Oklahoma City Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate

Description

How to fill out Oklahoma Warranty Deed For Parents To Child With Reservation Of Life Estate?

Locating verified templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional purposes, covering various real-life situations.

All the forms are appropriately categorized by type of use and jurisdictional areas, making it as simple as pie to find the Oklahoma City Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate.

Maintaining organized paperwork that adheres to legal standards is crucial. Leverage the resources of the US Legal Forms library to always have vital document templates readily available for all your needs!

- For those already familiar with our service and who have utilized it previously, retrieving the Oklahoma City Oklahoma Warranty Deed for Parents to Child with Reservation of Life Estate requires only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- The process will involve just a few more steps for new users.

- Review the Preview mode and form description. Ensure you’ve selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction guidelines.

- Search for another template, if necessary. If you spot any discrepancies, use the Search tab above to locate the accurate one. If it meets your needs, proceed to the next phase.

Form popularity

FAQ

A quitclaim deed effectively transfers whatever interest the current owner can transfer when signing the deed?including any interest that vests in the future. The new owner, though, cannot sue the current owner for breach of warranty if the transferred interest ends up being invalid or flawed.

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

The only way to change the title to a house is to get an order from a court in a probate case. In Oklahoma, there is, however, another situation where no court order is required: If the house is owned in joint tenancy between two or people, with a right of survivorship.

