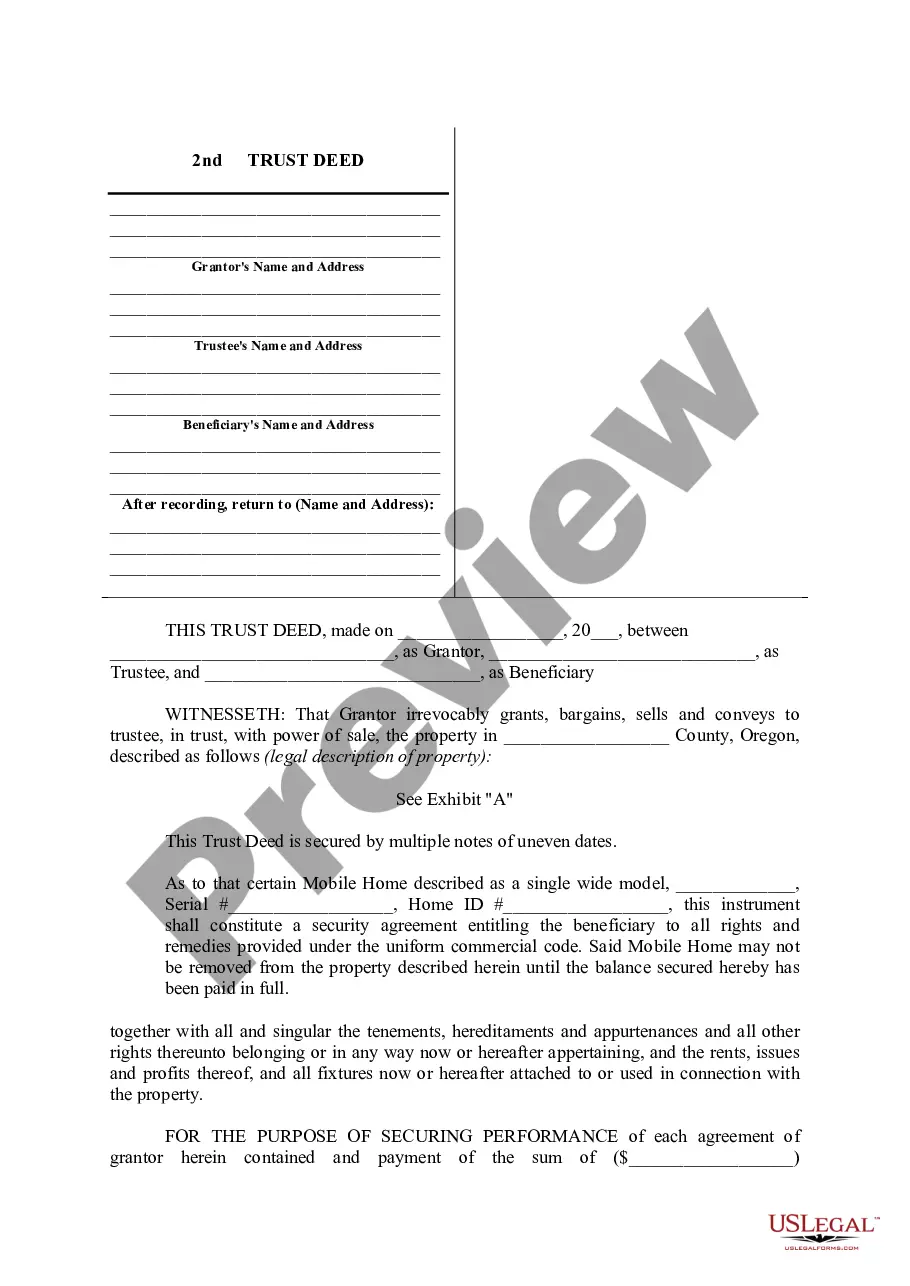

Bend Oregon Trust Deed

Description

security for a loan (debt) between a borrower and lender.

How to fill out Oregon Trust Deed?

If you have previously utilized our service, sign in to your account and store the Bend Oregon Trust Deed on your device by selecting the Download button. Ensure your subscription is active. If it is not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to access your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business needs!

- Ensure you have found a suitable document. Review the description and use the Preview feature, if accessible, to verify if it suits your needs. If it does not align with your requirements, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Establish an account and process a payment. Enter your credit card information or use the PayPal option to finalize your purchase.

