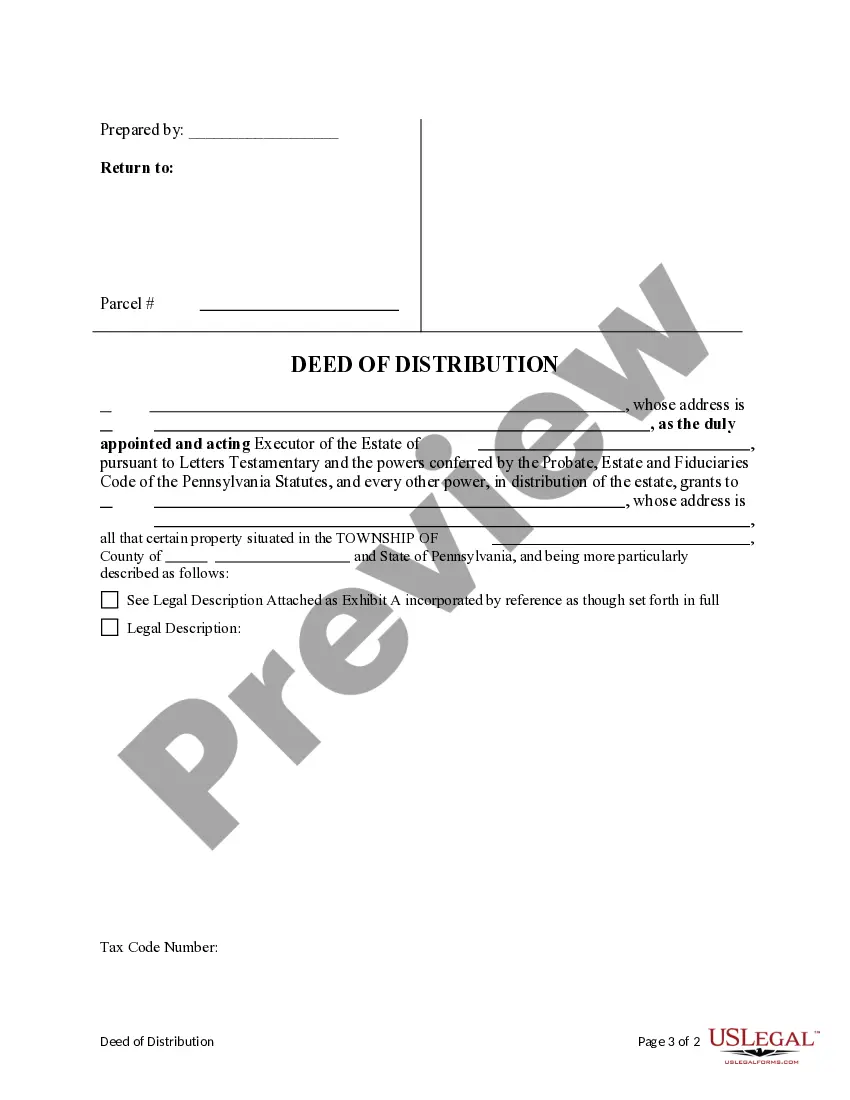

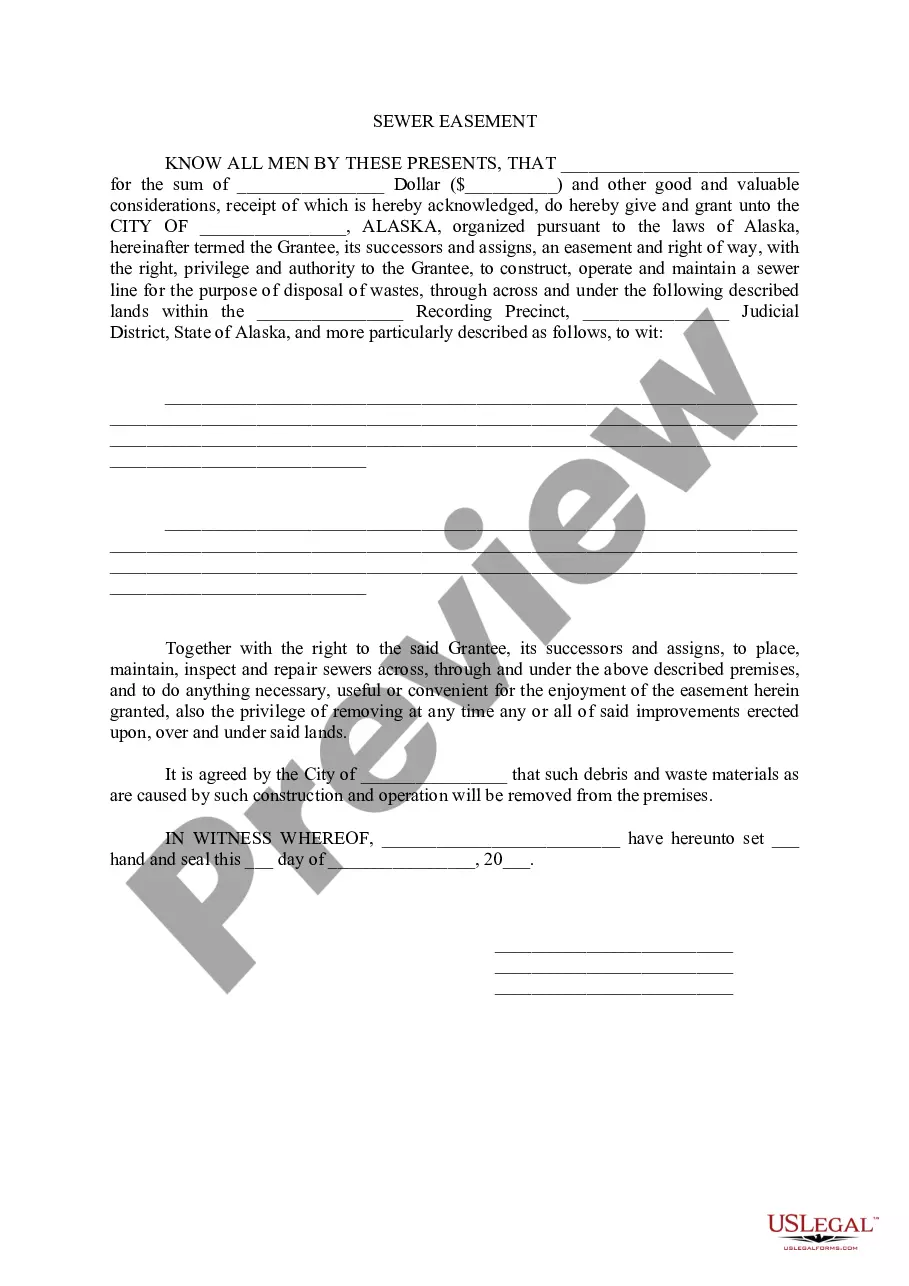

This form is a Deed of Distribution where the Grantor is the executor or personal representative of an estate and the Grantee is the beneficiary of the estate or purchaser of the real property. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual

Description

How to fill out Pennsylvania Deed Of Distribution - Executor / Personal Representative To Individual?

We consistently endeavor to reduce or evade legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney services that are typically very expensive.

Nevertheless, not every legal issue is as complicated.

Many of them can be handled independently.

Utilize US Legal Forms whenever you need to acquire and download the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual or any other document promptly and securely.

- US Legal Forms is an online inventory of current DIY legal documents encompassing a variety of items from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our collection enables you to manage your affairs without resorting to legal advisors.

- We provide access to legal document templates that aren’t always publicly available.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

