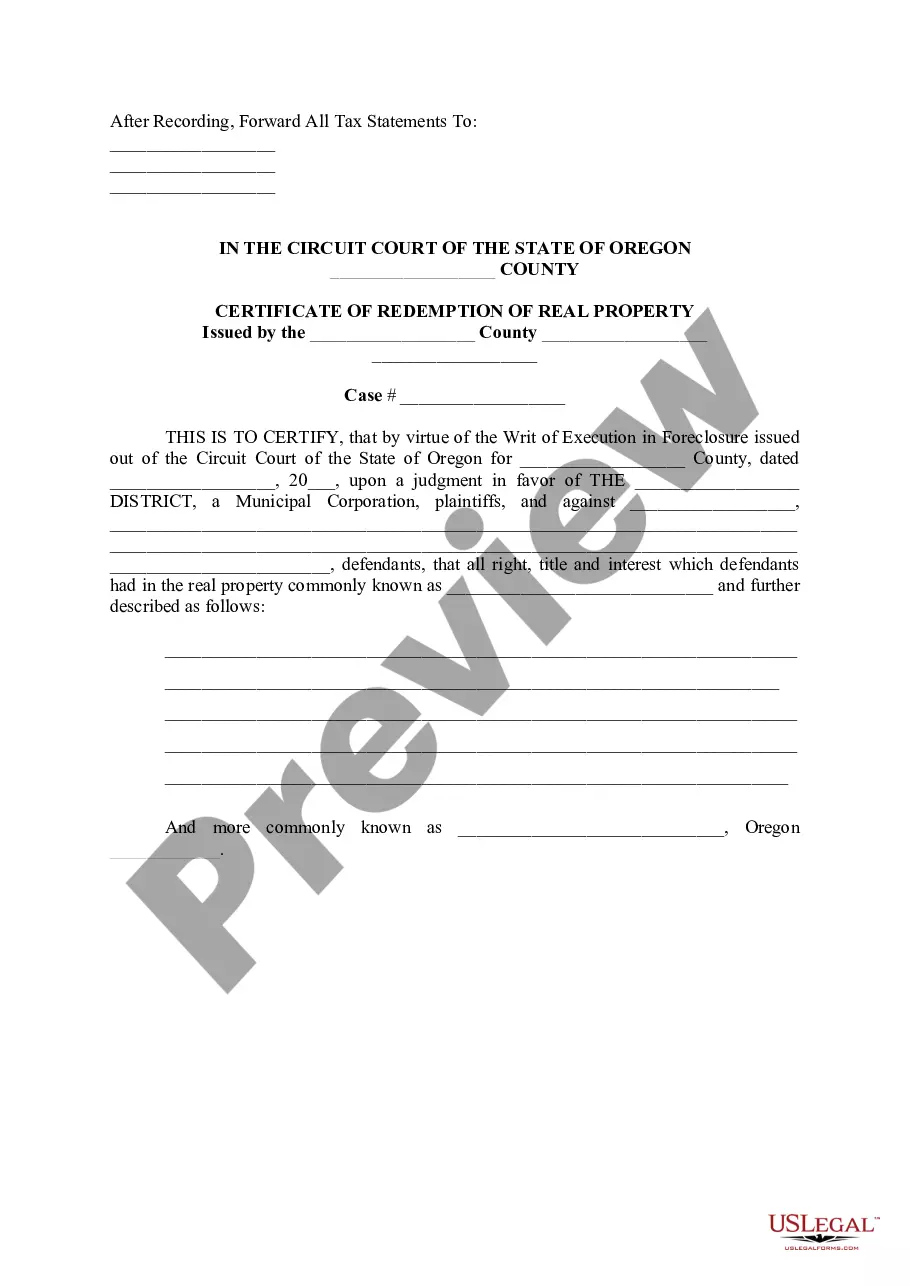

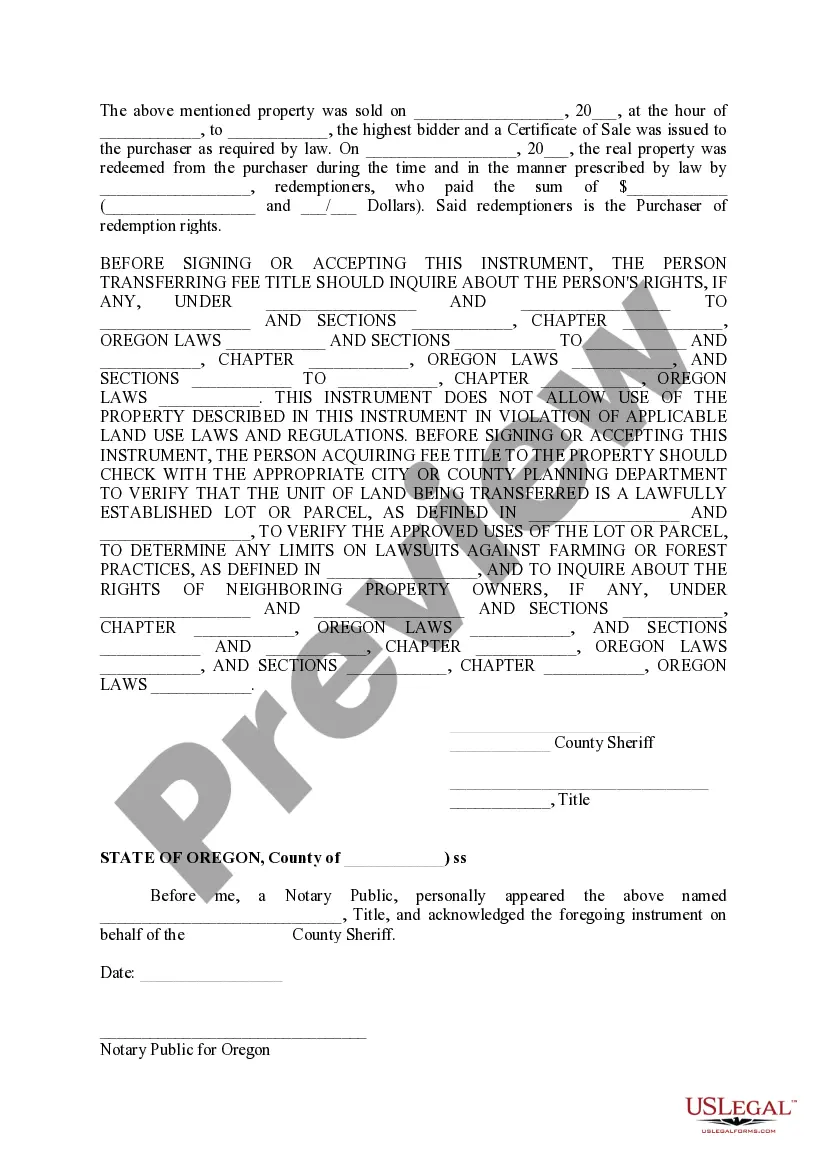

Hillsboro Oregon Certificate of Redemption of Real Property

Description

approved by the Commissioner of Commerce.

How to fill out Oregon Certificate Of Redemption Of Real Property?

No matter the societal or occupational rank, completing legal-related documents is a regrettable requirement in the modern world.

Frequently, it’s nearly unattainable for someone without any legal expertise to generate these kinds of papers from the beginning, chiefly because of the intricate terminology and legal nuances they encompass.

This is where US Legal Forms comes to the rescue.

Verify that the document you selected is appropriate for your area since the laws of one state or county may not apply to another.

Review the form and read a brief summary (if available) of scenarios for which the document can be utilized.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific documents applicable for nearly any legal circumstance.

- US Legal Forms also serves as an outstanding tool for associates or legal advisors looking to conserve time with our DIY templates.

- Whether you require the Hillsboro Oregon Certificate of Redemption of Real Property or another document valid in your state or county, US Legal Forms places everything at your fingertips.

- Here’s how you can obtain the Hillsboro Oregon Certificate of Redemption of Real Property in minutes using our reliable service.

- If you are already a member, you can proceed to Log In to your account for downloading the relevant form.

- However, if you are new to our library, ensure you follow these steps prior to downloading the Hillsboro Oregon Certificate of Redemption of Real Property.

Form popularity

FAQ

The redemption period timeline begins after the foreclosure sale is finalized. Typically, it lasts for nine months, giving property owners time to redeem their property. During this time, it's crucial to stay informed and consider services that can help guide you through the complexities of redemption, such as acquiring a Hillsboro Oregon Certificate of Redemption of Real Property.

The 120-day rule refers to a guideline for lenders concerning the initiation of foreclosure. It states that lenders must wait at least 120 days before beginning foreclosure proceedings after a homeowner misses a mortgage payment. Understanding this timeline helps property owners prepare for potential hardships and may lead them to explore options like obtaining a Hillsboro Oregon Certificate of Redemption of Real Property.

