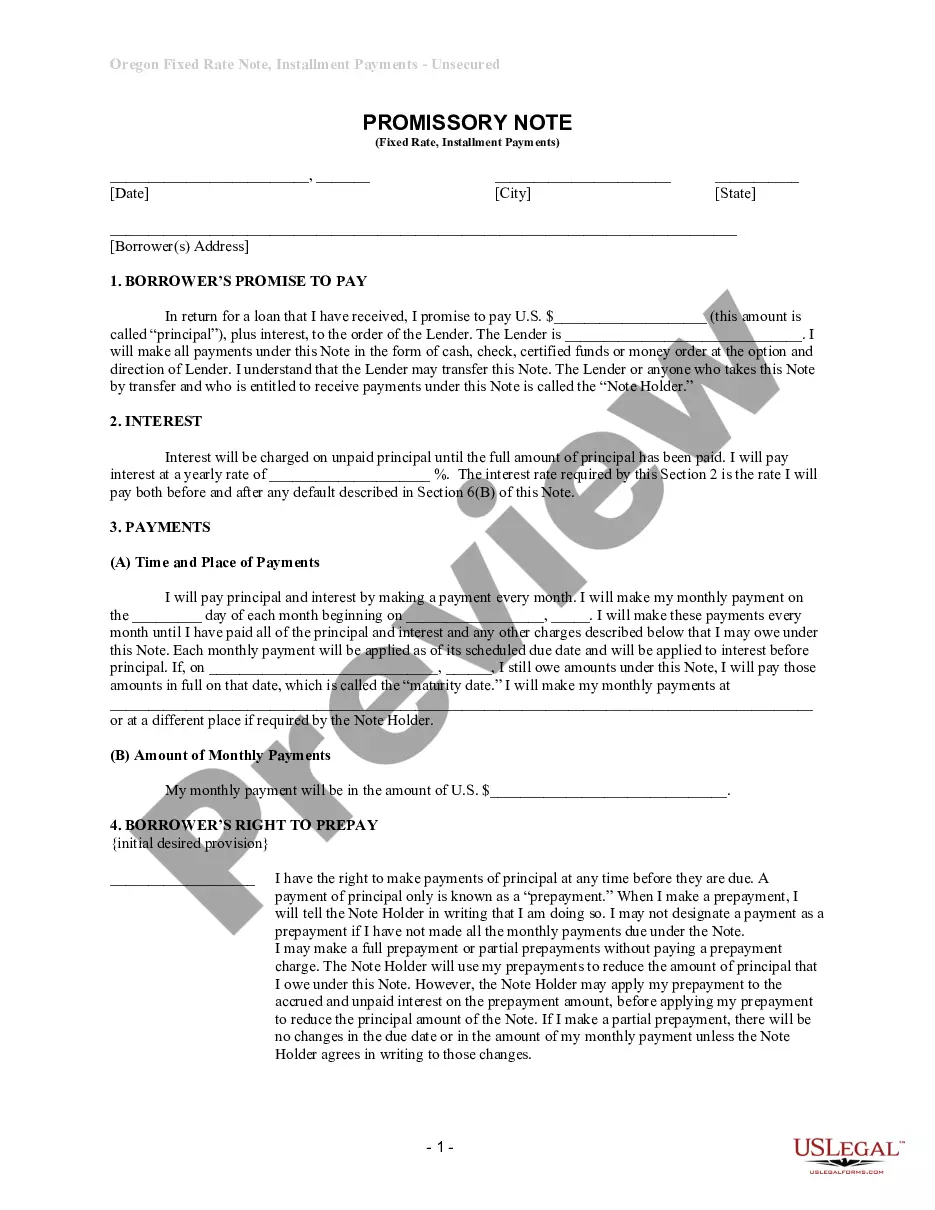

Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Are you searching for a dependable and budget-friendly legal forms provider to obtain the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate? US Legal Forms is your ideal solution.

Whether you require a straightforward agreement to establish guidelines for cohabiting with your partner or a bundle of documents to proceed with your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use. All templates that we provide access to are not generic and are structured in compliance with the regulations of specific states and counties.

To obtain the form, you need to Log In to your account, locate the desired template, and click the Download button next to it. Please remember that you can download your previously acquired form templates at any time in the My documents section.

Are you a newcomer to our platform? No problem. You can create an account in just a few minutes, but be sure to do the following before that.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is successful, download the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate in any offered format. You can return to the website whenever you need and re-download the form at no cost.

Acquiring up-to-date legal documents has never been simpler. Try US Legal Forms today and stop wasting your precious time trying to learn about legal papers online once and for all.

- Check if the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate complies with the laws of your state and local jurisdiction.

- Read the description of the form (if provided) to determine who and what the form is suitable for.

- Restart your search if the template is not appropriate for your specific situation.

