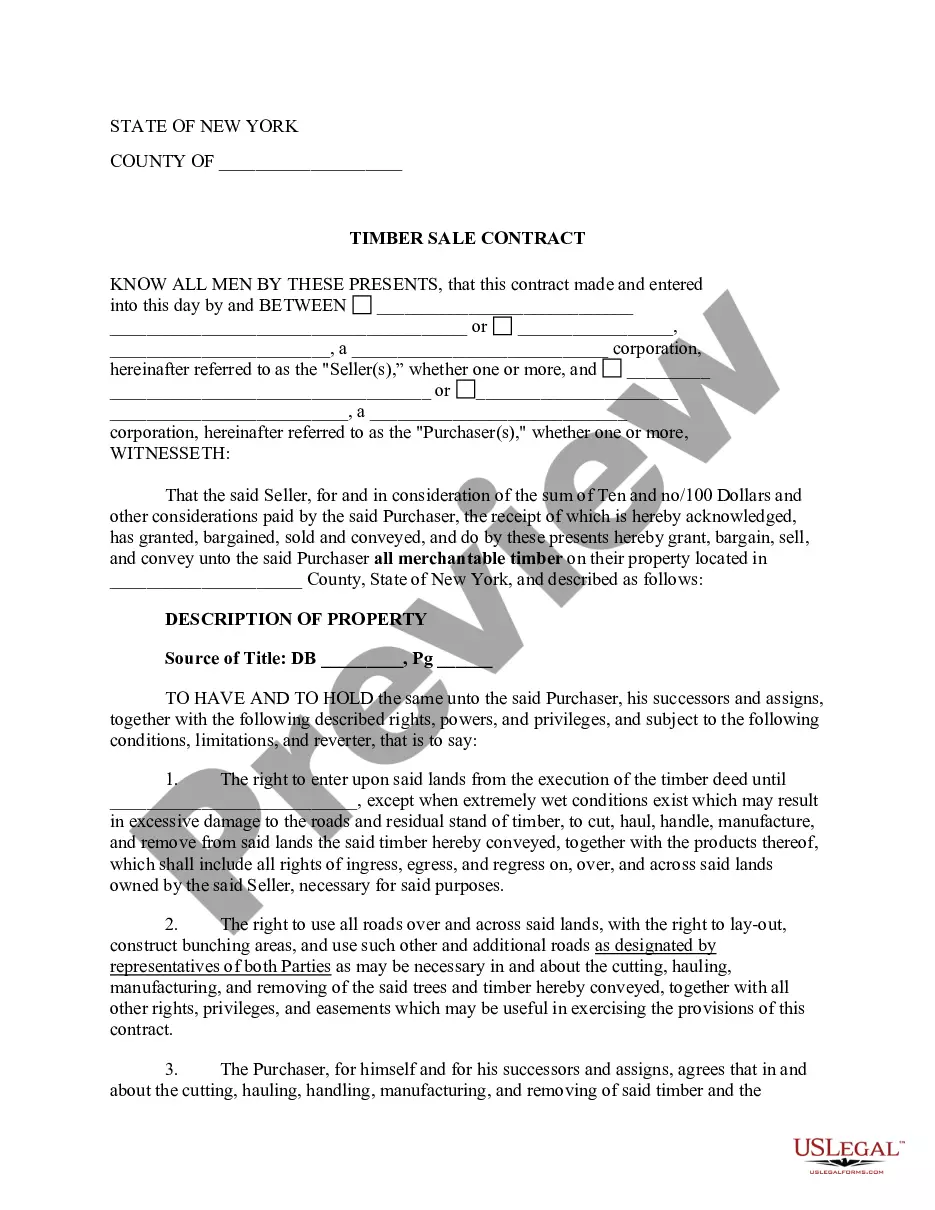

Syracuse New York Forest Products Timber Sale Contract

Description

How to fill out New York Forest Products Timber Sale Contract?

Are you in search of a reliable and affordable provider of legal forms to obtain the Syracuse New York Forest Products Timber Sale Agreement? US Legal Forms is your ideal choice.

