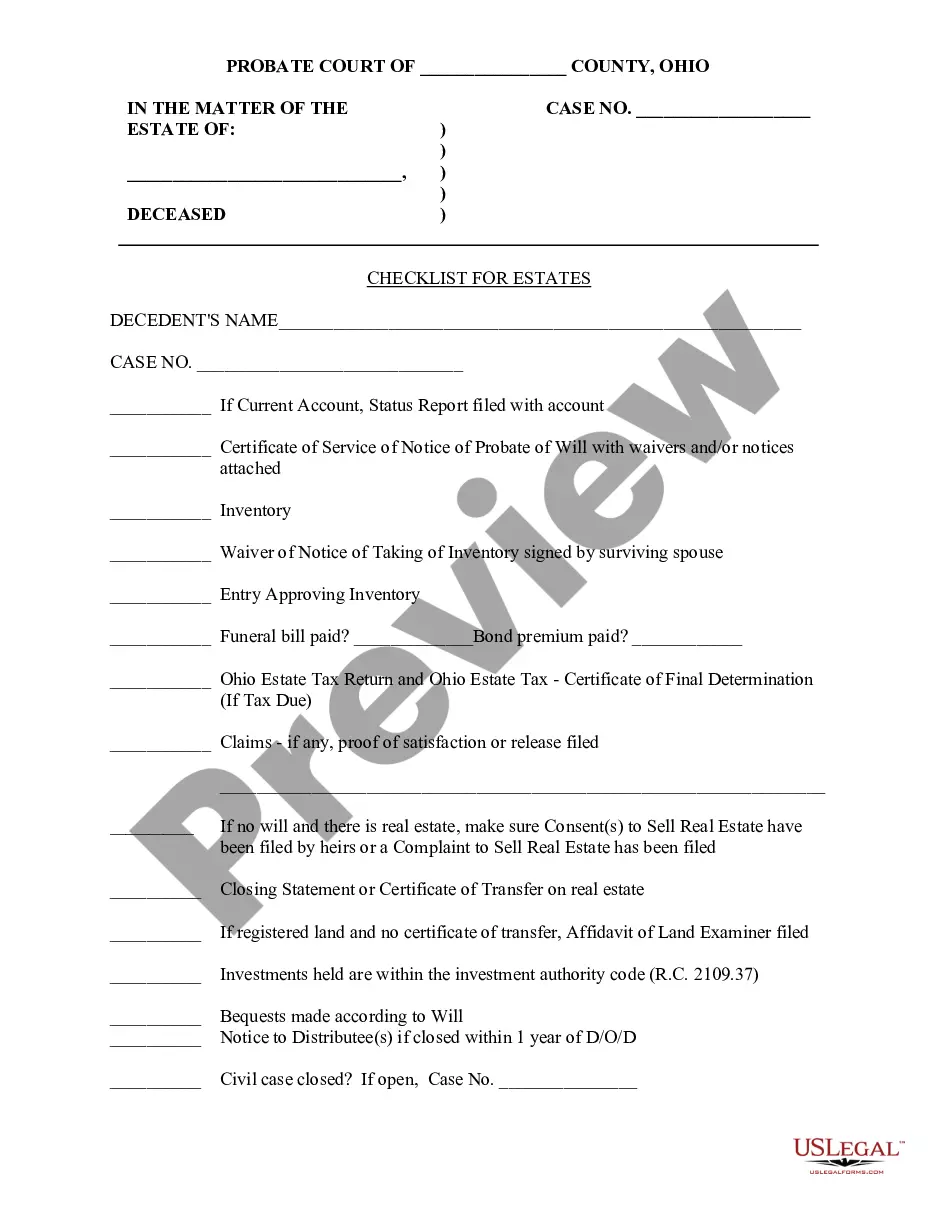

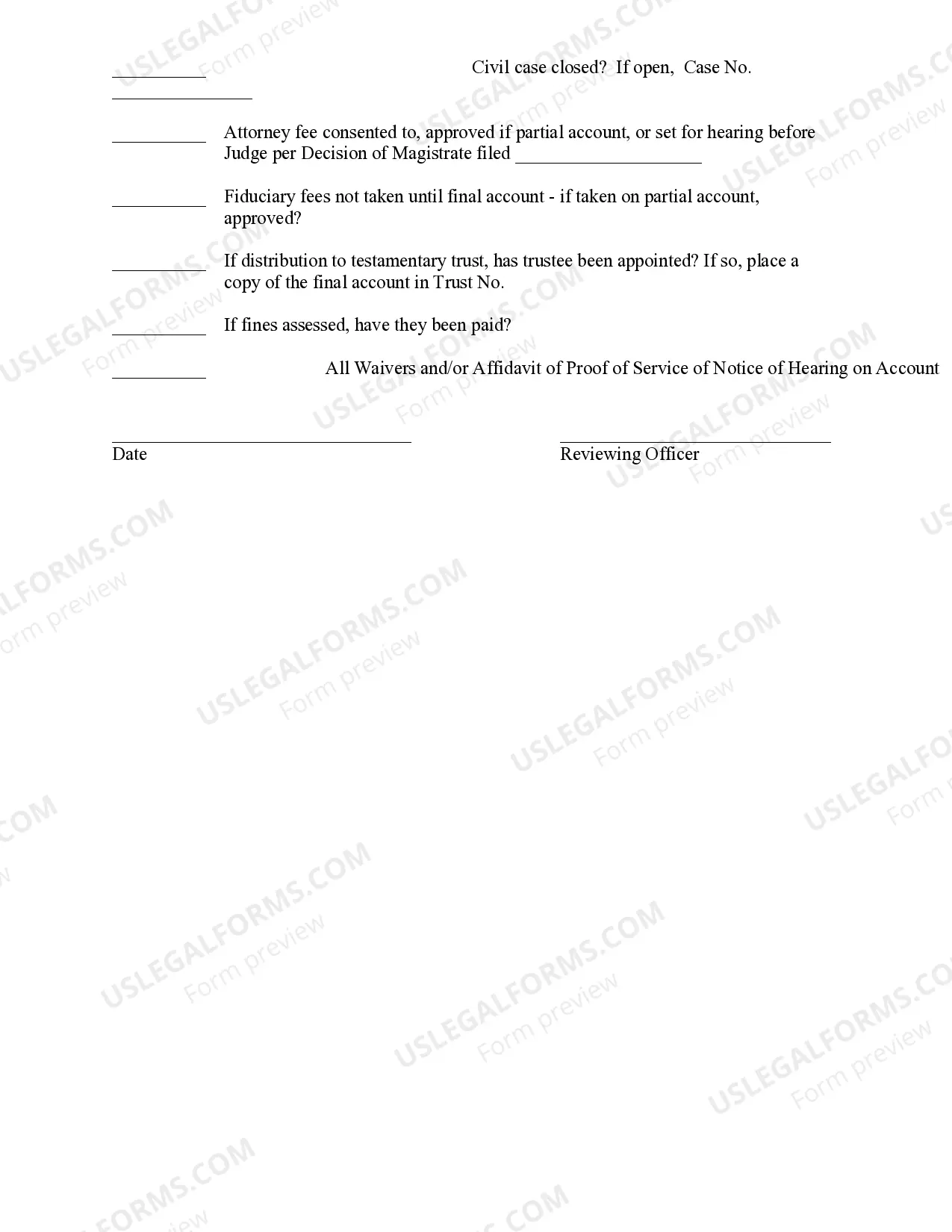

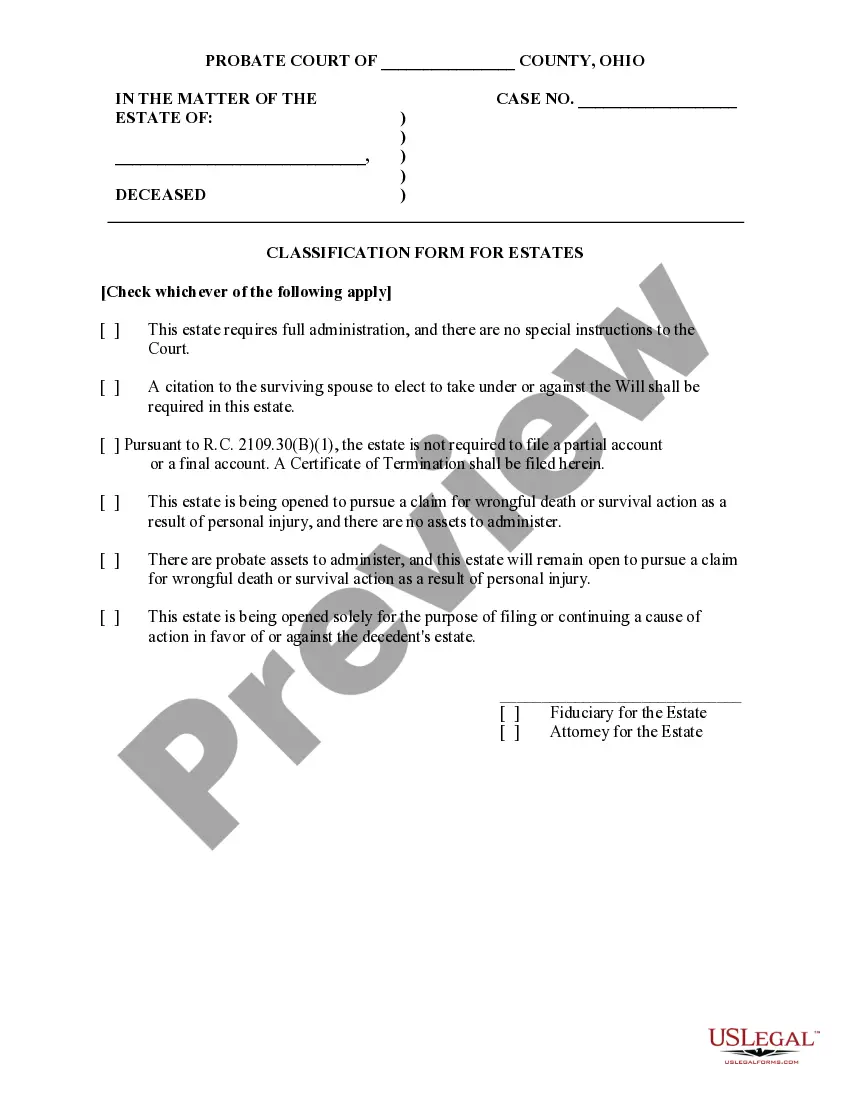

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Dayton Ohio Checklist for Estates

Description

How to fill out Ohio Checklist For Estates?

Take advantage of the US Legal Forms and gain instant access to any document you desire.

Our advantageous website featuring numerous document templates streamlines the method to locate and acquire nearly any document sample you require.

You can download, complete, and validate the Dayton Ohio Checklist for Estates in a matter of minutes rather than spending hours online searching for a suitable template.

Utilizing our repository is an excellent approach to enhance the security of your document filing.

If you haven't created an account yet, follow the instructions outlined below.

Navigate to the page with the form you need. Ensure that it is the document you were searching for: check its title and description, and use the Preview feature if available. If not, use the Search bar to locate the correct one.

- Our skilled attorneys routinely review all documents to ensure that the forms are suitable for a specific region and adhere to new legislation and regulations.

- How can you access the Dayton Ohio Checklist for Estates.

- If you have an existing account, simply Log In. The Download feature will be available on all the documents you examine.

- Moreover, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

