Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

We consistently endeavor to diminish or avert legal complications when managing subtle legal or financial matters.

To accomplish this, we seek legal assistance that, as a general rule, tends to be highly expensive.

However, not every legal concern is equally complicated. Most can be handled by us directly.

US Legal Forms is a digital repository of current DIY legal documents encompassing anything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and select the Get button beside it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure is just as uncomplicated if you are new to the platform! You can create your account in just a few minutes. Ensure that the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors complies with the laws and regulations of your state and region. Additionally, it’s crucial that you review the form’s description (if available), and if you find any inconsistencies with what you were initially seeking, look for a different template. Once you’ve confirmed that the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors is appropriate for you, you can select the subscription plan and complete the payment. Then you can download the document in any accessible file format. For over 24 years, we’ve assisted millions of individuals by supplying ready-to-customize and current legal documents. Make use of US Legal Forms now to conserve time and resources!

- Our library empowers you to take control of your matters independently without needing a lawyer.

- We provide access to legal form templates that are not always readily available to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you require to locate and download the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors or any other form swiftly and securely.

Form popularity

FAQ

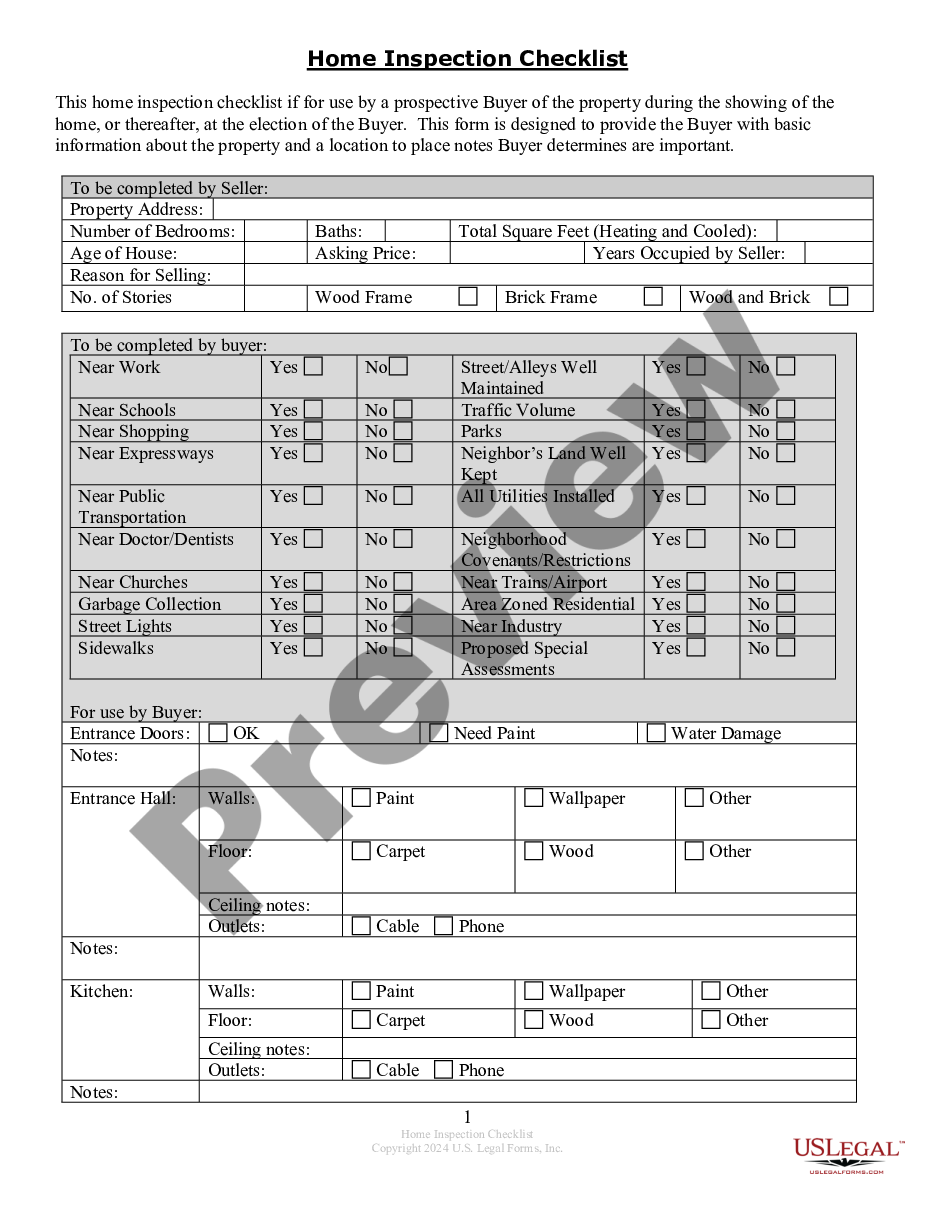

To assume a mortgage, you need a few key documents that typically include the assumption agreement itself, a credit application, and possibly other financial disclosures. This paperwork confirms your ability to take over the existing mortgage and outlines the terms. Engaging with the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors ensures that all parties involved understand their responsibilities. Using platforms like US Legal Forms can simplify gathering these documents.

An assumption and release agreement combines the transfer of mortgage obligations with the release of the original mortgagor’s liabilities. Specifically, the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors facilitates this process by clearly outlining how the responsibilities shift from the seller to the buyer. This dual purpose enhances legal clarity and protects all parties involved during real estate transactions.

The assumption agreement for a mortgage outlines the transfer of mortgage obligations from one borrower to another. In the context of the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors, it signifies that the new borrower agrees to adhere to the original terms while relieving the prior borrower of their responsibilities. This agreement simplifies the transfer of property and can enhance buyer confidence.

One disadvantage of an assumable mortgage involves the potential for a higher interest rate compared to current market rates, which may burden the new borrower. Additionally, the original borrower may remain liable if the new borrower defaults on payments unless a release agreement is signed. The Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors can help address these concerns by clarifying liabilities.

An assumption clause typically specifies that a new borrower can assume existing mortgage terms under certain conditions. For the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors, it may state that upon approval, the new borrower agrees to all the terms set forth in the original mortgage. This clause aims to formalize the transition and clarify the new borrower's responsibilities.

The assumption agreement serves to transfer the mortgage obligation from the original borrower to the new borrower. In the case of the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors, it ensures that the new borrower takes on the mortgage's payment responsibilities. This agreement can facilitate smoother transactions during property sales and protect the interests of all involved.

An assumption and release of liability agreement allows a buyer to take over the seller’s mortgage while also releasing the original borrower from responsibility. In the context of the Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors, this means the seller is no longer liable for the mortgage once the buyer assumes it. This can benefit both parties by clarifying responsibilities and ensuring the mortgage continues smoothly.

The parties involved in a Nassau New York Assumption Agreement of Mortgage and Release of Original Mortgagors include the lender, the original mortgagors, and the new borrower. The lender typically retains the right to approve or decline the assumption based on the new borrower's financial standing. The original mortgagors must agree to release their liability, while the new borrower assumes responsibility for the mortgage payments. This agreement protects everyone's interests and clarifies the obligations under the mortgage.