Form popularity

FAQ

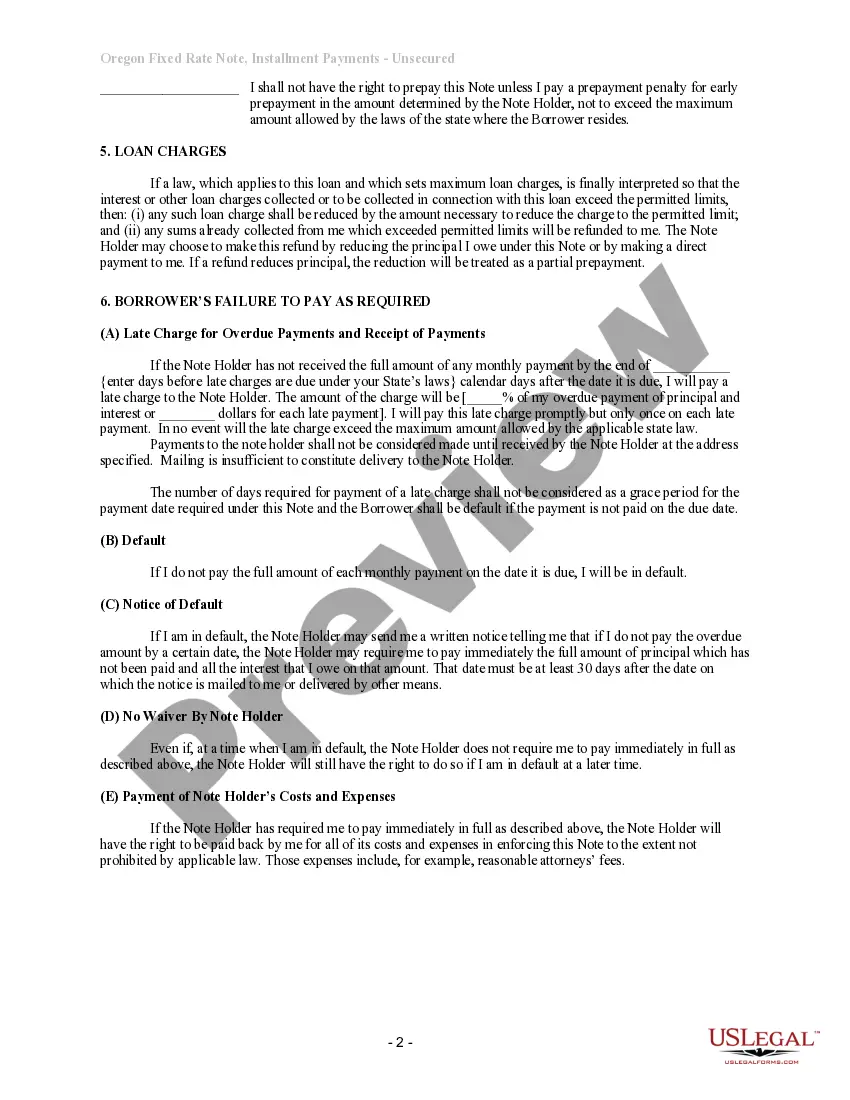

Filling out a promissory demand note involves stating the lender and borrower’s names, the owed amount, and the specific terms for repayment. Unlike a fixed payment plan, this type of note allows the lender to demand payment at any time. To ensure peace of mind, you can adapt your document into a Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate that provides clear repayment instructions. It is crucial to have both parties sign the note for it to be enforceable.

You can obtain a Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate by accessing online platforms that specialize in legal forms. Websites like uslegalforms offer easy-to-navigate templates that you can customize based on your specific situation. By entering your details, you can create a legally sound promissory note without needing extensive legal knowledge. This straightforward process ensures you have the documentation you need.

While it is not absolutely necessary to hire a lawyer for a Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, consulting one can be beneficial. A lawyer can ensure that the terms of the note meet your specific needs and comply with state laws. However, many people successfully draft their own notes using online services like uslegalforms, which provide user-friendly templates and guidance.

To get a Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, you can create one using online resources or templates. Many legal document services provide customizable templates that cater to your needs. You will simply fill in the required details, such as the payment amount and the repayment schedule. Alternatively, you can explore options with uslegalforms to find a comprehensive solution.

A handwritten promissory note can be legal in Eugene, Oregon, as long as it contains all essential details and both parties understand the terms. However, it is advisable to type and format the note clearly to avoid misunderstandings. Using platforms like US Legal Forms can help you craft a professional document that fulfills legal requirements.

In Eugene, Oregon, an unsecured installment payment promissory note for fixed rate does not necessarily require notarization to be valid. However, having a notary can add an additional layer of legitimacy and may help if any disputes arise in the future. It's always better to consult a legal professional to determine the specific requirements for your document.

An installment note is a type of promissory note that includes a repayment schedule with specific payment amounts over time. Conversely, a promissory note can have flexible repayment terms. When you create an Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, you establish clear terms for repayment, making it easier for both parties to understand their obligations.

For a promissory note to be valid in Oregon, it must include the principal amount, interest rate, terms of repayment, and signatures of both parties. It is crucial that both the borrower and lender understand the terms clearly. Using a structured template like the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate can help ensure all necessary elements are included.

Yes, a promissory note is legal in Oregon without notarization, provided it meets the state’s requirements. The important elements are clear terms and mutual agreement between the involved parties. The Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate remains valid, but notarization can enhance its credibility.

In Oregon, a promissory note does not strictly need to be notarized to be valid. However, notarization can make it easier to enforce the terms in case of a dispute. When using the Eugene Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, consider notarization for clarity and security.