Creating an inventory list for probate involves compiling a complete description of all the deceased’s assets and debts. Include items like real estate, bank accounts, and any personal effects. By using a Dayton Ohio Checklist for Estates, you ensure that your inventory meets all legal requirements for probate proceedings.

To make an inventory list, begin by identifying all categories of assets, such as real estate, vehicles, and personal items. Document each item in detail by noting its condition and approximate value. A Dayton Ohio Checklist for Estates can assist you in organizing this process, allowing for a clear and thorough inventory.

In Ohio, an estate inventory typically includes all real property, personal property, financial accounts, and any other assets owned by the deceased. Additionally, it may cover any debts owed by the estate. Following a Dayton Ohio Checklist for Estates can help ensure you include every necessary detail for accurate reporting.

The inventory of a deceased estate is a comprehensive list of all assets owned by the deceased at the time of their passing. This may include real estate, vehicles, bank accounts, investments, and personal possessions. Utilizing a Dayton Ohio Checklist for Estates ensures that you account for all significant items and properly manage the estate.

To create an effective inventory list for an estate, start by gathering all relevant documents such as property deeds, bank statements, and insurance policies. Next, list all assets, including real estate, personal belongings, and financial accounts. This detailed Dayton Ohio Checklist for Estates can guide you, ensuring you don't overlook any crucial items.

