Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New York Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are in search of a legitimate form template, it’s unattainable to discover a superior platform than the US Legal Forms site – one of the most comprehensive online collections.

Here you can locate a vast number of templates for business and personal objectives categorized by types and states, or keywords. With our top-notch search feature, locating the most recent Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate is as simple as 1-2-3.

Moreover, the significance of each document is validated by a team of qualified attorneys who routinely review the templates on our site and amend them in accordance with the latest state and county regulations.

Obtain the template. Specify the format and save it on your device.

Make modifications. Complete, edit, print, and sign the acquired Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate. Each template you save in your account has no expiration date and is yours indefinitely. You always have the option to access them via the My documents menu, so if you wish to have another version for editing or producing a hard copy, you can return and download it again at any time. Utilize the US Legal Forms extensive catalog to obtain the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate you were searching for along with numerous other professional and state-specific samples in one location!

- If you are already familiar with our system and possess a registered account, all that’s required to obtain the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the very first time, just follow the instructions outlined below.

- Ensure you have located the form you need. Review its details and use the Preview option (if accessible) to examine its content. If it does not fulfill your needs, utilize the Search bar at the top of the screen to find the correct document.

- Verify your selection. Click the Buy now button. After that, select your desired pricing plan and enter information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

A reasonable interest rate for a Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate typically falls between 5% and 10%, depending on various factors such as the borrower's creditworthiness and prevailing market conditions. It's essential to research current rates and consider reasonable terms to ensure fairness for both parties. Always document the interest rate clearly in the note to avoid confusion later on. Additionally, platforms like uslegalforms can help you create and customize your promissory note to include the agreed-upon rate.

Examples of promissory notes include personal loans between family members, business loans, and more formal agreements such as the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate. Each example shares common elements like the amount owed, terms of repayment, and signatures. These notes can vary in complexity based on the nature of the agreement.

Writing a simple promissory note is straightforward. Start by stating that the borrower promises to repay a specific sum to the lender, including the repayment schedule and interest rates. Finally, include signatures, dates, and any additional relevant terms, ensuring that all parties clearly understand their obligations.

An unsecured form of promissory note refers to loans that do not require collateral to back the borrowed amount. In the context of the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate, this means the lender cannot claim physical assets if the borrower defaults. However, it still carries legal obligations for repayment.

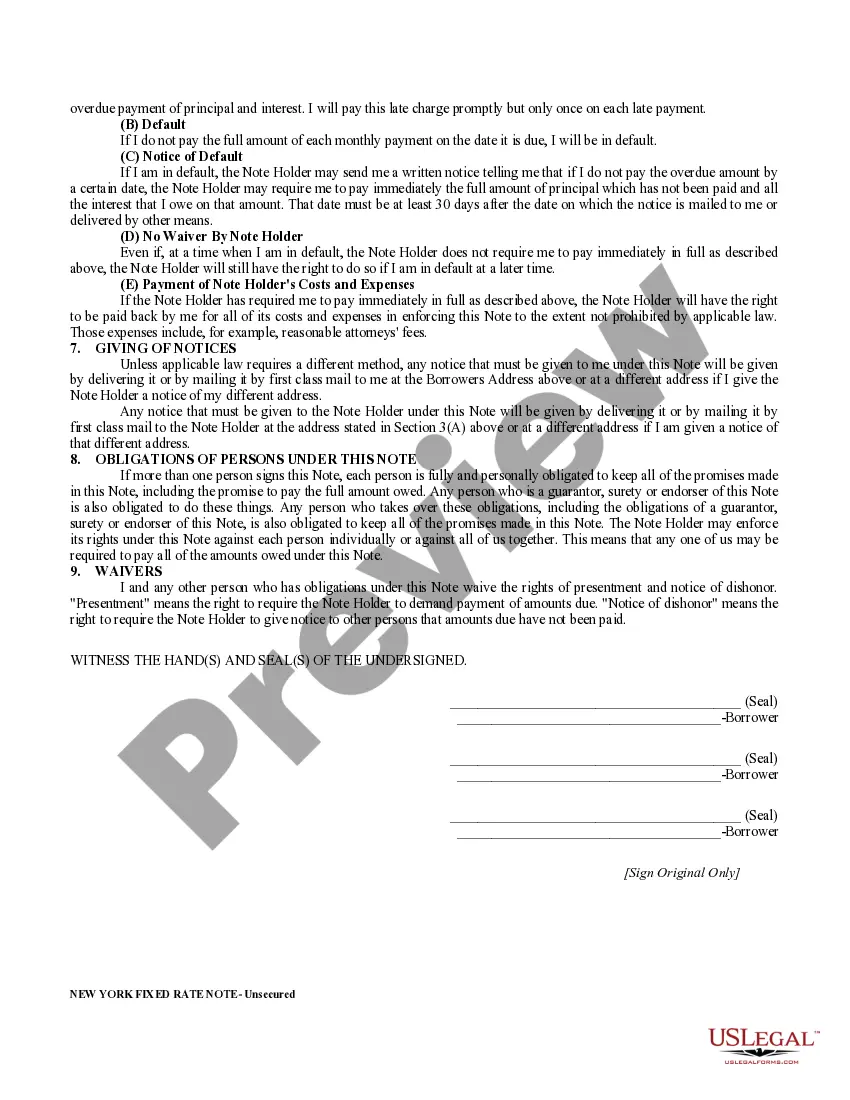

When filling out a sample for the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate, start by indicating the title at the top of the document. Next, fill in the principal amount, interest rate, and all contact information for both parties. Follow it with a clear repayment schedule and conclusion by signing at the end.

To make the Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate legally binding, ensure it includes essential elements like the date, parties' details, amount, terms of repayment, and signatures. You should also consider having the document notarized to enhance its legal weight. Compliance with state laws will further ensure its enforceability.

Yes, a promissory note can be unsecured, meaning it doesn't involve collateral. This type of note relies on the borrower's promise to repay and can be based largely on trust and creditworthiness. For those considering a Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate, it's essential to evaluate the borrower's financial health before entering into such an agreement.

Recording a payment on a Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate requires maintaining accurate financial records. Each payment should be documented, noting the date, amount, and remaining balance. This helps both parties stay informed about the obligations and can prevent disputes. Utilizing platforms like uslegalforms can simplify this process for you.

To enforce a Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate, start by communicating directly with the borrower to discuss the missed payments. If informal discussions do not resolve the issue, legal action may be necessary. Consider consulting with an attorney who specializes in contract law to explore your options, such as filing a lawsuit for breach of contract.

When you receive payments from a Nassau New York Unsecured Installment Payment Promissory Note for Fixed Rate, you generally need to report the interest income on your tax return. It's important to keep accurate records of the payments received. For tax purposes, the original amount of the promissory note is not taxable. However, any interest earned from that note contributes to your taxable income.