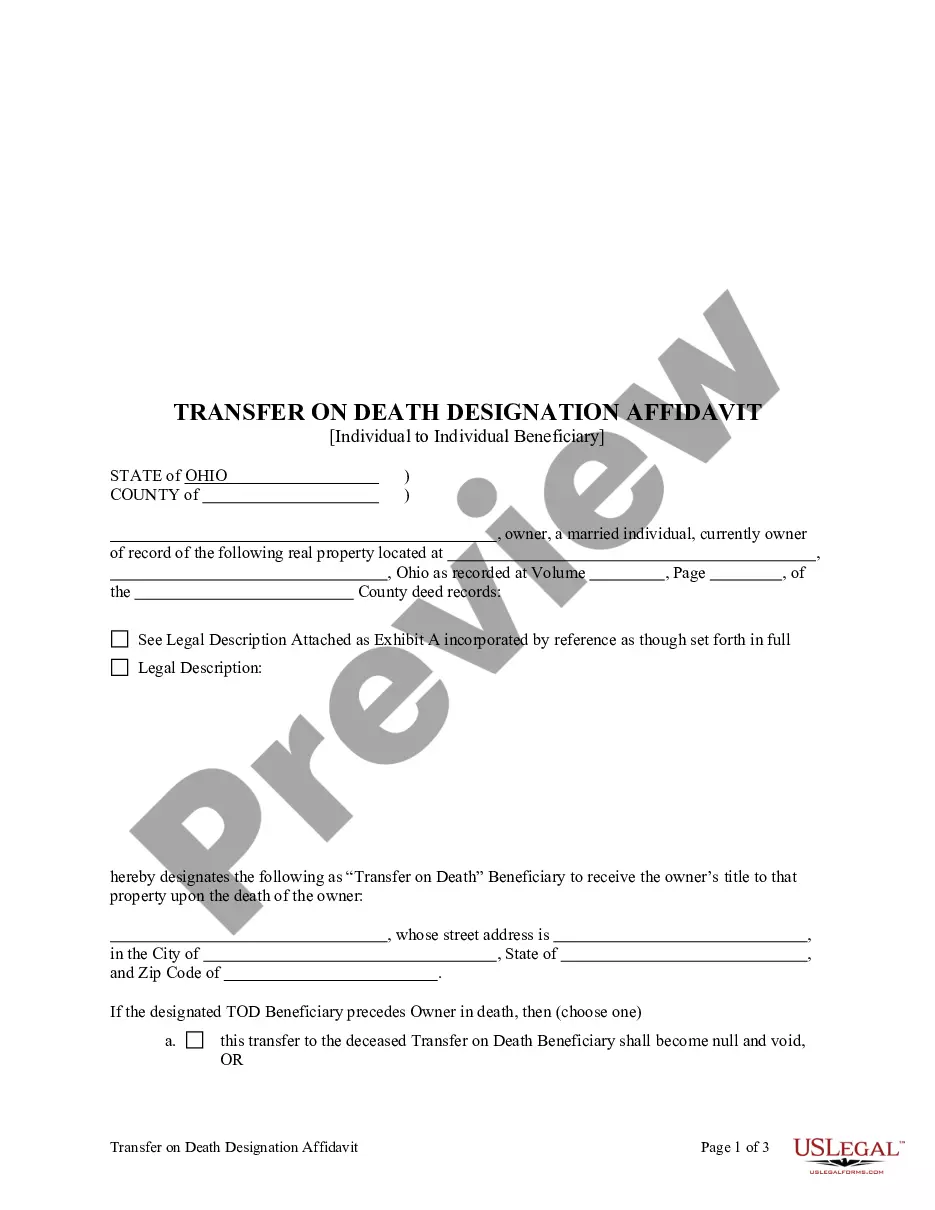

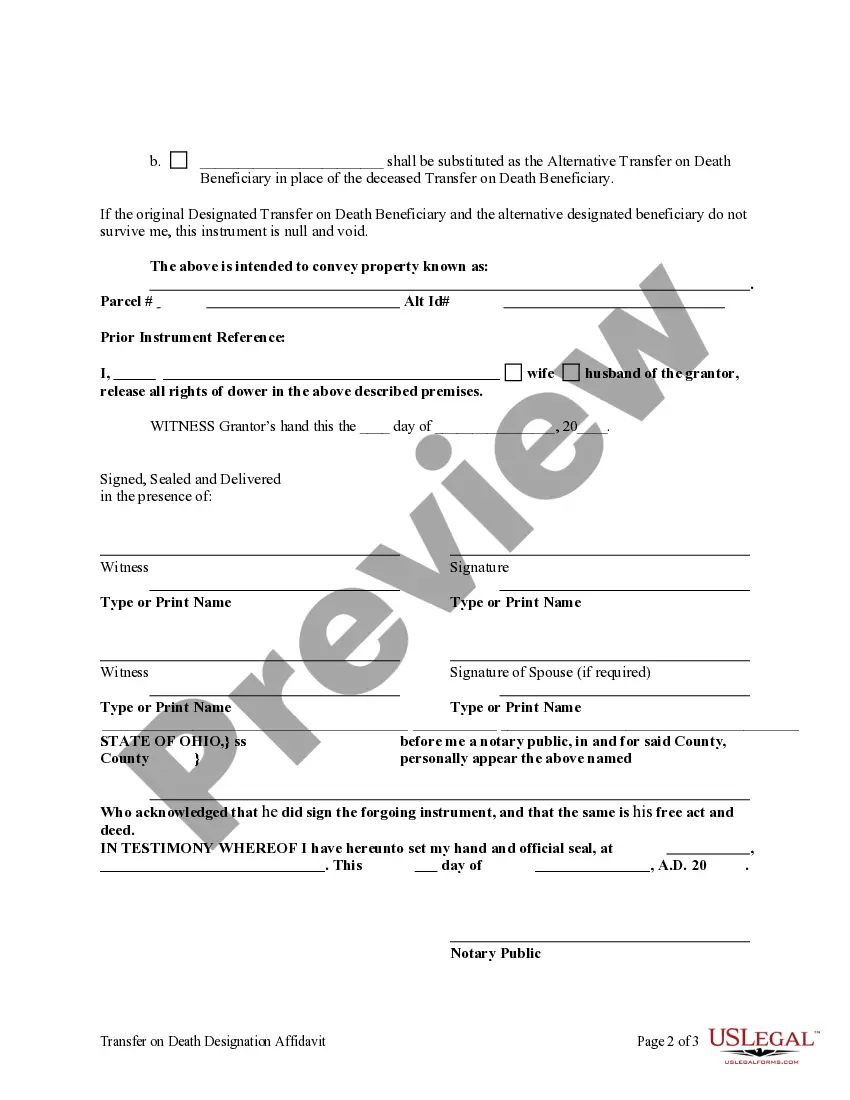

Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the designated Beneficiary. It should be signed in front of a Notary Public. The form includes provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the affiant/owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the affiant's entire, separate interest in the real property to one or more persons, including the affiant, with or without the designation of another transfer on death beneficiary.

Columbus Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual With Contingent Beneficiary?

Locating validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both personal and professional use across various real-world situations.

All the files are systematically organized by area of application and jurisdictional zones, making it simple and quick to find the Columbus Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary.

Maintaining documents organized and compliant with legal requirements is critically important. Leverage the US Legal Forms library to always have vital document templates for any needs right at your fingertips!

- For those already acquainted with our catalog and who have accessed it previously, obtaining the Columbus Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary requires just a few clicks.

- Simply Log In to your account, choose the document, and hit Download to store it on your device.

- This procedure will require only a few more steps for new users.

- Follow the steps below to begin with the most comprehensive online form library.

- Examine the Preview mode and document description. Ensure you’ve chosen the correct one that aligns with your needs and fully meets your local jurisdiction criteria.

Form popularity

FAQ