Whether you require a simple contract to establish rules for living together with your partner or a bundle of documents to facilitate your separation or divorce in court, we have you covered. Our platform provides over 85,000 current legal document templates for personal and commercial use. All templates that we provide access to are not generic and are structured in accordance with the specifications of individual states and counties.

To download the form, you must Log In to your account, locate the desired template, and click the Download button next to it. Please remember that you can download your previously acquired form templates anytime from the My documents section.

Are you unfamiliar with our website? No problem. You can easily create an account, but before that, ensure to do the following.

Now you are ready to set up your account. Next, select a subscription plan and proceed to payment. Once the payment is completed, download the Syracuse New York Forest Products Timber Sale Agreement in whichever format is available. You can return to the website whenever you need and redownload the form free of charge.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop spending hours deciphering legal paperwork online.

- Verify if the Syracuse New York Forest Products Timber Sale Agreement complies with the laws of your state and local region.

- Review the form’s details (if available) to understand who and what the form is intended for.

- Restart your search if the template does not meet your particular needs.

Form popularity

FAQ

To sell timber on your property, consider working with a professional forester who can help you assess your timber value and market it effectively. Utilizing a Syracuse New York Forest Products Timber Sale Contract can simplify this process, providing a clear framework for the sale. You can list your timber for sale or reach out to local timber buyers. Having an expert guide you can help maximize your profit and streamline the selling process.

Reporting timber sales on your taxes involves including the income as ordinary income on your tax return. If you've sold timber under a Syracuse New York Forest Products Timber Sale Contract, you should keep detailed records of the sale, including receipts and contracts. It's wise to consult the IRS guidelines or seek help from a tax advisor to ensure you accurately report all relevant details. This helps you avoid potential issues down the line.

Yes, timber sales are generally considered ordinary income. When you sell timber under a Syracuse New York Forest Products Timber Sale Contract, the income you earn from the sale typically falls under this category. It's essential to understand your tax obligations regarding these sales, as they can vary based on how you manage your timberland. Consulting a tax professional can help clarify your specific situation.

Timber leases grant rights to a logger or timber company to harvest trees from your property for a specified period. Typically, the lease contains terms about payment and the management of timber resources. Using a Syracuse New York Forest Products Timber Sale Contract can help clarify these terms and protect your rights as a landowner. This approach contributes to a fair and productive partnership between you and the lessee.

To claim timber sales on your taxes, you need to report the income received from selling timber as part of your gross income. It's essential to keep accurate records of costs associated with the sale, such as expenses incurred during harvesting. By leveraging a Syracuse New York Forest Products Timber Sale Contract, you can track financial aspects effectively, ensuring you meet tax regulations while maximizing deductions where applicable. Consulting with a tax professional can further clarify the process.

Timber contracts serve as legally binding documents that define the sale of timber from land. These contracts typically detail important aspects, like payment terms, the amount of timber, and the responsibilities of each party. Using a Syracuse New York Forest Products Timber Sale Contract can help ensure both parties understand their commitments and rights, which reduces the risk of disputes. Overall, it streamlines the transaction process.

A logging contract outlines the agreement between the landowner and the logger regarding timber harvesting. It specifies the rights and responsibilities of both parties, including compensation, harvesting methods, and timelines. By using a Syracuse New York Forest Products Timber Sale Contract, you can establish clear expectations and protect your interests throughout the logging process. This clarity helps foster a smooth working relationship.

To sell timber from your land, start by assessing the quantity and quality of your timber. Engaging a professional forester can help you determine the best approach and value. Next, consider using a Syracuse New York Forest Products Timber Sale Contract to outline the terms and ensure a fair deal with potential buyers. Ultimately, taking careful steps will help you successfully navigate the sale process.

Yes, income generated from selling timber is considered taxable income by the IRS. When you engage in a Syracuse New York Forest Products Timber Sale Contract, it's vital to keep accurate records of your sales for tax purposes. Consulting with a tax advisor is recommended to understand how the timber sales may impact your overall financial situation.

The amount you receive for selling timber will depend on several elements, including the species, size, and health of the trees being sold. In Syracuse, New York, using the Forest Products Timber Sale Contract can help you receive competitive offers from buyers. Ultimately, engaging with a timber sales professional can ensure you get the most value for your timber.