approved by the Commissioner of Commerce.

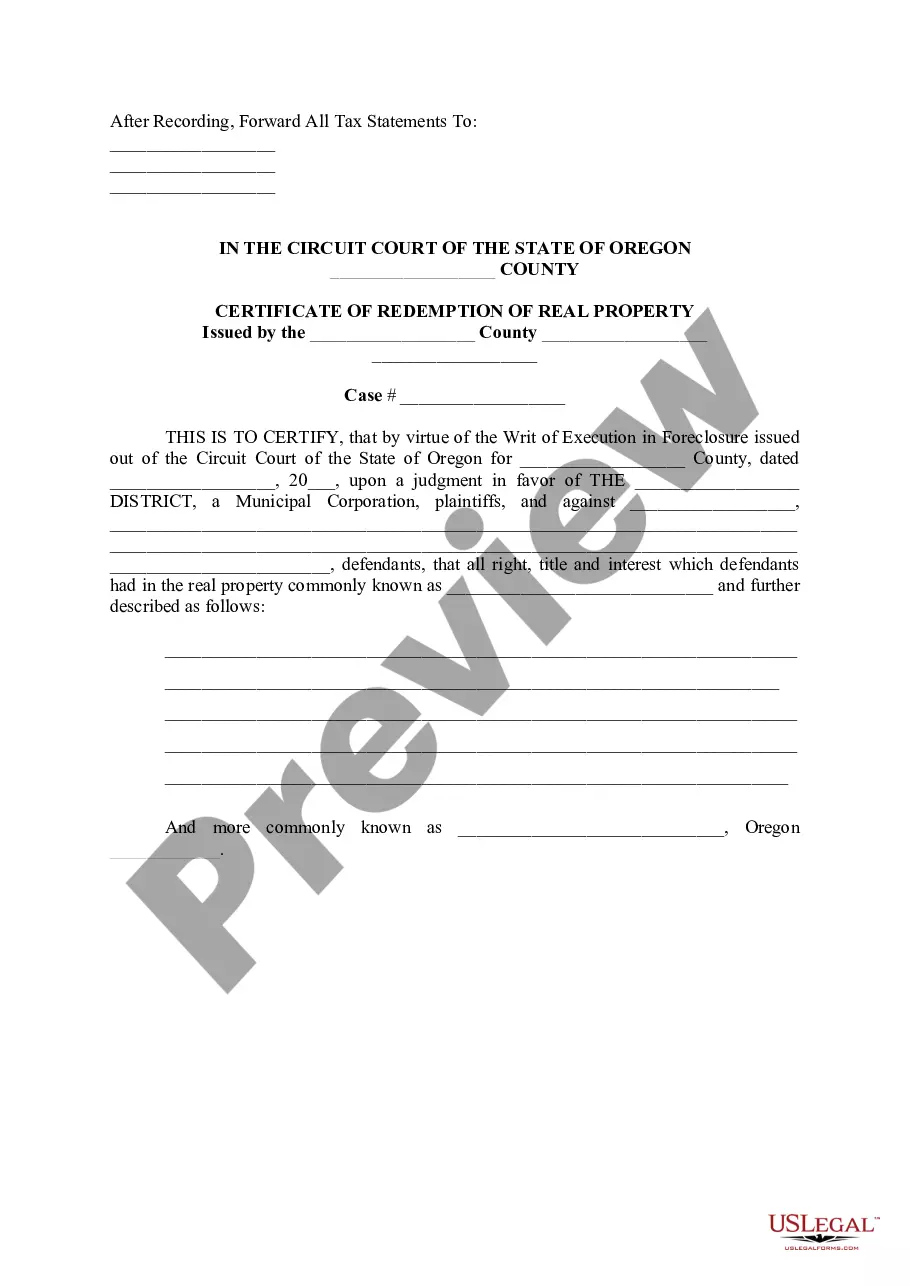

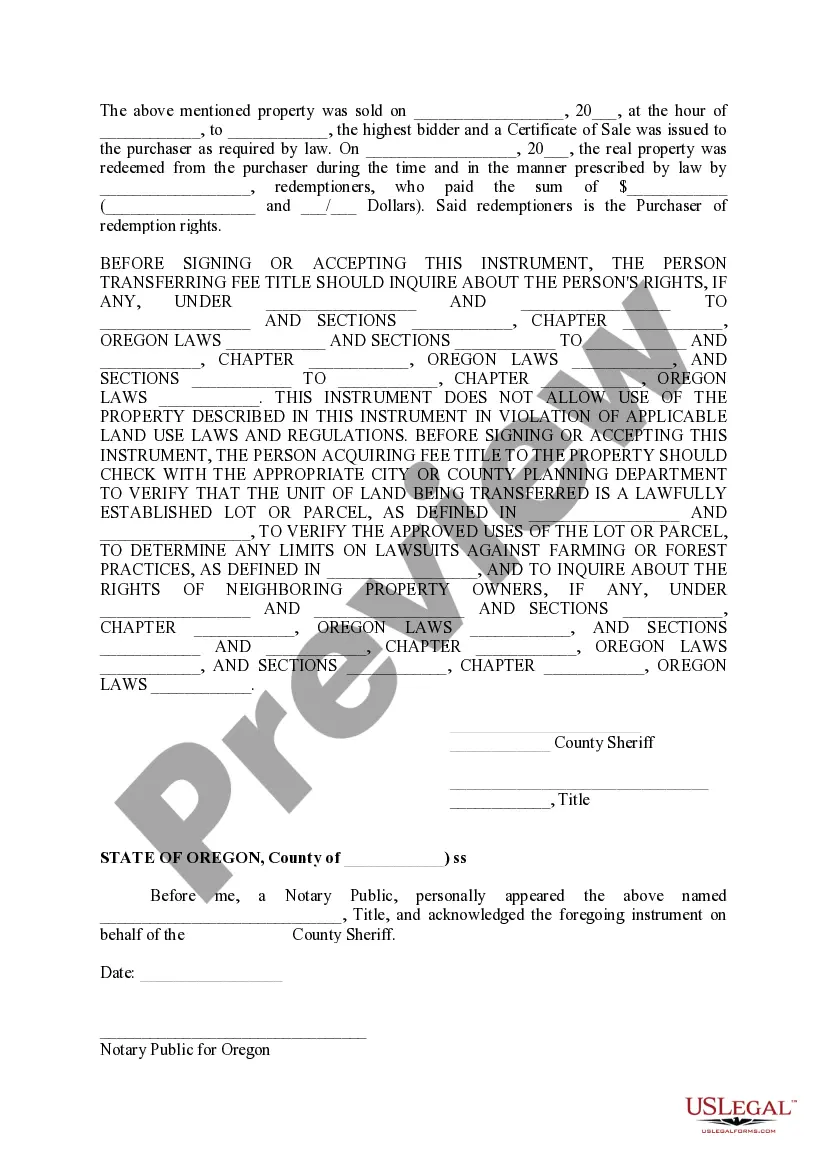

The Gresham Oregon Certificate of Redemption of Real Property is a legal document that provides landowners with an opportunity to redeem their property after it has been sold at a tax foreclosure auction. This certificate is crucial in ensuring that individuals or businesses regain ownership and control over their real estate. When a property owner fails to pay property taxes for an extended period, the county government may initiate a foreclosure process to recover the unpaid taxes. After the property auction, the successful bidder receives a certificate that shows their interest in the property. Subsequently, the former owner can acquire the Gresham Oregon Certificate of Redemption of Real Property to repurchase their land. The certificate serves as a proof that the property owner has fulfilled their debt obligations and has the right to reclaim their real estate. It essentially acts as a legal instrument that reinstates ownership rights and removes any encumbrances placed during the foreclosure process. There are a few different types of Gresham Oregon Certificate of Redemption of Real Property, depending on the specific circumstances of the situation. These include: 1. Standard Certificate of Redemption: This is the most common type and is issued when the property owner redeems their property within a specific period after the auction, usually within 180 days. 2. Extended Redemption Certificate: In certain cases, the property owner may be granted an extended redemption period, usually up to three years. This allows them additional time to gather funds and redeem their property. 3. Partial Redemption Certificate: If the property owner can only pay a portion of the owed taxes, they may be eligible for a partial redemption. This certificate reflects the amount paid and the remaining balance to be settled. 4. Final Redemption Certificate: Once the property owner fully repays their outstanding taxes and any associated fees, they are provided with a final redemption certificate. This document ensures that all obligations are met, and the owner's rights are fully restored. It is important for property owners in Gresham, Oregon, to understand the specific requirements and provisions related to the Certificate of Redemption of Real Property. Consulting with legal professionals or contacting the Gresham county government can provide accurate and up-to-date information on the redemption process, timelines, and necessary documentation.