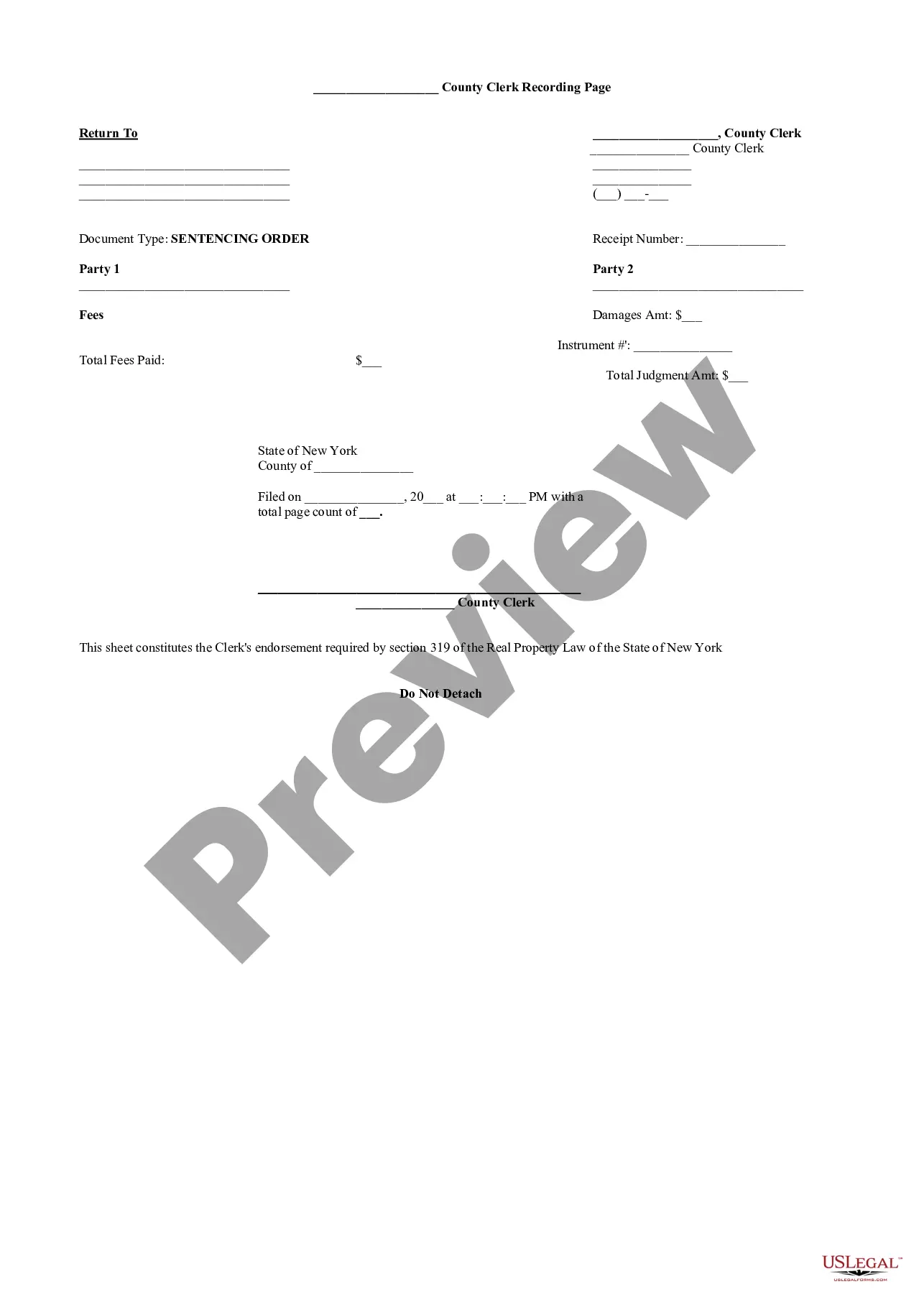

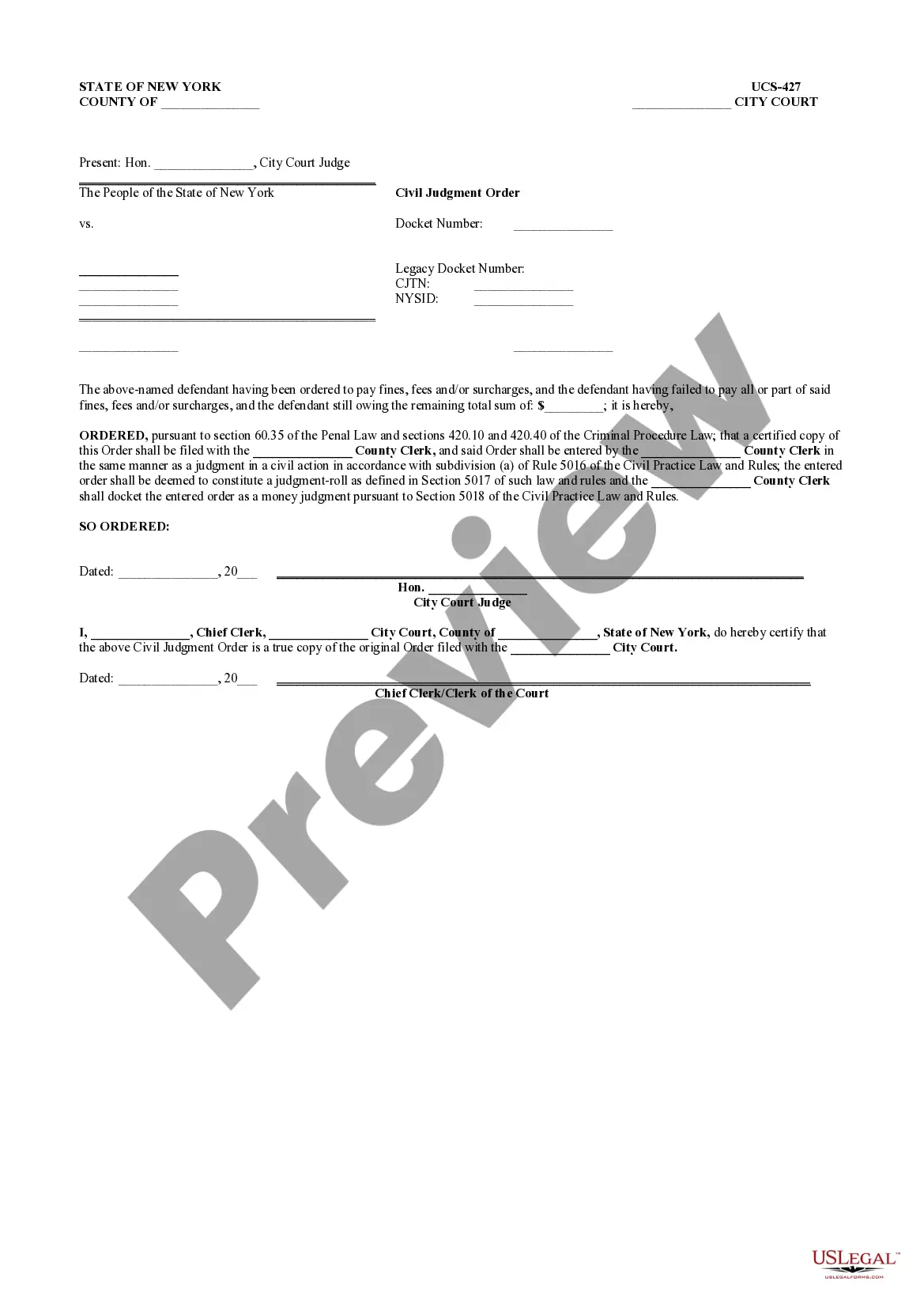

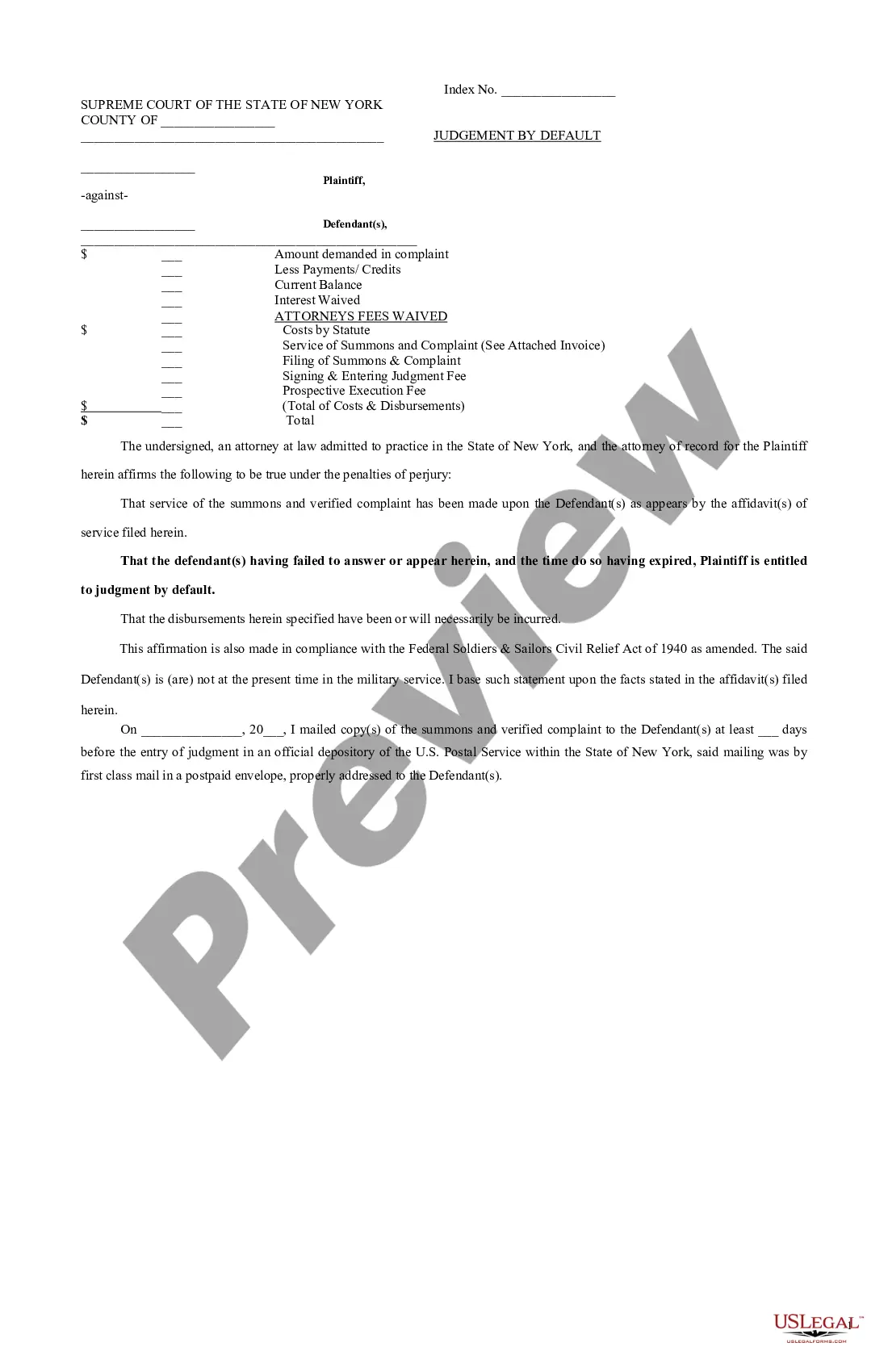

Nassau New York Civil Judgment Order

Description

How to fill out New York Civil Judgment Order?

We consistently seek to minimize or evade legal challenges when engaging with intricate legal or financial issues.

To achieve this, we enlist attorney services that are generally very expensive.

Nevertheless, not every legal challenge is that complicated.

Many of them can be handled by ourselves.

Utilize US Legal Forms anytime you need to locate and download the Nassau New York Civil Judgment Order or any other form easily and securely.

- US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your affairs independently without the need to consult an attorney.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to state and locality, which greatly streamlines the search process.

Form popularity

FAQ

The Show Cause rule is a legal procedure that requires a party to explain or justify why a court should not take a specific action. This rule often results in a short notice period for the party to respond. Understanding the implications of the Show Cause rule is essential, especially within the context of Nassau New York Civil Judgment Order cases. For clarity on procedures, utilizing resources like USLegalForms can be beneficial.