The redemption process typically lasts for nine months in Oregon; however, the exact duration may depend on various factors. Property owners should act swiftly during this timeframe to secure their rights effectively. If you need clarity on this process, obtaining a Hillsboro Oregon Certificate of Redemption of Real Property can be beneficial for navigating these timelines.

Yes, Oregon law provides a right of redemption for property owners facing foreclosure. This right allows them to regain ownership of their real property during the redemption period by paying off their debt, including any associated fees. Understanding this process can be crucial, especially if you obtain a Hillsboro Oregon Certificate of Redemption of Real Property to facilitate your redemption.

In Oregon, the redemption period for foreclosure is typically nine months. This means that after a foreclosure sale, property owners have up to nine months to reclaim their property by paying the total amount owed. However, the exact duration may vary based on specific circumstances surrounding the foreclosure. To ensure you understand your rights, consider obtaining a Hillsboro Oregon Certificate of Redemption of Real Property.

You may be eligible for this program if: You are at least 62 years of age by April 15th of the year you file.

Online information can be found through their two online databases, MultCoPropTax and MultCoRecords. You can also find basic property information, including ownership information, through Portland Maps . Title companies can also research the title to a piece of property. Generally, this will involve a fee.

Oregon laws provide for a variety of property tax exemptions for both qualifying individuals and certain organizations. Each type of exemption has specific qualifications. Oregon does not have a homestead exemption. Property tax exemptions are not automatic.

Each of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or. siblings (having at least one common parent) and. one of the owners is at least 65.

Most exemptions granted to non-governmental entities are granted to religious, fraternal, literary, benevolent, or charitable organizations. The exempt property must be reasonably necessary and used in a way to achieve the organization's purpose.