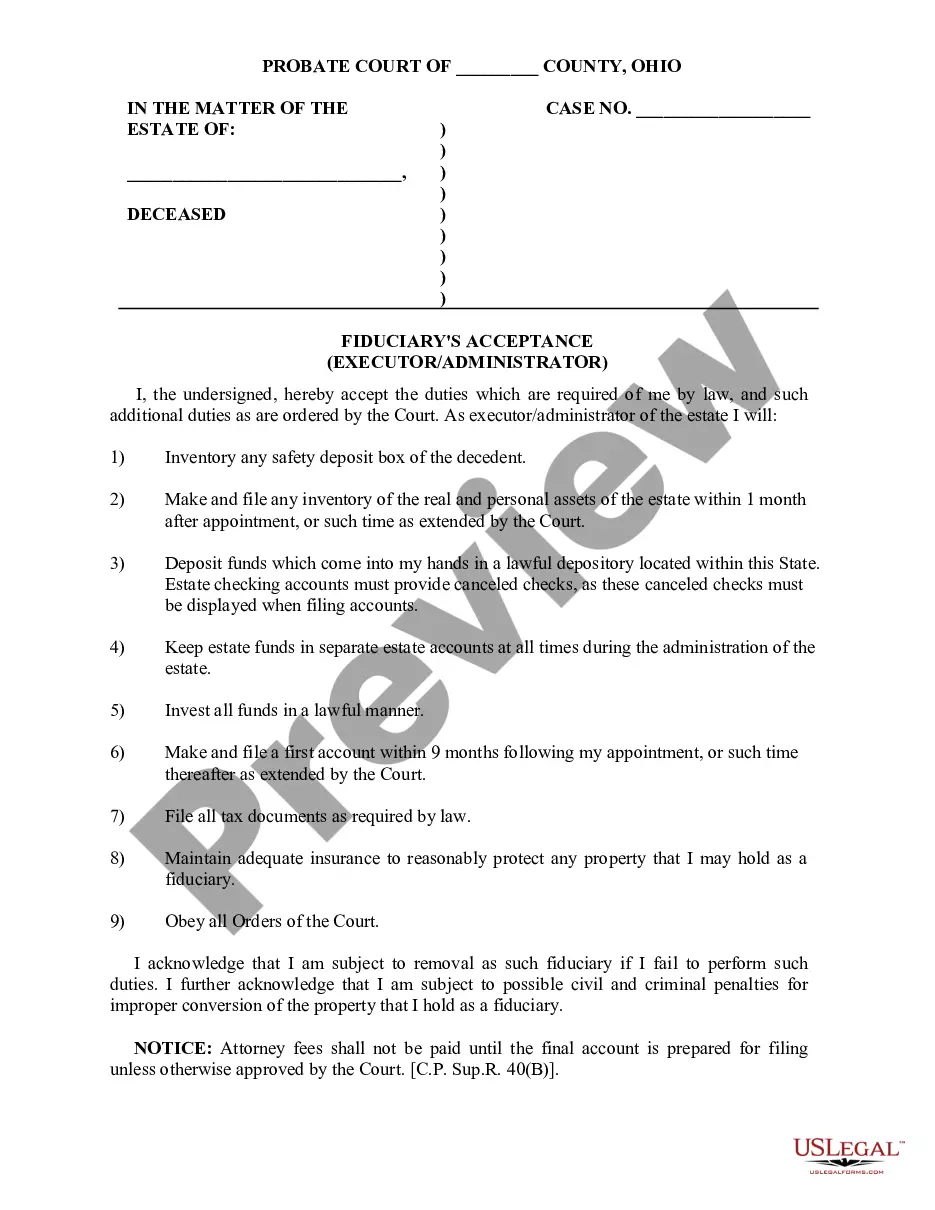

This sample form is a Fiduciary Acceptance - Executor/Administrator document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Columbus Ohio Fiduciary Acceptance - Executor - Administrator

Description

How to fill out Ohio Fiduciary Acceptance - Executor - Administrator?

Are you in search of a reliable and cost-effective legal forms supplier to obtain the Columbus Ohio Fiduciary Acceptance - Executor - Administrator? US Legal Forms is your preferred choice.