Responding to an Order to Show Cause involves drafting a detailed response that addresses the points raised in the order. You should file your response with the court and serve copies to all parties involved in the case. Make sure to follow the Nassau New York Civil Judgment Order guidelines to maintain the integrity of your response. If you're unsure how to proceed, consider using USLegalForms for templates and guidance.

When responding to a motion in New York, the standard timeframe is usually 20 days from the date you receive the motion papers. However, this could differ depending on the court's rules or specific orders in your case. It is essential to check the deadlines set in relation to your Nassau New York Civil Judgment Order to prevent any adverse consequences. Ensuring timely responses will help protect your rights.

To oppose an Order to Show Cause in New York, you must file your opposition with the court. It's important to prepare your documents carefully, clearly outlining your reasons for opposing the order. Additionally, you should serve your opposition papers to the other party involved in the case. Always keep in mind the deadlines and procedures specific to Nassau New York Civil Judgment Order to ensure your response is valid.

A civil judgment in New York, including a Nassau New York Civil Judgment Order, can last for 20 years if not satisfied or renewed. It’s crucial to be aware of this time frame, as it affects your financial obligations and credit report. Once understood, you can plan accordingly, whether it involves settling the judgment or seeking legal advice.

Filing a judgment in New York involves submitting the necessary paperwork to the court where your case was heard. You must also ensure that you provide copies to all relevant parties and comply with any specific requirements the court may have. For assistance, consider exploring services provided by USLegalForms to simplify your Nassau New York Civil Judgment Order filing process.

To file a civil lawsuit in New York, you need to prepare your complaint and file it with the appropriate court. Make sure to include all relevant details about your claim and the relief you seek. If you are unsure about the process, USLegalForms offers comprehensive resources to help you navigate filing a Nassau New York Civil Judgment Order lawsuit.

While it is important to address any civil judgment, there are ways to handle them without paying the full amount immediately. Consider negotiating a lower settlement with the creditor or contesting the judgment if you believe it was unfair. Utilizing resources like USLegalForms can provide guidance on how to effectively respond to a Nassau New York Civil Judgment Order.

In New York, a civil judgment does not automatically fall off after 7 years. Instead, judgments can remain enforceable for a longer period, often up to 20 years, unless the creditor chooses not to renew it. This extended duration applies specifically to Nassau New York Civil Judgment Orders as well.

In New York, a civil judgment, including a Nassau New York Civil Judgment Order, typically does not expire; however, a creditor must take steps to enforce it. A judgment can last for up to 20 years if it is properly renewed. If you obtain a judgment, be aware that it may remain on your credit report for several years, affecting your financial options.