- Obtain your Bend Oregon Trust Deed. Select the file format for your document and save it onto your device.

- Finalize your sample. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

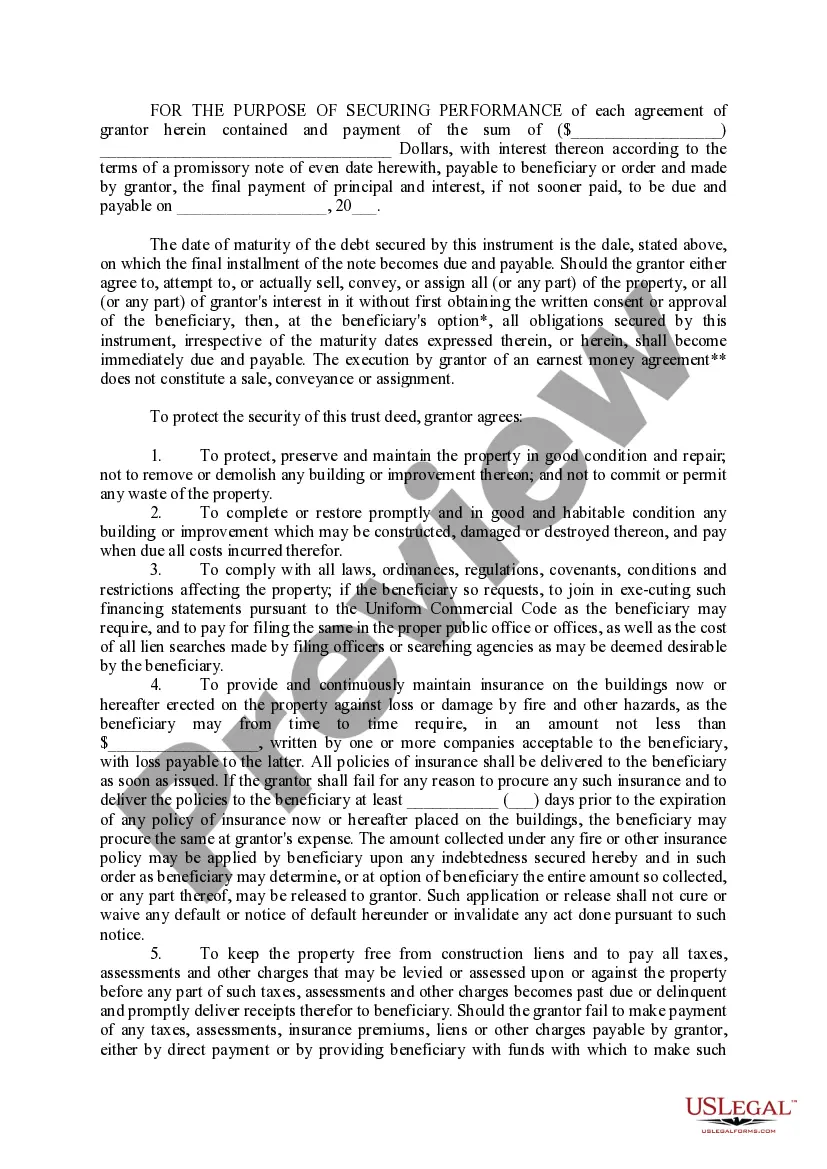

Writing a trust deed involves outlining the agreement between the lender and the borrower, specifying the property involved, and detailing the repayment terms. It’s crucial to include all the legal descriptions and parties' details accurately. For a reliable process, consider using USLegalForms to draft your Bend Oregon Trust Deed. They provide templates that simplify the writing process and ensure that your trust deed adheres to Oregon laws.

To fill out a quit claim deed in Oregon, you need to gather the property details, including the legal description and the names of the parties involved. Make sure to include the county in which the property is located. You can also use online resources, such as USLegalForms, to ensure you meet all requirements for the Bend Oregon Trust Deed. After completing the form, you must sign it in front of a notary and then file it with the County Clerk's office.