No one can change beneficiary designations after you die. There are two circumstances when you need another person's permission to update a beneficiary: if the policyholder lives in a community property state or if they named someone as an irrevocable beneficiary.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own.Find a copy of your deed.Complete the TOD for real estate form.Take the form to a notary .Submit the form at your County Recorder's Office.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (?TOD?) Designation Affidavit. What is a TOD Designation Affidavit?

The Transfer on Death Designation Affidavit (TOD), when properly recorded, permits the direct transfer of the described real property to the designated beneficiary or beneficiaries upon the death of the owner, thus avoiding Probate administration.

You can create a TOD Deed simply by moving real estate from your name only into your Beneficiary's name as a TOD. The property remains yours and you continue to control it until you pass away, at which point the deed automatically transfers to the name of your Beneficiary.

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty. However, the beneficiary of a Will is very different than an individual named in a beneficiary designation of an asset held by a financial company.

Trustees generally do not have the power to change the beneficiary of a trust. The right to add and remove beneficiaries is a power reserved for the grantor of the trust; when the grantor dies, their trust will usually become irrevocable. In other words, their trust will not be able to be modified in any way.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (?TOD?) Designation Affidavit. What is a TOD Designation Affidavit?

Transfer on Death (TOD) Similarly, you can use a transfer on death affidavit to automatically transfer real estate or vehicles upon your death. Assets designated as TOD will not need to pass through probate court.

Ohio Eliminates Transfer on Death Deeds. Get answers to questions on the impact of Ohio's elimination of Transfer on Death deeds. Effective December 28, 2009, Ohio eliminated transfer on death deeds and replaced that deed with a TRANSFER ON DEATH DESIGNATION AFFIDAVIT.