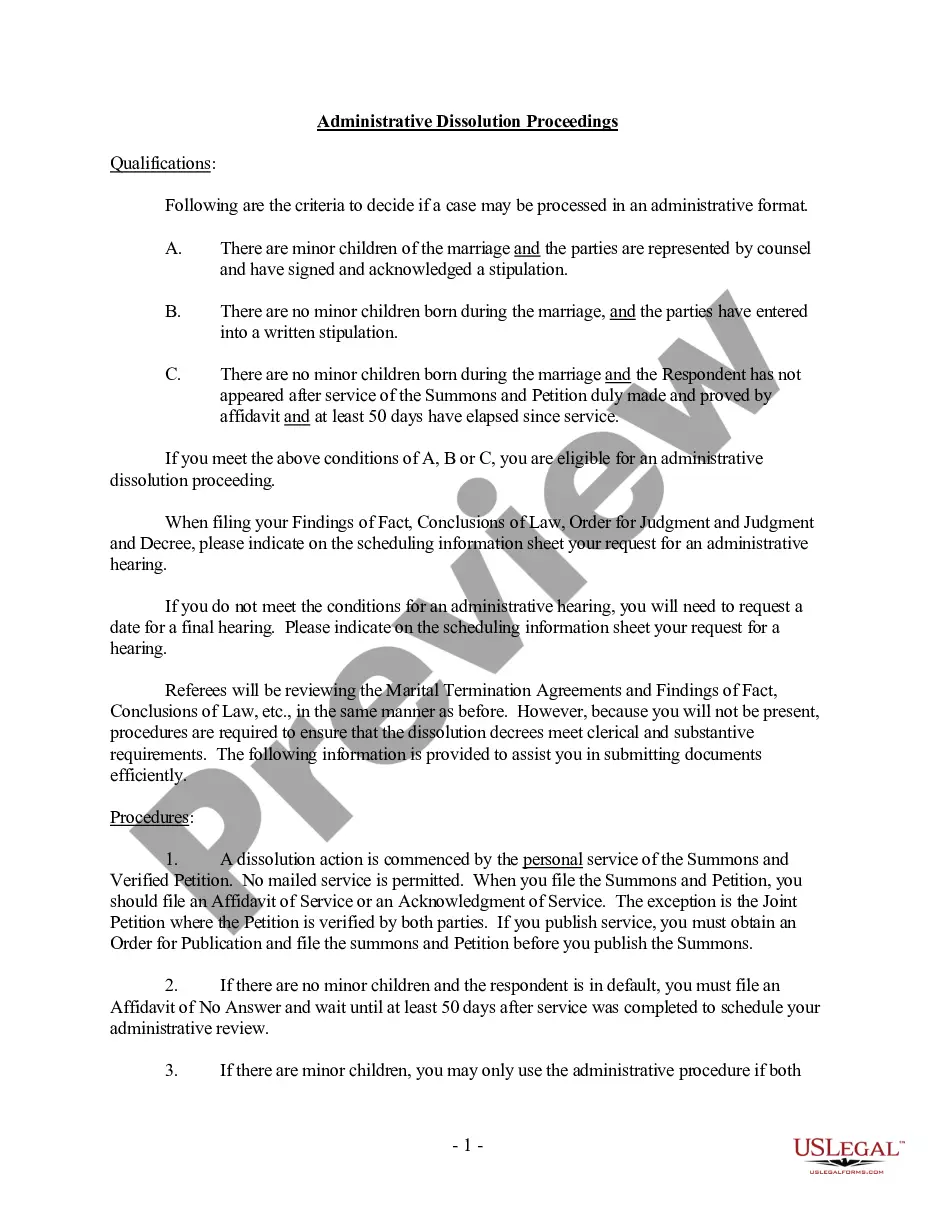

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our site provides over 85,000 current legal document templates for personal and business use. All templates we offer are specifically tailored and aligned with the requirements of individual states and regions.

To access the form, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please note that you can re-download your previously purchased document templates at any time from the My documents section.

Are you a newcomer to our platform? No need to worry. You can easily set up an account, but before doing that, ensure you complete the following steps.

Now you can create your account. Next, select the subscription option and proceed with the payment. Once the payment is finalized, download the Columbus Ohio Fiduciary Acceptance - Executor - Administrator in any available file format. You can return to the site whenever you need and redownload the form at no cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours searching for legal documents online.

- Verify that the Columbus Ohio Fiduciary Acceptance - Executor - Administrator complies with your state and local laws.

- Review the description of the form (if available) to understand whom and what the form is designed for.

- Restart the search if the template isn't appropriate for your legal situation.

Form popularity

FAQ

This means that the beneficiaries in order of preference are: the spouse of the deceased; the descendants of the deceased; the parents of the deceased (only if the deceased died without a surviving spouse or descendants); and the siblings of the deceased (only if one or both parents are predeceased).

Executor Fees: Executors can be compensated for the responsibility taken and the time and effort they put in to complete the estate process. Executor fees in Ohio are set by statute.: 4% of the first $100,000 of probate assets; 3% of the next $300,000; and 2% of the assets above $400,000.

A Fiduciary is the guardian, trustee, executor, administrator, receiver, conservator, or any person who accepts the responsibility for taking care of the needs or property of another person for the benefit of that person. The term usually refers to the executor or administrator of an estate or the trustee of a trust.

Normally, one or more of the executors named in the will applies for the grant of probate. Otherwise (if the person died without a will or the will did not appoint executors) a beneficiary or relative can be the administrator and can apply for letters of administration.

To sell real estate by consent, the executor or administrator must obtain the written authorization to sell the real estate from the decedent's surviving spouse and all of the beneficiaries under the Will or heirs at law.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

(A) Administration of the estate of an intestate shall be granted to persons mentioned in this division, in the following order: (1) To the surviving spouse of the deceased, if resident of the state; (2) To one of the next of kin of the deceased, resident of the state.

Specifically, fiduciary duties may include the duties of care, confidentiality, loyalty, obedience, and accounting. 5. Association Leaders must avoid, disclose, and resolve any conflicts of interest prior to voting or otherwise participating in any deliberations concerning an association matter.

If some executors choose not to be involved in the administration of the estate, they have two choices. They can either renounce their role altogether or they can have 'power reserved' to them, which means they can step back in later on if they choose to.

(B) An executor, administrator, or administrator with the will annexed may commence an action in the probate court, on the executor or administrator's own motion, to sell any part or all of the decedent's real property, even though the real property is not required to be sold to pay debts or legacies.