Chapter 13 Plan in Gresham, Oregon, is a legally structured repayment plan designed for individuals who are facing financial challenges while still wanting to retain their assets. This plan falls under the United States Bankruptcy Code and provides individuals with a realistic approach to tackling their debt by creating a manageable payment schedule over a period of three to five years. Gresham, Oregon Chapter 13 Plan allows individuals to reorganize their debts and establish a repayment plan approved by the court. This plan is particularly suitable for those who have a regular source of income and wish to prevent foreclosure or repossession of their property, while still repaying their debts in a structured manner. In Gresham, Oregon, there are various types of Chapter 13 Plans that may be applicable based on an individual's specific circumstances: 1. Standard Chapter 13 Plan: This is the most common type of Chapter 13 Plan, where individuals propose to use their disposable income to repay secured and unsecured creditors over the specified duration of the plan. 2. Zero Percent Plan: In some cases, individuals may be eligible for a Zero Percent Plan, where they propose a plan that repays all priority and secured debts in full, with no repayment towards unsecured debts. 3. Cram down Plan: A Cram down Plan allows individuals to reduce the principal balance of secured debts to the current market value of the asset securing the debt. This option is particularly helpful for individuals who owe more on their property than its current value, enabling them to lower their overall debt burden. 4. Equal Monthly Payment Plan: Under this type, individuals propose to pay a fixed monthly amount over the plan's duration. This plan is beneficial for individuals with consistent income, as it simplifies budgeting and ensures the repayment obligations. 5. Step Plan: A Step Plan is designed for individuals who expect their income to increase over the life of the plan. With this approach, individuals initially pay a fixed amount, which gradually increases at predetermined intervals. By filing for Chapter 13 bankruptcy under Gresham, Oregon laws, individuals can protect their assets while repaying their debts over time. The specific type of Chapter 13 Plan selected will depend on individual circumstances and the guidance of an experienced bankruptcy attorney. It is essential to consult a legal professional to determine eligibility, evaluate available options, and create a customized plan that best suits the individual's unique financial situation.

