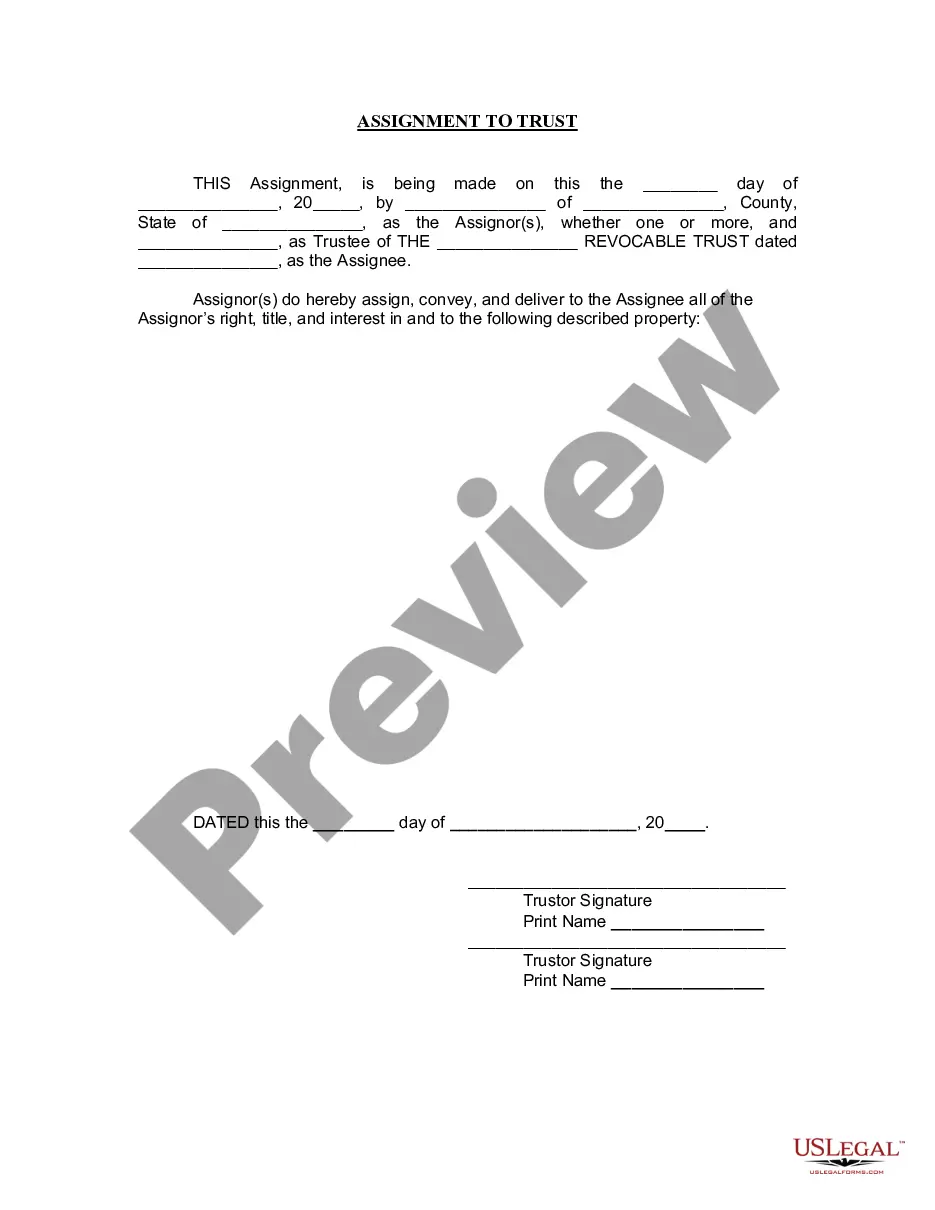

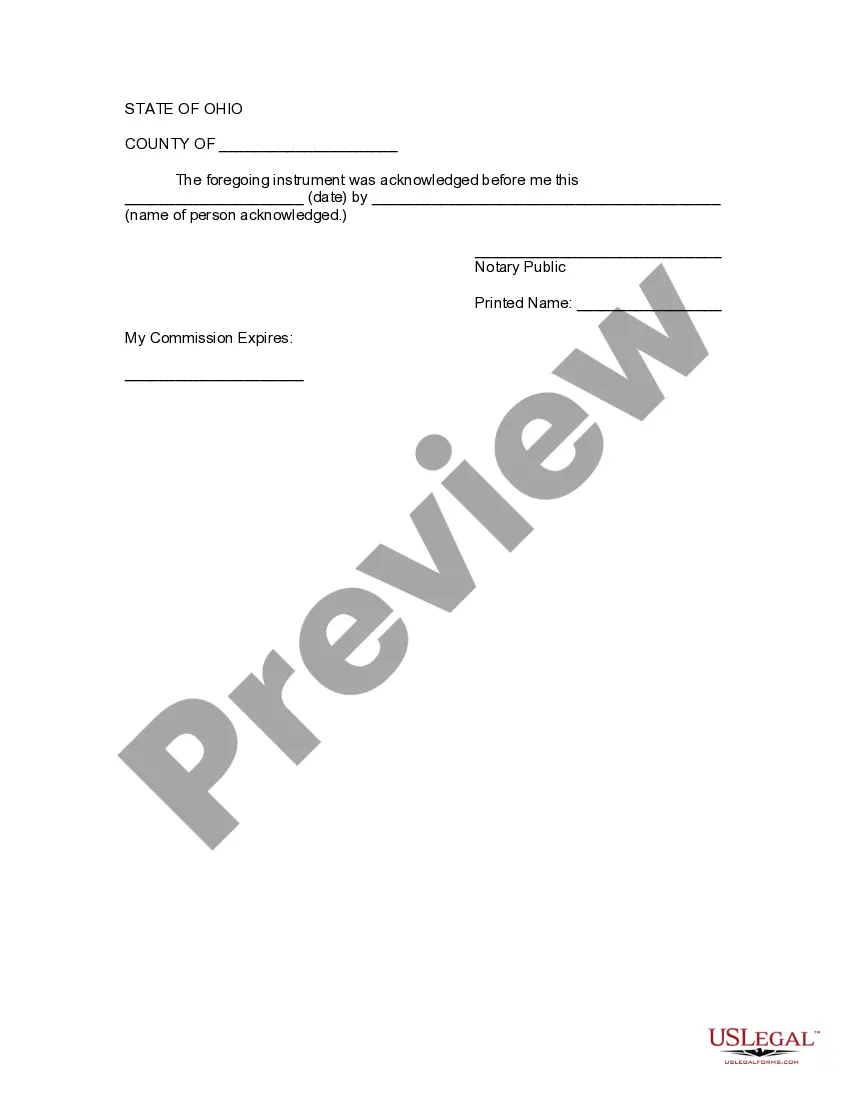

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Franklin Ohio Assignment to Living Trust

Description

How to fill out Ohio Assignment To Living Trust?

Regardless of one's social or occupational rank, finalizing legal-related documents is an unfortunate requirement in the contemporary world.

Frequently, it is nearly unattainable for an individual without a legal foundation to compose such documents from scratch, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms steps in to assist.

Ensure that the template you select is appropriate for your region, as the regulations in one state or area do not necessarily apply to another.

View the form and review a brief overview (if available) of scenarios the document can be utilized for.

- Our platform boasts an extensive repository with over 85,000 ready-to-use state-specific templates that cater to almost any legal circumstance.

- US Legal Forms is also an excellent resource for colleagues or legal advisors looking to enhance their time efficiency with our DIY documents.

- Whether you require the Franklin Ohio Assignment to Living Trust or any other documentation valid in your jurisdiction, US Legal Forms makes everything accessible.

- Here’s how to swiftly obtain the Franklin Ohio Assignment to Living Trust using our reliable platform.

- If you are already a member, you may proceed to Log In to your account to access the applicable form.

- If you are not acquainted with our collection, be sure to follow these instructions before securing the Franklin Ohio Assignment to Living Trust.

Form popularity

FAQ

One potential disadvantage of placing property in a trust is the upfront legal fees involved in establishing the trust. Additionally, if you decide to sell or change the property, it may require additional legal actions to maintain the trust's compliance. It's essential to weigh these factors carefully, and utilizing services like US Legal Forms can help you navigate the intricacies of the Franklin Ohio Assignment to Living Trust, ensuring that you make informed decisions.

To transfer assets into a trust in Franklin Ohio, you will need to formally assign your assets to the trust. This usually involves changing the title of the asset, such as real estate or financial accounts, to reflect the name of the trust. You may find that using a professional service like US Legal Forms simplifies this process, ensuring that all legal requirements are met while securing your assets under the Franklin Ohio Assignment to Living Trust.

