The dissolution of a corporation package contains all forms to dissolve a corporation in Ohio, step by step instructions, addresses, transmittal letters, and other information.

Toledo Ohio Dissolution Package to Dissolve Corporation

Description

How to fill out Ohio Dissolution Package To Dissolve Corporation?

Regardless of social or occupational standing, completing legal paperwork is an unfortunate requirement in the current professional landscape.

Frequently, it's nearly impossible for an individual without any legal expertise to draft such documents from scratch, primarily due to the intricate terminology and legal subtleties they contain.

This is where US Legal Forms comes to the aid.

Verify that the form you've selected is tailored to your area, keeping in mind that laws from one state or region do not apply to another.

Examine the document and read through a brief summary (if available) of scenarios the document can be utilized for.

- Our platform provides a vast library of over 85,000 ready-to-use state-specific forms suitable for almost any legal circumstance.

- US Legal Forms also serves as a valuable resource for partners or legal advisors who wish to enhance their efficiency by using our DIY forms.

- Regardless of whether you need the Toledo Ohio Dissolution Package to Dissolve Corporation or any other document that would be applicable in your region, US Legal Forms has everything readily available.

- Here’s how you can obtain the Toledo Ohio Dissolution Package to Dissolve Corporation swiftly using our reliable platform.

- If you are already a registered user, feel free to Log In to your account to download the relevant form.

- However, if you are new to our library, please ensure to follow these steps before acquiring the Toledo Ohio Dissolution Package to Dissolve Corporation.

Form popularity

FAQ

To notify the IRS of the dissolution of your corporation, you need to file the final tax return for the corporation. When completing the return, indicate that it is the final return by checking the appropriate box. It is also essential to report the corporation's final income and expenses in this return. Make sure to include a copy of the dissolution documents when submitting your Toledo Ohio Dissolution Package to Dissolve Corporation, as this provides a complete record of your corporation's closure.

Dissolving an LLC can have several disadvantages you should consider. Once you dissolve your LLC, you might encounter challenges with winding up business obligations, which could lead to financial liabilities or unresolved contracts. Furthermore, the loss of limited liability protection may expose personal assets to business debts. Using the Toledo Ohio Dissolution Package to Dissolve Corporation helps you navigate these risks and offers a clear understanding of the dissolution consequences.