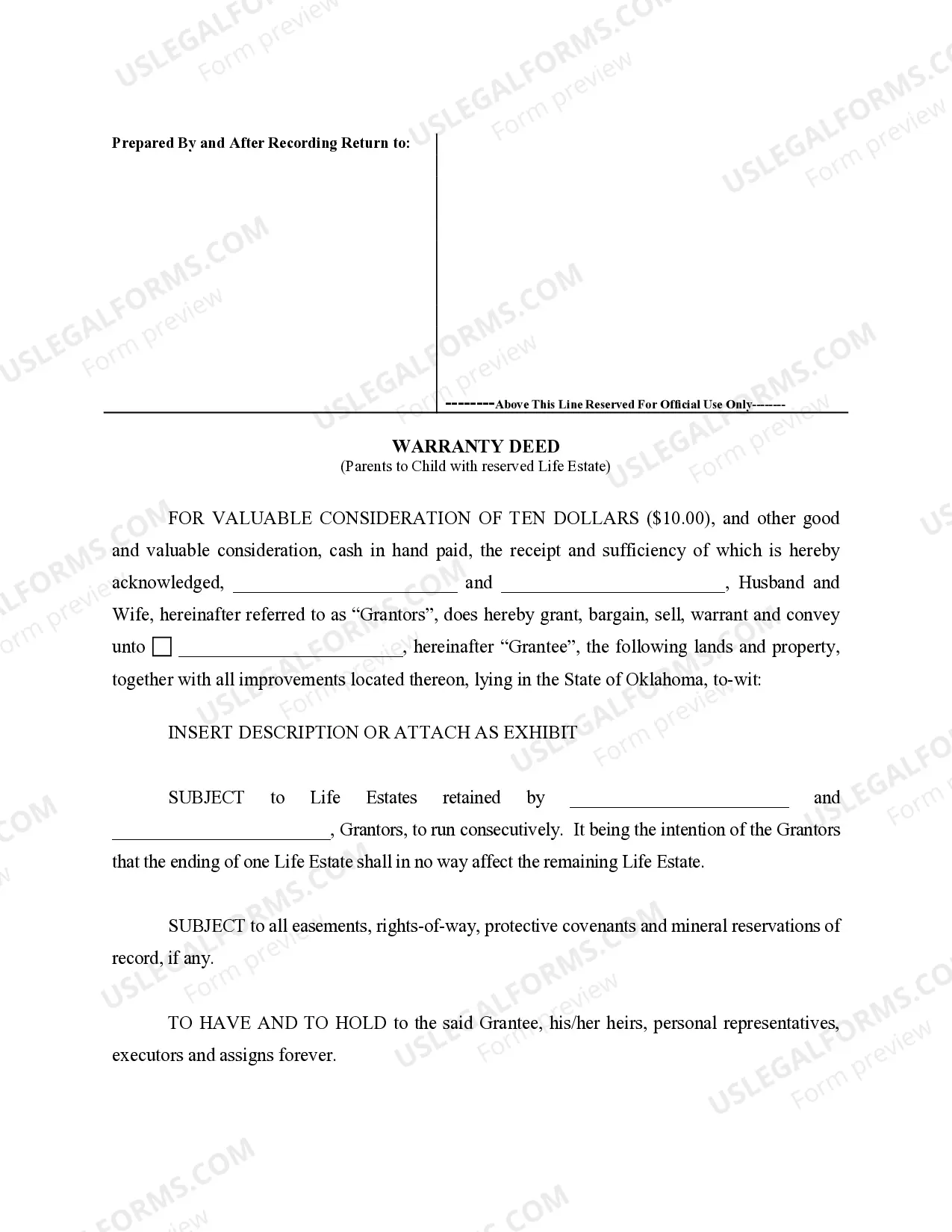

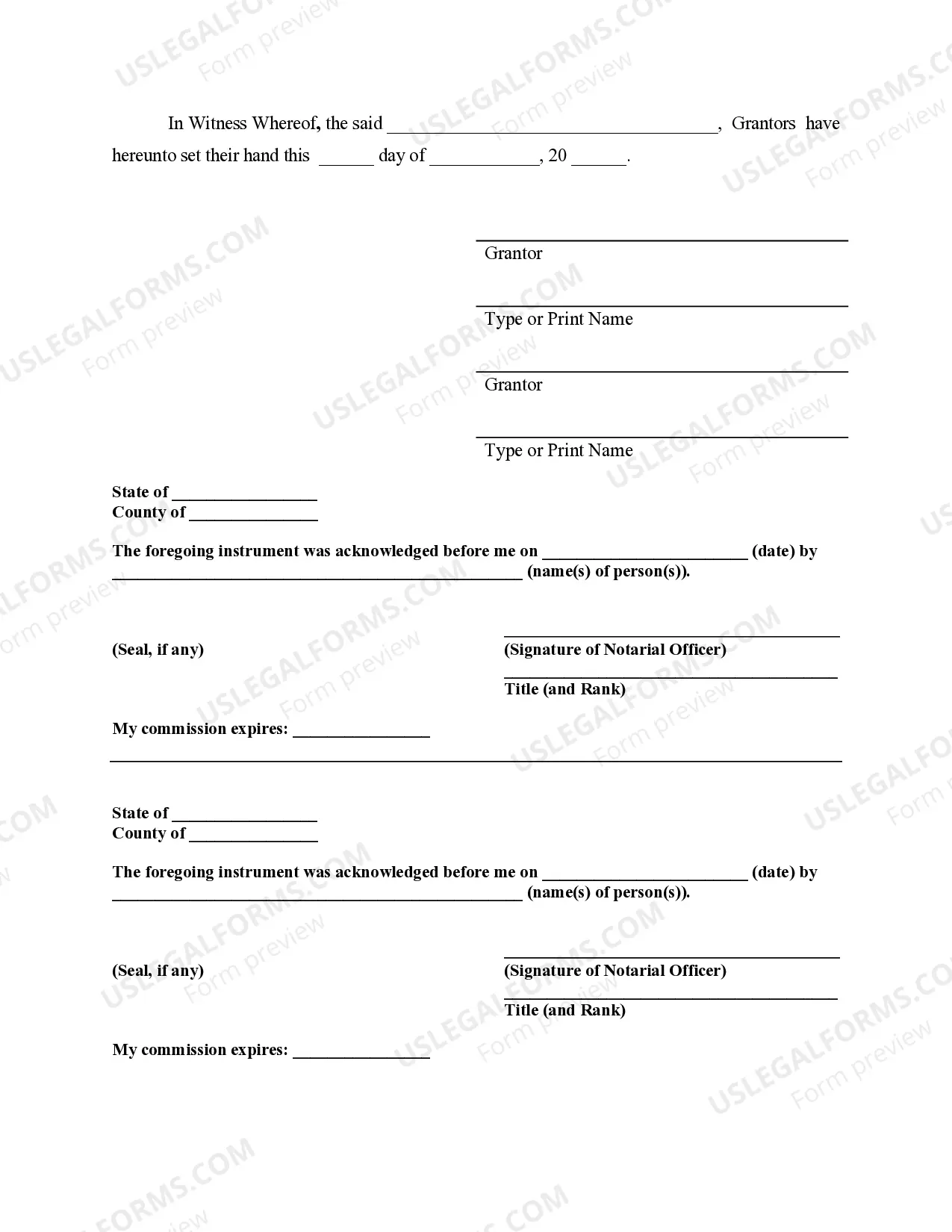

An Oklahoma deed is a legal form that can be used to transfer interests in real property, or land and buildings, from one owner to another. Deeds are required to list the seller (grantor) and the buyer (grantee), legal description of the property, and a notary acknowledgment.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Include the property address and its legal description, and identify by name the grantor(s) and the grantee(s). Make copies of the deed and record the deed transfer with the assessor's office in the county where the property is located.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

The lender will need to be satisfied that you will be able to afford the mortgage as the sole mortgagor. The mortgage lender will then need to give you written consent in order to remove the other party from the deeds to your house. The lender will require the change in ownership to be carried out by a solicitor.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A life estate deed is a special deed form that allows a property owner to use the property during life and transfer the property automatically at death. Life estate deeds are designed to transfer the property at death without losing the ability to use the property during life. Get Deed.