In Ohio, a trust does not need to be filed with the court; it is a private agreement. However, certain situations, like a dispute or a need for court intervention, may require court involvement. Your Franklin Ohio Assignment to Living Trust remains confidential until you choose to disclose it. For a smooth experience, rely on uslegalforms to help you navigate trust setup and ensure all legal aspects are correctly handled.

To file a living trust in Ohio, you first need to create the trust document that outlines the trust's terms and the assets involved. After preparing the document, you should sign it before a notary and transfer your assets into the trust. This process establishes your Franklin Ohio Assignment to Living Trust. For assistance, consider using a trusted platform like uslegalforms, which provides resources to simplify the creation and management of your living trust.

Filling out trust paperwork requires careful attention to detail. Begin by gathering all necessary information about your assets and beneficiaries as you prepare your Franklin Ohio Assignment to Living Trust documents. Make sure to follow the instructions precisely and provide accurate information. USLegalForms offers user-friendly templates that ensure you complete your trust paperwork correctly and efficiently.

A common mistake parents make when establishing a trust fund is not clearly defining their intentions and instructions. This lack of clarity can lead to confusion or disputes among beneficiaries. When setting up your Franklin Ohio Assignment to Living Trust, it is vital to communicate your goals and ensure all necessary terms are documented. Using a platform like USLegalForms can help ensure you avoid these pitfalls with clear, precise language.

Transferring property into a trust in Ohio involves several steps. First, you need to create a trust document that specifies the terms of your Franklin Ohio Assignment to Living Trust. Then, you must formally transfer ownership of your property to the trust, which often includes changing the title and deed. Utilizing resources from USLegalForms can simplify this process, guiding you through each essential step.