In Ohio, household items generally go through probate as part of the estate unless specific exemptions apply. It is essential to assess the value of these items when compiling your inventory. By following the Dayton Ohio Checklist for Estates, you can navigate this process effectively and ensure that all items are appropriately handled during probate.

Yes, clothing is typically considered an asset as it has value, even if it may not be substantial. When you work through the Dayton Ohio Checklist for Estates, remember that all assets, including clothing, should be accounted for in the estate inventory. This ensures a fair distribution according to the wishes of the deceased.

Filling out an estate inventory involves listing all assets and their estimated values accurately. Start by gathering relevant documents, such as bank statements and property deeds, and then systematically record each item. This process is a key step in the Dayton Ohio Checklist for Estates, as it promotes transparency and assists in asset distribution.

In Ohio, certain personal possessions can indeed be distributed before the probate process is completed. However, it's crucial to adhere to the specific laws governing this distribution to avoid complications later on. To ensure compliance with the Dayton Ohio Checklist for Estates, consulting with a legal expert can provide clarity and guidance.

The inventory in an estate typically includes all assets owned by the deceased at the time of their passing. This may consist of real estate, bank accounts, investments, vehicles, and personal possessions. Understanding this inventory is essential for navigating the Dayton Ohio Checklist for Estates, as it helps ensure all property is accounted for and distributed correctly.