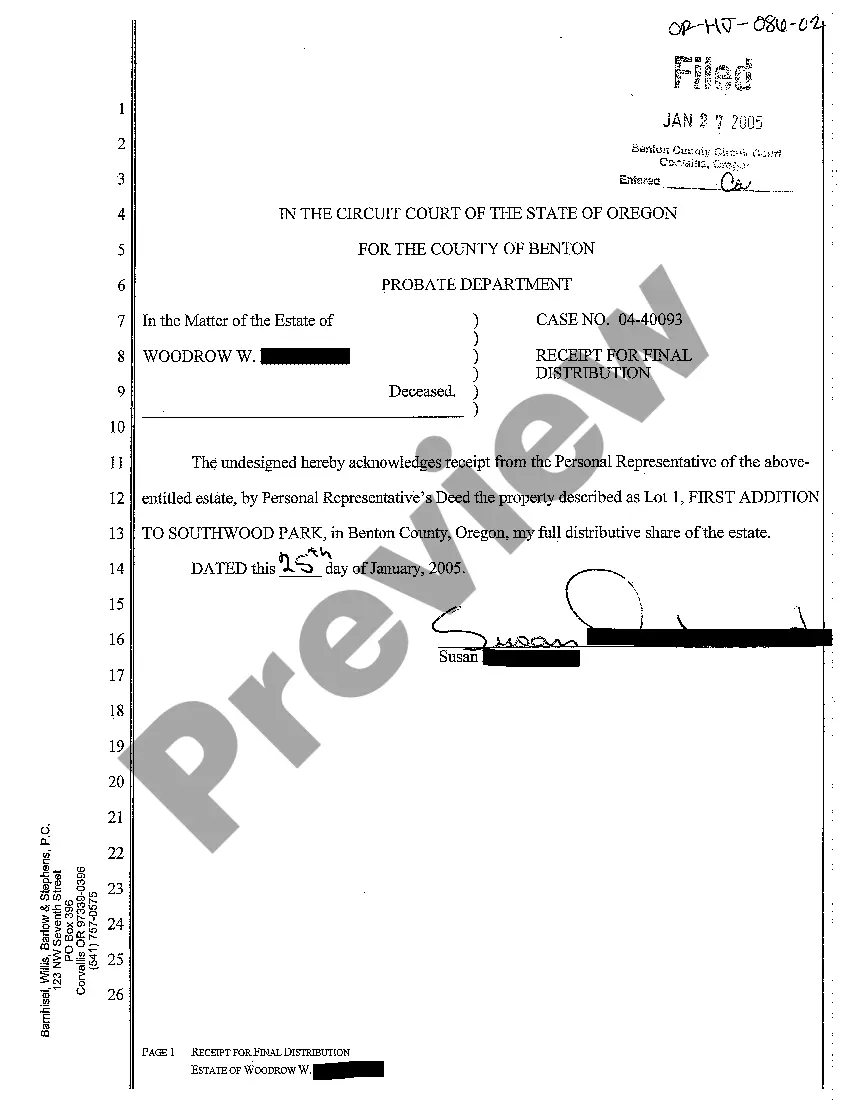

A Bend Oregon Receipt for Final Distribution is a legal document that serves as proof of the distribution of assets or properties to beneficiaries upon the closing of an estate or the conclusion of a trust. It outlines the final allocation and transfer of assets as stated in a will, trust agreement, or the applicable succession laws. The Bend Oregon Receipt for Final Distribution is a crucial document in the estate settlement process, ensuring transparency and accountability among the beneficiaries. It establishes the exact assets being distributed, their estimated values, and the parties involved in the transfer. This document provides documentation for inheritance and financial purposes. Types of Bend Oregon Receipts for Final Distribution may include: 1. Estate Receipt: This type of receipt is used when distributing assets from an estate. It outlines the distribution of properties, cash, and other valuable assets to the heirs as specified in the deceased person's will or determined by the laws of intestacy. 2. Trust Receipt: A trust receipt is applicable when a trust is involved in the final distribution process. It details the transfer of assets from the trust to the beneficiaries, as outlined in the trust agreement. 3. Probate Receipt: This type of receipt is specifically used in cases where the estate goes through the probate process. It confirms the final distribution of assets to beneficiaries and is often required by the probate court to close the proceedings. 4. Personal Representative Receipt: Sometimes referred to as Executor Receipt, this document is used when an appointed personal representative or executor distributes the assets of the deceased according to the will or laws of intestacy. It provides proof that the personal representative has fulfilled their duties and properly distributed the assets. 5. Beneficiary Receipt: This receipt is issued to beneficiaries who receive a distribution from an estate or trust. It serves as proof that the beneficiary has received their entitled share of assets, such as cash, real estate, valuables, or investments, and acknowledges their acceptance of the distribution. In conclusion, a Bend Oregon Receipt for Final Distribution is a detailed document that outlines the allocation and transfer of assets to beneficiaries, ensuring transparency and accountability. The various types of receipts cater to different situations such as estate distribution, trust distribution, probate cases, distribution by a personal representative, or acknowledgment from beneficiaries.

Bend Oregon Receipt for Final Distribution

Description

How to fill out Bend Oregon Receipt For Final Distribution?

If you are looking for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms site – one of the most considerable libraries on the web. Here you can get thousands of templates for business and personal purposes by categories and states, or keywords. Using our high-quality search feature, discovering the latest Bend Oregon Receipt for Final Distribution is as easy as 1-2-3. In addition, the relevance of each record is confirmed by a team of expert lawyers that on a regular basis review the templates on our website and revise them based on the newest state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the Bend Oregon Receipt for Final Distribution is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the form you require. Read its information and make use of the Preview option (if available) to see its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the needed file.

- Confirm your selection. Click the Buy now button. Next, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Choose the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Bend Oregon Receipt for Final Distribution.

Each and every template you save in your profile does not have an expiry date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to have an additional duplicate for editing or creating a hard copy, you may return and save it again anytime.

Make use of the US Legal Forms professional collection to get access to the Bend Oregon Receipt for Final Distribution you were looking for and thousands of other professional and state-specific templates in a single place!

Form popularity

FAQ

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim ? in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

6-9 months is how long probate typically takes in Oregon Once the four-month discovery and notice period is complete, the probate court and PR begin overseeing the settling of the estate. For example, valid creditors receive payment and settlement from out of the estate's assets.

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house.

So typically a lawyer will draft a receipt and release form, which says money is going to this beneficiary. The beneficiary is acknowledging receiving that money. The beneficiary is releasing the trustee from any liability in exchange for receiving this money.

6-9 months is how long probate typically takes in Oregon Once all debts are settled, any remaining assets may then be distributed and/or liquidated according to the terms of the will after an accounting.

Other deadlines exist that must be followed. For instance, a list of assets must be provided within 90 days after the executor was appointed.