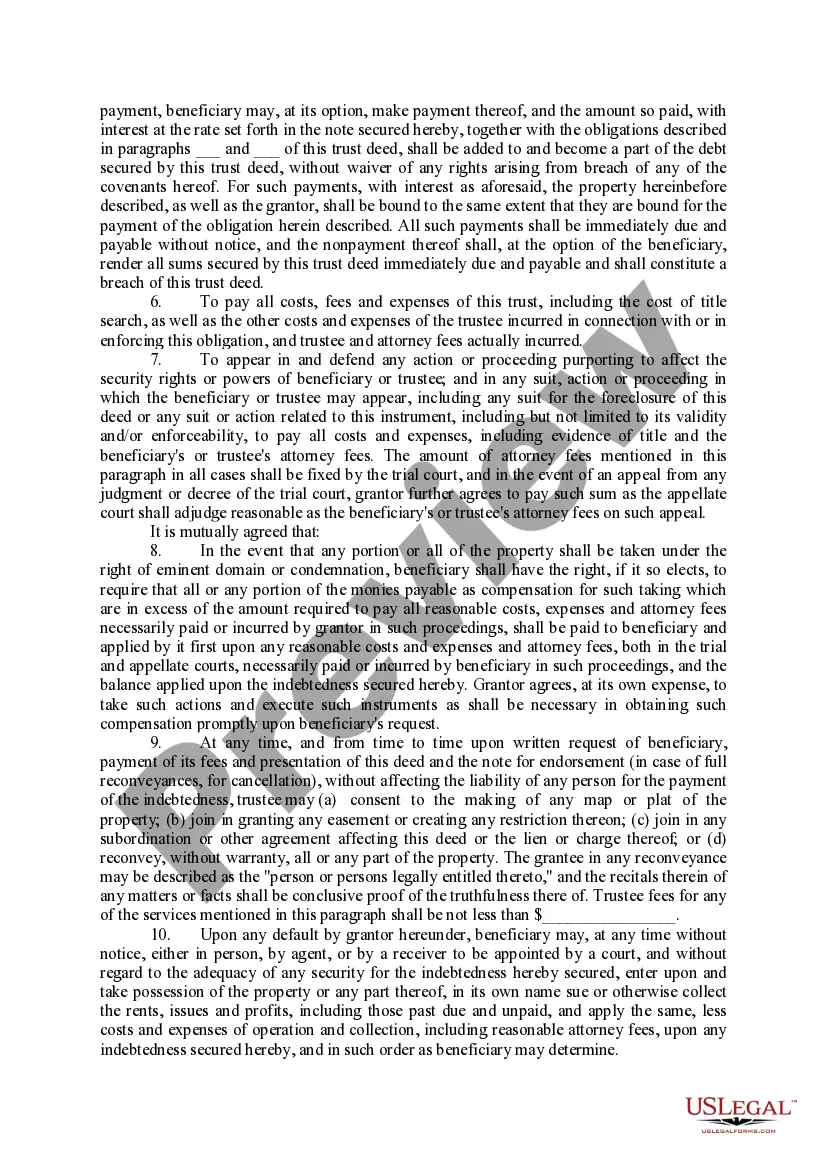

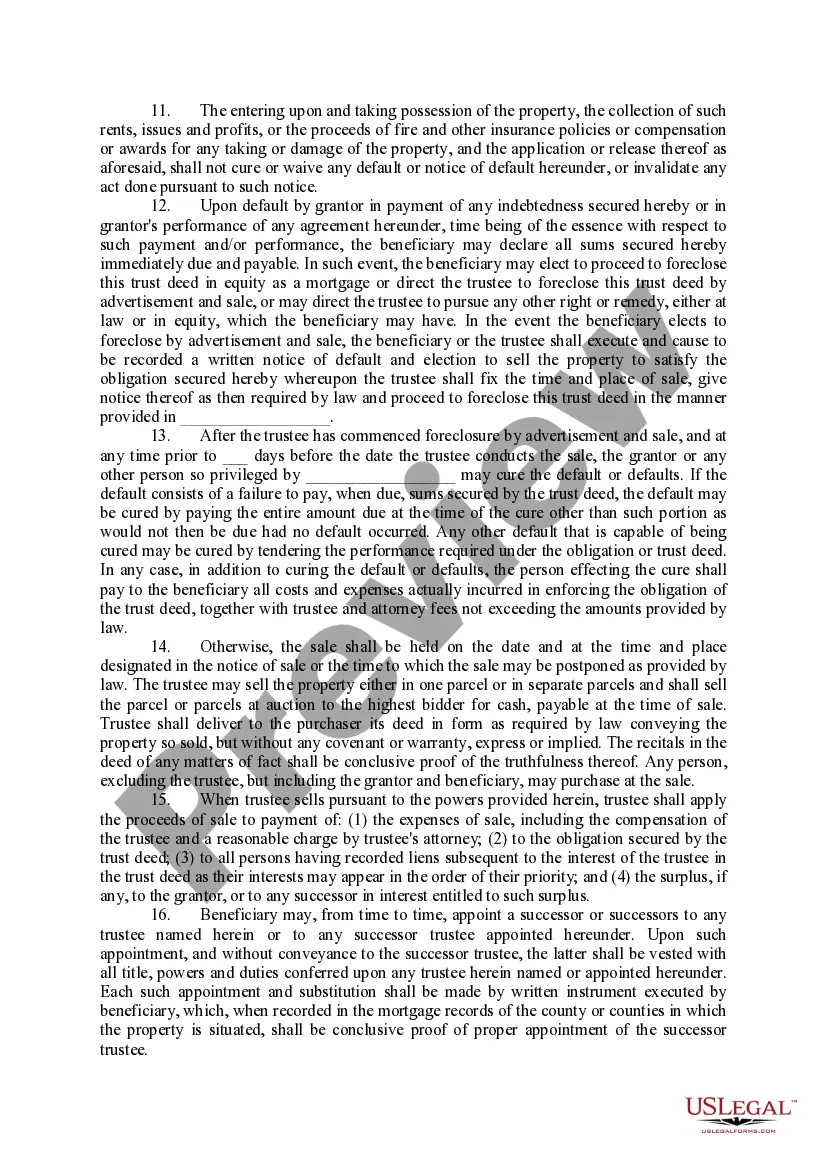

A deed of trust is commonly used in states like California, Washington, and Oregon, including Bend. In these states, the deed of trust acts as a security agreement between the borrower, the lender, and a third-party trustee. This arrangement simplifies the foreclosure process, allowing lenders to take action quickly if necessary. Understanding the specifics of a Bend Oregon Trust Deed can help you navigate your options effectively.

Yes, you can sell a house with a deed of trust, but it involves specific considerations. The seller must address any outstanding obligations tied to the deed of trust and may need to settle the debt before the sale. Working with platforms like uslegalforms can help navigate these nuances when dealing with a Bend Oregon Trust Deed.

'In trust' on a deed refers to the legal arrangement where property is held by one party for the benefit of another. This means that while the trustee manages the property, the beneficiary enjoys the benefits of ownership. This concept is vital to grasp when dealing with a Bend Oregon Trust Deed, as it affects rights and responsibilities.

To record a deed in Oregon, you need to prepare the deed form correctly, including the details of the property and the parties involved. After completing the deed, you should take it to the county clerk’s office in the county where the property is located. By recording it, you create a public record of the ownership, which is crucial for establishing claims related to the Bend Oregon Trust Deed.

The primary beneficiary of a trust is the individual or entity who stands to gain the most from the trust's assets. In the case of a trust deed, this often represents the lender. Understanding the relationship between the borrower and beneficiary is critical when entering into Bend Oregon Trust Deeds. It is advisable to clarify these roles during the establishment of any trust.

Yes, Oregon is a trust deed state. This means that it uses trust deeds as a way to secure loans made by lenders. In case of default, the foreclosure process is generally faster than in states that use mortgages. Familiarizing yourself with the intricacies of Bend Oregon Trust Deeds will help you make informed decisions in your real estate dealings.

To look up a deed in Oregon, you can visit the County Clerk's office where the property is located. Online databases are often available, allowing for easier access to property records. This digital convenience can save you time and effort in your search. As you explore Bend Oregon Trust Deeds, make sure to utilize these resources for efficiency.

Yes, Oregon does allow for a type of deed known as a beneficiary deed. This deed enables an individual to transfer property upon their death while allowing them to retain full control during their lifetime. A beneficiary deed does not go through probate, providing a smoother transition of ownership. Those interested in Bend Oregon Trust Deeds should explore this option for its potential benefits.