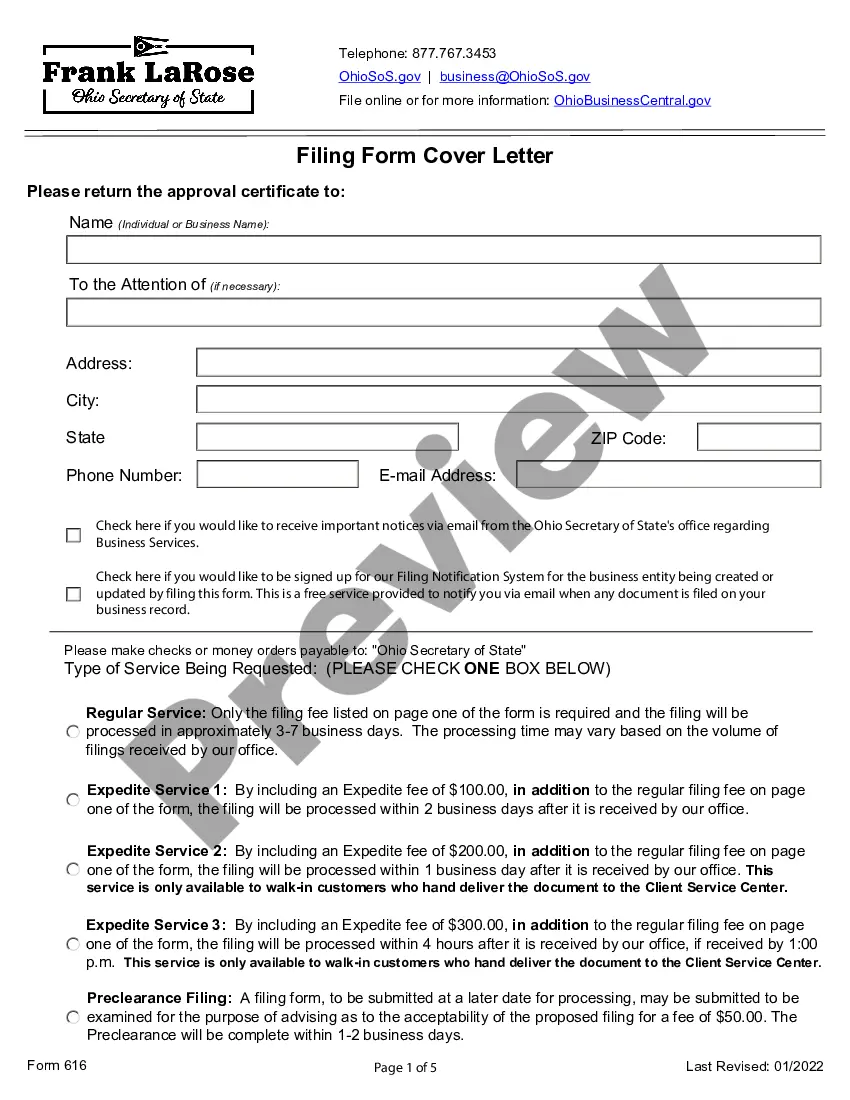

To dissolve your LLC in Ohio, you need to follow several key steps. First, file the Articles of Dissolution with the Ohio Secretary of State, ensuring that you have settled any outstanding debts and obligations. Additionally, be sure to distribute any remaining assets to members according to your operating agreement. Utilizing the Toledo Ohio Dissolution Package to Dissolve Corporation can simplify this process and provide guidance every step of the way.

Dissolving a partnership in Ohio requires specific procedures to be followed. Initially, partners should agree to dissolve and notify any relevant parties. Additionally, file a Statement of Dissolution with the Secretary of State, which can be efficiently handled with a Toledo Ohio Dissolution Package to Dissolve Corporation to help simplify legal requirements and protect all parties involved.

To dissolve a partnership, start by discussing the decision with your partner and reach a mutual agreement. Then, settle any outstanding debts and obligations and distribute the partnership assets. Filing the necessary documents with the state is crucial, and using a Toledo Ohio Dissolution Package to Dissolve Corporation can streamline this process, ensuring compliance with Ohio laws.

Breaking up a business partnership involves several key steps. First, review your partnership agreement to understand the terms related to dissolution. Next, openly communicate with your partner about your intentions. Finally, consider using a Toledo Ohio Dissolution Package to Dissolve Corporation to ensure you follow the legal requirements and protect your interests throughout the process.

Dissolving a corporation does not automatically trigger an audit; however, it may raise red flags depending on the circumstances. If your corporation has unresolved tax issues or compliance problems, an audit may be more likely. It is wise to address any outstanding concerns before starting the dissolution process. Using a Toledo Ohio Dissolution Package to Dissolve Corporation helps ensure you cover all bases and minimize future audit risks.

The dissolution of a company involves several steps, including notifying employees, settling debts, and filing dissolution documents with the state. You will also need to cancel any business licenses and permits. Once you complete all legal requirements, the state will officially dissolve your company. Consider leveraging a Toledo Ohio Dissolution Package to Dissolve Corporation to navigate this process effectively.

To dissolve a business partnership in Ohio, partners should first review their partnership agreement. You must notify all partners and reach an agreement on settling debts and distributing assets. Filing the necessary documents with the state may also be required. A Toledo Ohio Dissolution Package to Dissolve Corporation can simplify this process and ensure you follow all legal requirements.

Dissolving a corporation starts with submitting the appropriate dissolution documents to the state of Ohio. You will need to settle any outstanding debts and obligations before proceeding. After filing, the state will process your paperwork and issue a Certificate of Dissolution. Consider using a Toledo Ohio Dissolution Package to Dissolve Corporation for a smoother experience, as it guides you through each step.