Gresham Oregon Chapter 13 Plan

Description

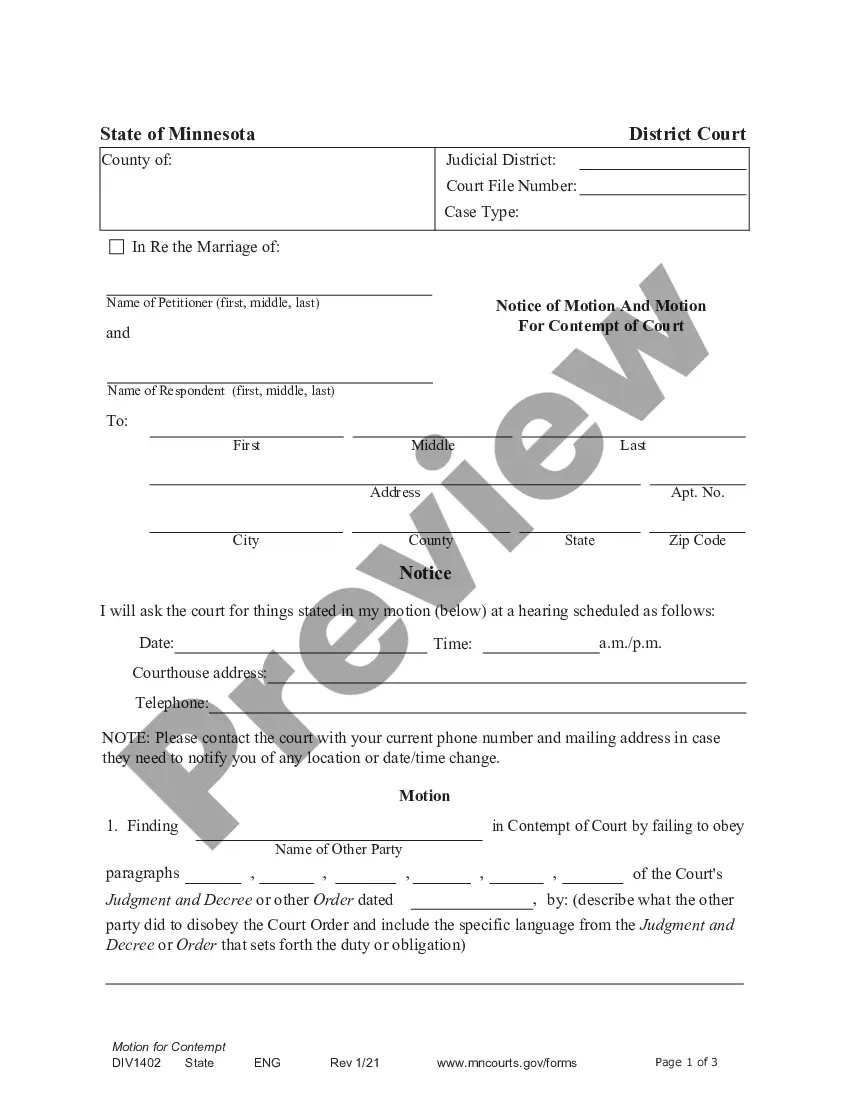

How to fill out Gresham Oregon Chapter 13 Plan?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law education to draft this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Gresham Oregon Chapter 13 Plan or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Gresham Oregon Chapter 13 Plan quickly employing our reliable platform. In case you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps prior to obtaining the Gresham Oregon Chapter 13 Plan:

- Ensure the form you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Gresham Oregon Chapter 13 Plan once the payment is done.

You’re all set! Now you can go ahead and print the form or fill it out online. Should you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

Filing a Chapter 13 plan in Gresham, Oregon, involves several steps. First, you’ll need to complete the required forms, providing details about your debts, income, and expenses. After preparing your plan, you submit it to the bankruptcy court, where a judge will review it for approval. Consider using reliable platforms like USLegalForms to ensure that your documents are completed correctly and promptly.

The average Chapter 13 payment plan in Gresham, Oregon, varies based on your income, expenses, and the total amount you owe. Typically, individuals commit to three to five years of monthly payments, which are calculated to fit your budget. This plan allows you to catch up on missed payments while keeping your assets. Understanding your financial situation is essential, and seeking guidance can simplify this process.

To survive your Gresham Oregon Chapter 13 Plan, it’s vital to manage your budget wisely. Track your income and expenses closely and cut unnecessary costs to make timely payments. Stay in touch with support channels, whether friends, family, or financial advisors. Remember, perseverance during this time can lead to financial recovery.

Success in your Gresham Oregon Chapter 13 Plan hinges on committing to your repayment plan. Make your payments on time and maintain open communication with your creditors and attorney. Following your plan diligently will lead to debt discharge and help you regain control of your financial situation.

While you're in a Gresham Oregon Chapter 13 Plan, you cannot incur new secured debts without permission from the court. Additionally, selling significant assets or failing to fulfill your repayment plan can jeopardize your case. It’s essential to adhere to the guidelines and keep your attorney informed of any changes in your financial situation.

During a Gresham Oregon Chapter 13 Plan, it's crucial to avoid missing your payment deadlines. Skipping payments can lead to dismissal of your case. Also, refrain from taking on new debts without consulting your attorney. Staying informed and responsible will help you navigate this process effectively.

Filling out a Gresham Oregon Chapter 13 Plan involves several steps. First, you need to gather financial information, including your income, expenses, and debts. Then, you will fill out the necessary forms, which outline your repayment plan. USLegalForms offers user-friendly templates that can simplify this process and ensure you include all vital details.

Certain financial situations can disqualify you from a Gresham Oregon Chapter 13 Plan. If your unsecured debts exceed $394,725 or secured debts surpass $1,184,200, you may not qualify. Additionally, you must have filed all required tax returns and demonstrated a steady source of income. It's important to review your financial circumstances closely.

While there is no fixed amount of debt required to file a Gresham Oregon Chapter 13 Plan, individuals usually have a significant amount of unsecured debt. Many people find that having at least $10,000 in unsecured debts makes filing more worthwhile. It's best to discuss your financial situation with a bankruptcy expert to determine if your debts warrant a filing.

To begin filing for a Gresham Oregon Chapter 13 Plan, gather all necessary financial documents, including income records and creditor information. Next, you should consult with an experienced bankruptcy attorney to help you navigate the filing process. They can guide you in drafting your repayment plan and submitting your case to the court.