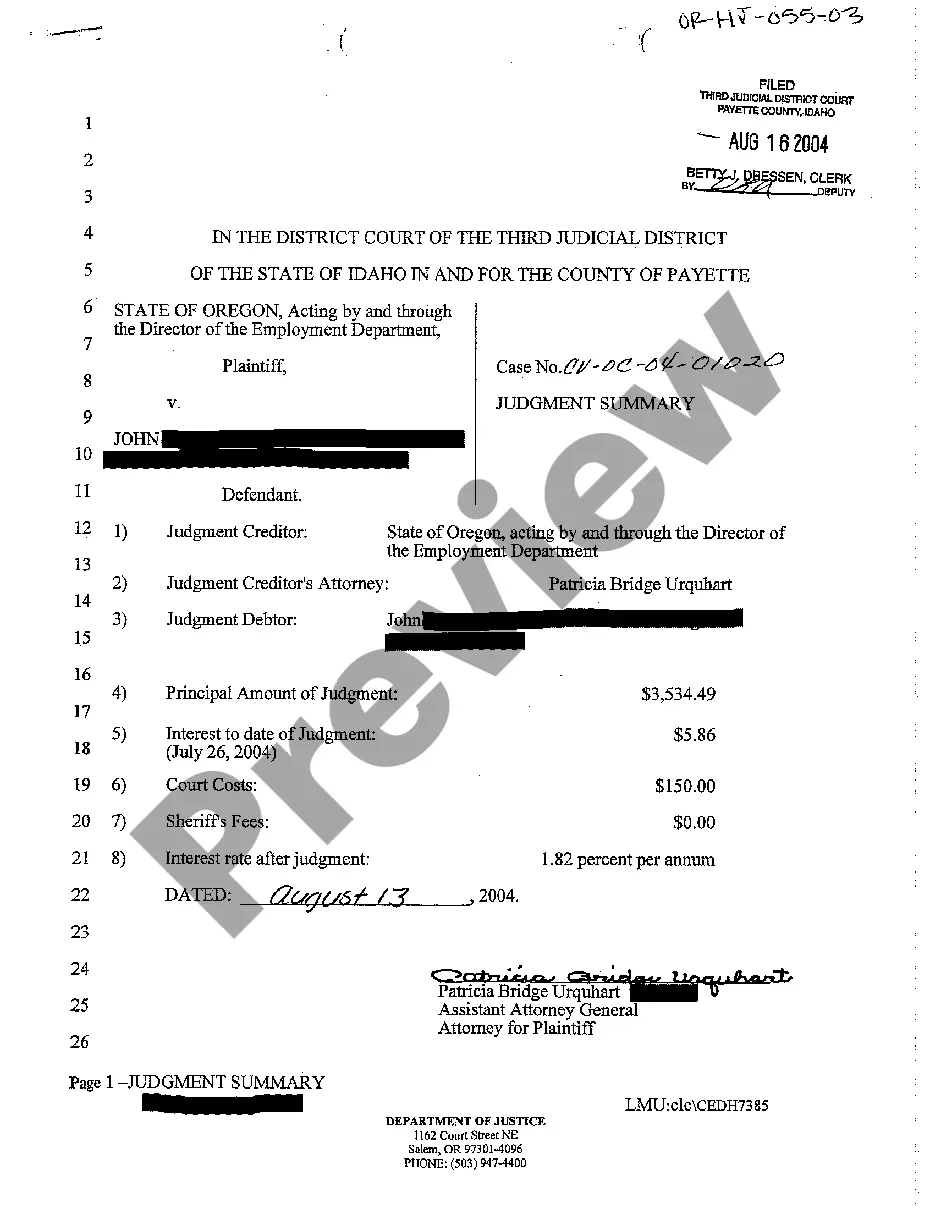

In Pennsylvania, the terms 'personal representative' and 'executor' are often used interchangeably, but they can have different implications. An executor is specifically appointed in a will, while a personal representative can be appointed by the court if no will exists. Understanding the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual can clarify the distinct roles and responsibilities involved. If you need assistance, using resources like US Legal Forms can provide the clarity you need in these situations.

An attorney typically represents the estate in Pennsylvania, ensuring that the personal representative fulfills their duties according to the law. The attorney provides guidance on the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual, helping navigators through complicated legal processes. This relationship helps protect the interests of both the estate and the personal representative. If legal issues arise, having an attorney can greatly simplify the matter.

In Pennsylvania, an executor may have the right to sell property without full beneficiary approval, depending on the language in the will. The Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual outlines the responsibilities of the executor, which may include selling assets to settle debts or distribute the estate fairly. It's important for the executor to act in the best interests of the estate and communicate openly with beneficiaries. If there are disputes, consulting a legal expert can provide clarity.

The terms 'executor' and 'personal representative' are often used interchangeably, but there are subtle differences. An executor is specifically named in a will to manage the estate after death, while a personal representative can refer to someone appointed by the court if no will exists. Both roles involve overseeing the distribution of the deceased's assets. The Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual serves both parties in managing estate distribution effectively.

Yes, Pennsylvania allows for a transfer on death deed, which enables property owners to designate a beneficiary to receive the property upon their death. This type of deed allows the property to avoid probate, making the transfer simpler and quicker. However, certain formalities must be followed for it to be valid. Using the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual may help in understanding the specifics.

The best way to transfer a property title between family members is through a deed of distribution or a quitclaim deed. This method legally establishes the new owner without the need for a sale. It is advisable to have a written agreement and ensure all parties are in consent. The Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual can facilitate this process smoothly.

In Pennsylvania, co-executors can act independently, but they should collaborate on significant decisions regarding the estate. Each co-executor has the authority to manage the estate, but certain actions may require mutual consent to ensure proper administration. Clear communication between co-executors is essential to avoid conflicts. Utilizing the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual may help in coordinating their efforts.

To transfer a deed after death in Pennsylvania, the personal representative must gather all necessary legal documents, including the will, death certificate, and the deed itself. They must complete the deed of distribution, which specifies the beneficiaries. After signing the deed, it must be recorded at the county office. The Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual can guide you through this process efficiently.

A personal representative deed of distribution is a legal document used to transfer real property from the estate of a deceased person to individual beneficiaries. This deed is executed by the personal representative, often an executor named in the will. It establishes the rightful ownership of the property and can take various forms depending on the specifics of the estate. The Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual is specifically designed for this purpose.

To transfer a deed of a house after death in Pennsylvania, the executor or personal representative must first obtain a certified copy of the death certificate. Then, they should prepare a deed of distribution that indicates the transfer from the estate to the beneficiary. This deed must be signed and recorded in the county where the property is located. Utilizing the Allentown Pennsylvania Deed of Distribution - Executor / Personal Representative to Individual form can simplify this process.